NEW:

Kamala Harris' 2019 financial report has dropped.

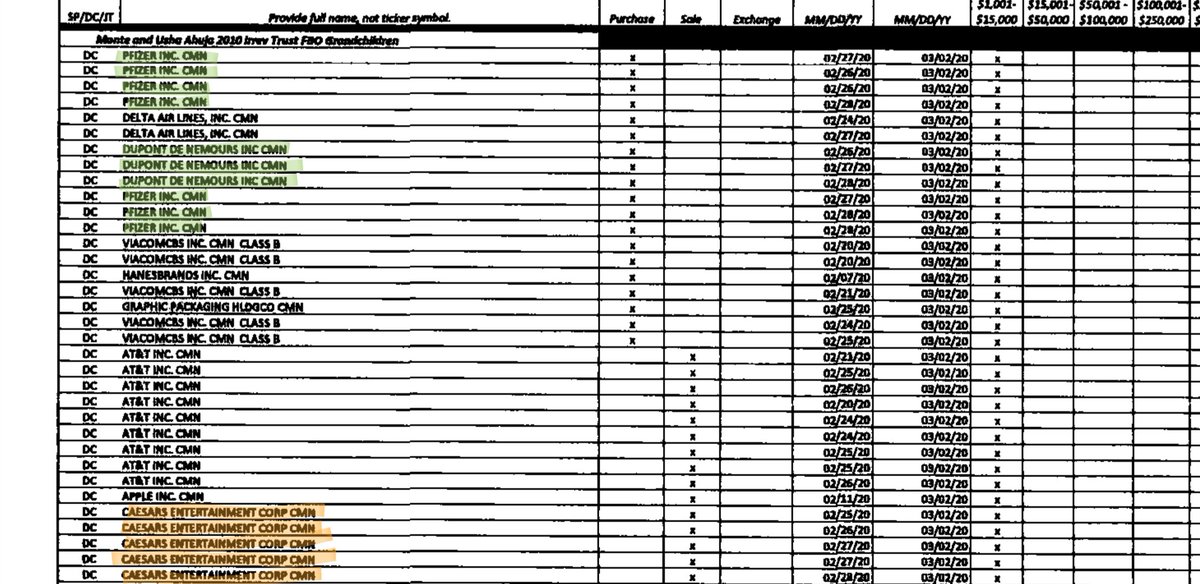

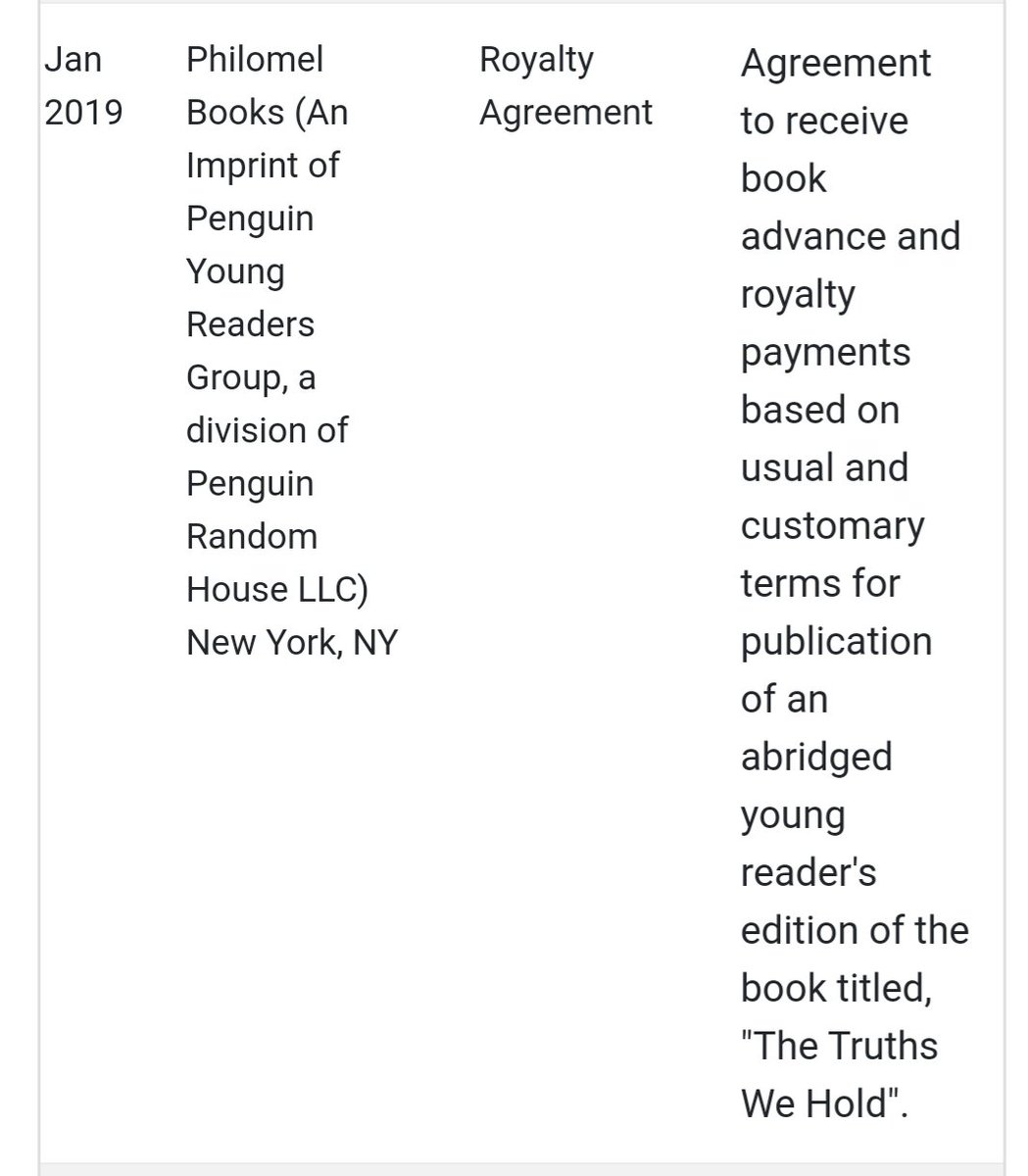

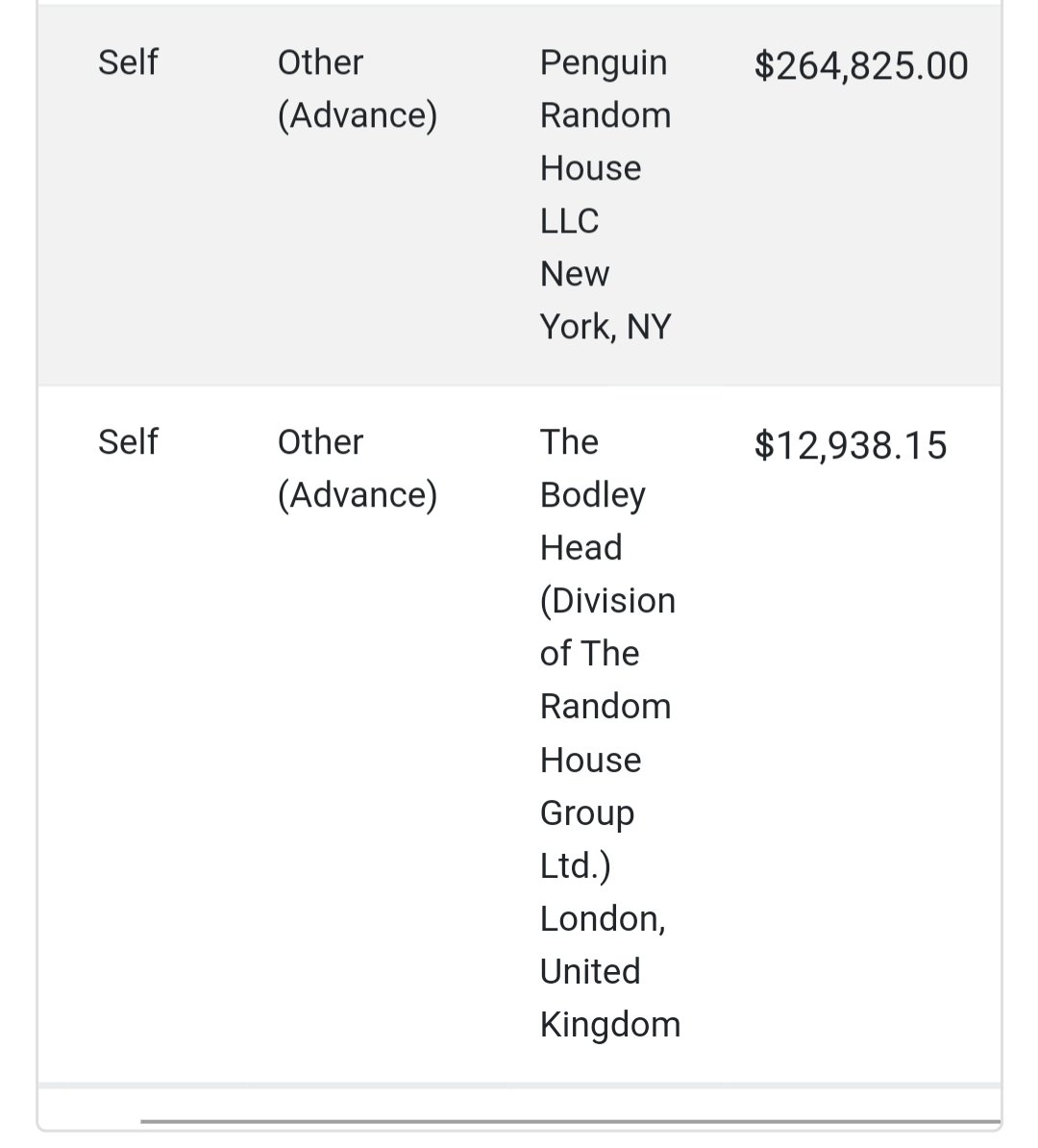

She reported over $270,000 in advance royalties from her book, "The Truths We Hold"—but the real juice is diving into where her millionaire lawyer husband, Doug Emhoff, parks his money.

Let's take a look, shall we?

Kamala Harris' 2019 financial report has dropped.

She reported over $270,000 in advance royalties from her book, "The Truths We Hold"—but the real juice is diving into where her millionaire lawyer husband, Doug Emhoff, parks his money.

Let's take a look, shall we?

As I said before, Kamala Harris pulled in $270,000+ in advance royalties from her book deal in 2019.

That's where a large bulk of her income came that year.

Now, let's look at some of their investments.

That's where a large bulk of her income came that year.

Now, let's look at some of their investments.

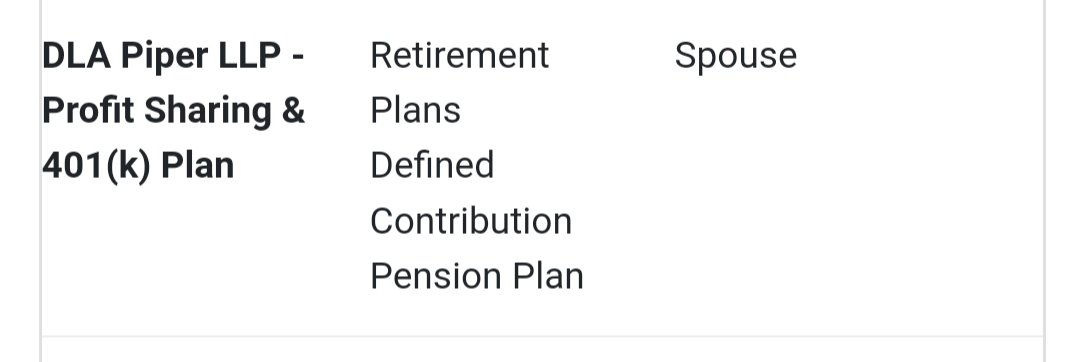

Kamala Harris' husband, attorney Doug Emhoff, is a partner at global white-collar law/lobbyist firm DLA Piper—with whom he has a profit sharing agreement.

That means that a certain percent of every dime they make lobbying gets deposited into an account. That's problematic.

That means that a certain percent of every dime they make lobbying gets deposited into an account. That's problematic.

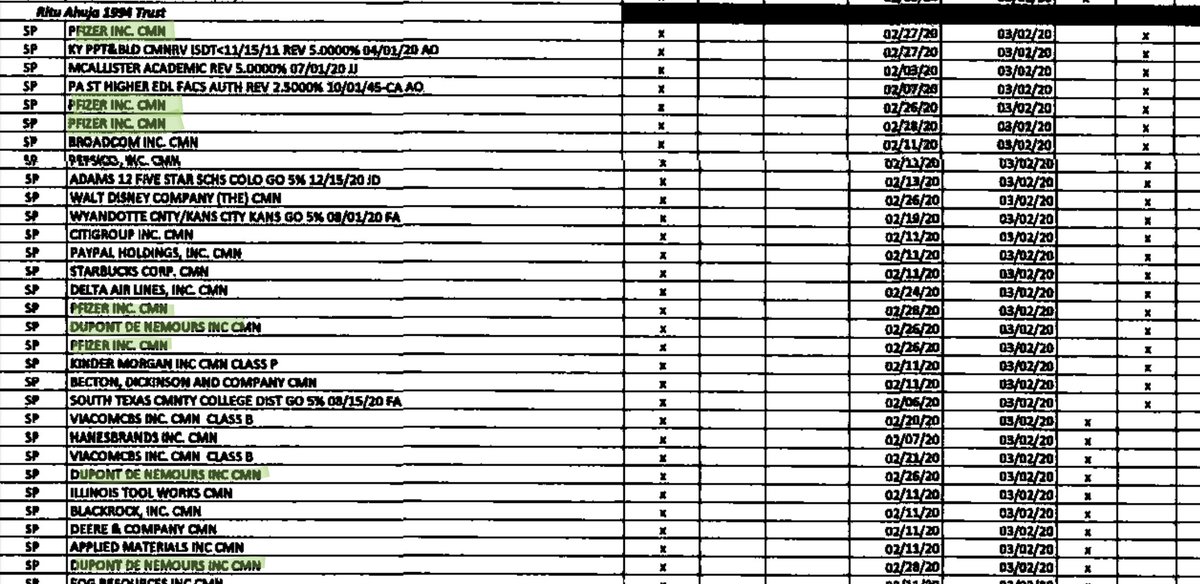

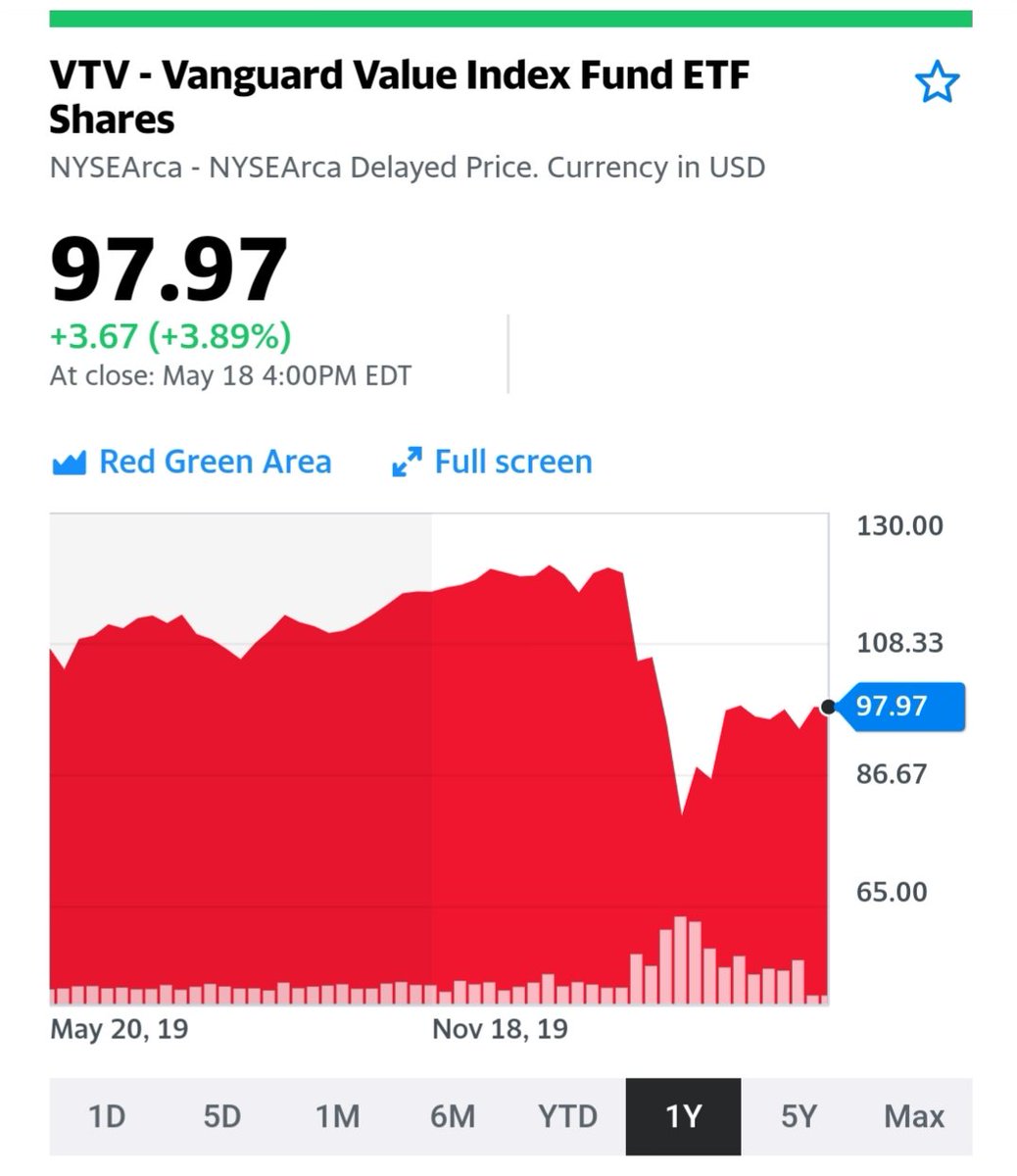

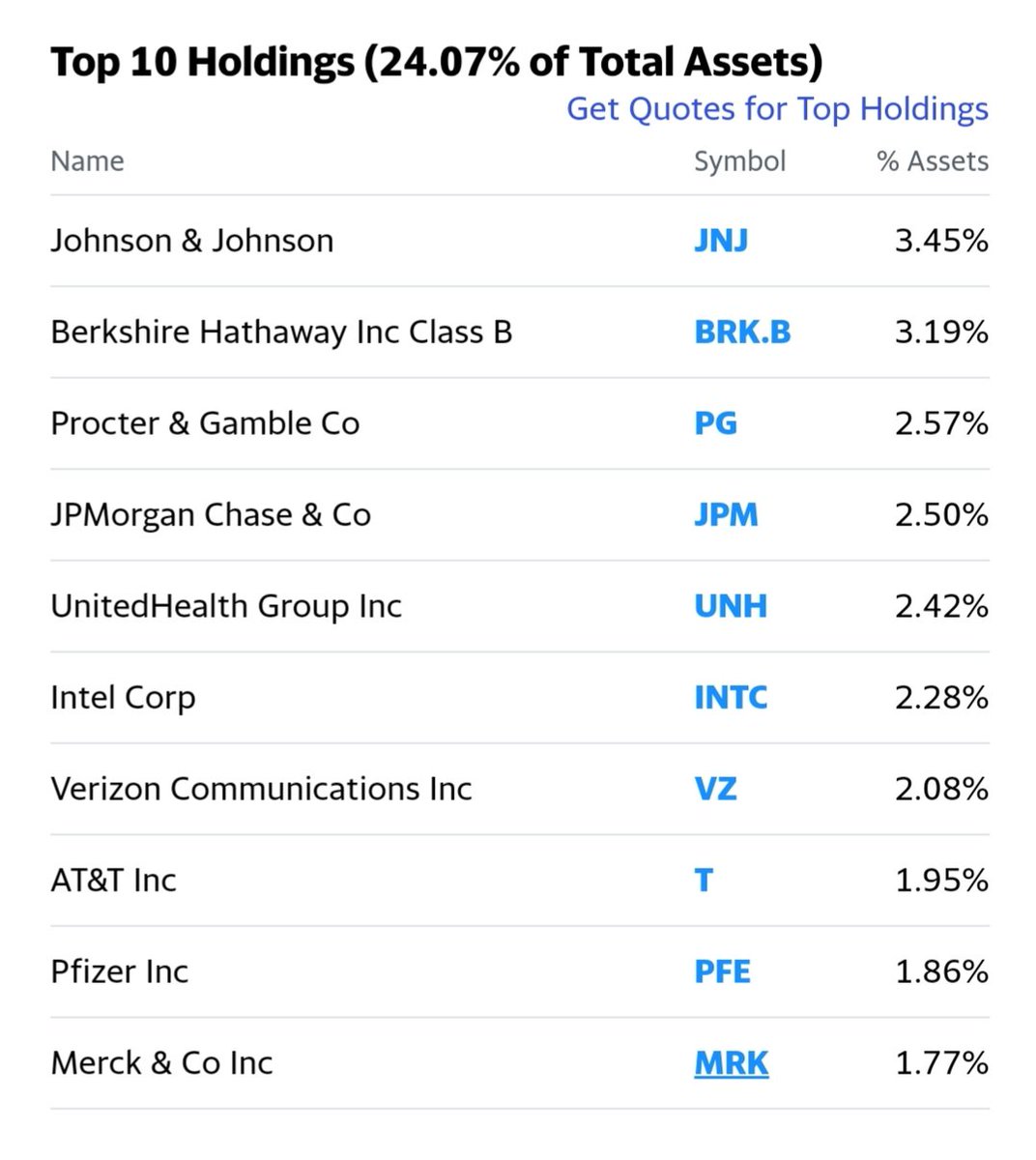

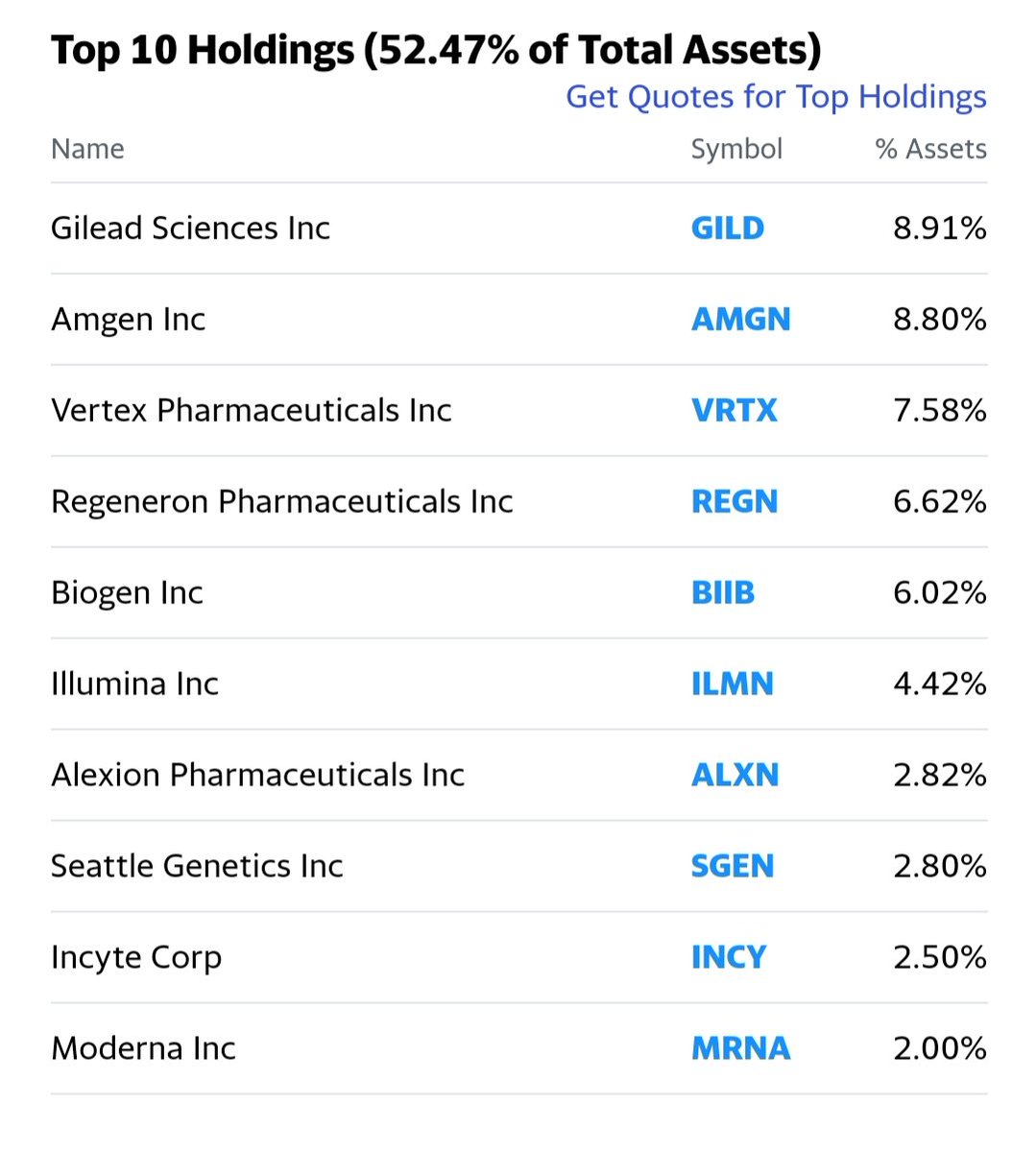

Emhoff has anywhere between $250,000-$500,000 invested in a Vanguard Value ETF.

This portfolio contains notable holdings in pharma and healthcare companies such as Johnson & Johnson, Pfizer, Merck, and United Health—along with institutions like JP Morgan and Berkshire Hathaway.

This portfolio contains notable holdings in pharma and healthcare companies such as Johnson & Johnson, Pfizer, Merck, and United Health—along with institutions like JP Morgan and Berkshire Hathaway.

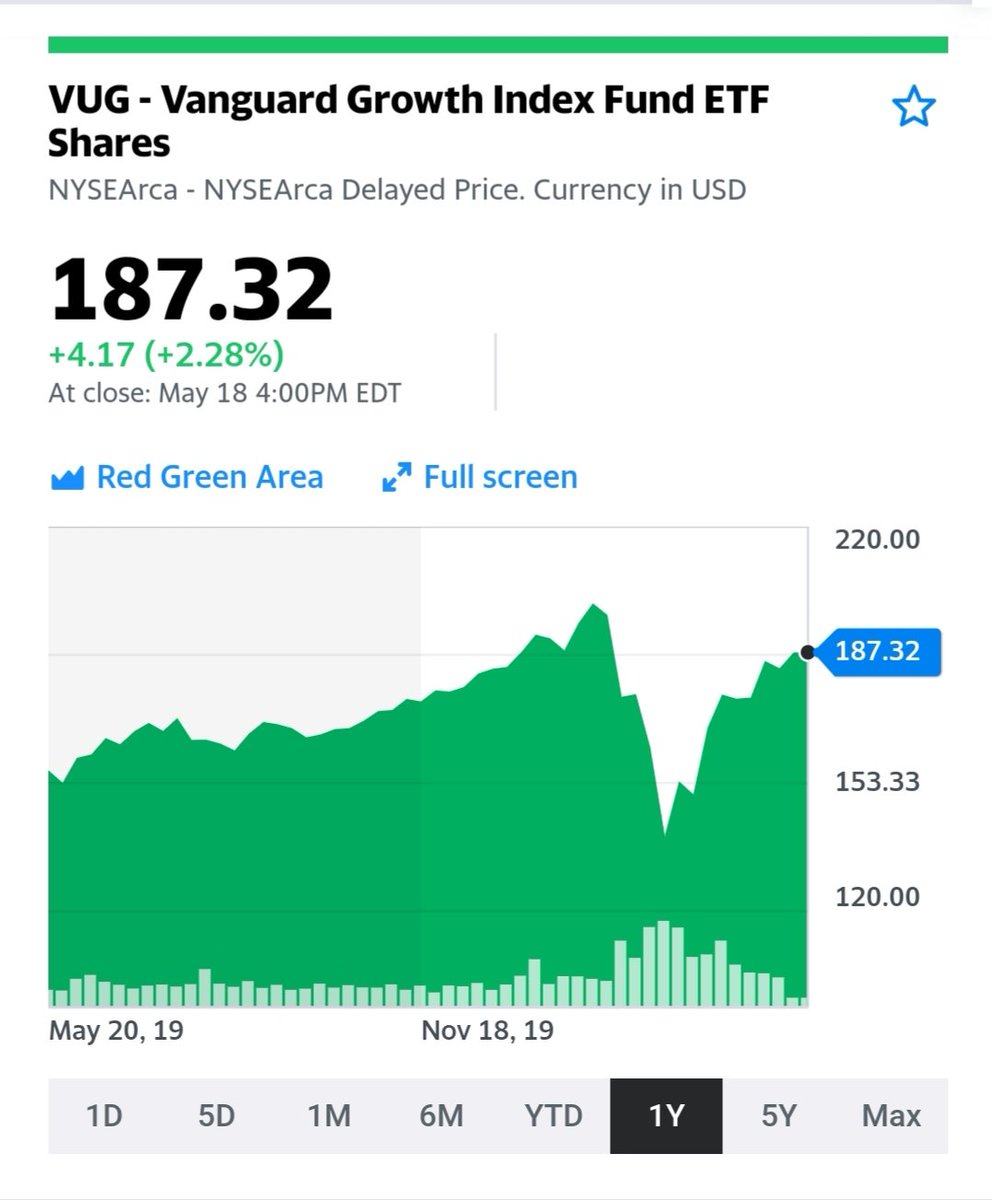

Kamala Harris' husband also has another $250K—$500K parked in a Vanguard Growth Index Fund.

Notable holdings include tech industry giants Microsoft, Alphabet, Facebook, and Amazon—along with creditors like Visa and Mastercard.

Notable holdings include tech industry giants Microsoft, Alphabet, Facebook, and Amazon—along with creditors like Visa and Mastercard.

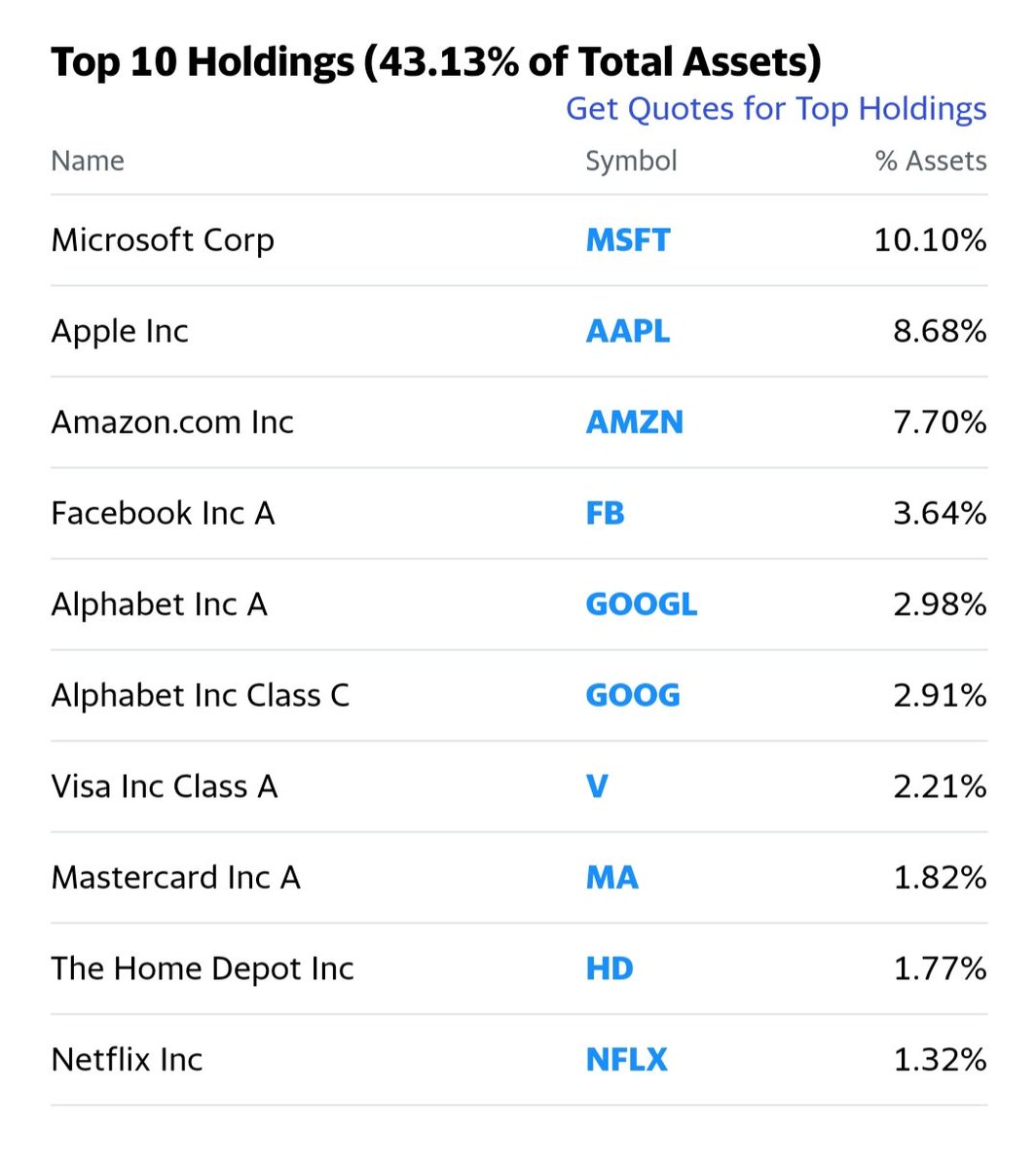

Emhoff has anywhere $100K-$250K invested in an iShares Core account.

Notable holdings include several pharmaceutical companies such as AstraZeneca, Novo Nordisk, and Novartis.

Notable holdings include several pharmaceutical companies such as AstraZeneca, Novo Nordisk, and Novartis.

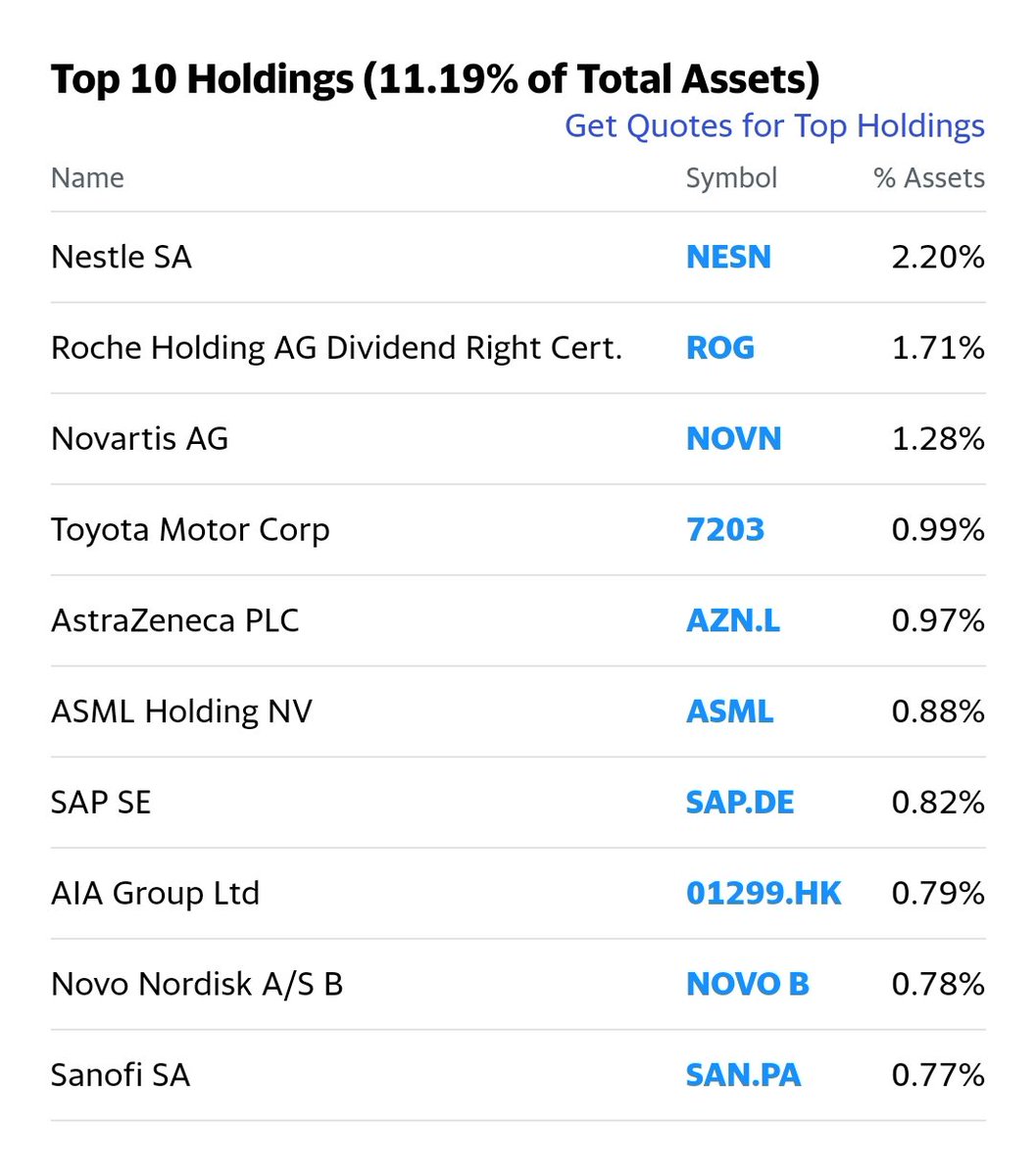

Emhoff has up to $15,000 invested in a iShares Nasdaq Biotechnology fund, with notable holdings including Gilead Sciences, Amgen, and Biogen.

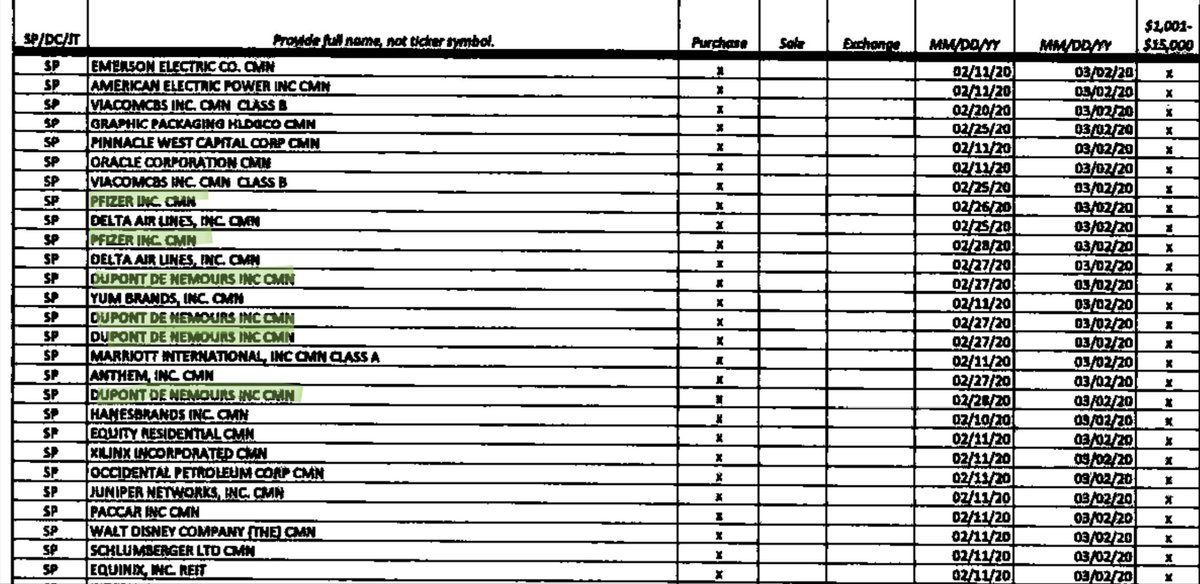

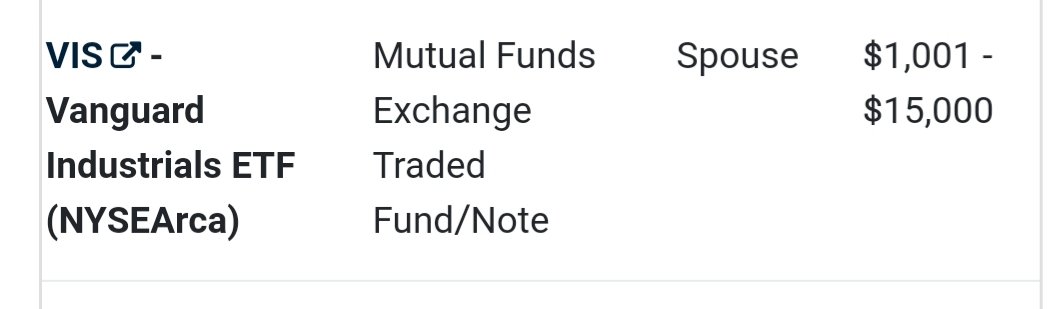

Here's another $15,000 Harris' husband has parked in a Vanguard Industrials Index Fund, which is chock full of defense contractors like Raytheon, Northrop Grumman, Boeing, and Lockheed Martin.

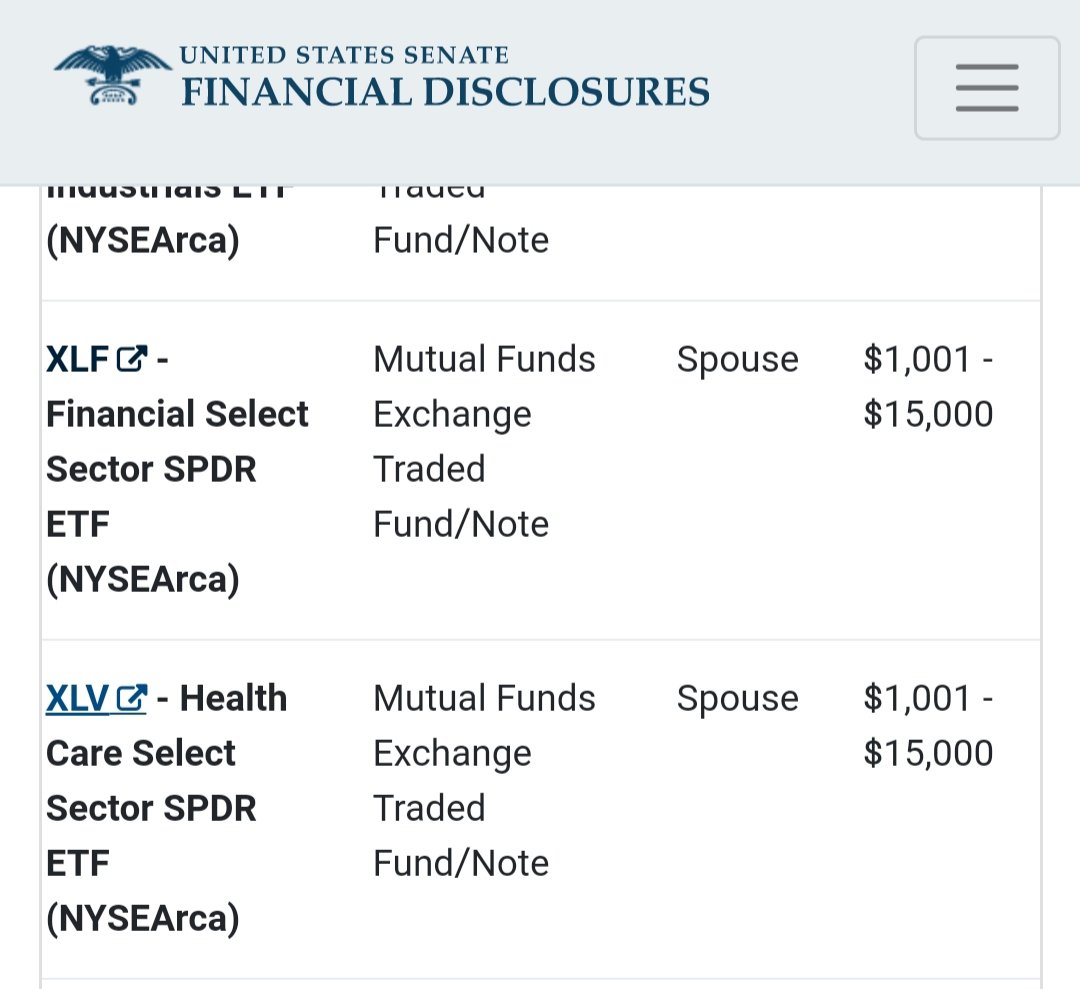

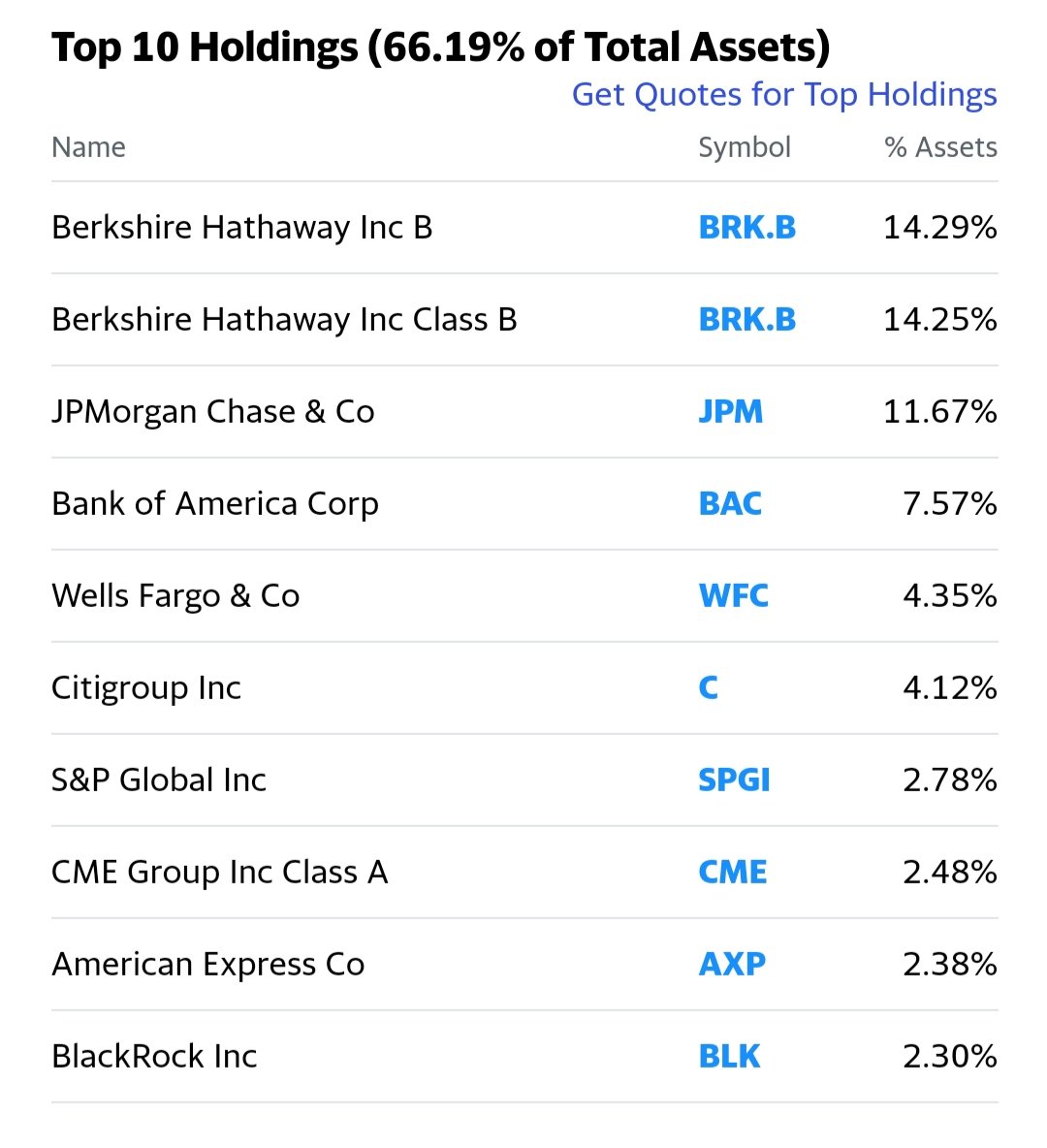

Here's another $15,000 a piece Emhoff has parked in Financial Sector and Health Care Sector SPDR funds.

Everything from Berkshire Hathaway to UnitedHealth is represented in those portfolios.

Everything from Berkshire Hathaway to UnitedHealth is represented in those portfolios.

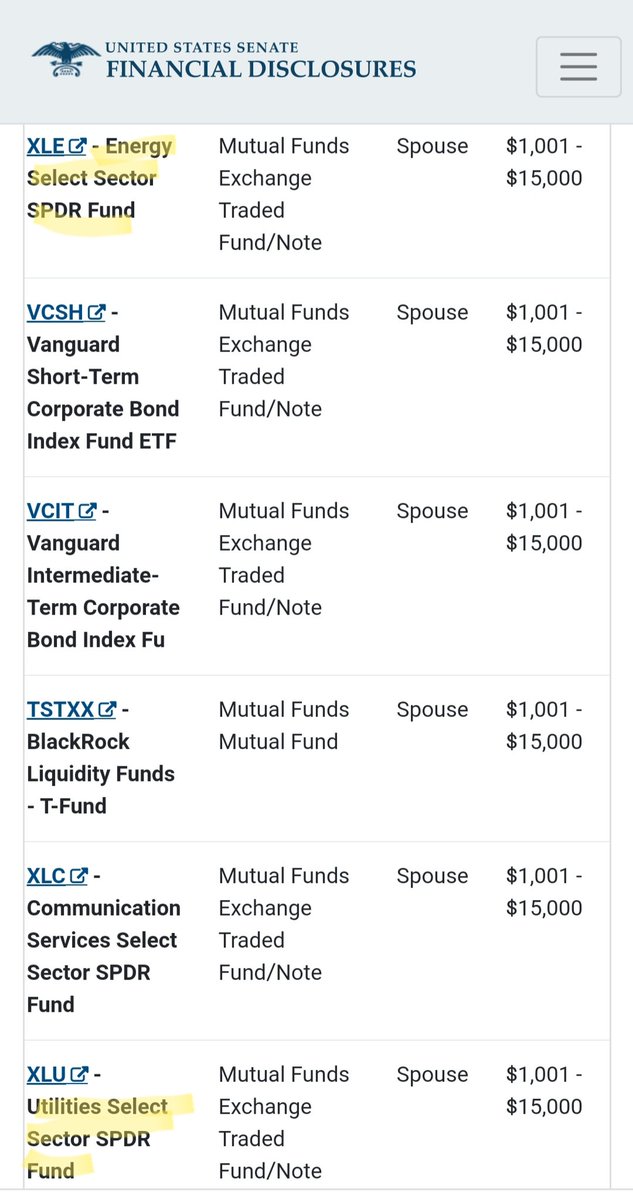

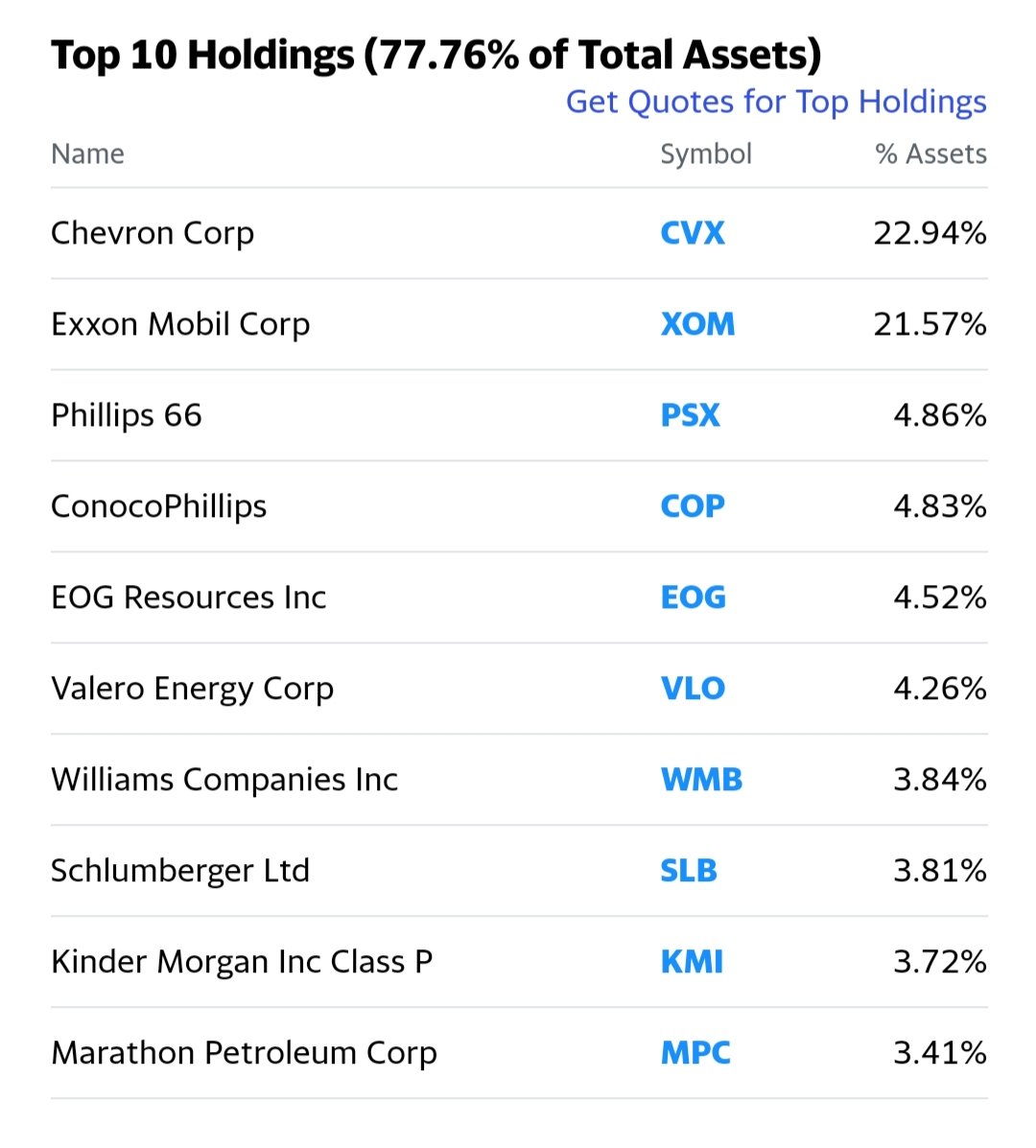

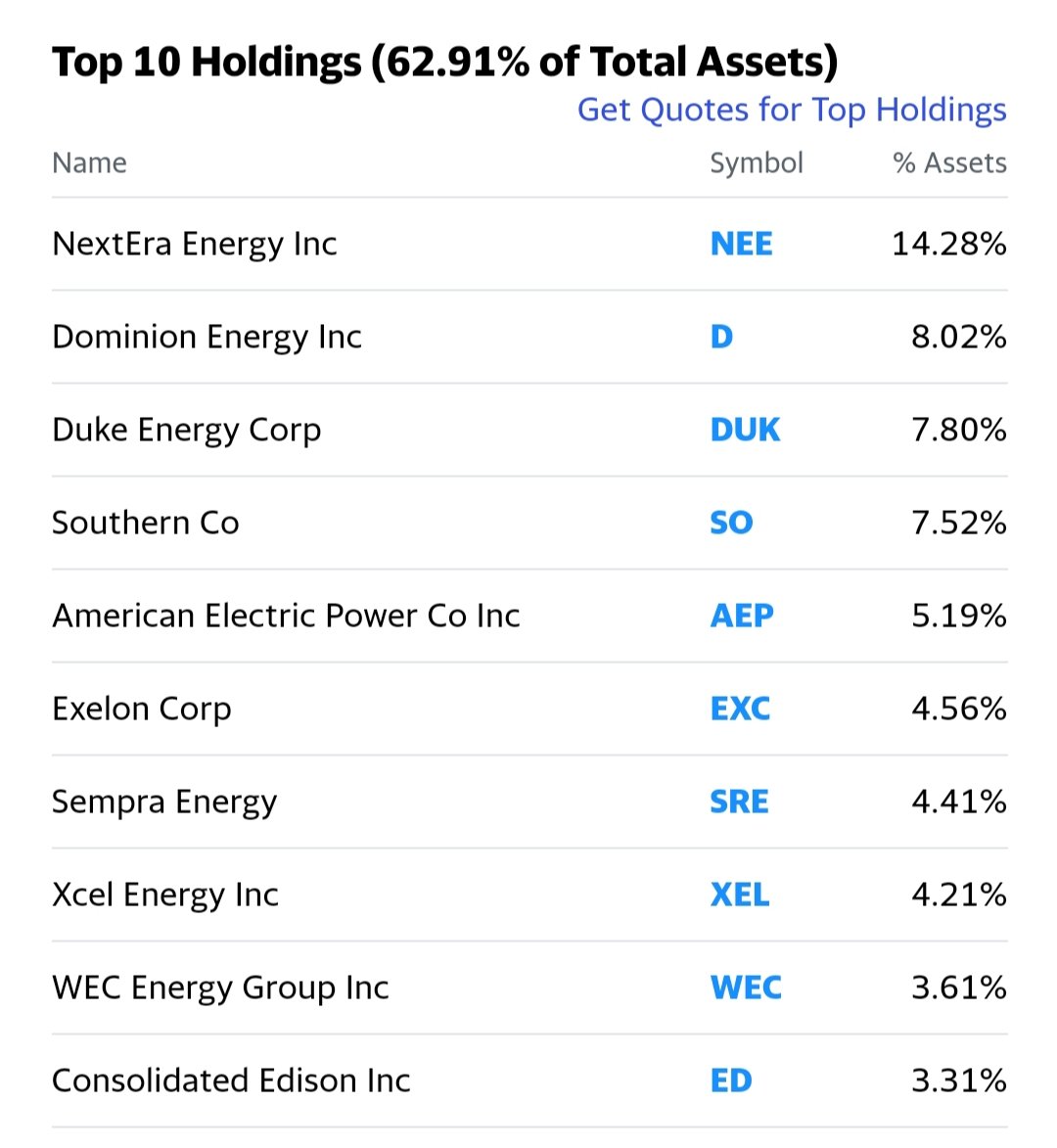

The list wouldn't be complete without Harris' husband having up to $3OK in oil $ gas stocks.

His Energy and Utilities SPDR funds contain holdings in Chevron, Exxon, and Phillips 66 as well as Duke Energy, Dominion Energy, and Southern Co—all owners of the Atlantic Coast Pipeline

His Energy and Utilities SPDR funds contain holdings in Chevron, Exxon, and Phillips 66 as well as Duke Energy, Dominion Energy, and Southern Co—all owners of the Atlantic Coast Pipeline

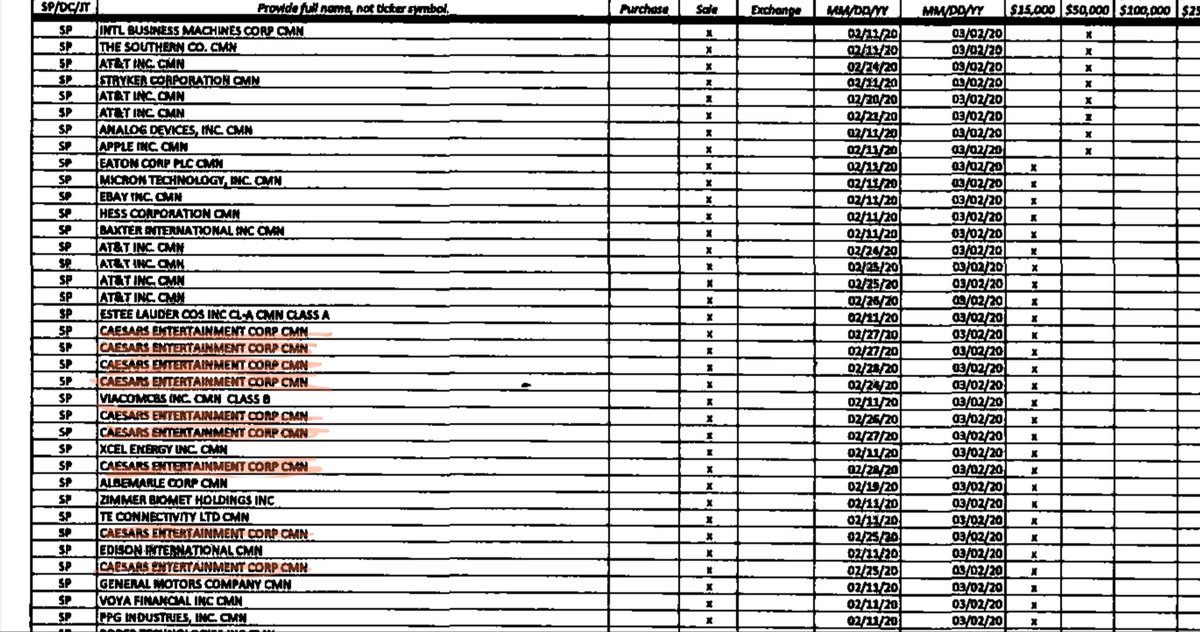

Knowing this, remember:

Every time Kamala Harris comes out railing against big banks, big pharma, big oil, big healthcare—her and her husband's wealth are, in alot of ways, tied to those industries' success.

Every time Kamala Harris comes out railing against big banks, big pharma, big oil, big healthcare—her and her husband's wealth are, in alot of ways, tied to those industries' success.

As far as Emhoff goes, I'd like to once again remind you that he's a partner at one of the biggest global law firms who make millions lobbying for companies like Raytheon and Blue Cross.

A percentage of every dime they make doing so goes into his pocket.

opensecrets.org/federal-lobbyi…

A percentage of every dime they make doing so goes into his pocket.

opensecrets.org/federal-lobbyi…

You can view all of this information and more by Searching for Kamala Harris in the Senate Financial Disclosure Database here:

efdsearch.senate.gov/search/

efdsearch.senate.gov/search/

• • •

Missing some Tweet in this thread? You can try to

force a refresh