@bfeld makes the case that VC sort of begun with $70,000 AR&D investment in DEC. Ken Olson and Harlen Anderson received funding from Geroges Doriot.

-Entrepreneur

-VC/Venture Capitalist, typically a Managing Partner at a fund,

-Lawyer

-Angel Investor

-Mentors to Entrepreneur

-Determine amount to raise

-Answer the time + burn rate (monthly spend)#

Focus on how much runway to next milestone of the company. I see many entreprneurs on twitter guestimate 18 months as typical

Pitch Deck/ (Executive Summary) 3-5 pages with

- Product idea

- Problem

-Team

-Business Model/Business Description

-High level financial data

Focus on Assumptions and rationale

This is the visual document and turns out FORM, Design matters a lot.

-problem entrepreneur is solving

-size of market

-team experience

-moat/competitive advantage

-financials (cash flow, P&L, use of funds)

-underlying assumptions

-milestones

-Private Placement Memorandum- Business Plan with some legal disclaimers

Most investors and entrepreneurs will know that the forecasts will be certain to be wrong

Focus more on;

-Assumptions underlying projections

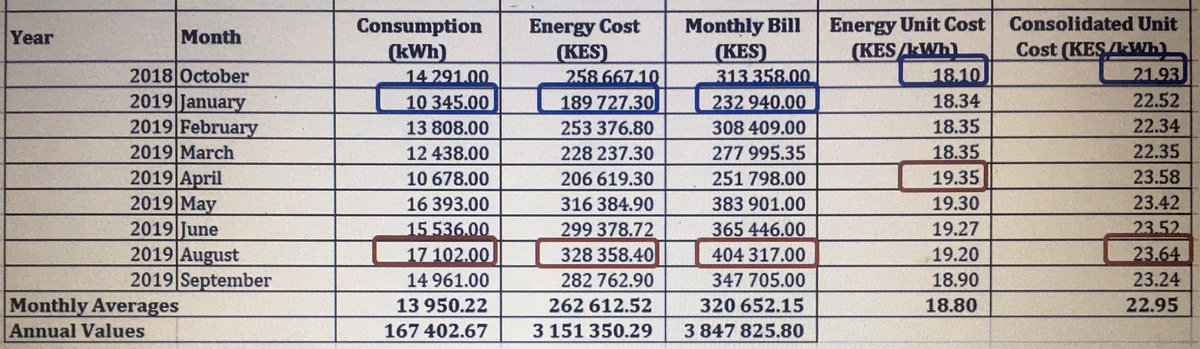

-Monthly Burn rate or cash consumption of the business and the assumptions that affect these

Demo and Prototype. And if possible some pilot generating incomes

-Research

- Recommendations from fellow entrepreneurs

-Engaging with VC's

-Finding someone who can lead, is interested

-Publishing content on domain area

How did you find VC @SamGichuru? How should others go about this? Should they seek VC anyway?

Focus on:

-Economics; return the investors will ultimately get

-Control; typically, preferred stock, the ways investors will exert control and the situations/decisions they will control

What valuation is affected many many terms that include;

-Price per share

-Number of shares available

-Pre-money or post money expectations

Lets see some exampls

If it is $500K for premoney valuation $1M , this gives them 33%

Ask do you mean premoney?

Dilution, fully diluted

So imagine, you had set aside 10% for your team at this premoney valuation of $1M and the VC wants employee pool expanded to 20%. What does this mean?

Well it means, 10% will come out of your $1M valuation, making your valuation $900K premoney.

-stage of company, experience of founders, money being raised, opportunity and how its perceived.

-Competition by other funding sources....How hot its perceived.

-Leadership team

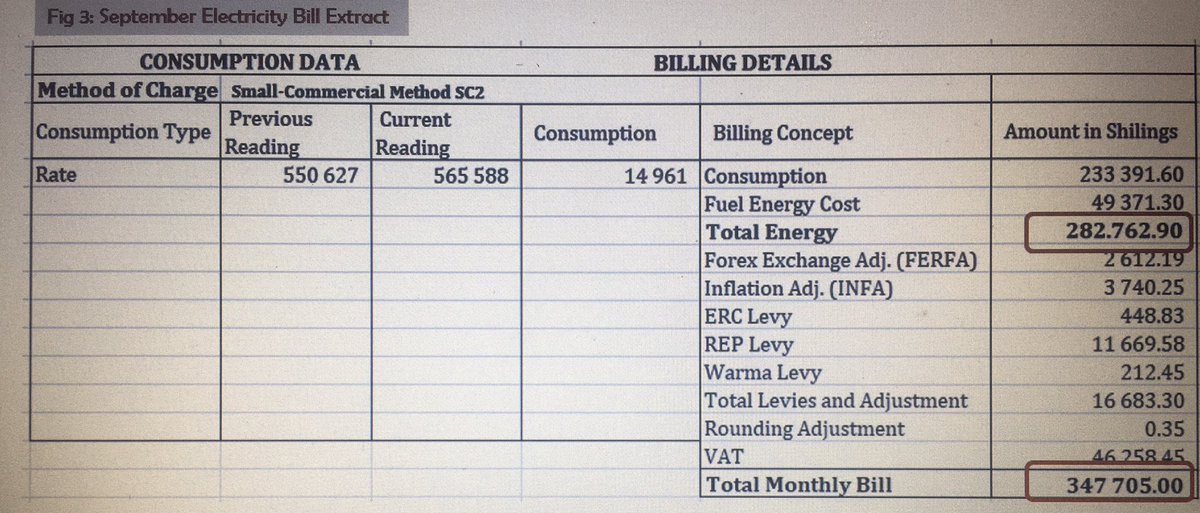

-Numbers; EBITDA, Free cashflow, revenue

-Economic climate!

-Liquidation preference

-Pay to Play provisions

-Vesting

-Employee Pool

-Anti dilution