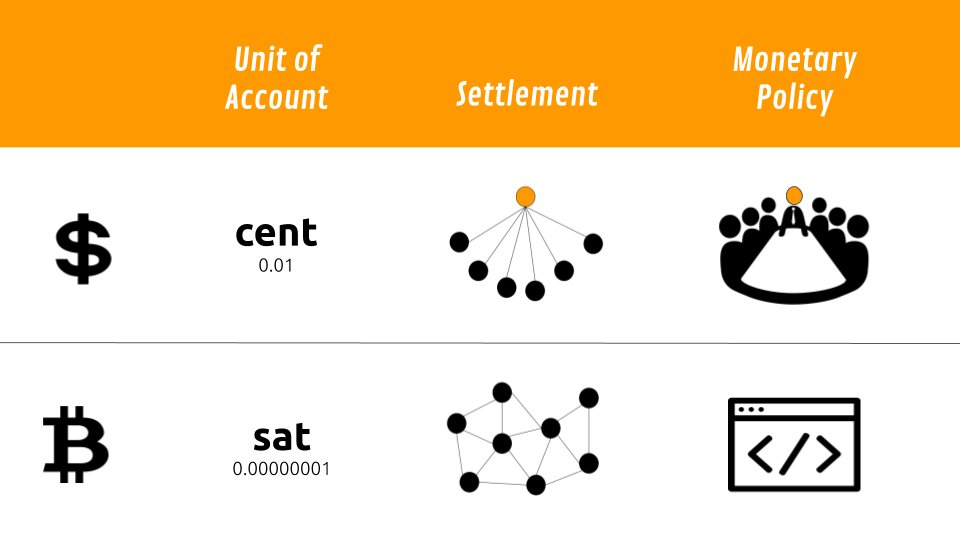

Comparing the $USD and #Bitcoin across three dimensions:

🔸Unit of Account: cent vs. satoshi

🔸Settlement: Centralized/permissioned (i.e. SWIFT) vs. decentralized/permissionless

🔸Monetary Policy: 12 member board meeting (8x/yr) vs. pre-determined, executed by code

🔸Unit of Account: cent vs. satoshi

🔸Settlement: Centralized/permissioned (i.e. SWIFT) vs. decentralized/permissionless

🔸Monetary Policy: 12 member board meeting (8x/yr) vs. pre-determined, executed by code

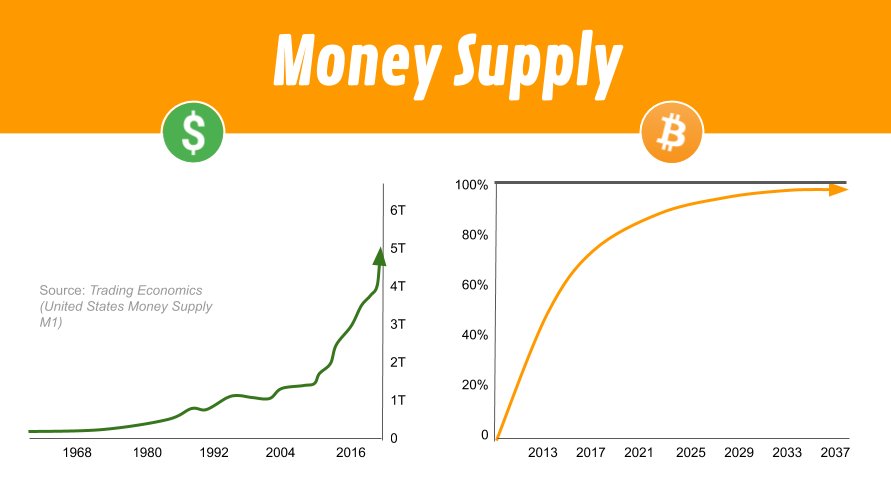

'To maintain its value, money must be in limited supply.

The Fed.. carefully calibrates the supply of dollars to promote stable prices and maximum employment.

No central bank controls the supply of bitcoin.'

-Federal Reserve Bank of St. Louis

bit.ly/2CkMXG5

The Fed.. carefully calibrates the supply of dollars to promote stable prices and maximum employment.

No central bank controls the supply of bitcoin.'

-Federal Reserve Bank of St. Louis

bit.ly/2CkMXG5

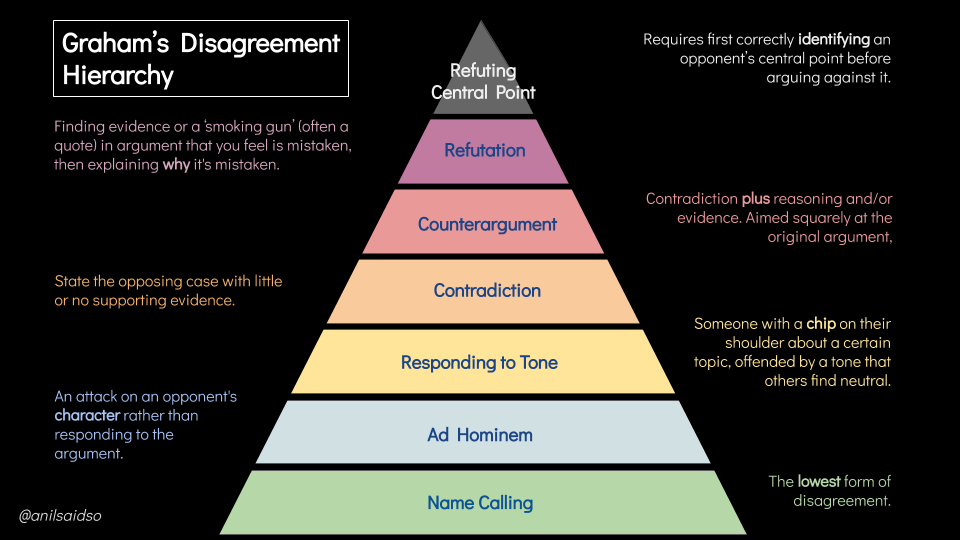

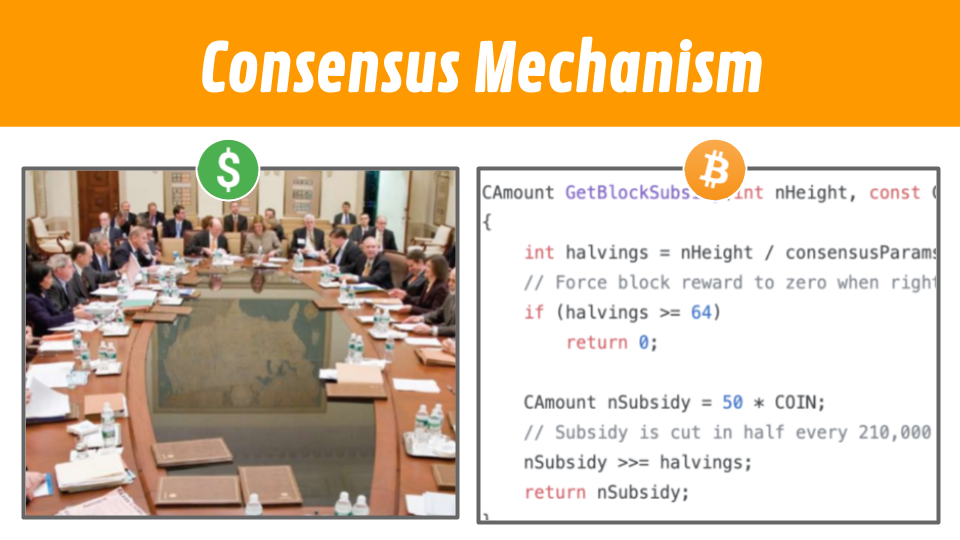

REACHING CONSENSUS:

USD-

The FOMC consists of 12 members, holding 8 meetings annually + additional as needed. Committee membership changes at the 1st meeting of the year. The minutes are released 3 weeks after policy decisions.

BTC-

Proof of Work

USD-

The FOMC consists of 12 members, holding 8 meetings annually + additional as needed. Committee membership changes at the 1st meeting of the year. The minutes are released 3 weeks after policy decisions.

BTC-

Proof of Work

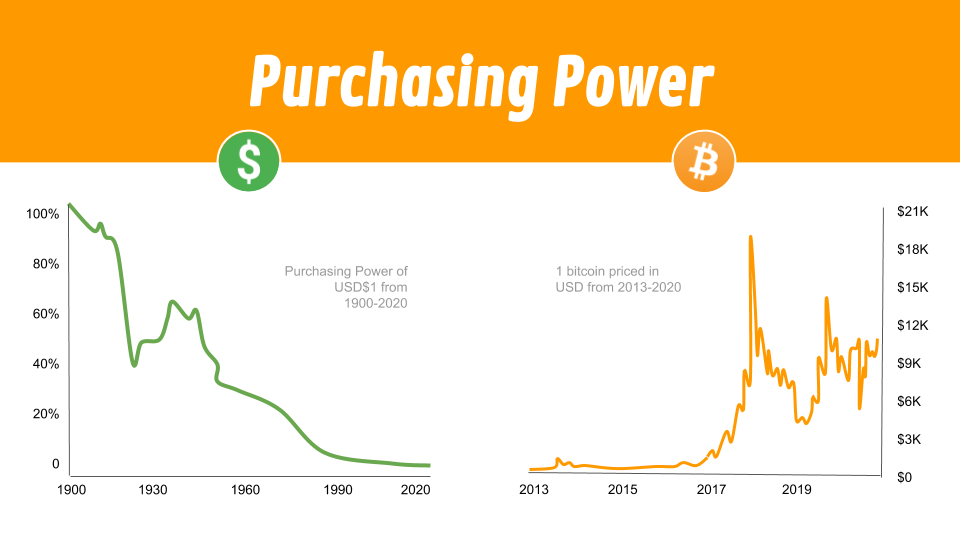

PURCHASING POWER:

"That it is logical, fair and reasonable to maintain the purchasing power of an hour's work in terms of goods and services the employee must purchase in his daily living."

-Charles E. Wilson

(former CEO of GM and US Secretary of Defense)

"That it is logical, fair and reasonable to maintain the purchasing power of an hour's work in terms of goods and services the employee must purchase in his daily living."

-Charles E. Wilson

(former CEO of GM and US Secretary of Defense)

TRANSACTION FEES:

Int'l Wire Transfer vs. Bitcoin

'SWIFT is the way the world moves value. We do this every single instant of every single day, right across the world. No other organisation can address the scale, precision, pace and trust that this demands.'

-SWIFT website

Int'l Wire Transfer vs. Bitcoin

'SWIFT is the way the world moves value. We do this every single instant of every single day, right across the world. No other organisation can address the scale, precision, pace and trust that this demands.'

-SWIFT website

AUDIT:

"The Fed's financial statements are also a matter of public record, and are audited annually by independent, outside auditors.. I am well aware of this because I chair the committees that have oversight responsibility for the audits."

-Jerome Powell (2015)

"The Fed's financial statements are also a matter of public record, and are audited annually by independent, outside auditors.. I am well aware of this because I chair the committees that have oversight responsibility for the audits."

-Jerome Powell (2015)

• • •

Missing some Tweet in this thread? You can try to

force a refresh