"VIX rolldown performs at least as well as carry.

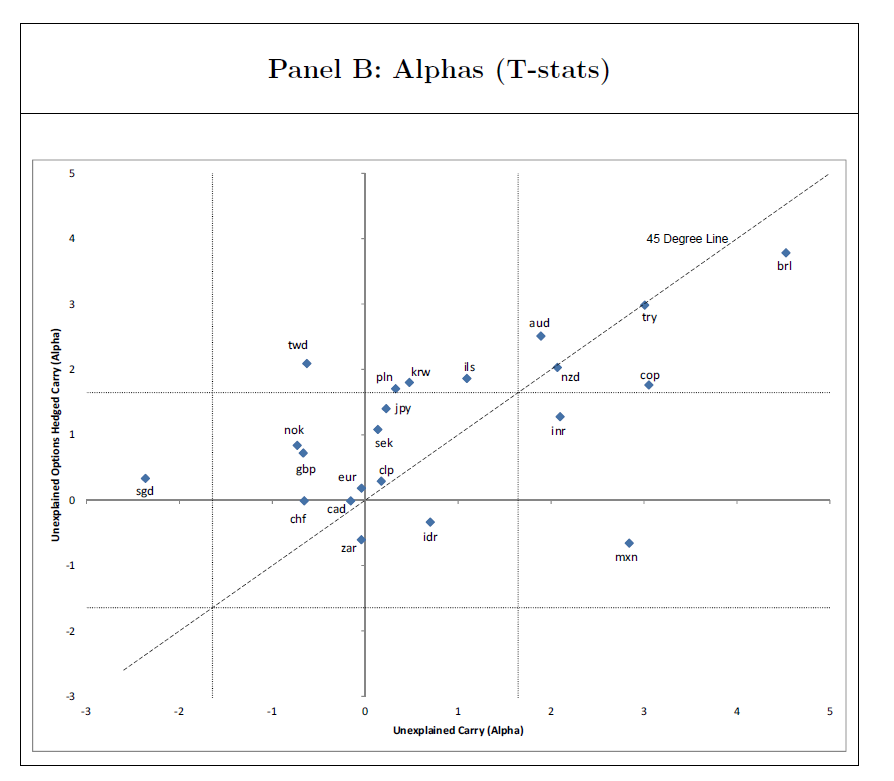

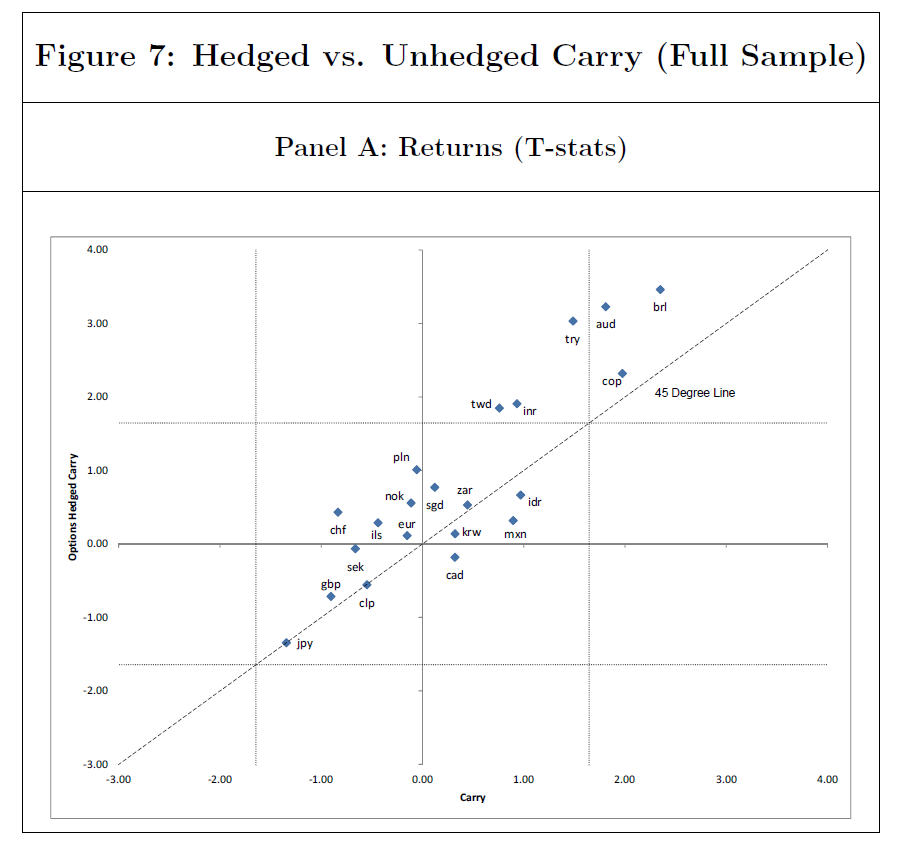

"However, hedging carry with exchange rate options produces large returns that are not a compensation for systemic risk."

papers.ssrn.com/sol3/papers.cf…

In his interview with Jack Schwager, he notes that implied volatility was too low during that period (and suggests that carry hedged with options may not always work).

Bhansali looks at a similar strategy going further back in time and gets similar results (but does not control for exposure to VIX futures):