Father, Husband, Investor, Author & Optimist. My now: https://t.co/OD8KxFzlRB #FreeTheHostages #slavaukraini #IStandWithIsrael #RejoinEU Investor in Care Rating

How to get URL link on X (Twitter) App

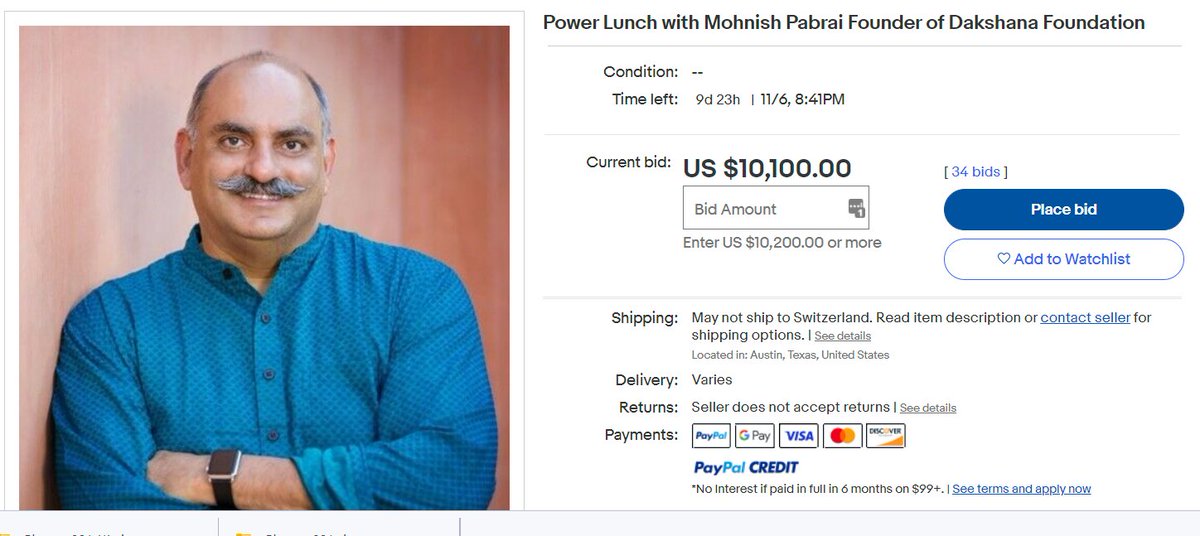

Almost two decades ago, I had the opportunity to break bread with Mohnish. It changed my life. We all know about the charity lunch with Warren Buffett - that was huge.

Almost two decades ago, I had the opportunity to break bread with Mohnish. It changed my life. We all know about the charity lunch with Warren Buffett - that was huge.

"On the surface, it appeared that Trump was acting irrationally, but what I've learned over the years as an investor is that almost everyone behaves rationally..."

"On the surface, it appeared that Trump was acting irrationally, but what I've learned over the years as an investor is that almost everyone behaves rationally..."

I used to be very bullish on the for-profit education industry.

I used to be very bullish on the for-profit education industry.

Switzerland, in terms of doses per 100, you are also behind: Serbia, Hungary, Turkey, Portugal, Morocco and Bahrain.

Switzerland, in terms of doses per 100, you are also behind: Serbia, Hungary, Turkey, Portugal, Morocco and Bahrain.

Research. Read. Assimilate. Rinse and Repeat.

Research. Read. Assimilate. Rinse and Repeat.

Let's be clear what we mean by Power when it comes to business:

Let's be clear what we mean by Power when it comes to business: