The basic difference between Private Banks & PSBs were always Regulation, where Private Banks managed & run by independent board with minimum Govt interference & RBI supervision, PSBs have directly controlled by Govt for its Social Banking for Financial Inclusion

#IndiaNeedPSBs

#IndiaNeedPSBs

Out of 38.88 Crore PMJDY A/c, merely 1.25 Crore Were opened by Pvt Banks, Iconic Rupay card distribution is also lagged in Pvt Banks. Pvt Banks have issued 1.14 Crore Rupay cards to customers compare to 24.76 Crore Card issued by Public Sector Banks

#IndiaNeedPSBs

#IndiaNeedPSBs

A study conducted by NABARD for Rupay Kisan Credit Cards (The pioneer scheme for Rural Financing), Pvt Banks have only 1.03% share compare to 59.70% Share of Public Sector Banks. Honourable PM shri @narendramodi promised to double farmers income by 2020!!

#IndiaNeedPSBs

#IndiaNeedPSBs

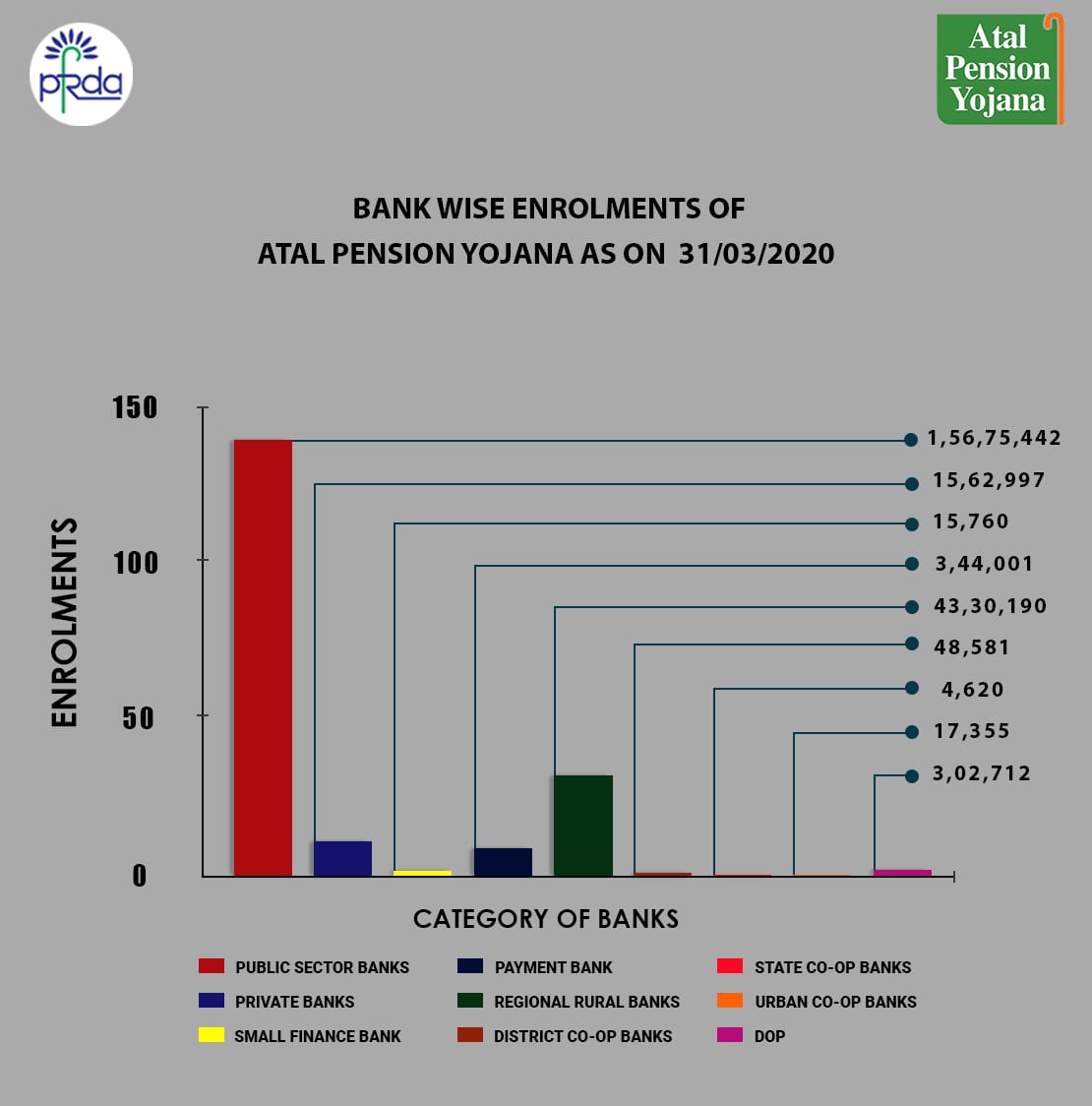

"Pension for All" scheme of Atal Pension Yojna to provide social security to all Indians was started by @PMOIndia where pvt Banks enrolled only 15.62 Lakh benefecries compare to 1.56 Crore enrolment done by PSBs. Clearly #IndiaNeedPSBs to provide Social security to all

The MSME sector on which @FinMinIndia is focusing utmost to drag country out from Slow growth have also been implemented by PSBs only. Figures indicated that PSBs r way ahead to private banks to finance MSME sector.

#IndiaNeedPSBs

#SavePSBs

#IndiaNeedPSBs

#SavePSBs

The country where more than 70% population lives in Villages & below poverty line in terms of Income, pvt Banks have opened their most PMJDY A/c in URBAN areas(???) Just to Show Numbers!!!

Whereas PSBs major share of PMJDY A/c is at SemiUrban & Rural Areas!!

#IndiaNeedPSBs

Whereas PSBs major share of PMJDY A/c is at SemiUrban & Rural Areas!!

#IndiaNeedPSBs

• • •

Missing some Tweet in this thread? You can try to

force a refresh