For the past few days we’ve been doing a lot of research on the telecom companies.

1️⃣ Reliance Jio

2️⃣ Bharti Airtel

3️⃣ Vodafone Idea

Lot’s of not so good points about Vodafone Idea.

Retail investors usually don’t like to hear critical views.

Share or not?

So here’s what we’ll do;

Instead of just sharing the data one-way, we’ll make it an interactive session dedicated to #VodafoneIdea

This way we all can do our own research and collectively learn from it

🔸 This is NOT a buy / sell recommendation.

🔸 This is NOT technical analysis / price action analysis.

🔸 This is NOT meant to spread any negative sentiment.

Feel free to analyze the data on your own and take your own decision.

#RelianceJio is a relatively new company & is not affected a lot by AGR.

Also it is not independently listed on the markets and is backed by Reliance. They have recently raised almost ₹1 lakh crore & are cash flush.

This will be a purely fundamental comparison of the companies.

Like said before, this will be an interactive session to make sure that you do participate in the research so that you can believe the facts.

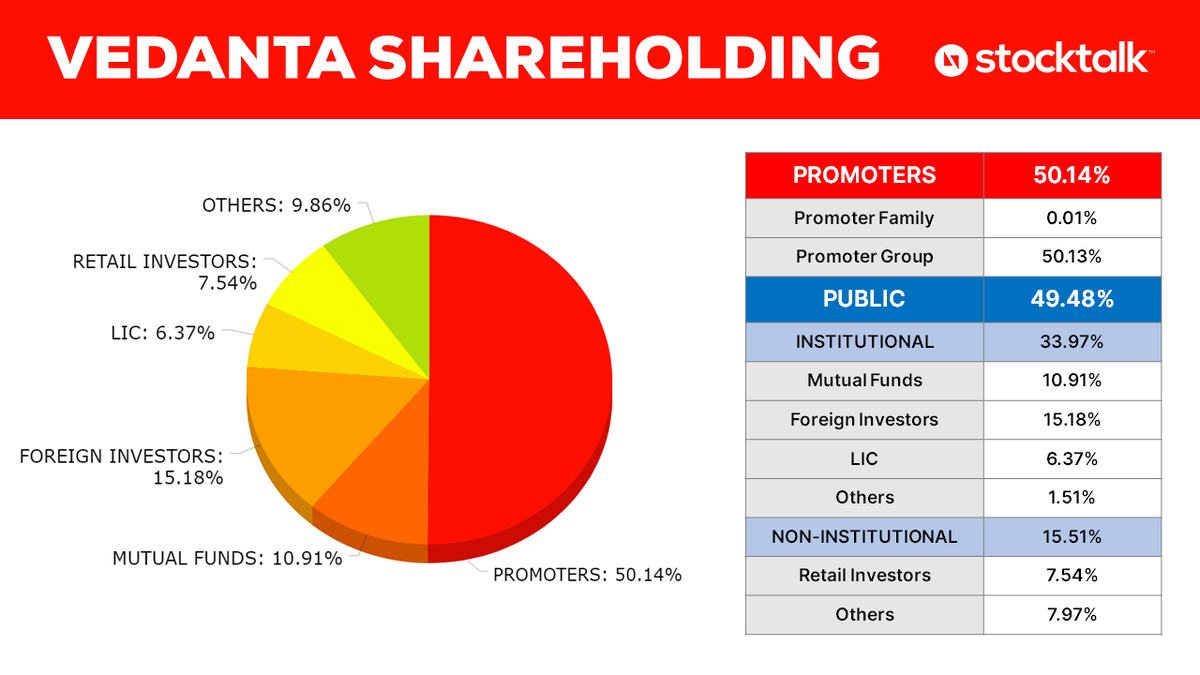

1) What is the institutional holding of the telcos?

2) What is the equity size and debt size?

4) What is the EPS of the company?

5) What is the P/E of the company?

6) What is the CAGR (%) returns of the company for the last 3, 5 and 10 years?

8) What is the ROE % and ROCE % of the company?

You will get answer to these questions by doing a basic Google search or referring the company website.

Try to understand those numbers if your really want to understand it.

The company either needs to start raising capital fast or the parent company Vodafone UK needs to step in and infuse capital.

Reliance Jio has raised ₹1 lakh crore and Airtel has raised ₹7,000 crore.

There are advanced methods like discounted cash flow valuation, etc. that digs deeper in the company's financial position to estimate the future valuation.

But for now these 8 questions should give a fair idea.

It will show institutional confidence in the company which is currently more necessary than the capital itself.