Chemical Sector - Catalytic Substitution in Play by @swarnabh_m

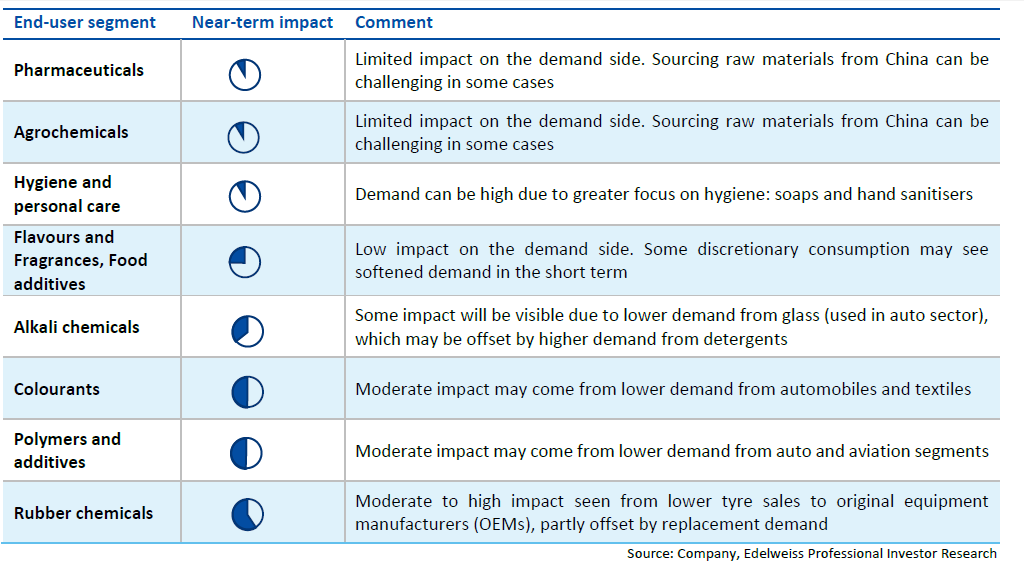

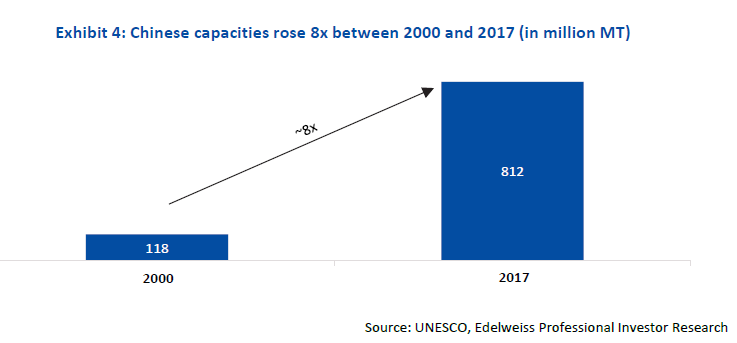

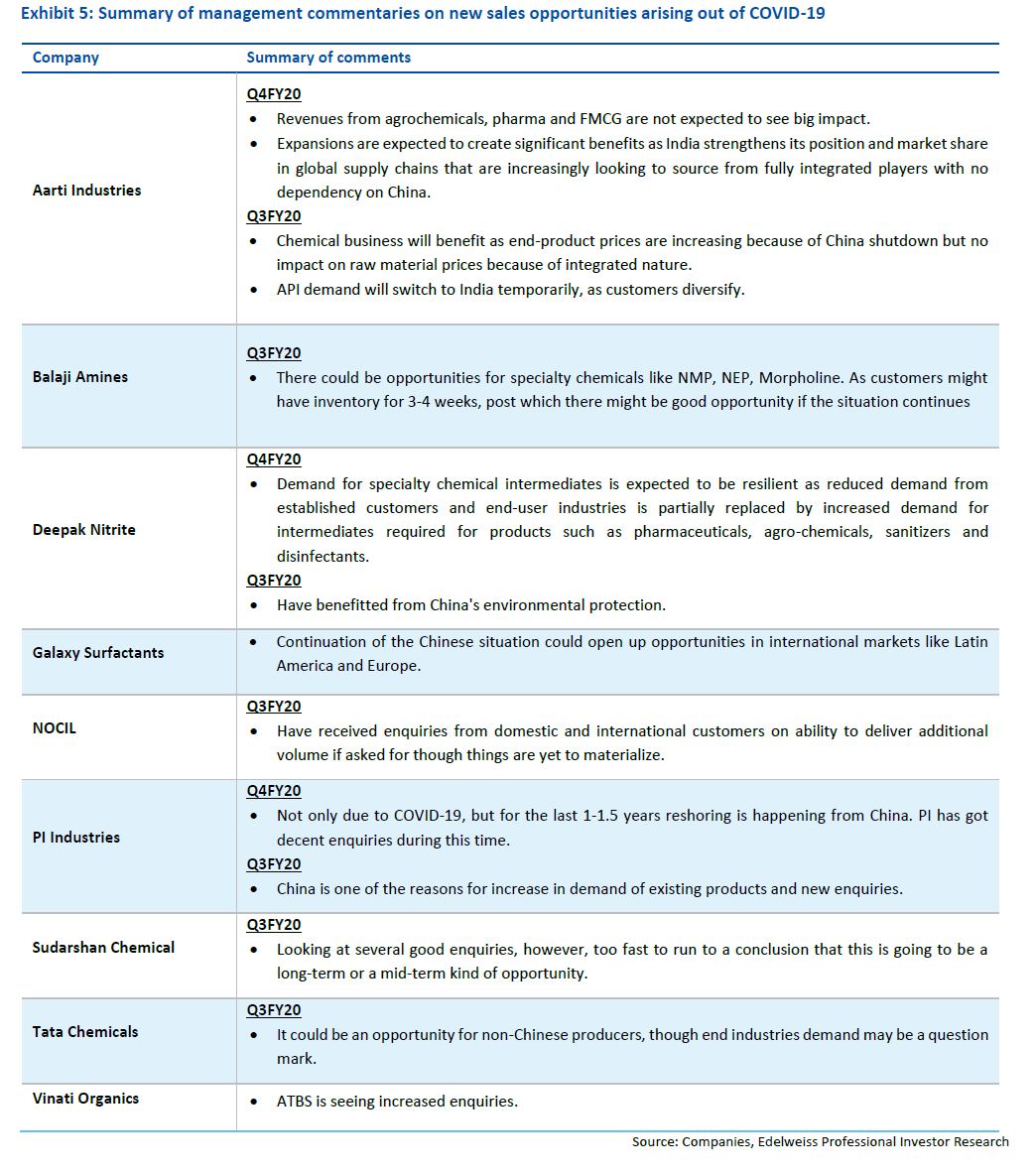

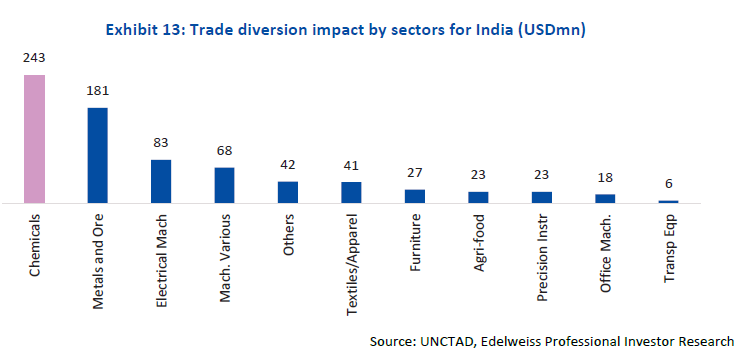

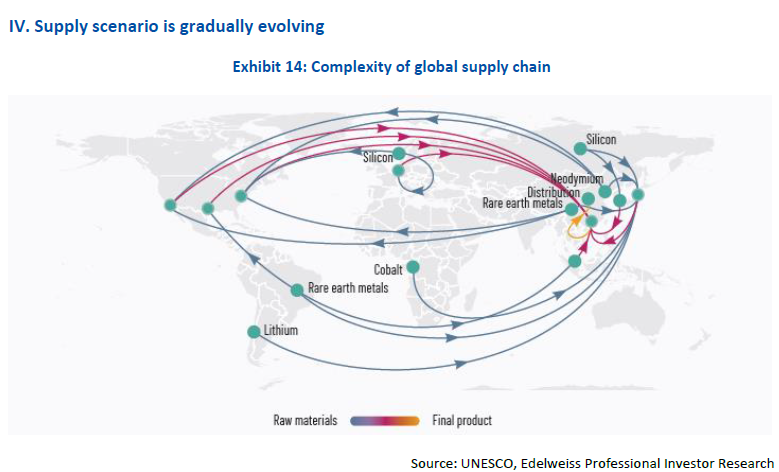

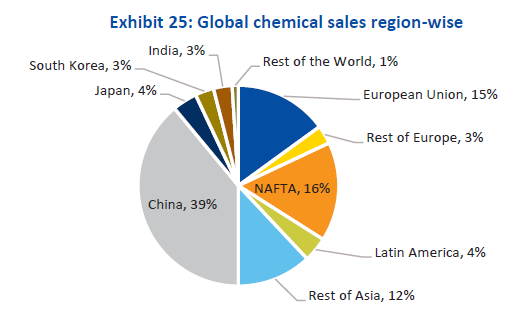

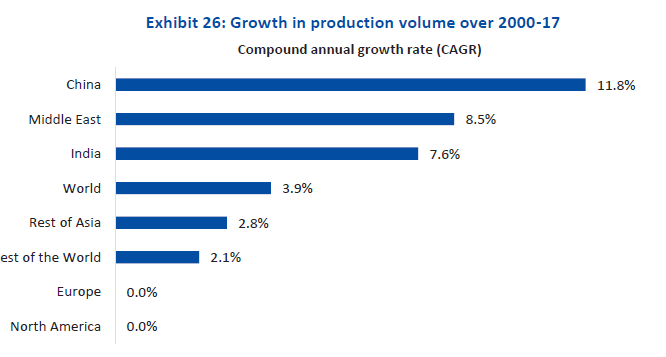

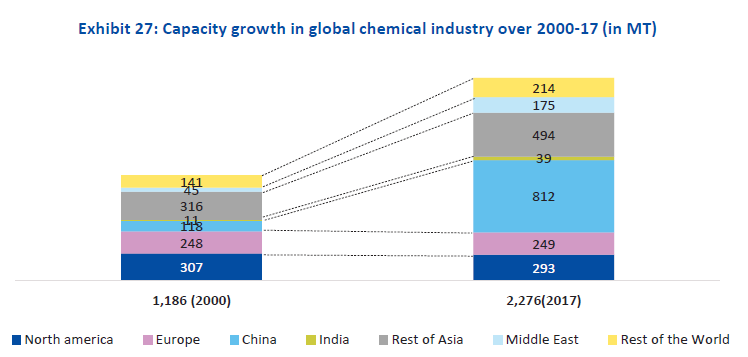

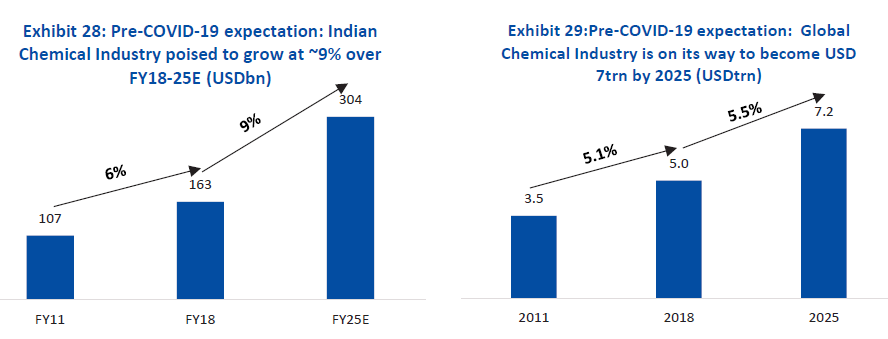

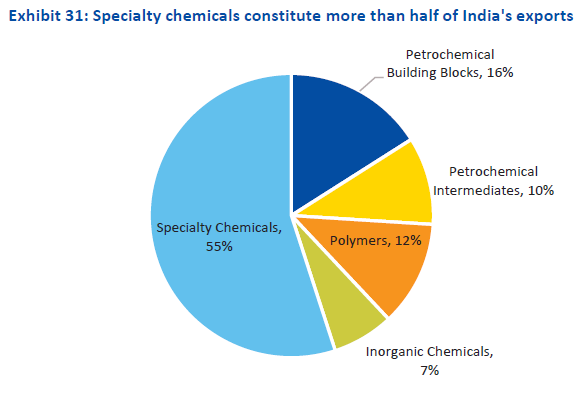

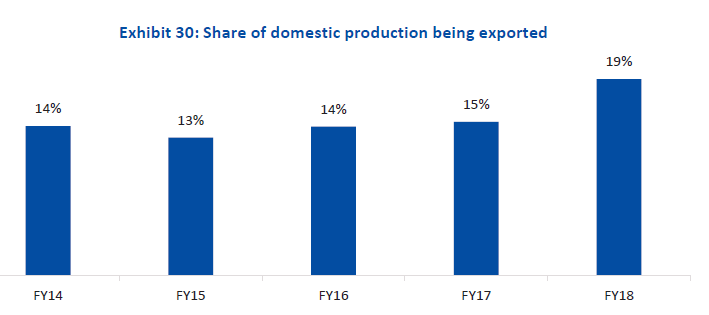

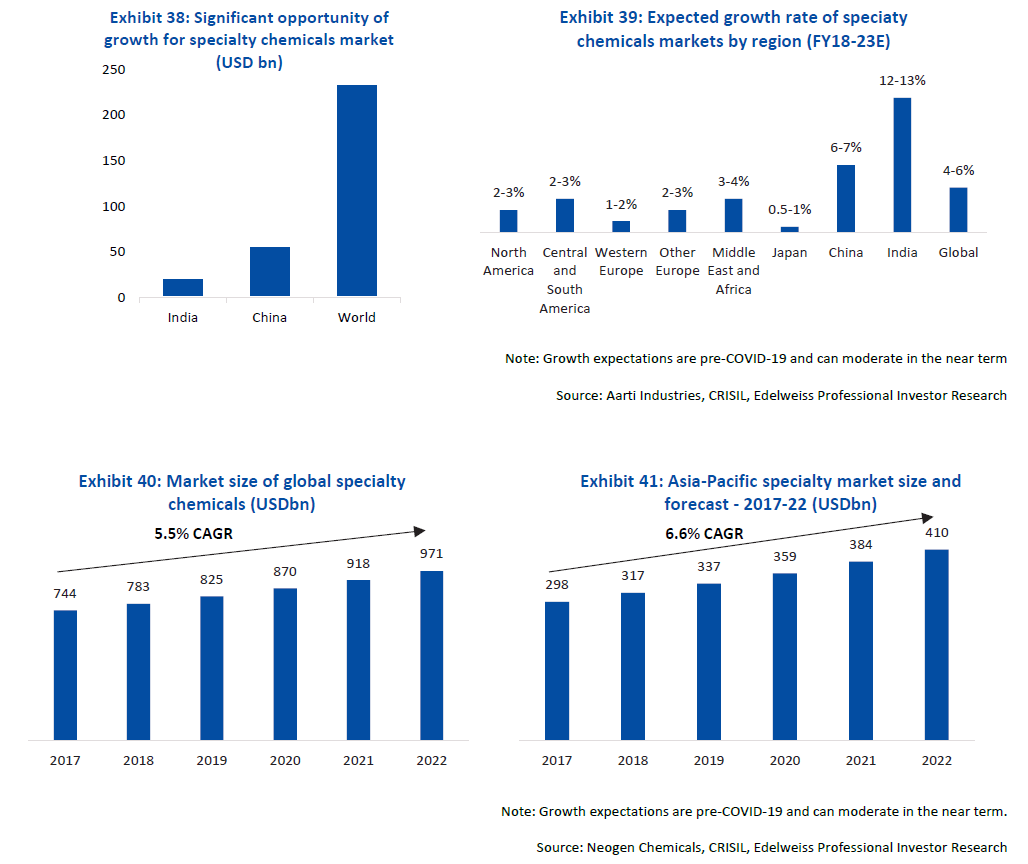

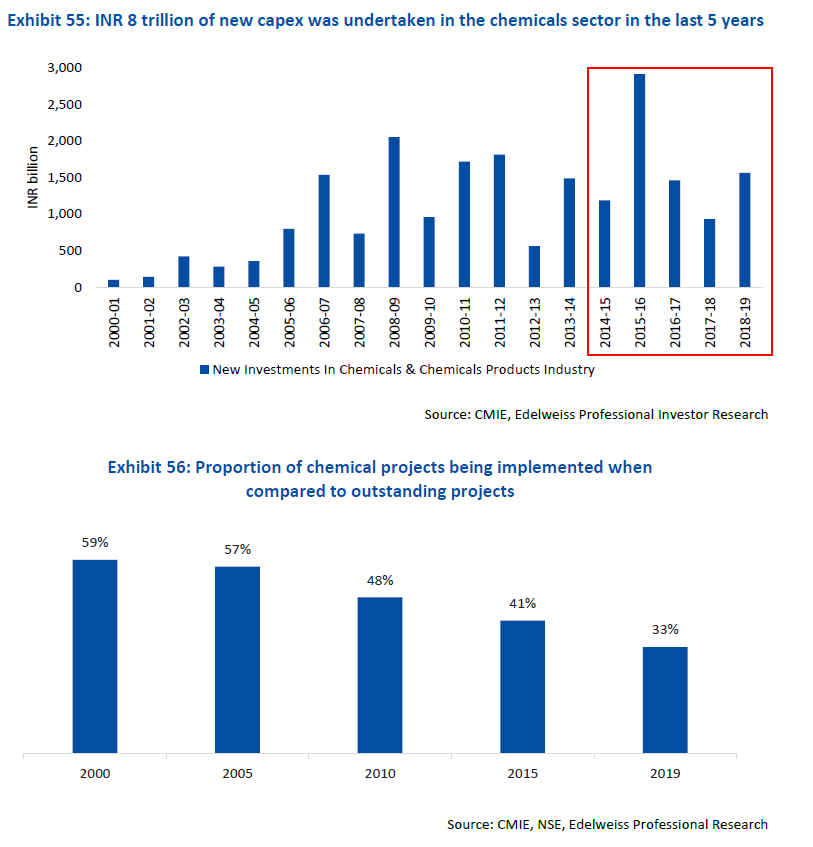

The Indian Chemical Industry is presently positioned in front of a set of developments that would result in strong growth opportunities in both the overseas and the domestic markets for Indian players.

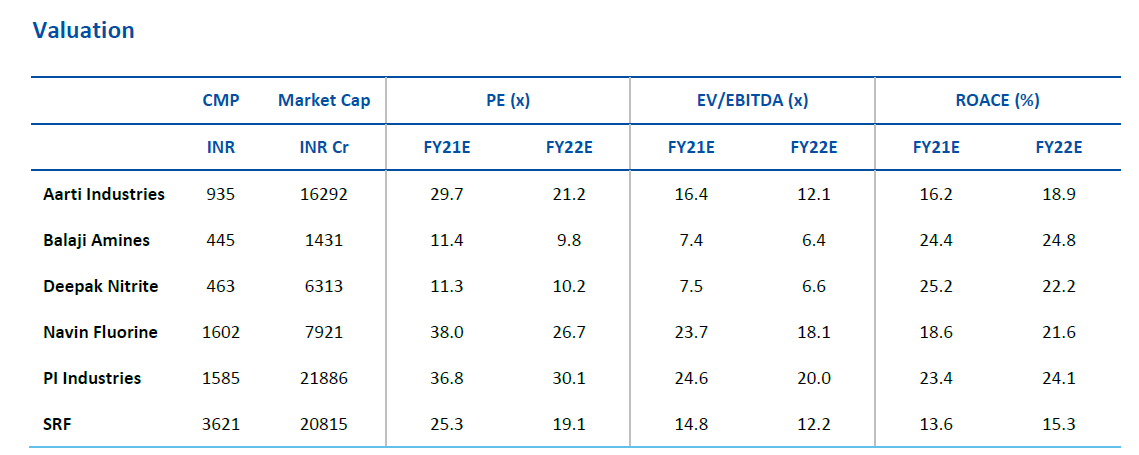

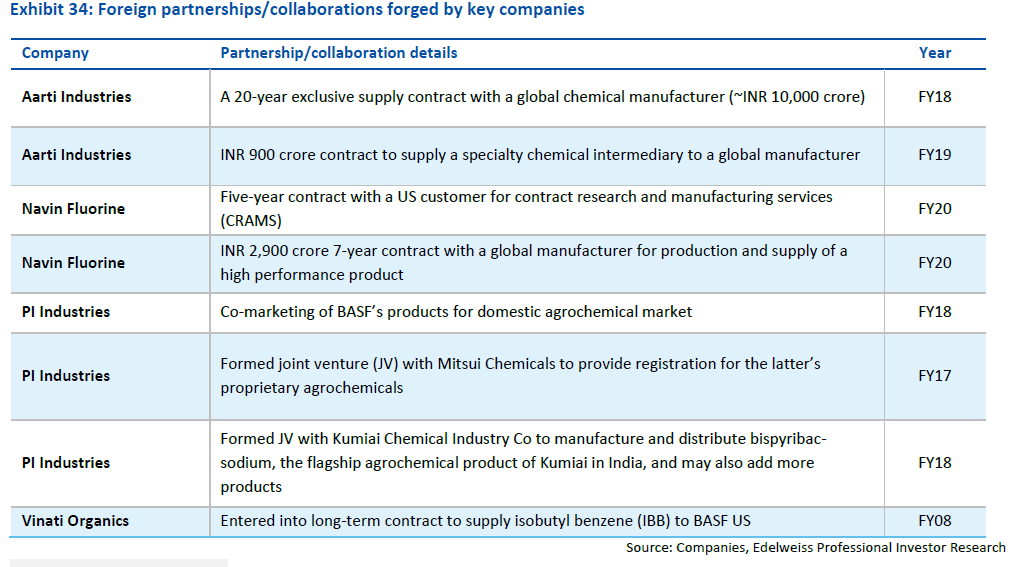

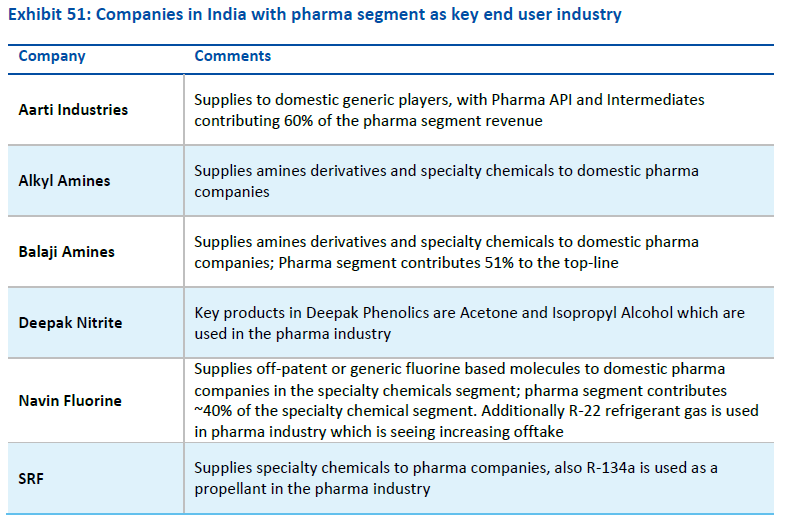

Focus companies - SRF, PI Industries, Navin Fluorine, Aarti Industries, Balaji Amines, Deepak Nitrite.

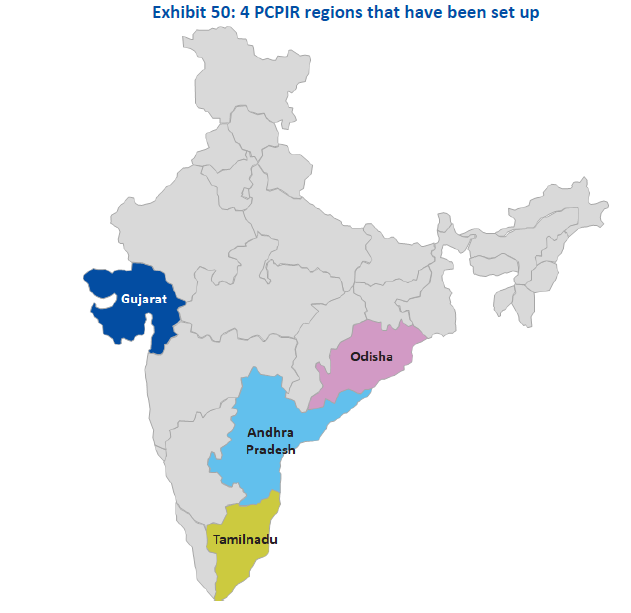

emphasizes on development of integrated bulk drug parks

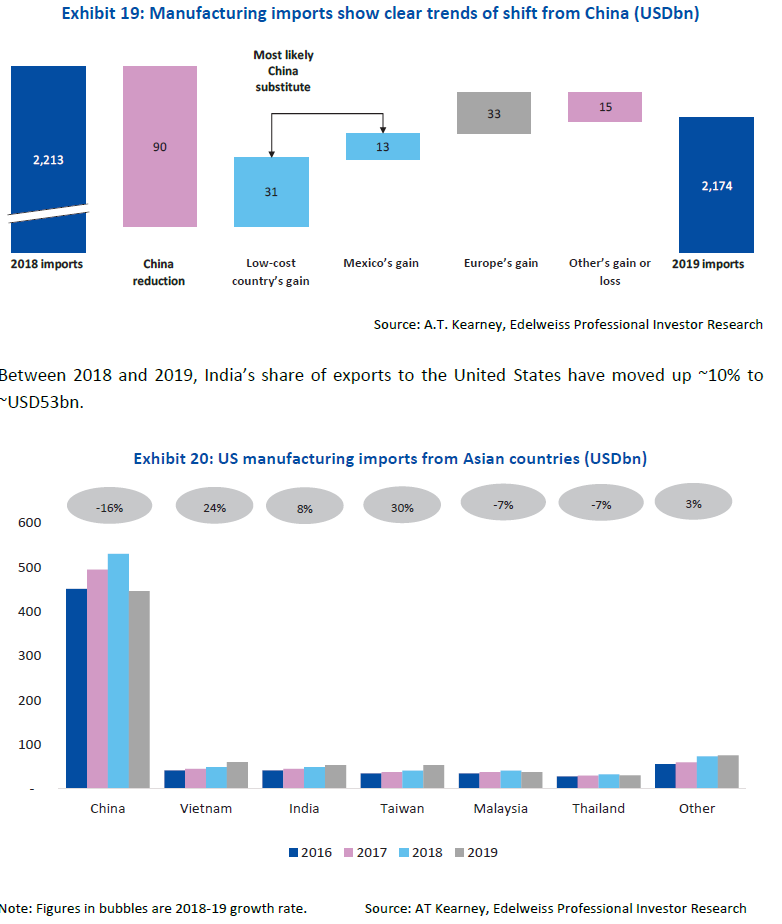

chain to countries other than China. India could be a key beneficiary of this trend.

more import substitutions are added.

valued in the market, due to the quality of their business model and earnings visibility.

1. invest in players who have already proven their mettle or are in the process. SRF, NAVIN, PI, Aarti

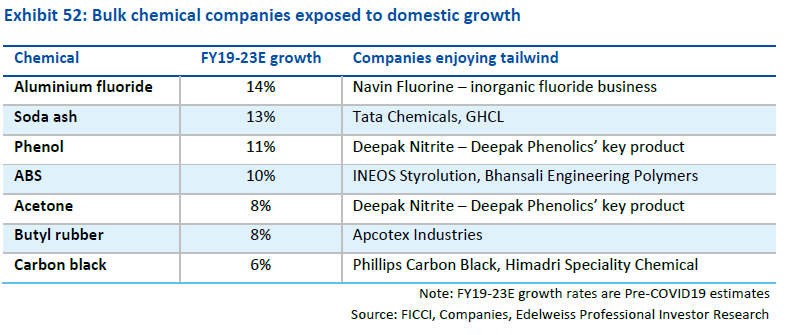

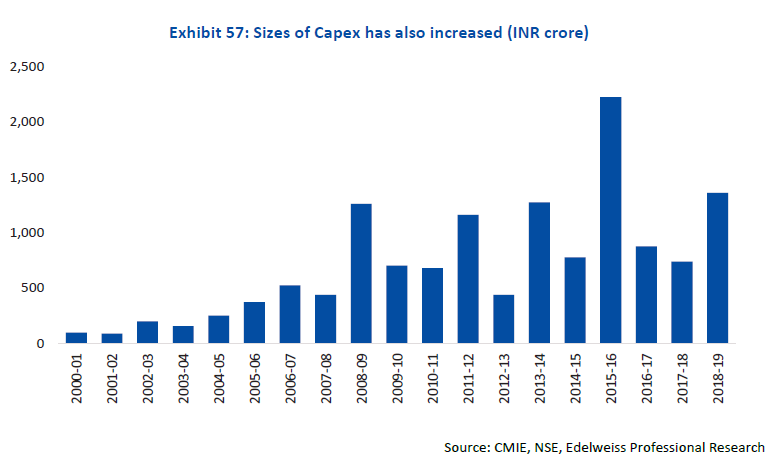

2. players who are rampingup substantial capex or are currently undertaking large capex to respond to the domestic demand. Balaji, Deepak Nitrite

ends