Will be sharing my earlier tweets on it.

#WeekendReading

#LearningTogether

The best loser is the long-term winner.

—Phantom of the Pits

- methodology

- money management

- psychology

Money management - amount of money you commit to trades

Psychology - having the discipline to follow your own trading plan.

- Brent Penfold

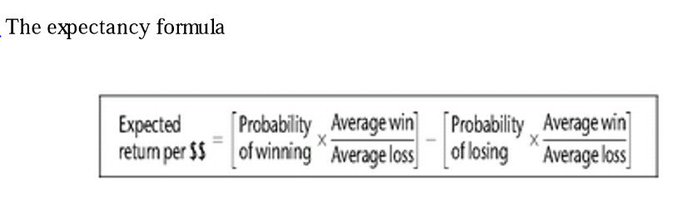

Reducing amount of money risked/trade

Increasing accuracy or win rate

Increasing average win to average loss payoff ratio.