1/n Health Insurance customers have always been wary of the definition of pre-existing disease in health insurance policies. And why not, it has been a grey area where many claims are declined to the dissatisfaction of thousands.

Here's how the definition has changed since 2016.

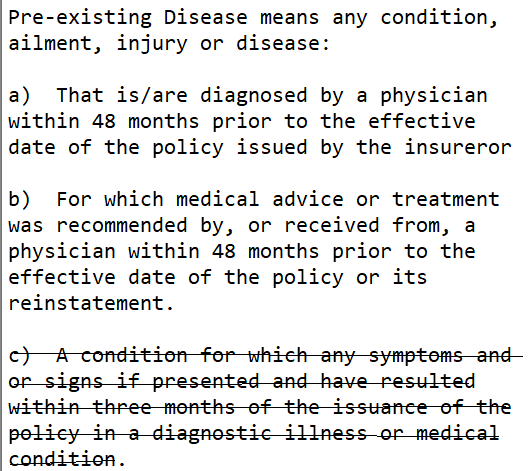

On the other hand, if he had to undergo surgery within 3 mths of the issuance of the policy, the claim would be declined.

Now the condition should be *diagnosed* or *medical advice received* from a medical professional prior to the issuance of the policy for it to be considered pre-existing

There is no impact on people who already own a health insurance.