- tweet and go deep on differentiated insights

- respond to everyone

- reach out to people with <10k followers I thought were undervalued

- hop on too many last minute flights

To build a track record, I made two fantasy VC portfolio's. h/t @jtriest for the idea!

turner.substack.com/p/turners-fant…

With no info rights and only public data, I learned as I went. Combined with Twitter, the fantasy portfolios helped me break into VC.

Branding is key to being a successful VC, so I always knew I’d eventually expand beyond Twitter.

Next step: writing long-form content.

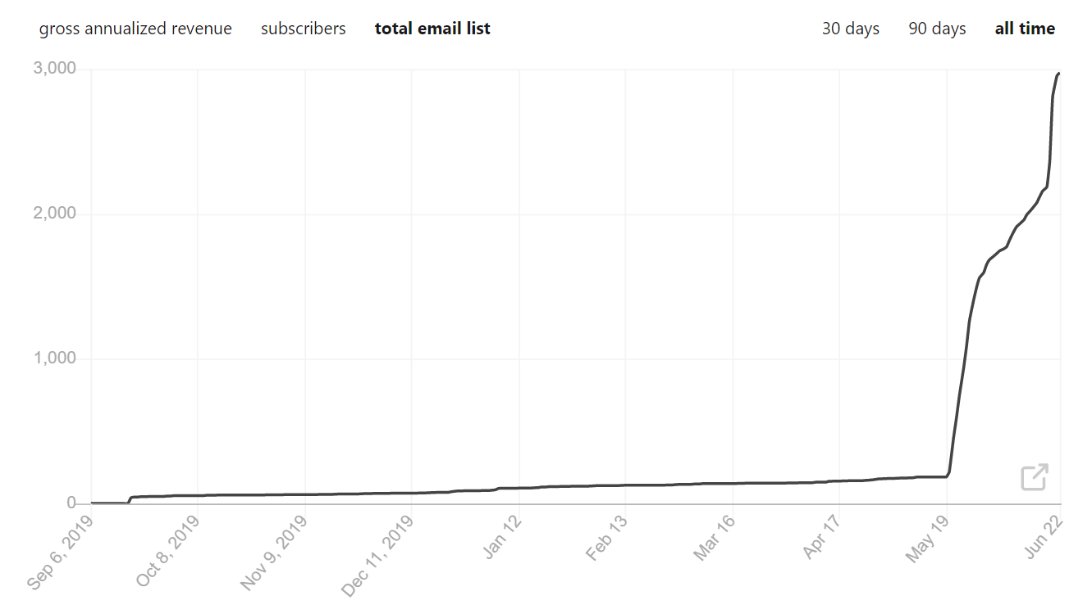

I set up my Substack in Sept '19 and leveraged the 5.8k Twitter followers I'd built up over 2 years to get my first 45 subs 👇

I put a link in my bio to get to 180 over the next 8 months.

This first piece on TikTok kicked things off by recapping my thoughts from Twitter

turner.substack.com/p/the-rise-of-…

I think charging skews my incentives: I want to be compensated for investing, not gathering an audience.

- write things people actually want to read and share

- collaborate with others

- keep it free, forever

- add to the investment team and help them build their own platform

turner.substack.com