WE HAVE A PLAN.

More than 51bn€ in NPL reduction expected over 2019-2022.

Fantastic! Great job!

The crowd goes wild!

70% of that is supposed to come from NPL sales.

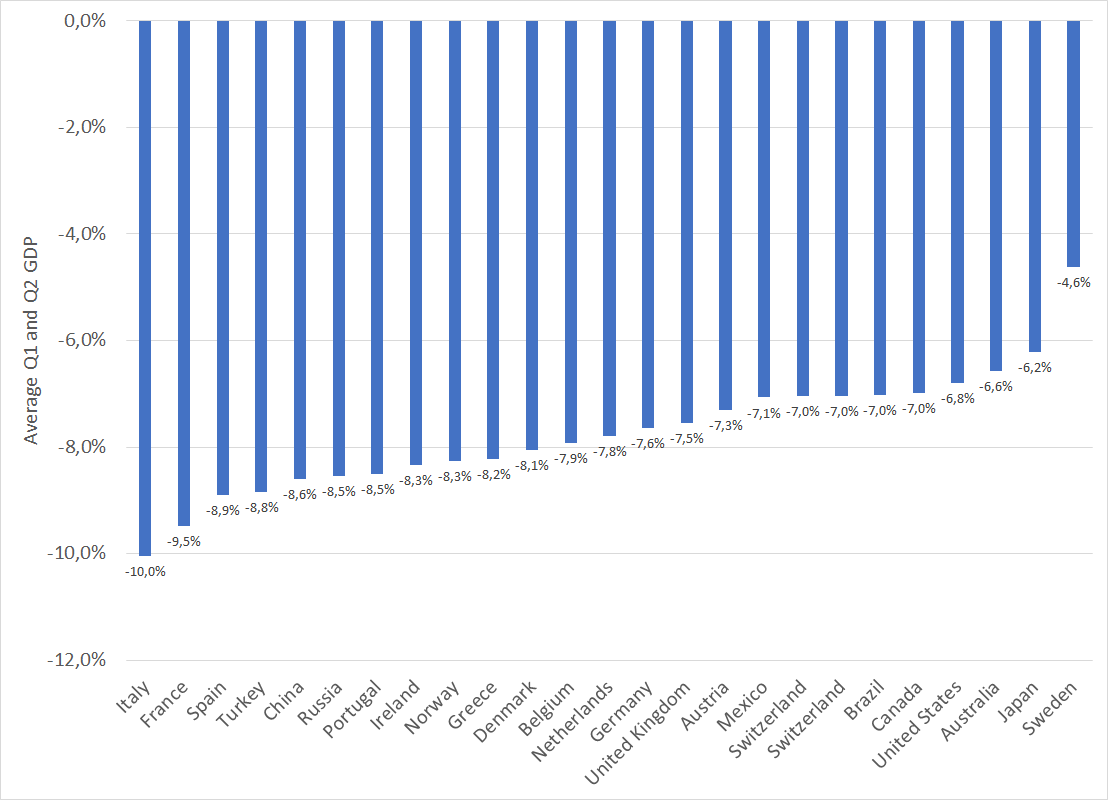

All right, if you’re brave and want to buy NPLs in an economy in freefall, which is based on the worst sector right now (tourism), please send an email to:

NPEReliefForGreece@RedCross.com

What’s left in the books?

Err, sorry.

"Performing" might be a stretch here.

More than 30% of the loan books are in sectors severely affected by Covid. That’s probably at par with the worst bank in all the rest of the EU+UK!

Closed shops, empty hotels, ships with no cargo.

Argh.

Not to mention the 3bn to 5bn forborne loan per bank, i.e. loans that were restructured to avoid default but are not in NPL.