Get a cup of coffee.

In this thread, I'll help you understand the fundamentals of options.

Warning: this thread is extra long!

Let's start with the basics: what is an option?

An option is the right to buy or sell a stock in the future.

Which company's stock? At what price? How far into the future? All that is spelled out in the "options contract".

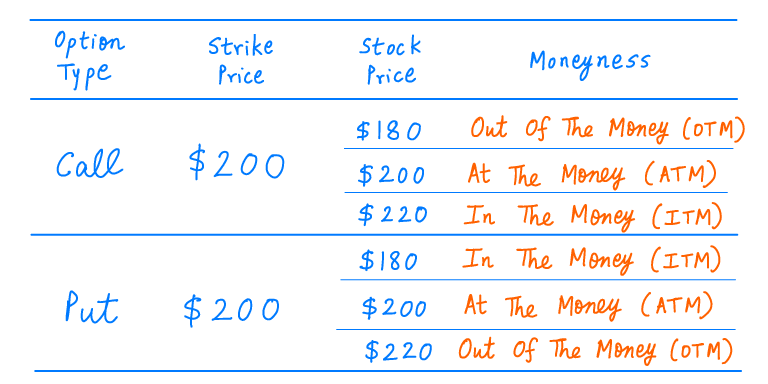

There are 2 kinds of options: calls and puts.

Calls give you the right to *buy* a stock in the future at a particular price.

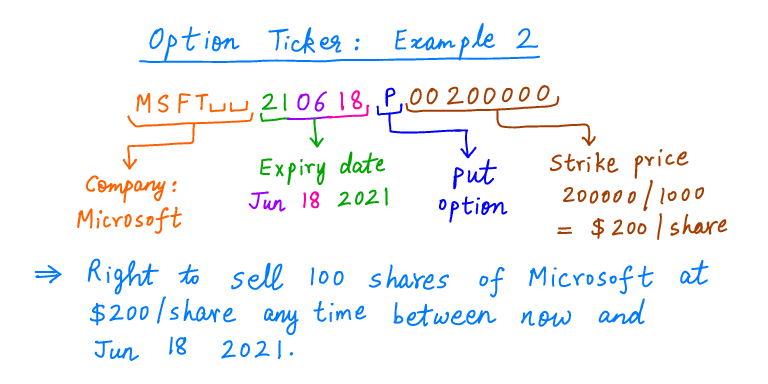

Puts give you the right to *sell* a stock in the future at a particular price.

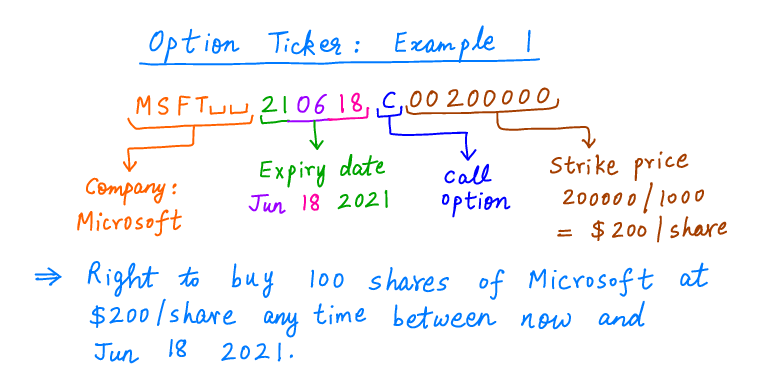

For example, you can buy a call option giving you the right to buy 100 shares of Microsoft ($MSFT) at $200/share 1 year from now.

Even if $MSFT is trading at $300 at that time, this option gives you the right to buy it for just $200. How awesome is that!

With puts, it's the other way round.

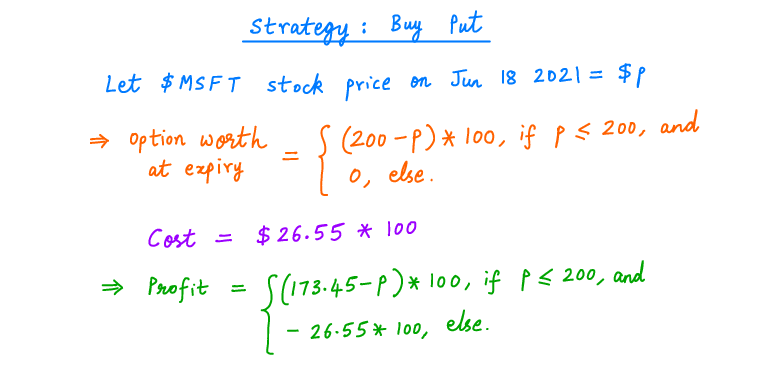

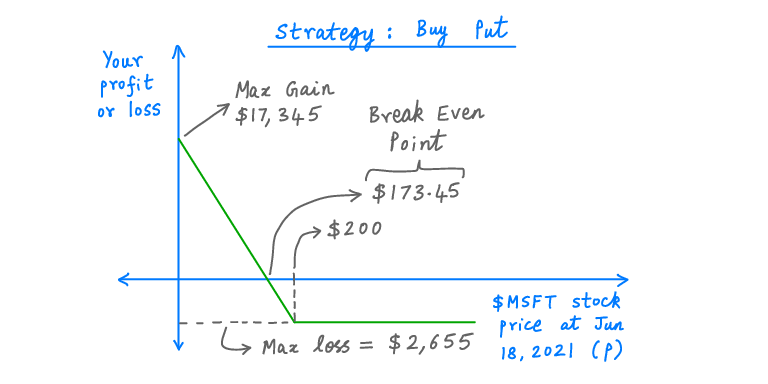

Suppose you buy a put option giving you the right to *sell* 100 shares of $MSFT at $200/share 1 year from now.

Then, even if $MSFT is trading at $100 at that time, you still have the right to sell it at $200. Again, awesome!

Note: Options always mean "100 share" multiples.

1 call contract means the right to buy 100 shares. 5 call contracts means the right to buy 500 shares.

Similarly for put contracts.

You can't get the right to buy 43 shares or sell 221 shares. It has to be a multiple of 100.

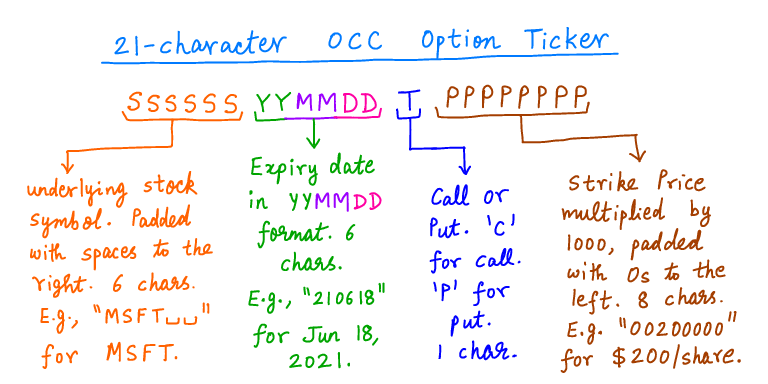

Every option has an "expiry date" and a "strike price".

The "expiry date" tells you how much time you have to exercise the right that the option gives you.

The "strike price" is the price at which the option allows you to buy or sell the stock at.

For example, say a put option gives you the right to sell 100 shares of $MSFT at $200/share 1 year from now.

Then the "expiry date" of this option is 1 year from now, and the "strike price" is $200.

If this all wasn't complicated enough, there's American options and European options.

American options give you the right to buy/sell stock *any time between* now and the expiry date.

European options only allow you to exercise your right *on* the expiry date. Not before.

If you're trading options only in US exchanges, you will only encounter American options.

Whichever country you're in, make sure you know whether the options you're trading are American or European.

In this thread, the options I discuss are all American.

Just like stocks, options are also bought and sold in the market.

The price at which an option is bought or sold is called the "premium".

Note: options *premiums* are always quoted on a per-share basis, even though options *contracts* are always for 100 shares.

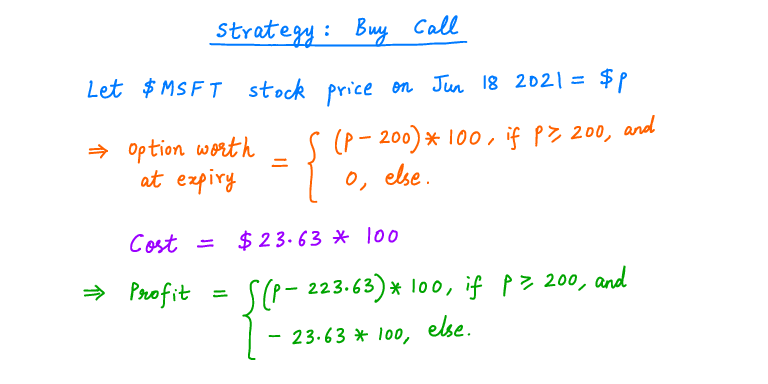

For example, suppose you paid $2,363 for the right to buy 100 $MSFT shares (i.e., 1 options contract) any time between now and Jun 18 2021 (i.e., ticker "MSFT 210618C00200000").

Then, the premium you paid was $2,363/100 = $23.63.

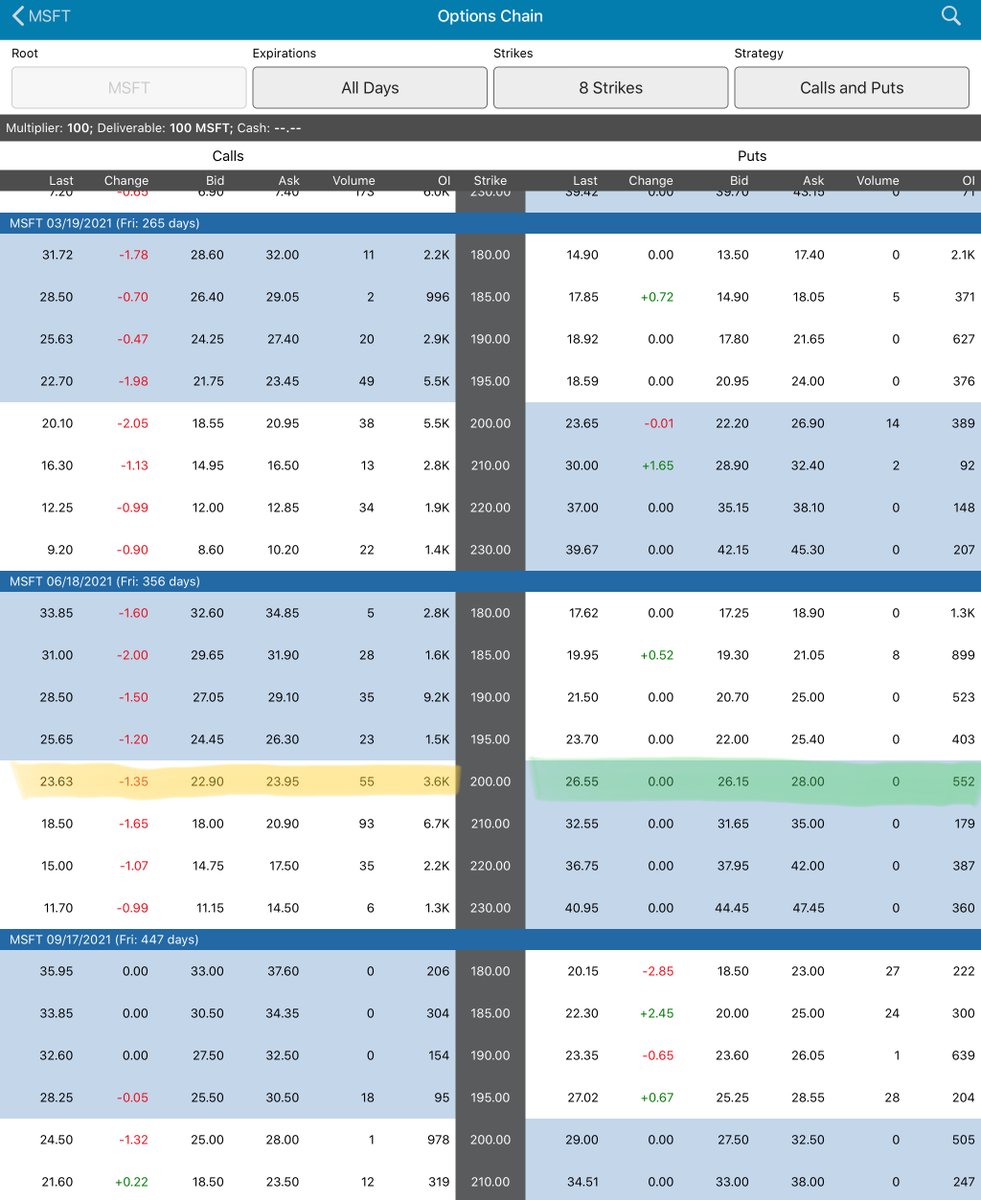

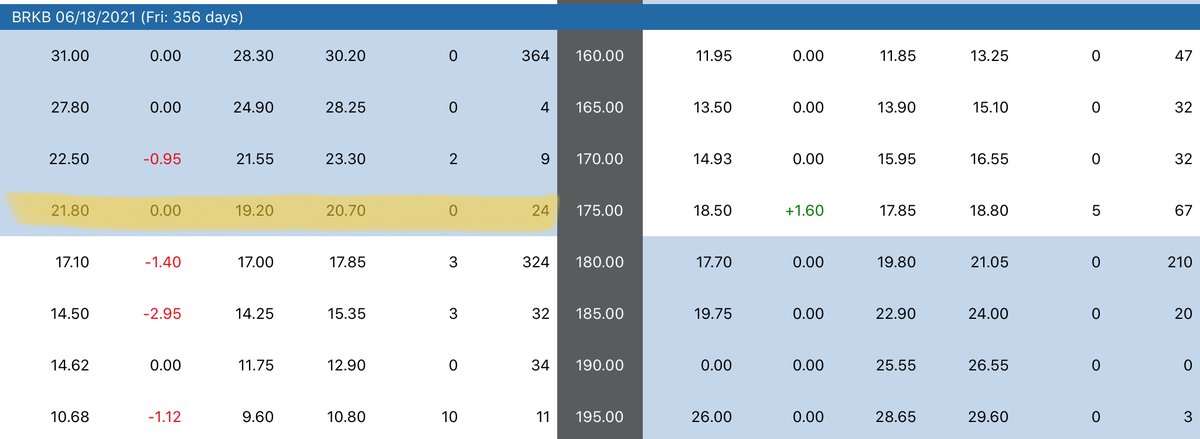

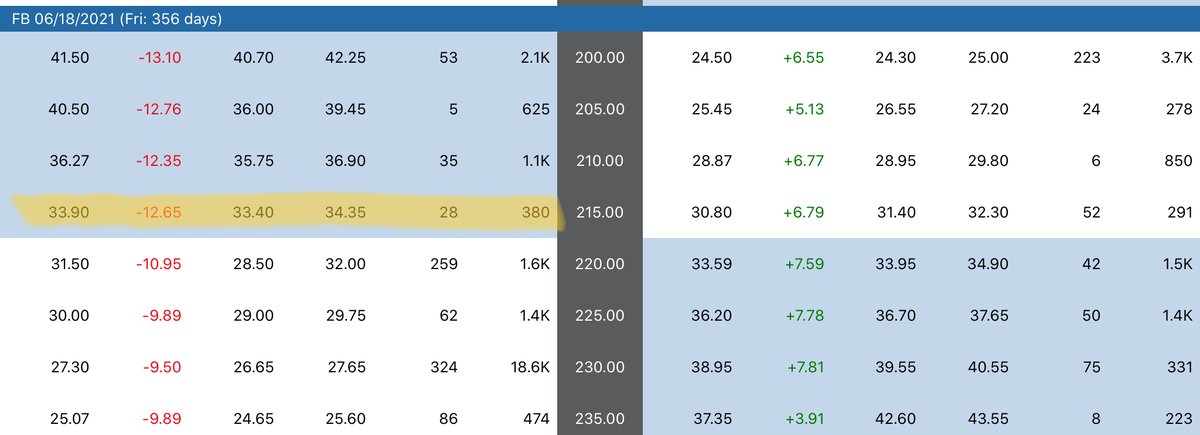

Your brokerage app (Robinhood, IBKR, Charles Schwab, etc.) will give you the going rates for options premiums.

The premiums will be quoted in table after table of numbers -- various combinations of strike prices and expiry dates.

These tables are called "options chains".

Options premiums depend on many factors.

The most important are 1) strike price, 2) time to expiry, and 3) the underlying stock's volatility.

Strike price.

Call options with lower strike prices command higher premiums. After all, the right to buy a stock at a cheap price is more valuable than the right to buy it at an expensive price.

Similarly, put options with higher strike prices command higher premiums.

Time to expiry.

The more time there is for an option to expire, the more valuable the option is, and the more premium it commands.

But this is a melting ice cube. As time passes and the expiry date nears, this "time value" in the options premium keeps decreasing.

Let's now talk options strategies.

The simplest strategy is to just buy a call option.

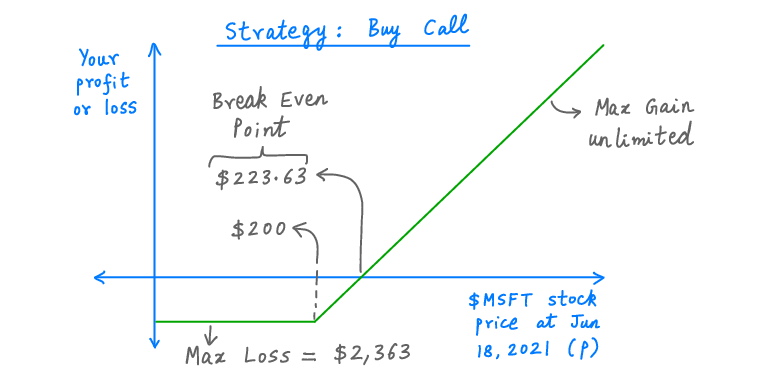

Say you buy the $200 2021-Jun-18 $MSFT call option above for $2,363.

How much will your option be worth at expiry?

Well, if $MSFT is trading at $250 at the time, the right to buy it at $200 will naturally be worth $50.

That's because you can use the option to buy 100 shares of $MSFT at $200/share, and immediately sell them in the market at $250/share, netting yourself a cool $50/share.

Let's try the other side of the trade now.

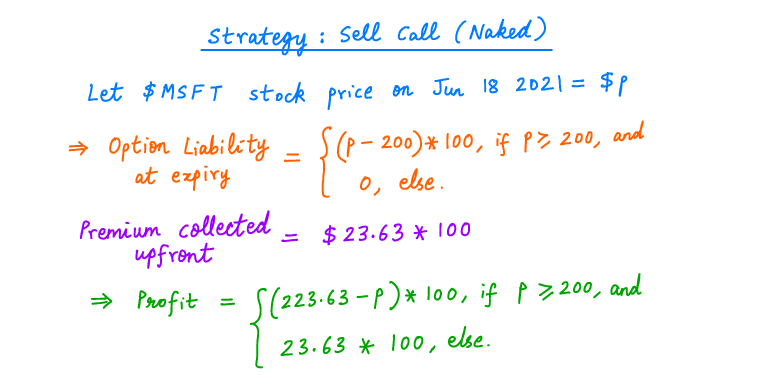

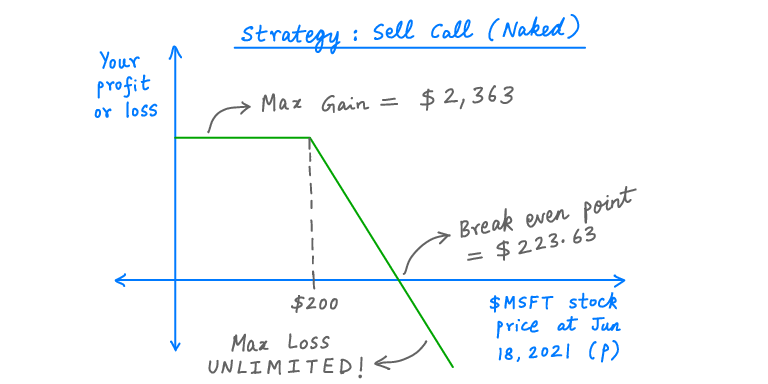

What if your strategy is to *sell* the $MSFT call instead of buying it?

Well, as soon as you sell the call, you'll be paid $2,363 as premium.

But this premium is *not* a free lunch.

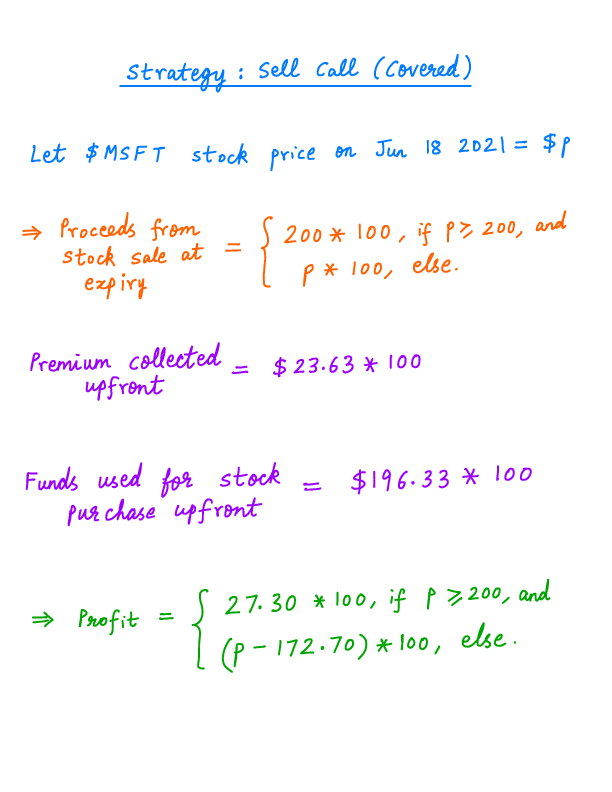

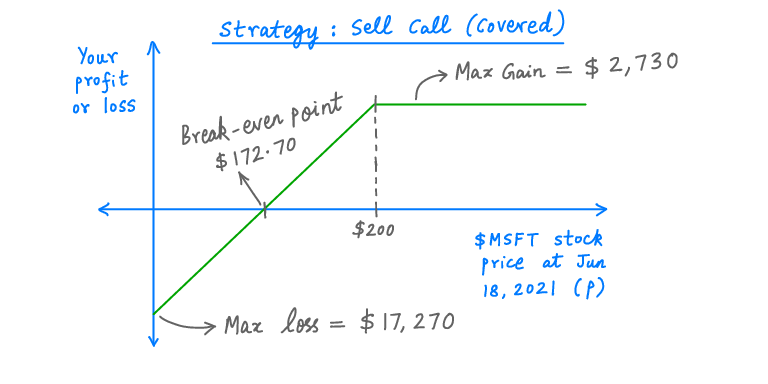

In exchange for the premium, you're making a commitment: if the buyer wishes, *you* have to sell them 100 shares of $MSFT at $200 each.

So, at any time between now and expiry, you should be prepared to deliver those 100 $MSFT shares.

If you don't happen to have 100 shares of $MSFT -- and the buyer decides to exercise their right -- you'll be forced to buy the 100 shares at whatever price they're trading at.

This is a huge risk! The shares could be trading at $1000. Or $10,000. Or $100,000.

The options strategies above are the simplest ones.

There are all kinds of more complicated strategies -- with exotic names like "iron condor" and "long call butterfly spread" and whatnot.

Here's an Investopedia article if you're interested: investopedia.com/trading/option…

But no matter how complicated your options strategy is, never forget the basics:

First and foremost, never open yourself to the possibility of unlimited loss. You may get lucky once. Or twice. But do this enough times, and you *will* eventually get burned.

Second, always understand your "reserve" requirements. This is what you need to hold at all times while your strategy is in play.

When you sell a call, you need to hold 100 shares of the underlying stock in reserve.

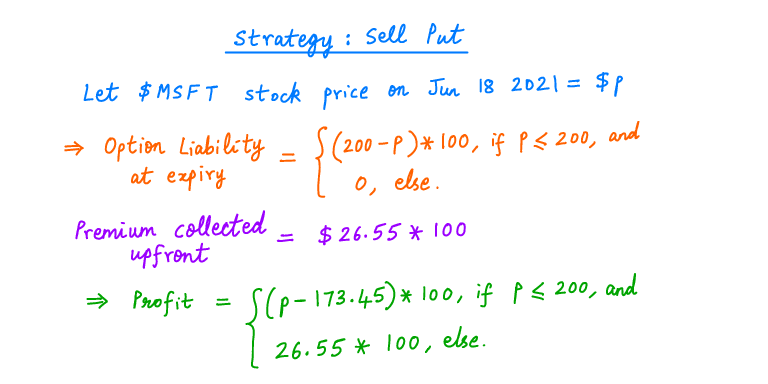

When you sell a put, you need to hold cash in reserve.

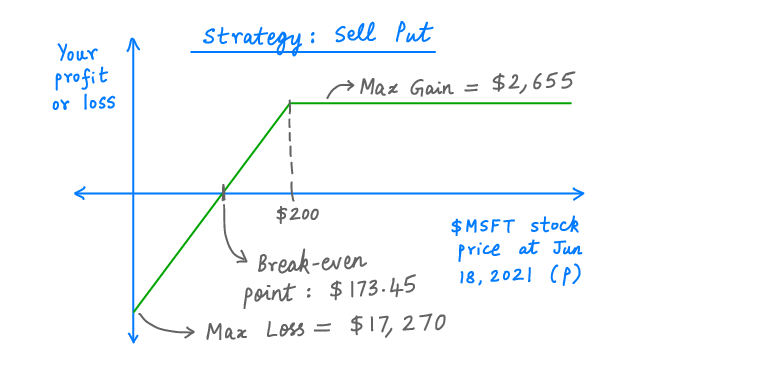

Third, graph your profit/loss vs the underlying stock price.

Thoroughly understand your minimum and maximum gains and losses, where the break-even points are, etc.

This is so simple. And yet, so many investors get into options without such basic understanding.

Finally, thoroughly understand how your broker will deal with any "transient" effects your options strategies may trigger.

For example, if you owe 100 $MSFT shares at $200 each, but you have the right to buy them at $190 each, will your broker just credit you the $1K difference?

Or will your broker insist that you deposit $19K into your account, buy the shares, and then flip them for $20K?

I want to stress this because a misunderstanding of this kind is what caused a young man (@BillBrewsterSCG's cousin) to recently take his own life. This is incredibly sad.

cnbc.com/2020/06/18/you…

Options volumes have been skyrocketing of late.

And many inexperienced investors now have access to commission free options trading -- thanks to @RobinhoodApp and other services.

I don't think @RobinhoodApp is evil.

The founders of @RobinhoodApp probably started with a noble idea: bring sophisticated investing tools to small investors.

They're probably horrified that a misunderstanding with their app led to the suicide above.

But as the saying goes, the road to hell is paved with good intentions.

To me, it is clear that @RobinhoodApp must rethink its user interface for options trading.

I have a few suggestions that I hope they will implement.

First, please educate customers about options.

Make customers go through an in-app course on options, complete with quizzes, before giving them the ability to trade options.

Second, whenever a customer wants to place an options trade, draw the "profit/loss vs stock price" curve right there for them on the screen.

Show their maximum loss, reserve requirements, break-even points, etc. -- before they hit the "Submit Trade" button.

Third, please allow customers to execute complex options strategies "atomically".

For example, if a customer wants to buy a call at one strike price and immediately sell a call at a higher strike price, don't make the customer do two separate transactions.

Instead, let the customer do a single "all or nothing" transaction.

This will help customers avoid big loss exposures that come from partially executed strategies.

And of course, display the profit/loss vs stock price graph for the full combined transaction.

Fourth, please improve the way "transient" effects of options are handled.

If a customer has the right to buy stock at one price, but the obligation to supply it at a different price, just take the difference. Don't show large transient liabilities that unsettle customers.

This has been an unusually long thread.

Options strategies are not for everyone. But if you want to use them -- please, please, take the time to educate yourself thoroughly about them.

Thanks for reading. You're the best. Enjoy your weekend!

/End