If you can keep your head when all about you are losing theirs & blaming it on you…

NOT TRADING ADVICE

https://t.co/l29nWovEkm

22 subscribers

How to get URL link on X (Twitter) App

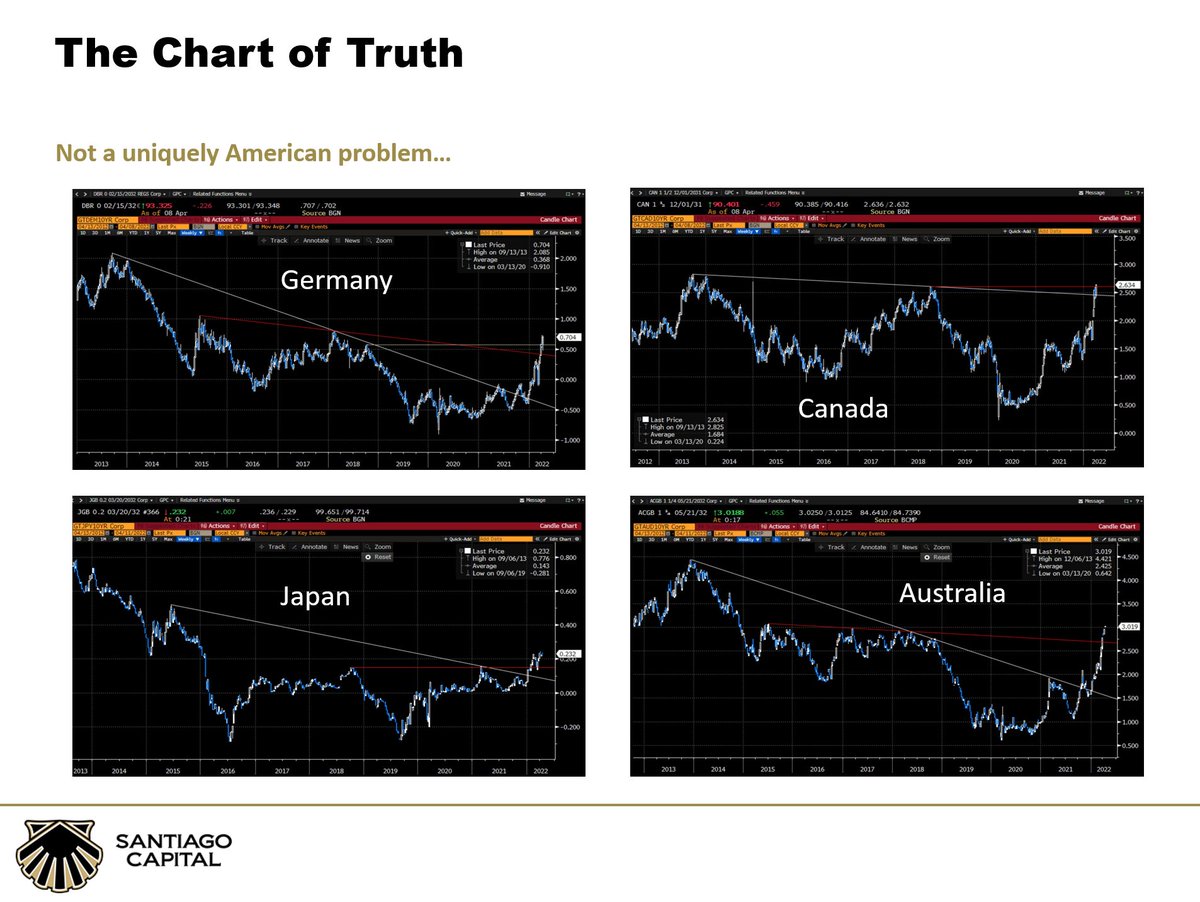

What I do know is that this is not a uniquely American issue. The whole world is dealing with funding costs rising. Germany, Canada, Australia...for god's sake even Japanese rates are rising...

What I do know is that this is not a uniquely American issue. The whole world is dealing with funding costs rising. Germany, Canada, Australia...for god's sake even Japanese rates are rising...

2/

2/

https://twitter.com/SantiagoAuFund/status/1268703151751786496Long story short, the fall in Q1 & subsequent rally we've seen in last 3 months in equities is NOT due to the core part of my thesis. It IS part of "moments of great terror & disbelief along the way" part of thesis...but not how I envision equities moving to all time highs.