1. Natural risks (which may include hail, storm, flood, diseases, etc.)

2. Manmade /Artificial risks (fire, theft, vandalism, etc.)

3. Economic risks (price fluctuations, loss of income, currency, etc.

Poultry Farm Insurance: this product provides cover for birds (broilers, layers, parent stock, grandparents stock, etc.) against death as a result of fire, lightning, windstorm damage, flood, uncontrollable disease and accident.

Photo credit in first tweet: @sholaanimashaun & @Nig_Farmer

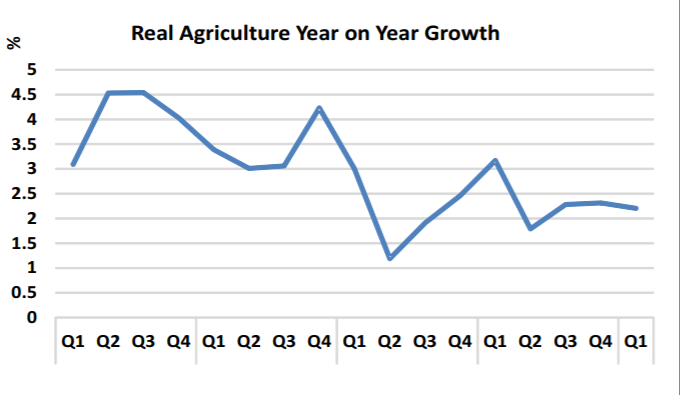

Data source: @nigerianstat

Thread inspired by @borie_nla