bis.org/publ/bisbull20…

See the BIS Quarterly Review published today:

bis.org/publ/qtrpdf/r_…

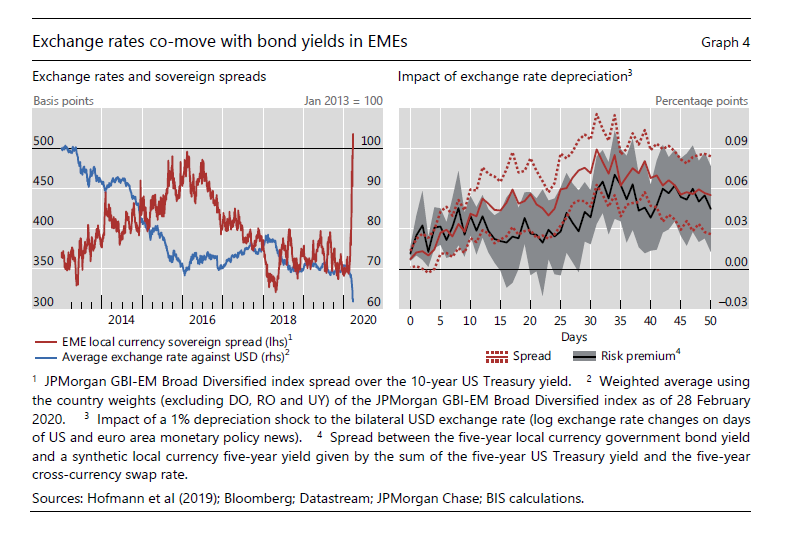

The external/internal dimension needs to be taken seriously, separately from the foreign currency/domestic currency dimension