Should you have a separate Coronavirus Health plan? Read on.

Thread 1/n

timesofindia.indiatimes.com/world/rest-of-…

2/n

3/n

Yes. Insurers will be forced to use this clause to make deductions in your claim.

4/n

(Have recently seen a bill that charged Rs. 8900 per day just for PPE.)

5/n

The average *claim* for Covid19 is reported to be Rs. 2 Lakhs. In which case, you may have to pay Rs. 50K from your pocket (quick estimate)

6/n

Can help compensate these deductions (and maybe even loss of income in case you are self-employed.)

7/n

No bills are required to be submitted.

8/n

How do you decide on a plan?

9/n

a) a plan that offers Fixed Benefit, and not an indemnity/ reimbursement of your expenses.

b) Ensure you take a significant cover (above or equal to Rs. 1 Lakh)

10/n

If you are looking for an upgrade, then a Super Top-up plan is a better option.

11/n

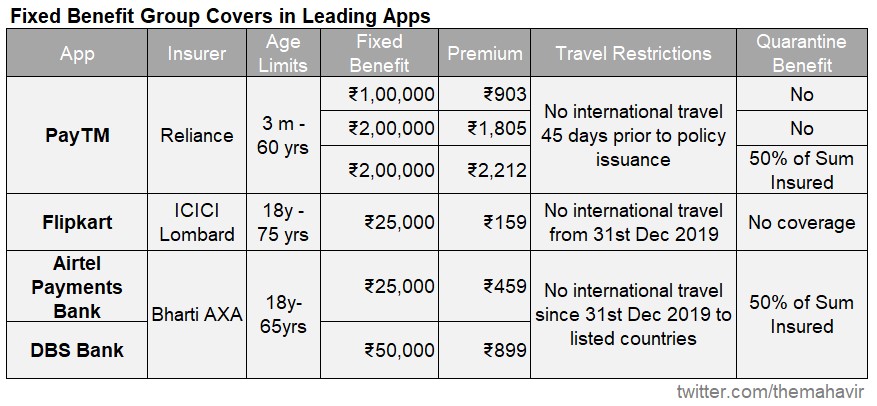

- Currently, only PayTM with Reliance offers significant covers.

- The cover other apps like Flipkart- ICICI, Airtel-Bharti provide are too small.

12/n

Excerpts from Data compiled by @Rahul_J_Mathur

I can send you the comparison separately if you want.

13/n

In case you have any existing disease, you will only get the claim if the doctor certifies that the reason for the hospitalization is Covid19 and not the existing disease.

14/n

So don't buy these policies if you are living with someone who is Covid19 positive.

15/n

You must read the policy conditions carefully and consult your financial advisor before you buy the policy.

Hope this helps 🙏

16/n

Fin.