It is a primary offering of tokens to the public but now instead of using a specific sales mechanism (ICO) or a CEX (IEO) its using a DEX.

(2/19)

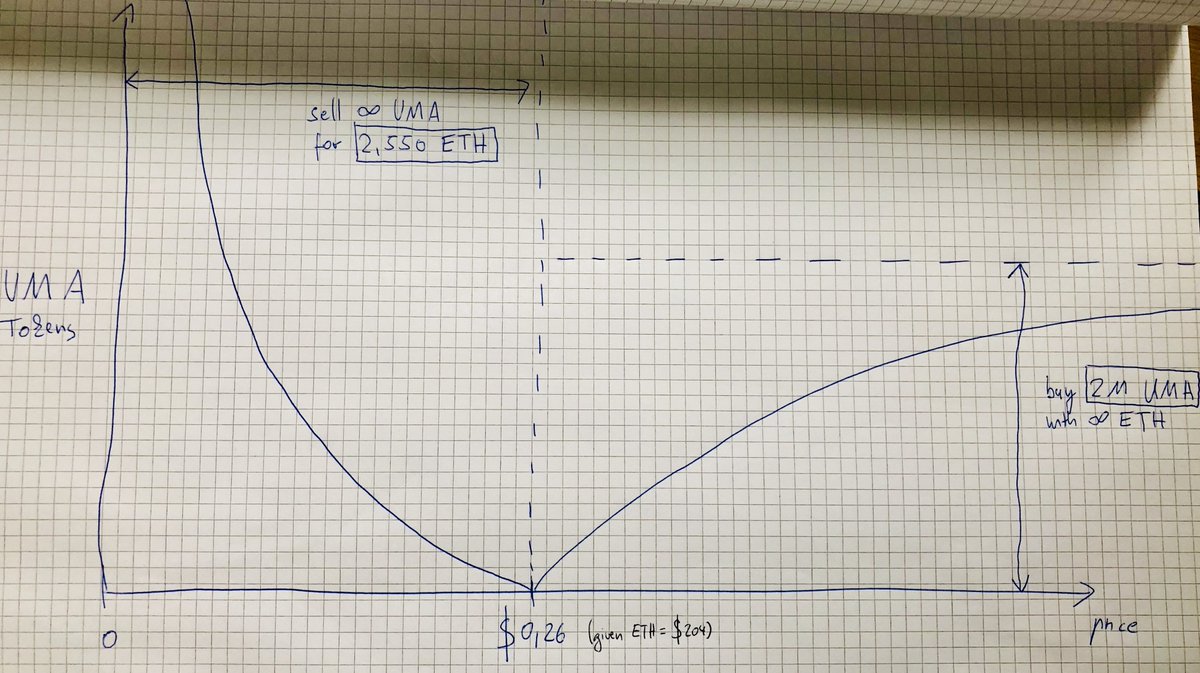

(3/19)

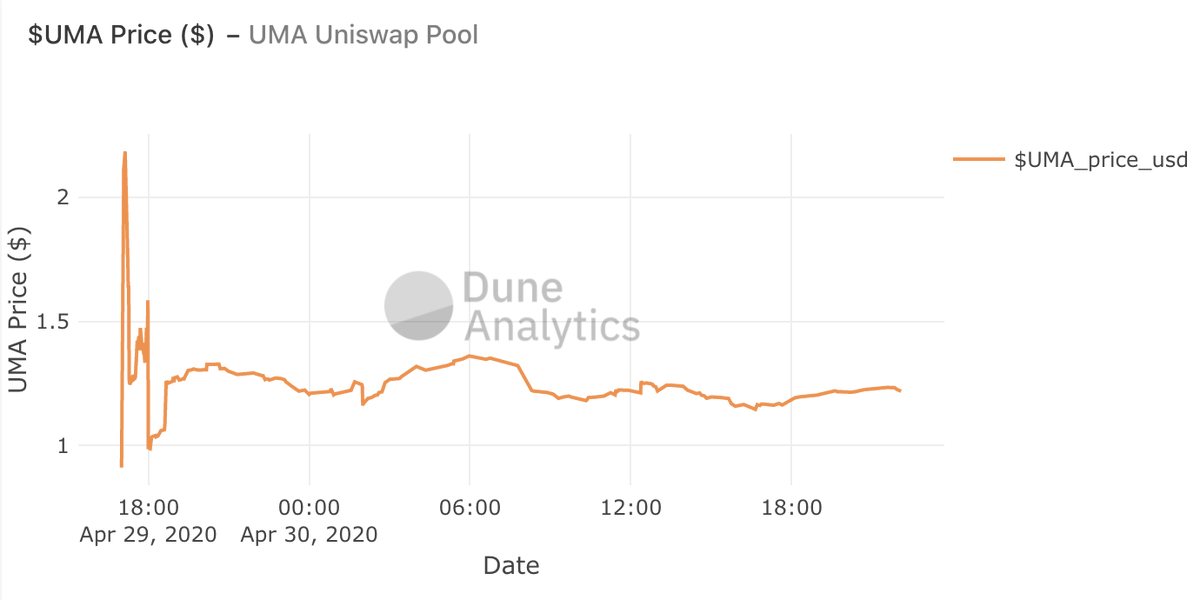

explore.duneanalytics.com/public/dashboa… (6/19)

Winner: everyone who could buy below the current price; Miners: since they can effectively decide who can do the first trades, the long term expectation of those games is that most value would go to miners (check @phildaian MEV) (10/19)

(11/19)

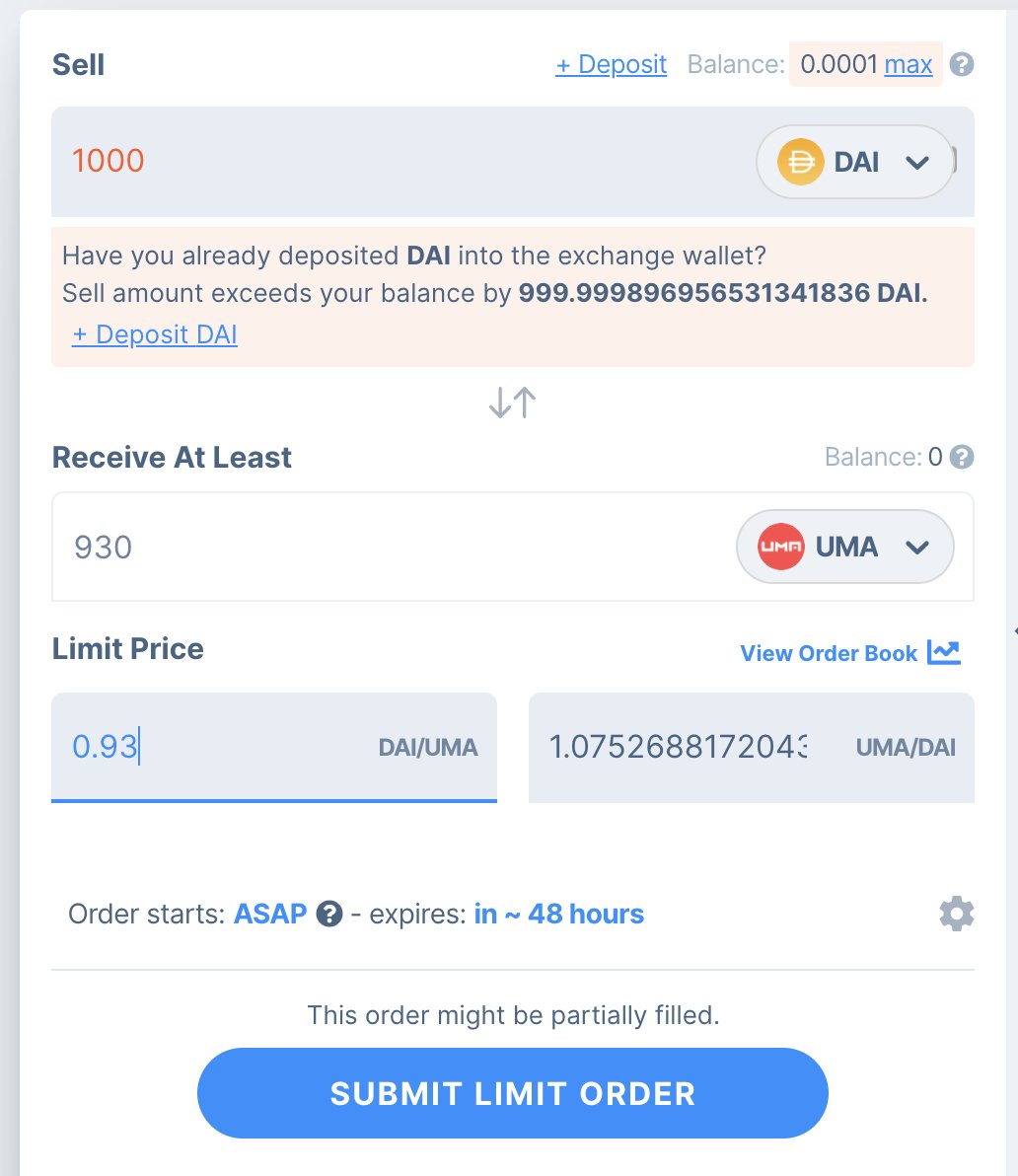

Yes we can! Let me shill you Gnosis Protocol.

theblockcrypto.com/post/61622/con…

(12/19)

(13/19)

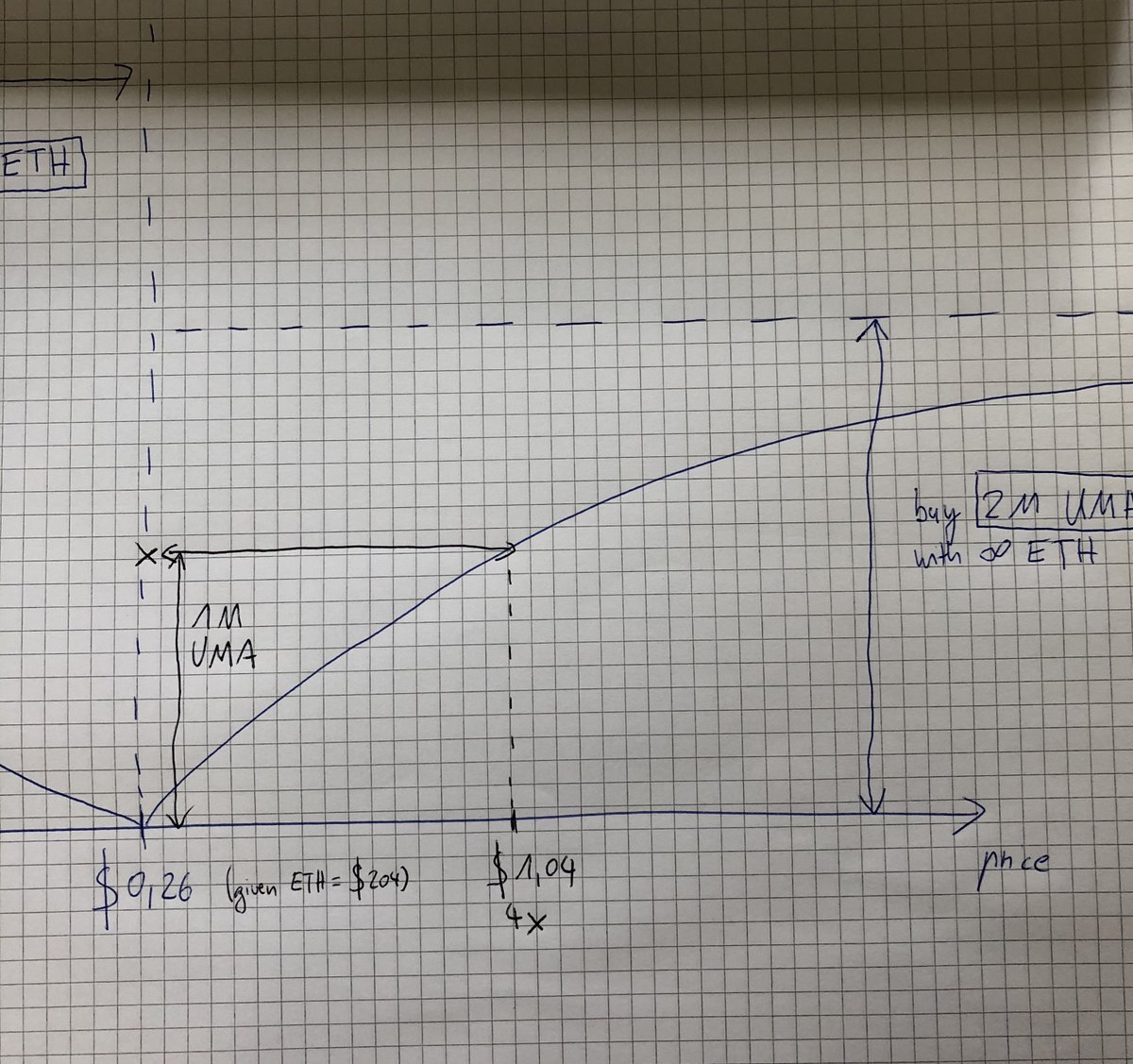

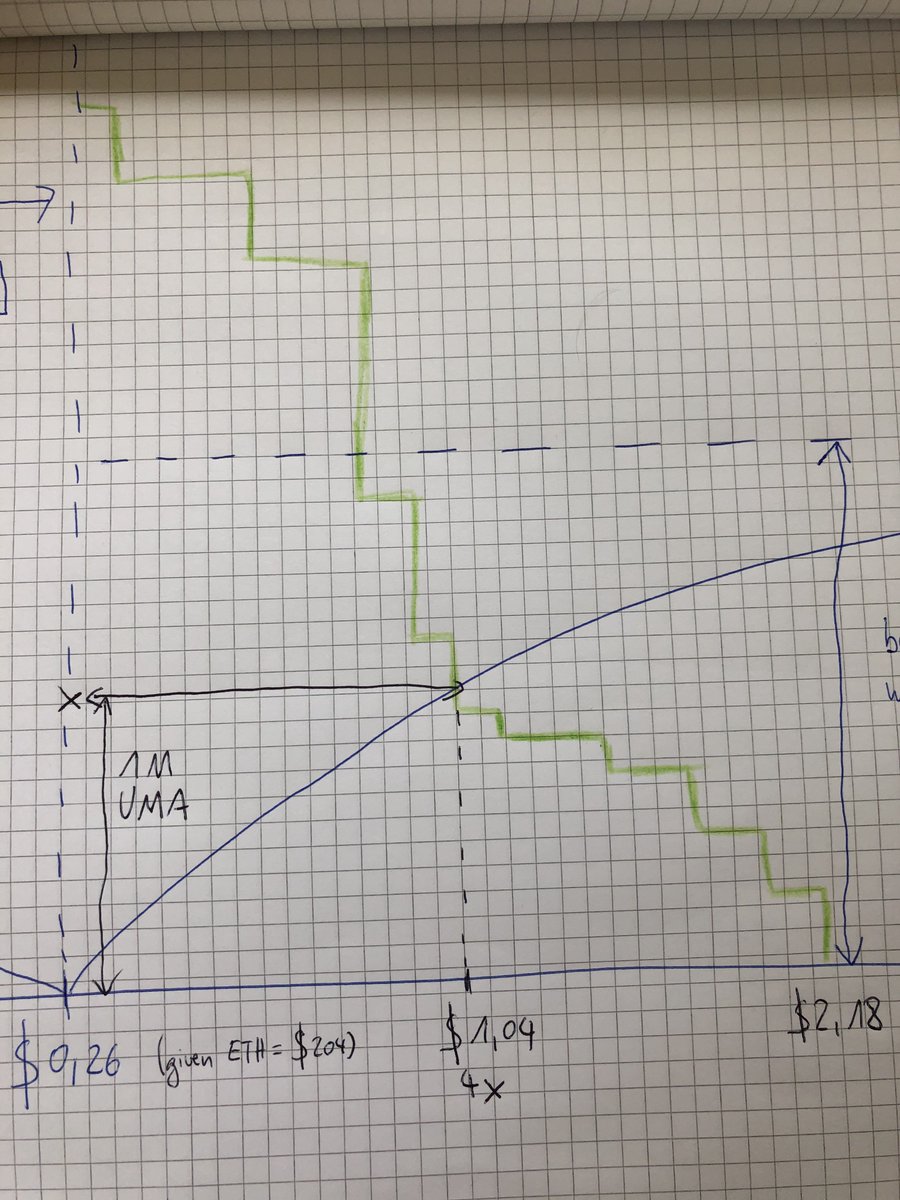

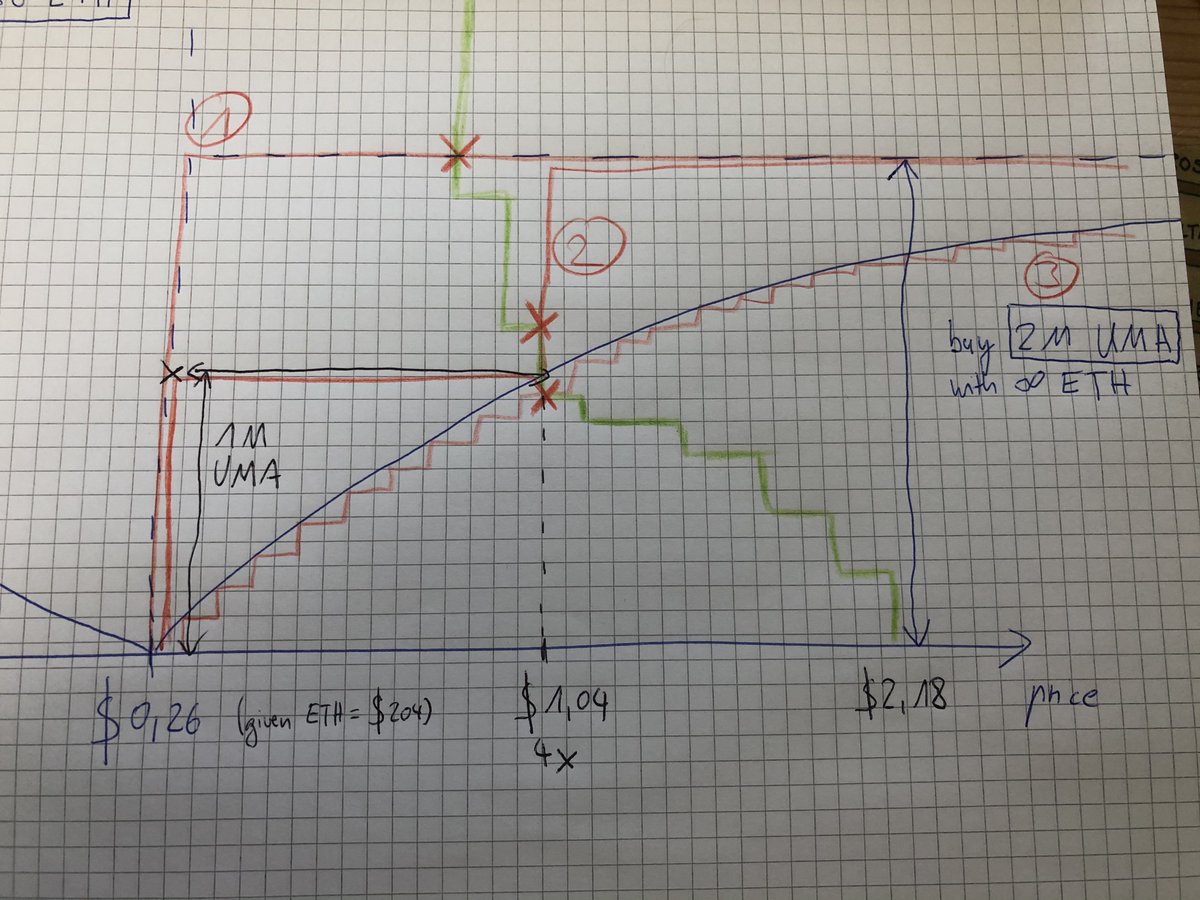

2) sell 1M at $0.26 and 1M at $1.04 or 3) to copy the Uniswap curve you can approximate it with many small orders.

(16/19)

Advantages for UMA - higher average sales price, Advantages for user: no wired front-running games, no risk to pay double than everyone else.

(17/19)

(18/19)

(19/19)