This data is important because if nifty opened Flat OTM as well as ATM option premium melts 35-40% in the opening it self . Far OTM premiums will get zero in the opening .

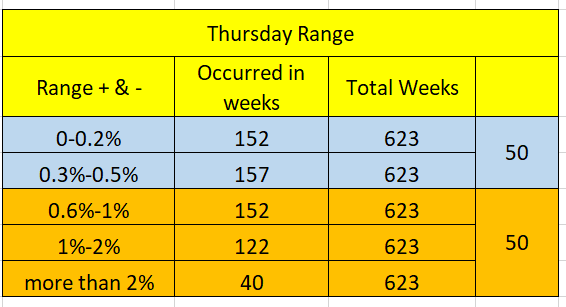

Data Analysed for 623 weeks .

If we develop option strategy which can handle 1-2% gap easily , then we can mint some money here in every expiry .

Here also big RISK is GAP UP or GAP DOWN beyond 2%

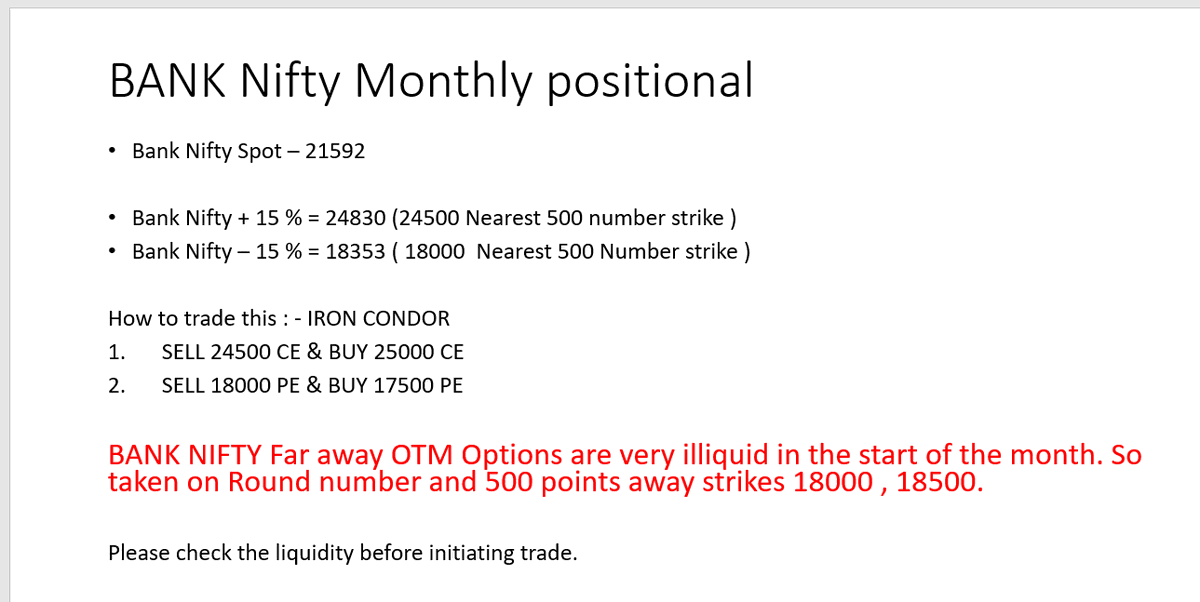

Selling Premiums up to 9 rs and buying premiums up to 2 Rs for hedging will be good strategy here .

some brokers like zerodha doesnt allow to buy far OTM option . This is very important for hedge .

Enter on Wednesday after 15:00 Hrs and Exit on Thursday morning once all premiums eroded .

Last thursday it given good returns .

Create Bull put spread or bear call spread or ratio spread on these days .

Thread ends here . Thanks . Good luck