nber.org/papers/w0838.p…

scholar.harvard.edu/files/campbell…

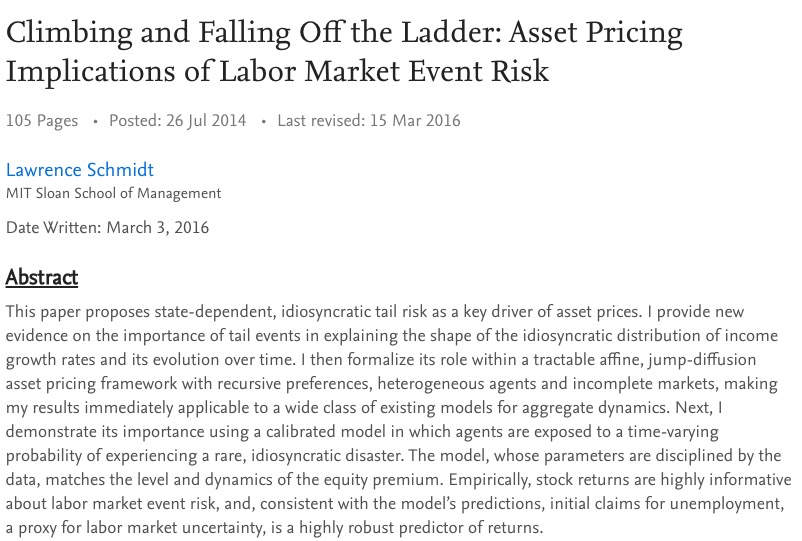

papers.ssrn.com/sol3/papers.cf…

papers.ssrn.com/sol3/papers.cf…

Ralph + Xavier first write this paper on "Granular IV" which uses idiosyncratic shocks from large players for identifying variation

papers.ssrn.com/sol3/papers.cf…

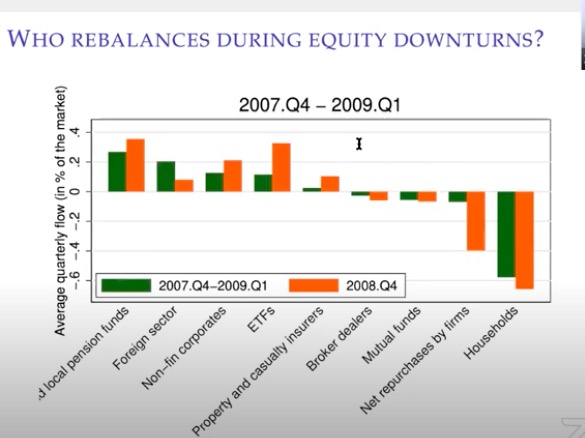

- take idiosyncratic shocks to intermediaries as instrument for flows

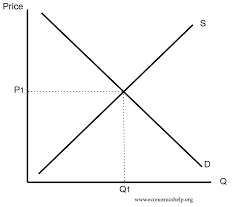

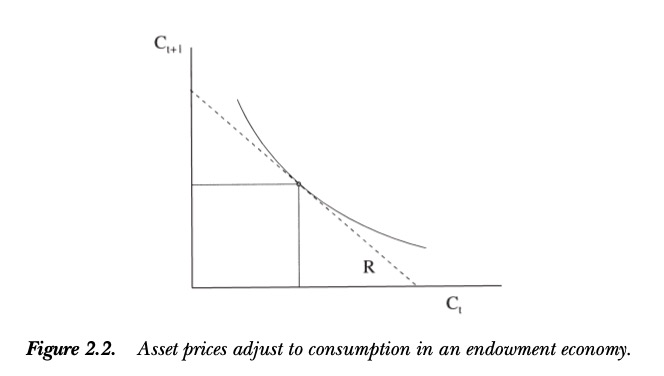

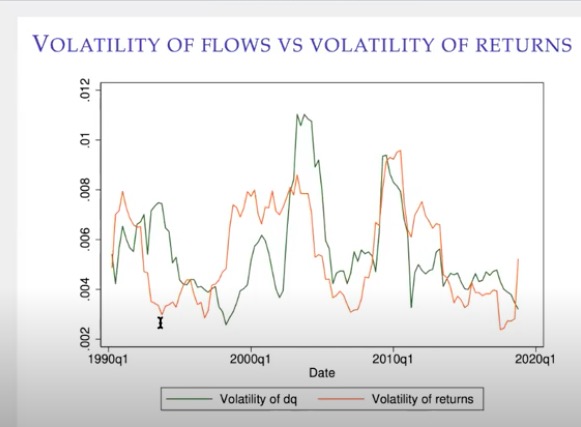

- exogenous flow variation estimates "macro elasticity"—how much market moves in response to given flow

- Find it's super large: $1 (or 1%) move in flow ->5-12$/% impact

Another implication: addresses this "puzzle" of why US gov debt is holding value. Fed is buying a ton

papers.ssrn.com/sol3/papers.cf…