Thread on calendar spread options trading.

Getting started with calendars, watch all the videos from this link to understand the basics

tastytrade.com/tt/learn/calen…

RT if you find useful.

#Trading #Options #Calendar

Getting started with calendars, watch all the videos from this link to understand the basics

tastytrade.com/tt/learn/calen…

RT if you find useful.

#Trading #Options #Calendar

When to initiate (1/2)

- Low IV in near expiry (<12 India VIX) like Dec/Jan '20

- Event in next expiry like budget, elections etc. (Apr/May '19)

- High IV difference in near/far expiries. More the IV difference between expiries the better. More details below.

- Low IV in near expiry (<12 India VIX) like Dec/Jan '20

- Event in next expiry like budget, elections etc. (Apr/May '19)

- High IV difference in near/far expiries. More the IV difference between expiries the better. More details below.

When to initiate (2/2)

- High options skew - If puts are priced much higher than calls, then sell puts in near and buy in next expiry to benefit from mean reversion of the skew. This is one sided calendar spread

- High options skew - If puts are priced much higher than calls, then sell puts in near and buy in next expiry to benefit from mean reversion of the skew. This is one sided calendar spread

Strikes to choose (straddle/strangle)

- If near/far IV > 1.5x -> straddle. But limited such opportunities.

- If >1.2x, strangle and avoid below that

- Strikes from price action in chart at key supp/resist levels

- Direction unclear -> delta neutral and adjust later

- If near/far IV > 1.5x -> straddle. But limited such opportunities.

- If >1.2x, strangle and avoid below that

- Strikes from price action in chart at key supp/resist levels

- Direction unclear -> delta neutral and adjust later

Stoploss

- I keep SL at 2-3% of deployed capital as SL but keep managing it by rolling up/down in near expiry and varying sold quantity

- I keep SL at 2-3% of deployed capital as SL but keep managing it by rolling up/down in near expiry and varying sold quantity

How to adjust

- Form a view on underlying. Look at chart and predict bullish/bearish and align delta accordingly. You will make money even if you're wrong

- Ensure theta/vega ratio doesn't go below 1. It means if IV falls by 1% you lose the same that you gain by theta tomorrow.

- Form a view on underlying. Look at chart and predict bullish/bearish and align delta accordingly. You will make money even if you're wrong

- Ensure theta/vega ratio doesn't go below 1. It means if IV falls by 1% you lose the same that you gain by theta tomorrow.

Expiries to select

- Depends on your patience level (I don't keep >2 weeks away) else higher vega kills you if you're wrong

- If willing to roll for longer then weekly/monthly else weekly/next weekly

- Remember the IV differential should be high

- Depends on your patience level (I don't keep >2 weeks away) else higher vega kills you if you're wrong

- If willing to roll for longer then weekly/monthly else weekly/next weekly

- Remember the IV differential should be high

Underlying selection

- Index (N and BN, with BN better than N) works best because it has weekly expiry plus liquidity across multiple expiries is good

- Next month's options in stocks will get liquidity towards the month end which is not favorable

- Index (N and BN, with BN better than N) works best because it has weekly expiry plus liquidity across multiple expiries is good

- Next month's options in stocks will get liquidity towards the month end which is not favorable

Customized calendars

- Align the delta to your view. Sell closer puts if view is bullish

- <100% hedging. Sell more than buying in next month -> this helps you gain more theta than you lose if IV falls

- One sided calendars (high options skew)

- Align the delta to your view. Sell closer puts if view is bullish

- <100% hedging. Sell more than buying in next month -> this helps you gain more theta than you lose if IV falls

- One sided calendars (high options skew)

Something that most people won't tell you (1/2)

- Best to initiate after the IV has spiked up in near expiry and the IV difference is high b/w near/far expiries. Why? When you're selling straddle/strangle, the higher IV improves your breakeven points in near expiry

- Best to initiate after the IV has spiked up in near expiry and the IV difference is high b/w near/far expiries. Why? When you're selling straddle/strangle, the higher IV improves your breakeven points in near expiry

Something that most people won't tell you (2/2)

- When does this happen? When a significant move has already happened leading to IV spike in near expiry

- Event coming up next month like budget, election etc. -> next month's IV will rise > this month's IV

- When does this happen? When a significant move has already happened leading to IV spike in near expiry

- Event coming up next month like budget, election etc. -> next month's IV will rise > this month's IV

Example of a calendar I did sometime back

https://twitter.com/TarunNa16156541/status/1250281841128378369?s=20

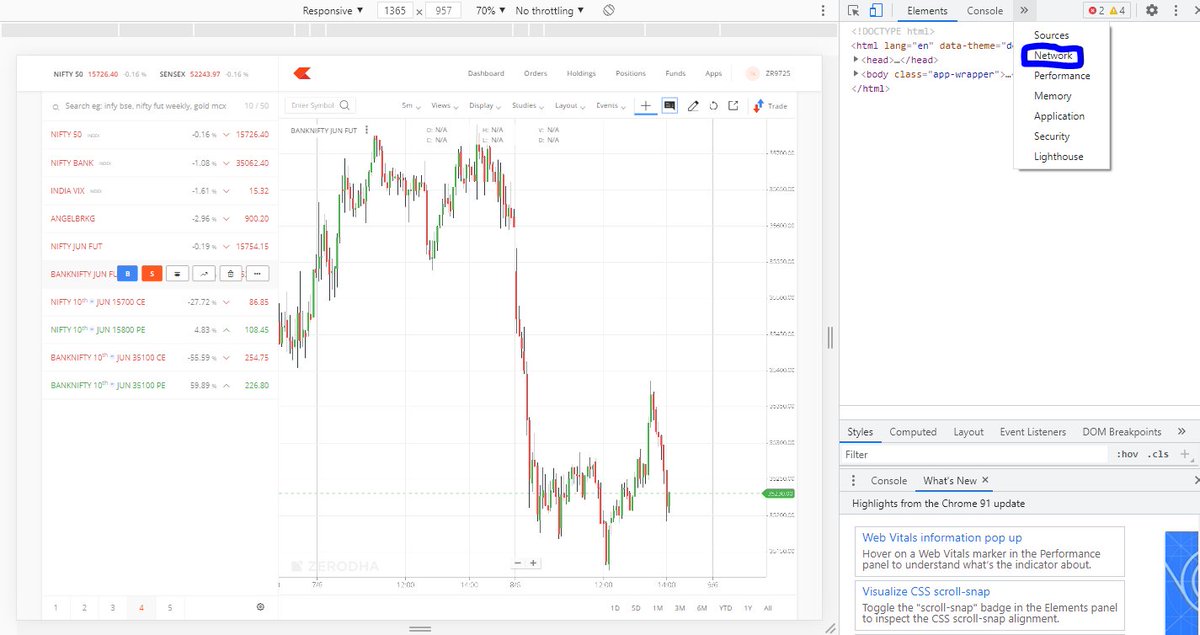

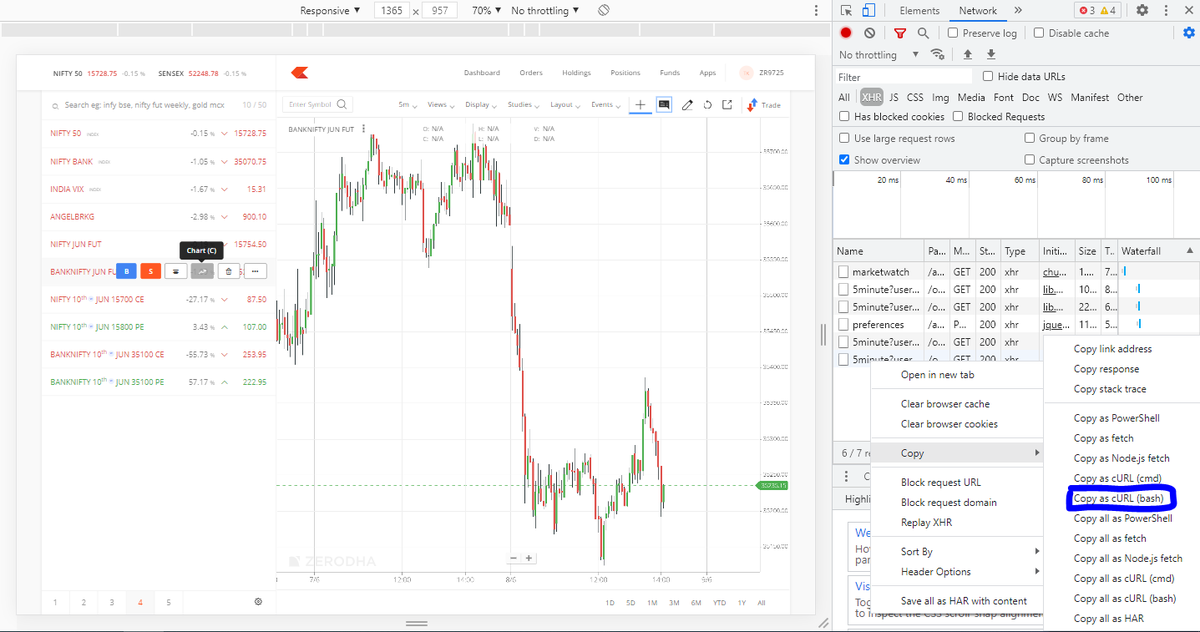

Tools (free) that you can use

- Opstra strategy builder

- Opstra options skew

- Opstra strategy builder

- Opstra options skew

Thanks for your patience. Would love to hear feedback and improvements and will try to answer any question you may have. 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh