Economic Adviser and Head of Research, Bank for International Settlements

7 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/FMG_LSE/status/1923043236257341650The GFC was a watershed event that set in motion two related structural changes to the global financial system. Those changes define the state of the system today

First, some background to set the scene

First, some background to set the scene

Price rises have affected a broader range of commodities this time round than in the 1970s (for instance, see the yellow bar on industrial metals), but the size of the oil price shock has been much less than the 1973 shock

Price rises have affected a broader range of commodities this time round than in the 1970s (for instance, see the yellow bar on industrial metals), but the size of the oil price shock has been much less than the 1973 shock

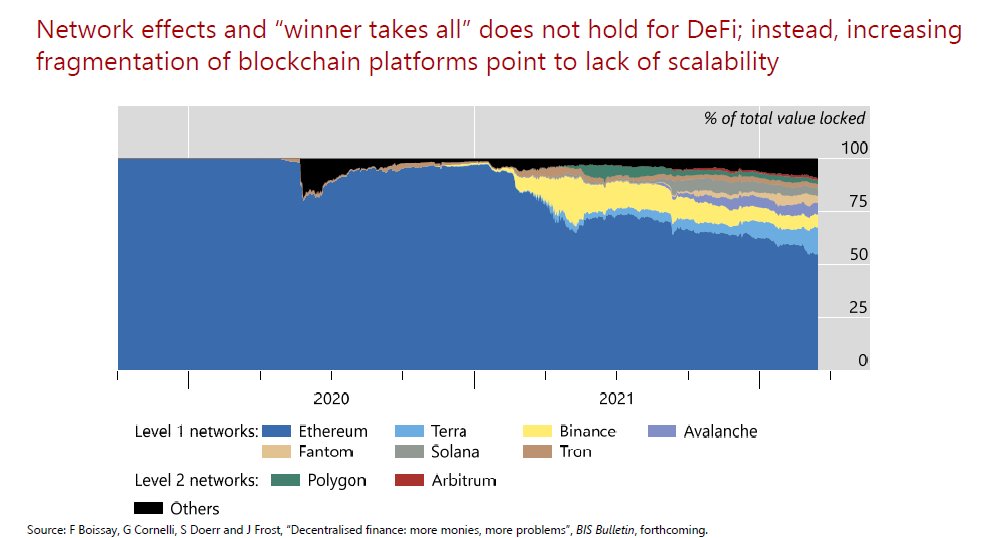

One notable development has been the fragmentation of the blockchain universe, with #Ethereum giving up its dominance to newer chains

One notable development has been the fragmentation of the blockchain universe, with #Ethereum giving up its dominance to newer chains

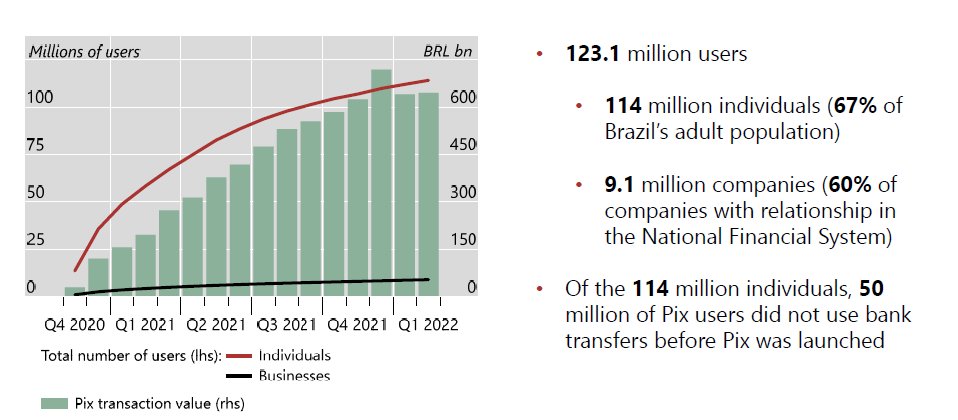

The trajectory of adoption by users has been phenomenal since the launch of Pix in November 2020

The trajectory of adoption by users has been phenomenal since the launch of Pix in November 2020

First, it's worth stressing how unusual the Covid recession was in terms of house prices

First, it's worth stressing how unusual the Covid recession was in terms of house priceshttps://twitter.com/BIS_org/status/1501947247738585092

https://twitter.com/BIS_org/status/1491339845628743681First finding:

https://twitter.com/BIS_org/status/1468874062227288068Supply bottlenecks have grabbed all the headlines recently, but longer-term structural changes brought about by the pandemic (labour markets, especially) are important to understand where we are headed

https://twitter.com/EtraAlex/status/1462173607883382785First, regarding the counterparty sector, the 2020:Q1 surge in cross-border banking flows stands out

https://twitter.com/BIS_org/status/1461053785778888710Blockchain has breathed new life into the idea of money as a substitute for a ledger that keeps score of who owes what to whom

Bottlenecks started out as disruptions to supply, but they have morphed into something more

Bottlenecks started out as disruptions to supply, but they have morphed into something more

https://twitter.com/ChrisBrummerDr/status/1450146924288528386Decentralization is motivated by the governance benefits - the idea is that the checks and balances of the community as a whole is the best way to safeguard the integrity of the system and avoid capture by a few powerful entities

https://twitter.com/TheStalwart/status/1408032963925848070Privacy looms large when CBDCs come up, as digital currencies rely on a ledger of some kind - a record of who owns what, when, and who pays what to whom; see this (tough but fair) interview with @izakaminska and @senoj_erialc I gave to @FTAlphaville

https://twitter.com/HyunSongShin/status/1407760371302252544?s=20

The BIS Quarterly Review out today has an introductory piece outlining what's new

The BIS Quarterly Review out today has an introductory piece outlining what's new

https://twitter.com/bis_org/status/1352578962141151235Dreamcatcher puts into one package the BIS’s cross-border banking statistics; or more accurately, it gathers the BIS’s locational banking statistics that breaks out the cross-border bank claims according to the residence principle

https://twitter.com/bis_org/status/1326118161704476672The Bank of Amsterdam started life as a rigid stablecoin, where holders of silver and gold coins delivered them to the Bank, in return for deposits

First, some facts:

First, some facts: