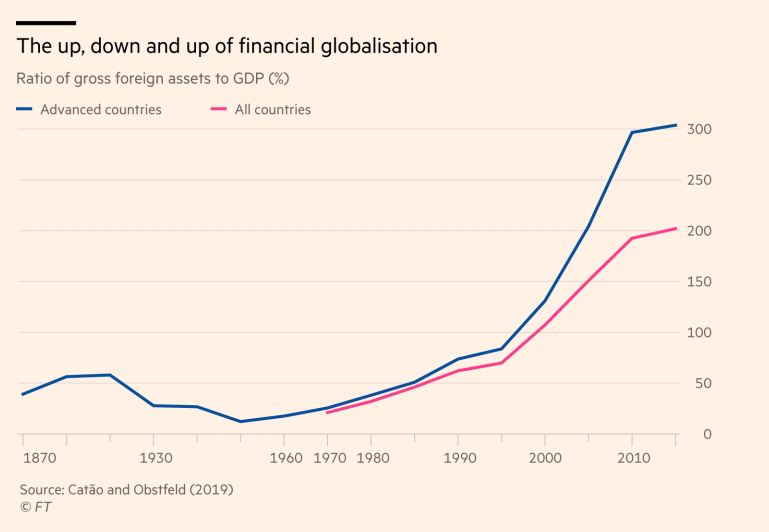

I cannot see much evidence for the death of the latter.

ft.com/content/9bcc0a…

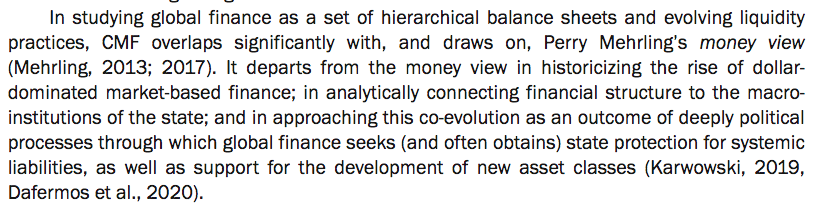

And despite that FT title, real and financial globalisation have not been not moving in the same direction.

ft.com/content/5887ec…

ft.com/content/3b4a56…

Apparently 'Nature as an asset class' will give us transformative change.

#WallStreetConsensus