In order to try and provide some clarity...this thread will need to suffice for now.

1/

2/

The core of Milkshake Theory relates to US equities rising while ROW remains under pressure due to $ liquidity falling. So while this isn't surprising, it also isn't IT.

3/

This the money printer go brrrr meme that is basically mentioned in every conversation surrounding global finance these days

4/

5/

6/

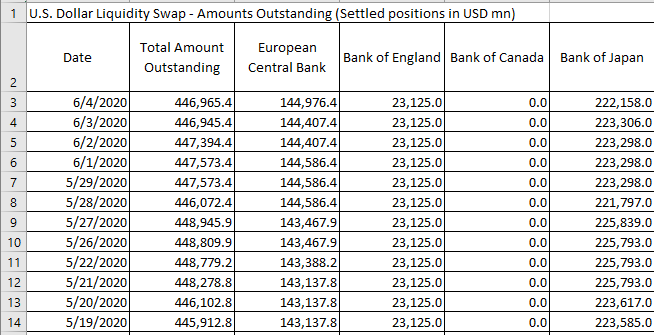

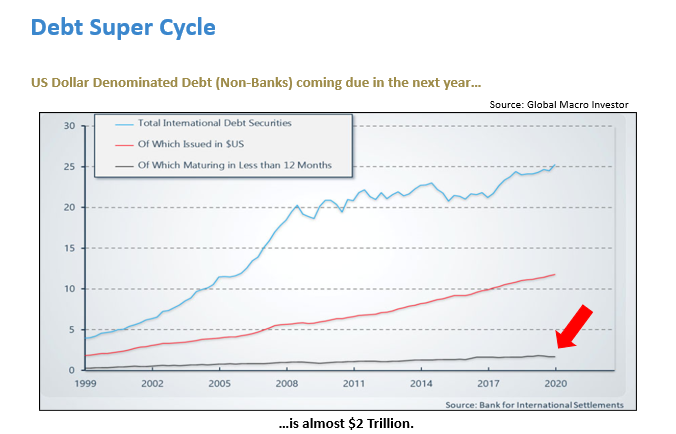

Yes...yes...I know...I'm constantly told the Fed will bail out the whole world via swap lines. Problem is swap lines aren't nearly big enough to plug dollar demand. Currently $450b of SLs extended. But almost $2T in eurodollar loans are due in next year...

10/

13/

14/

Of course!

Does that mean I could be wrong?

Of course!

Just ask all my twitter trolls...they will be happy to point out my many mistakes.

15/

-Totally wrong

-Early

I know that w/o change of behavior I'm not totally wrong. Just look at .com bubble to GFC to Covid crisis...to know that problems can be deferred but not fixed unless do something new. & nothing new has been done

16/

This is VERY possible...

and YES, this would still mean I got it wrong.

Early wrong is annoying.

Early wrong hurts.

But early wrong is not fatal.

And if you are strong, it doesn't kill you.

And it means you still have an opportunity to be right...

17/

18/

Ive been very wrong on equities for last month.

And it hurts.

So its possible I'm wrong/early on $ & it falls further over coming months. If so I will be bombarded with the "How could you get it so wrong" tweets, emails, phone calls and dms.

19/

Im aware Ive made a big call & have been been loud about it. Even friends who agree w/me have called me insufferable!😅

U don't get to take credit when right if don't take the arrows when wrong. This is not a game for little girls & little boys.

20/

21/

For those of you on the other side, and even those of you firing the arrows, I'd say this game is far from over. I don't expect it to be easy & I learn something new every day. But regardless, i will continue to fight.

22/

Peace ✌️

/23