If you are a CEO, learn about your path to power.

And if you are an investor - learn about your path to power.

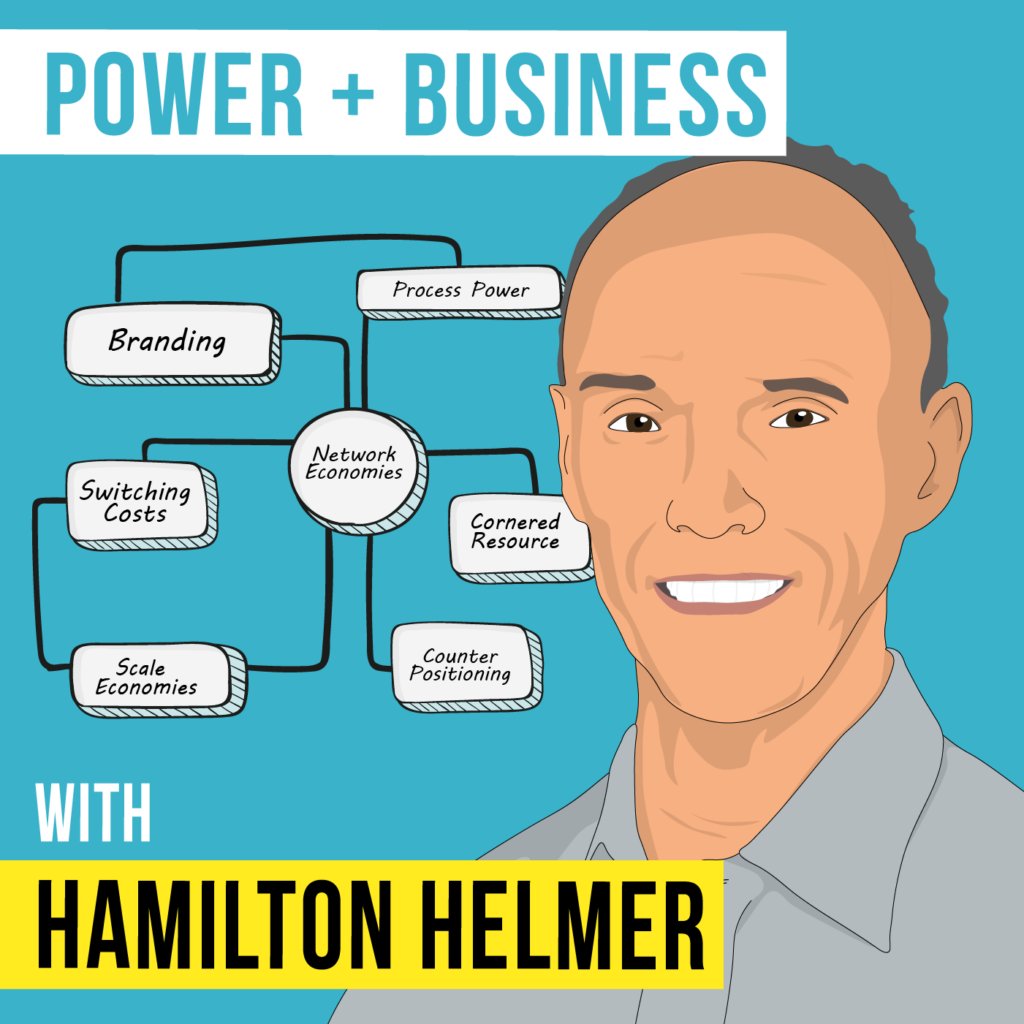

With thanks to Hamilton Helmer who wrote an excellent book with the same title. bit.ly/7powersbook

Power is the ability to earn supernormal profits and generate large amounts of shareholder value over a long time.

Companies that have done it in the past would include: Intel, Walmart, Ikea and Costco.

Their transformation was anything but a certain thing.

There were key decisions taken by the CEO's - Reed Hastings and Andy Grove that made it happen.

"The forces of competition are just incredibly strong. Everyone is trying to eat your lunch, and if you don't read 7 Powers you're going to die a lot sooner.

"Hamilton Helmer understands that strategy starts with invention.

He can't tell you what to invent, but he can and does show what it takes for a new invention to become a valuable business."

1/7: Scale Economies.

Most business analysts are aware of this and understand it. The key is when they kick in. At what point, in a growing business, it makes sense to invest heavily to achieve those scale economies.

Best reading on is by James Currier and others at nfx.com This is a must-read for all CEO's and investors: bit.ly/NFXMustRead

My summary: For many networks, forget Metcalf's N^2 and think more 2^N (Reeds Law)

Sometimes your competitor just does not have the willpower to compete with your business.

Think Kodak vs Canon and others.

Helmer should have included Christensen's book into the discussion but so be it.

amzn.to/3d0LXnp

SAP is discussed.

Oracle and Salesforce come to mind.

Not all brands are created equal.

My favourite person on the topic of brands is not Warren Buffett, but Tom Russo bit.ly/30J5wxY

At certain points it's development, a company may be able to dominate a key resource.

Patents and Pharma come to my mind. Helmer discusses Pixar. Or we have real estates, "location, location, location">

From time to time a company manages to develop a superior process. Helmer discusses Toyota. I like to think Berkshire Hathaway. Some people understand companies like Fastenal (but I don't - yet..)

This, of course, is the key question.

Key insight: it's not about static analysis - it's about the dynamics of getting there.

That's what I (like so many followers of Porter's 5 Forces) failed to see.

- Hamilton Helmer in the 7 Powers

- Hamilton Helmer in the 7 Powers.

That feels right intuitively.

Action, Creation, Risk.

These lie at the root of invention.

Passion, monomania and domain mastery fuel invention and are so central.

It may meaningfully boost power once you have established it, but if power does not yet exist, you cannot rely on planning.

All of this will be the subject of an upcoming podcast episode with @Jeremy_Deal of JDP Capital who introduced me to the book.

And also thanks to @MattPetersonCFA who introduced me to Jeremy.

investorfieldguide.com/helmer/