A platform of All PSU Bankers Serving the Nation with utmost integrity & Honesty without any Prejudice.

Truly NonTrade Union Forum

RTs r nt Endorsements.

3 subscribers

How to get URL link on X (Twitter) App

& Repo Rate declined from 9.9 percent in October-08 to 3.17 in May-2008. Although RBI increased liquidity significantly, the utilization of liquidity by banking system was limited because of the low credit demand from the Market &

& Repo Rate declined from 9.9 percent in October-08 to 3.17 in May-2008. Although RBI increased liquidity significantly, the utilization of liquidity by banking system was limited because of the low credit demand from the Market &

4th- Scrap NPS

4th- Scrap NPS

Day 3- 22.06.2020

Day 3- 22.06.2020

Insurance is a purely Voluntary service & Banks can't force customers to Buy policy but can advise. In reality 90% of Retail Loan Borrowers r somewhere policy holders of 1 or more Insurance policy. Its given them forcefully & Media can easily call some of the borrower to find out

Insurance is a purely Voluntary service & Banks can't force customers to Buy policy but can advise. In reality 90% of Retail Loan Borrowers r somewhere policy holders of 1 or more Insurance policy. Its given them forcefully & Media can easily call some of the borrower to find out

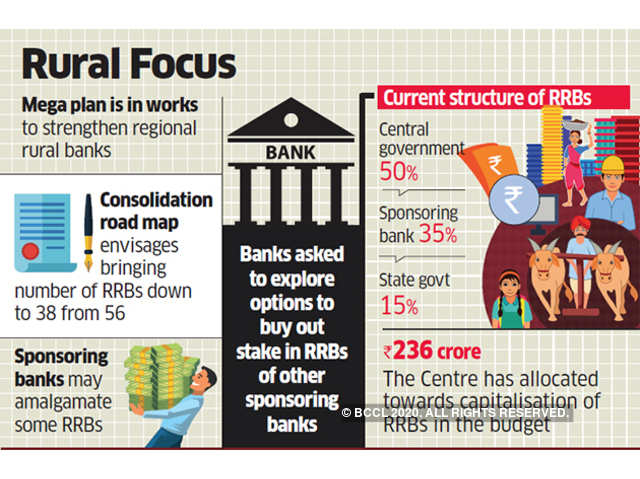

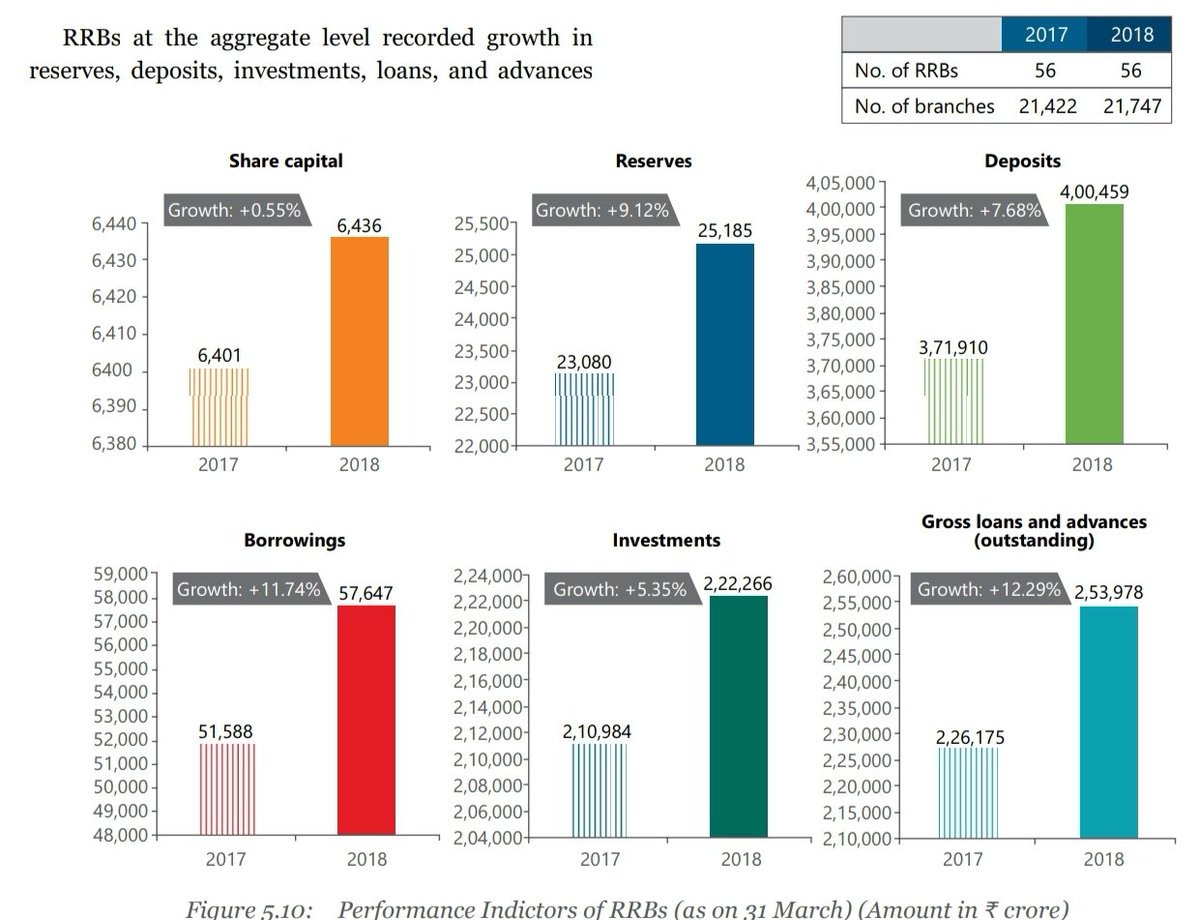

The number of Regional Rural Banks (RRBs) stood at 56 as on 31 March 2019 with a branch network of 21,747. RRBs at the aggregate level recorded growth in reserves, deposits, investments, loans, and advances. At present 43 #GraminBank in functioning, 95% branches in Most Interiors

The number of Regional Rural Banks (RRBs) stood at 56 as on 31 March 2019 with a branch network of 21,747. RRBs at the aggregate level recorded growth in reserves, deposits, investments, loans, and advances. At present 43 #GraminBank in functioning, 95% branches in Most Interiors

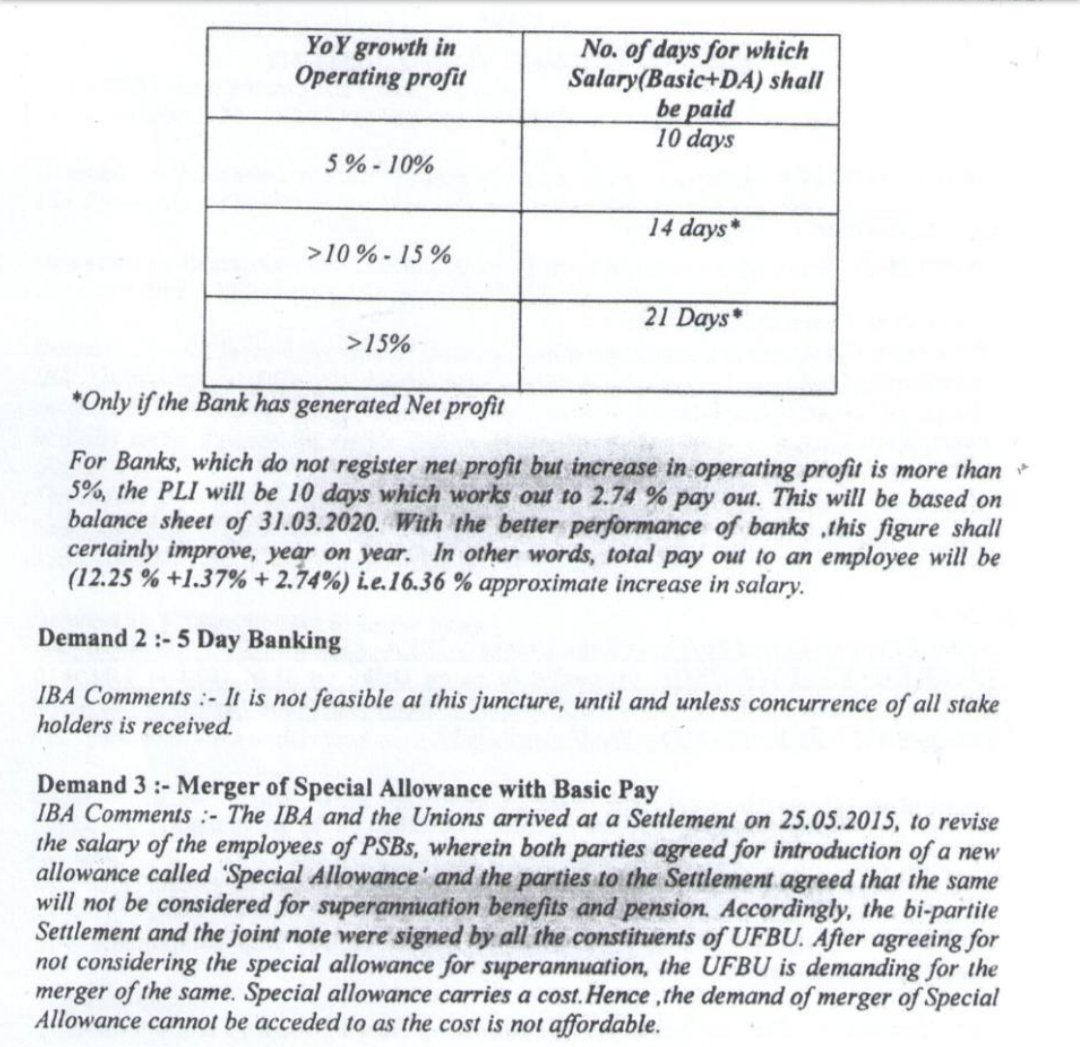

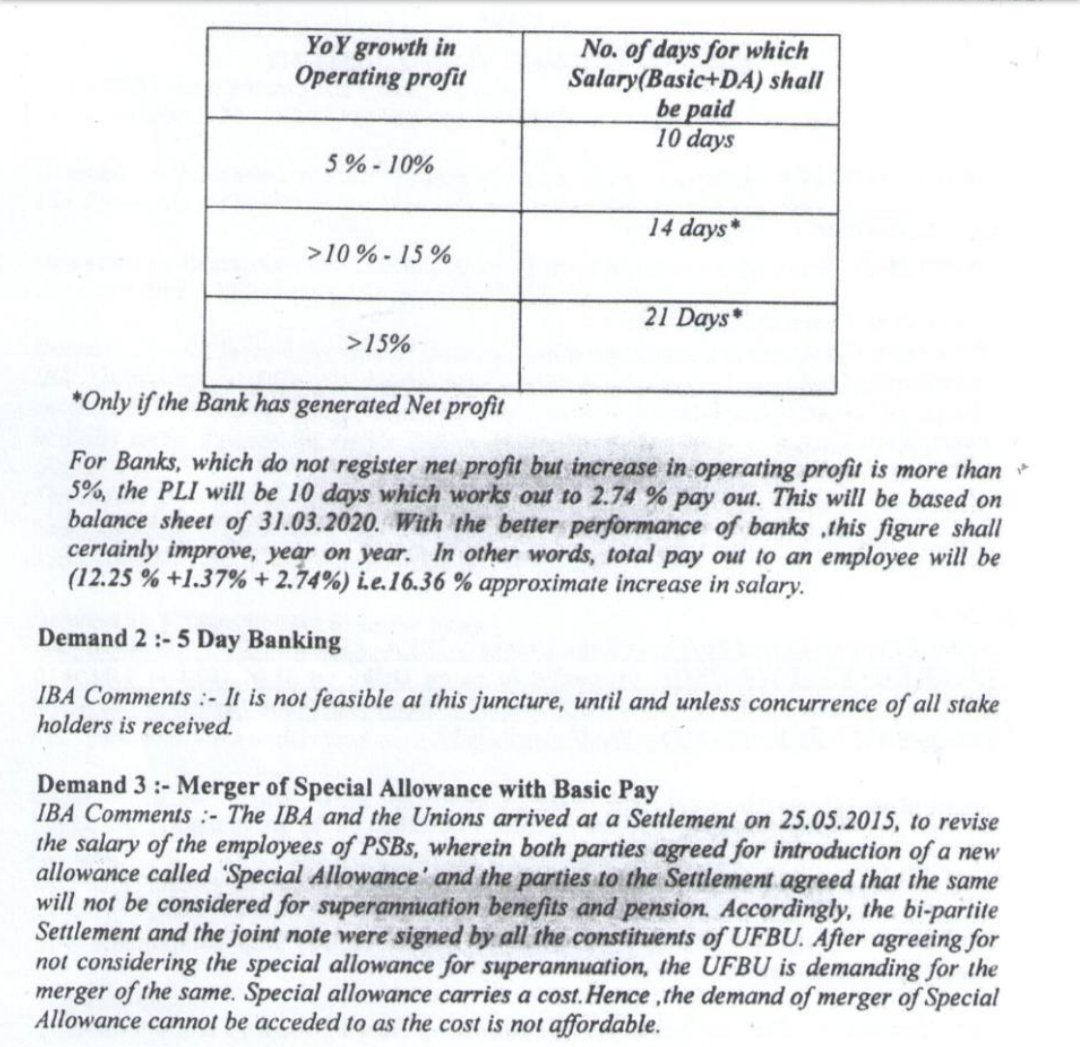

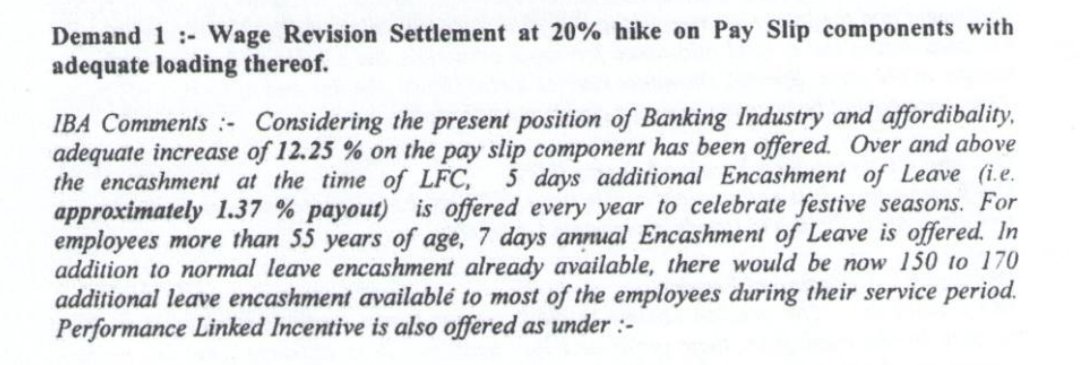

There were 2 Major breakthrough happened in 10thBPS,

There were 2 Major breakthrough happened in 10thBPS,

APR 2019 says that CGTMSE is self driven Trust as the income of the trust for year 2019 stands as 170 Crore compared to Expenditure of 161 Crore (90% Expensec was for Guarantee Claim).

APR 2019 says that CGTMSE is self driven Trust as the income of the trust for year 2019 stands as 170 Crore compared to Expenditure of 161 Crore (90% Expensec was for Guarantee Claim).

Sri Mahendra Singh Mahara, on 14.03.2017 asked in Upper house abt Banks Role during demonatization & abt their Wage Revision.

Sri Mahendra Singh Mahara, on 14.03.2017 asked in Upper house abt Banks Role during demonatization & abt their Wage Revision.