1. Largely non-discretionary + ~95% customer retention = Highly recurring revenue

2. More stable organic topline growth (LSD to MSD)

3. Higher margin than consulting

During GFC, $MMC's broking arms i.e. Marsh and Guy Carpenter's organic revenue were -1% and +8%

Both are capital light businesses (2-2.5% of sales).

Salaries are 55-60% of total opex. Very little fixed costs, so margins are not very volatile.

"disintermediation risk" is in the air for quite some time, but nothing much has changed.

InsurTech platforms are mainly focusing on individual/SMB segments. Those are indeed ripe for disruption.

Some of the InsurTech co's are also being acquired by these large brokers e.g. CoverWallet by AON in 2019.

Large brokers have decades of proprietary premium data by customer, segment, geography, and risk which can be difficult to replicate for smaller players.

Many of the smaller brokers also don't have the expertise to create these models by themselves.

Not much. As already mentioned, 30-40% revenue comes from consulting. Of the rest, 2/3rd is commission (5-10% of premium), and 1/3rd is fees.

So being right on P&C cycle is not terribly important. Rates are firming though.

Reported FCF to adjusted earnings is ~75% in last 14 years. If FCF is adjusted for restructuring expenses, it becomes 90% during this period. The rest gets lost to working capital management.

It's an all-stock deal. $WLTW shareholders will get 1.08 $AON shares.

Market didn't like the deal despite $AON saying it's going to be accretive in year 1. $AON was -16%

It's ~10% of $WLTW's total opex in 2019.

For $AON's last two major acquisitions, Benfield and Hewitt, they either met or exceeded cost savings target.

Deal may require some divestment from regulators.

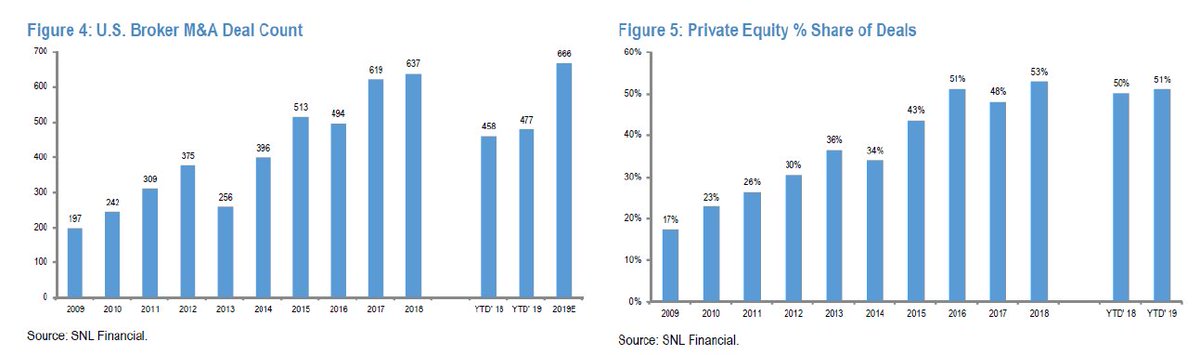

Also, in terms of size, the deal is ~5x larger than the next biggest deal in this industry.

Integrating a $30 Bn company is never fun and easy, and can also introduce whole lot of unforeseen risks.

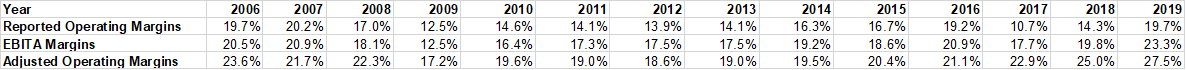

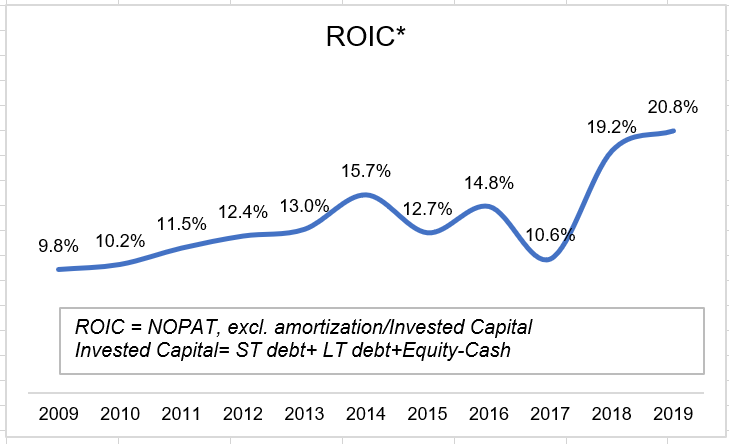

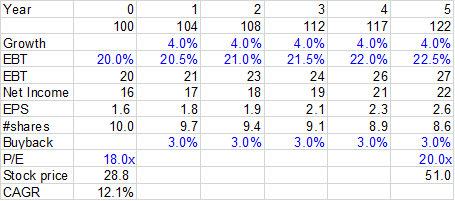

EPS algorithm: 3-5% topline growth+ ~50-100 bps margin improvement + 3% buyback (~30% decline in share count in last 8 yrs) = 7-8% growth

$AON is trading at 18x P/E but...

Counterpoints/DMs welcome.

~55-60% of total revenue, NOT opex