good morning from @bankofengland with a reminder we still live in financial capitalism, and we wouldnt be without central bank bailouts in March.

https://twitter.com/staffordphilip/status/1258297002791702530

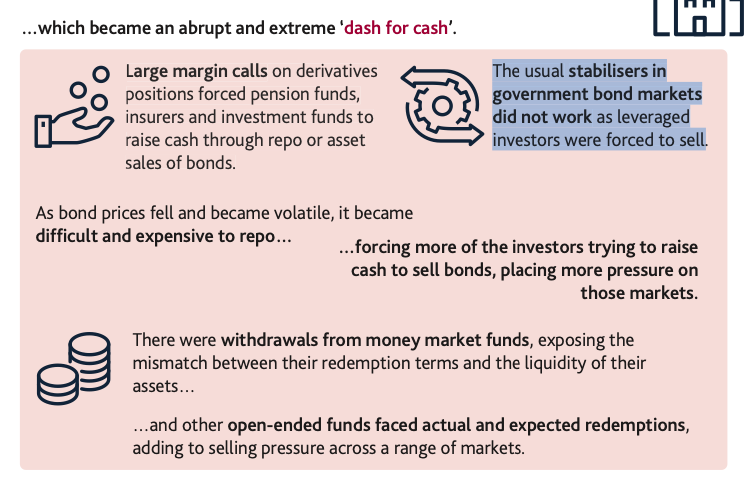

ah, fond memories of 'what leverage in pension funds? there are patient investors' talking points from the industry #shadowbanking

maybe @bankofengland can do @bundesbank a favour and translate this picture of runs on government bond markets into German, so they can in turn send it to #BVerfG

• • •

Missing some Tweet in this thread? You can try to

force a refresh