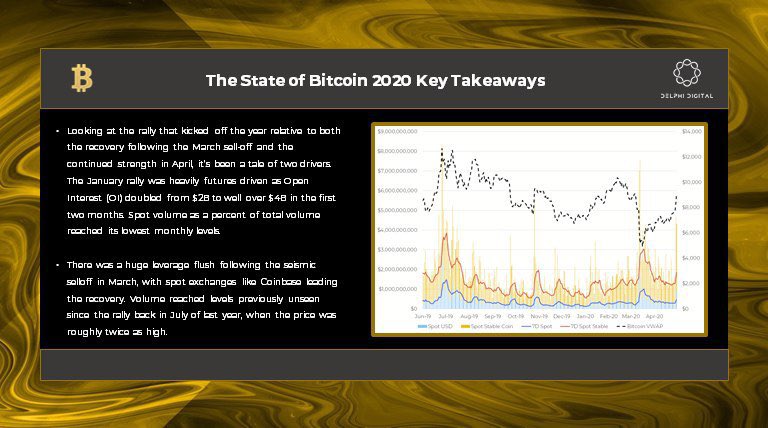

It’s close to 60 pages, so for convenience we wanted to tweet out a few of our favorite takeaways:

Short thread below 👇👇👇

delphidigital.io/halving

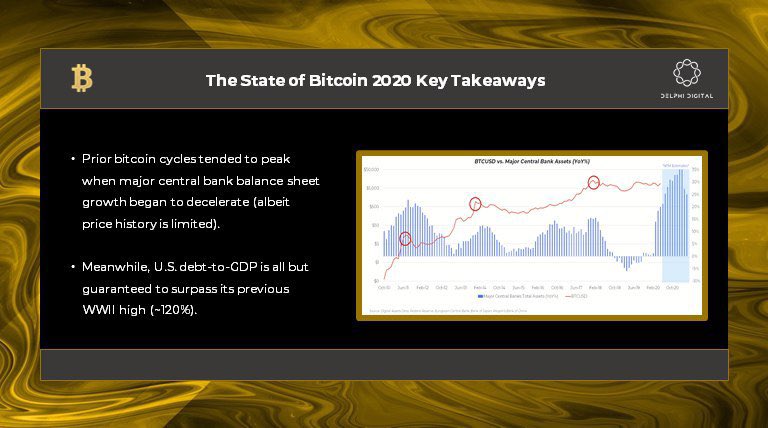

Meanwhile, U.S. debt-to-GDP is all but guaranteed to surpass its previous WWII high (~120%).

They’ve gone in completely opp. directions since, w/ Binance taking ~every point of mkt share that BitMEX lost. So far in May, Binance has nearly 50% more volume

@cz_binance