1/

Get a cup of coffee.

In this thread, I'm going to walk you through the concept of "owner earnings".

Get a cup of coffee.

In this thread, I'm going to walk you through the concept of "owner earnings".

2/

Imagine that you're opening a coffee shop.

You find a nice corner location with lots of foot traffic. And you sign a lease. Your monthly rent, including all utilities, will be $5K.

Imagine that you're opening a coffee shop.

You find a nice corner location with lots of foot traffic. And you sign a lease. Your monthly rent, including all utilities, will be $5K.

3/

Then you spend $100K on swanky furniture, fancy lights and other fixtures, etc.

Now the place looks really inviting. And you don't have to touch it for the next 10 years.

Then you spend $100K on swanky furniture, fancy lights and other fixtures, etc.

Now the place looks really inviting. And you don't have to touch it for the next 10 years.

4/

Next, you buy some high-end coffee making equipment: coffee roasters, espresso machines, etc. This sets you back about $60K.

This equipment will last you 3 years.

Next, you buy some high-end coffee making equipment: coffee roasters, espresso machines, etc. This sets you back about $60K.

This equipment will last you 3 years.

5/

Then you buy supplies for $30K: coffee beans, milk, water, napkins, paper cups, etc.

These supplies will maybe last you a month before you have to replenish them.

The next day, you open for business. This happens to be Jan 1, 2019.

Then you buy supplies for $30K: coffee beans, milk, water, napkins, paper cups, etc.

These supplies will maybe last you a month before you have to replenish them.

The next day, you open for business. This happens to be Jan 1, 2019.

6/

Fast forward 1 year.

We're now at Dec 31, 2019.

Your coffee shop was a huge success.

You sold $1M of coffee in the very first year.

Fast forward 1 year.

We're now at Dec 31, 2019.

Your coffee shop was a huge success.

You sold $1M of coffee in the very first year.

7/

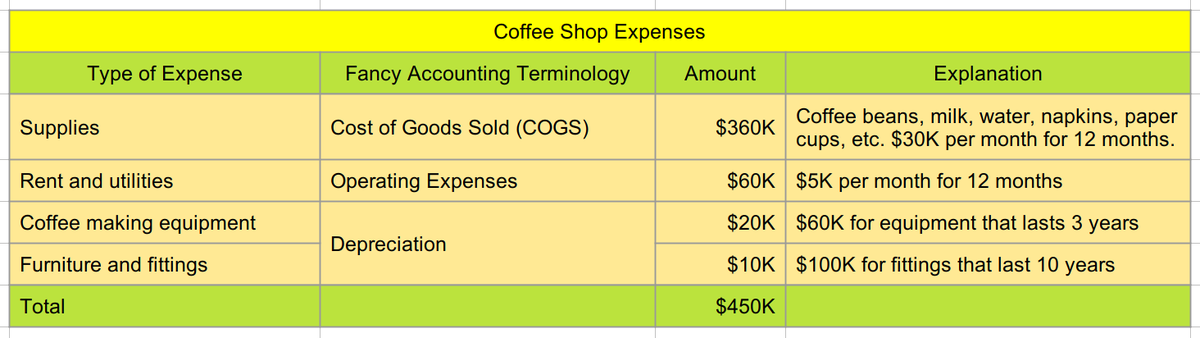

Let's calculate how much money you made in 2019.

Your revenues were $1M. That's how much coffee you sold.

And your expenses? They come to around $450K:

Let's calculate how much money you made in 2019.

Your revenues were $1M. That's how much coffee you sold.

And your expenses? They come to around $450K:

8/

So, your pre-tax income for 2019 was about $550K ($1M revenue minus $450K expenses).

Say you make a $110K immediate payment to the IRS to cover your taxes for 2019.

That leaves you with a respectable $440K in "net income" for 2019.

So, your pre-tax income for 2019 was about $550K ($1M revenue minus $450K expenses).

Say you make a $110K immediate payment to the IRS to cover your taxes for 2019.

That leaves you with a respectable $440K in "net income" for 2019.

9/

Let's say your coffee shop has a checking account where all cash is kept.

On Jan 1 2019, let's say this checking account had enough to cover about 3 months worth of expenses. That's ($5K rent/mo + $30K supplies/mo)*3 = $105K.

Let's say your coffee shop has a checking account where all cash is kept.

On Jan 1 2019, let's say this checking account had enough to cover about 3 months worth of expenses. That's ($5K rent/mo + $30K supplies/mo)*3 = $105K.

10/

Here's a simple question:

Net income for 2019 was $440K.

Does that mean the checking account will have grown to $545K (initial $105K plus $440K net income) by Dec 31 2019?

Here's a simple question:

Net income for 2019 was $440K.

Does that mean the checking account will have grown to $545K (initial $105K plus $440K net income) by Dec 31 2019?

10/

No.

Why? Let's think about all the deposits and withdrawals that would have affected the account in 2019.

Deposits would have totaled $1M (all the cash collected from customers).

Withdrawals would have totaled $530K (the cash used to pay for rent, supplies, and taxes).

No.

Why? Let's think about all the deposits and withdrawals that would have affected the account in 2019.

Deposits would have totaled $1M (all the cash collected from customers).

Withdrawals would have totaled $530K (the cash used to pay for rent, supplies, and taxes).

11/

So, the checking account's balance will have increased by $470K (not $440K) during 2019.

So, the account's balance on Dec 31 2019 will be $575K (initial $105K plus this $470K).

So, the checking account's balance will have increased by $470K (not $440K) during 2019.

So, the account's balance on Dec 31 2019 will be $575K (initial $105K plus this $470K).

12/

But net income was only $440K. How did the checking account grow by $470K?

The $30K difference is because net income included a $30K "non-cash" charge (depreciation).

This is to account for wear and tear on furniture, coffee making equipment, etc.

But net income was only $440K. How did the checking account grow by $470K?

The $30K difference is because net income included a $30K "non-cash" charge (depreciation).

This is to account for wear and tear on furniture, coffee making equipment, etc.

13/

This $30K depreciation is a very real cost to you.

It just didn't affect your checking account in 2019.

But you can be sure your checking account will be hit when you need to buy new coffee making equipment in 2 years.

This $30K depreciation is a very real cost to you.

It just didn't affect your checking account in 2019.

But you can be sure your checking account will be hit when you need to buy new coffee making equipment in 2 years.

14/

Key lesson 1: Learn the difference between "net income" and "operating cash flow".

In 2019, your coffee shop's net income was only $440K.

But operating cash flow (the amount your checking account increased by) was $470K.

Key lesson 1: Learn the difference between "net income" and "operating cash flow".

In 2019, your coffee shop's net income was only $440K.

But operating cash flow (the amount your checking account increased by) was $470K.

15/

Here's another question:

How much of this $470K can you actually withdraw from your coffee shop's checking account to your personal checking account, without hurting the business?

Here's another question:

How much of this $470K can you actually withdraw from your coffee shop's checking account to your personal checking account, without hurting the business?

16/

Well, let's see.

As before, you want to keep 3 months worth of operating expenses in cash.

There's always inflation. In 2019, 3 months of expenses was $105K. But in 2020, it may be more like $110K.

Well, let's see.

As before, you want to keep 3 months worth of operating expenses in cash.

There's always inflation. In 2019, 3 months of expenses was $105K. But in 2020, it may be more like $110K.

17/

But that's not all.

In 2 years' time, you'll need new coffee making equipment. That costed $60K a year ago, but may cost $70K in 2 years.

Better sock away a third of that $70K (~$23K) right now, so there's no cash crunch later.

But that's not all.

In 2 years' time, you'll need new coffee making equipment. That costed $60K a year ago, but may cost $70K in 2 years.

Better sock away a third of that $70K (~$23K) right now, so there's no cash crunch later.

18/

Oh, and you'll need new furniture and fittings in 9 years time.

That costed $100K a year ago. It may cost $200K in 9 years. Better put away $20K this year (and each of the next 9 years) to cover that.

Oh, and you'll need new furniture and fittings in 9 years time.

That costed $100K a year ago. It may cost $200K in 9 years. Better put away $20K this year (and each of the next 9 years) to cover that.

19/

So you'll need to set aside $110K for operating expenses and $43K for future capital expenses (coffee making equipment, furniture, etc.). That's $153K.

Your coffee shop checking account has $575K.

So you can safely withdraw about $422K without hurting the business.

So you'll need to set aside $110K for operating expenses and $43K for future capital expenses (coffee making equipment, furniture, etc.). That's $153K.

Your coffee shop checking account has $575K.

So you can safely withdraw about $422K without hurting the business.

20/

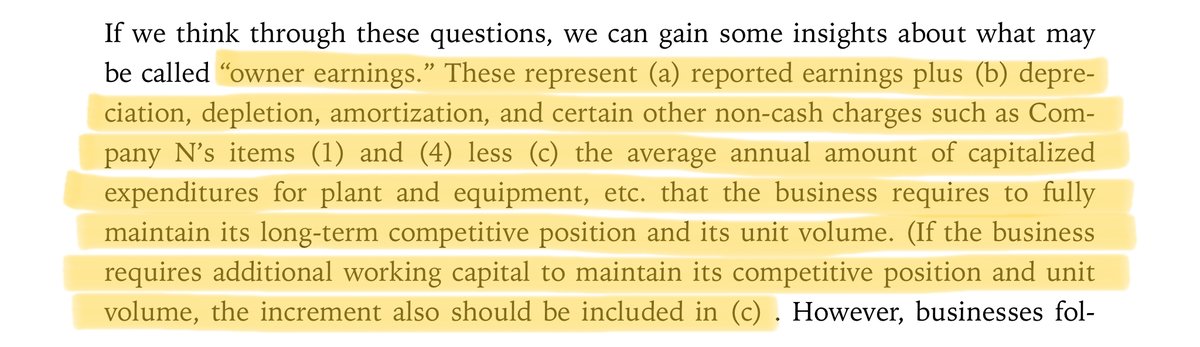

This $422K is called "owner earnings".

It's not how much cash the business has. It's how much cash the owner of the business can safely withdraw each year *without* hurting the business's current earning power or long-term prospects.

This $422K is called "owner earnings".

It's not how much cash the business has. It's how much cash the owner of the business can safely withdraw each year *without* hurting the business's current earning power or long-term prospects.

21/

Key lesson 2: When you buy a stock, think like an owner.

How much cash can the company distribute to you each year *without* hurting its business? And how much are you paying for those future cash flows? Do the numbers make sense?

Key lesson 2: When you buy a stock, think like an owner.

How much cash can the company distribute to you each year *without* hurting its business? And how much are you paying for those future cash flows? Do the numbers make sense?

22/

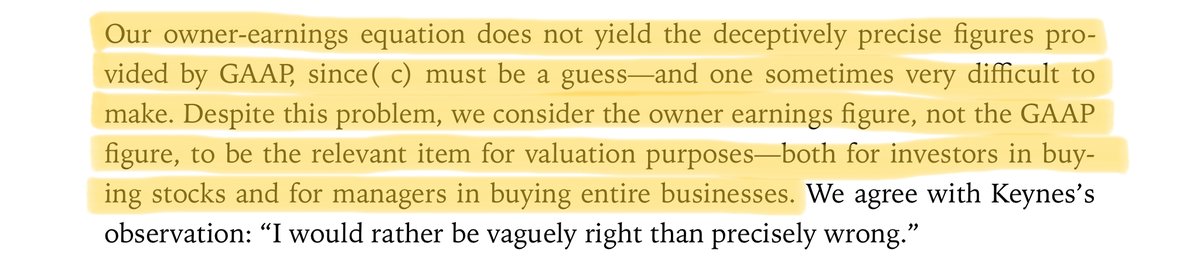

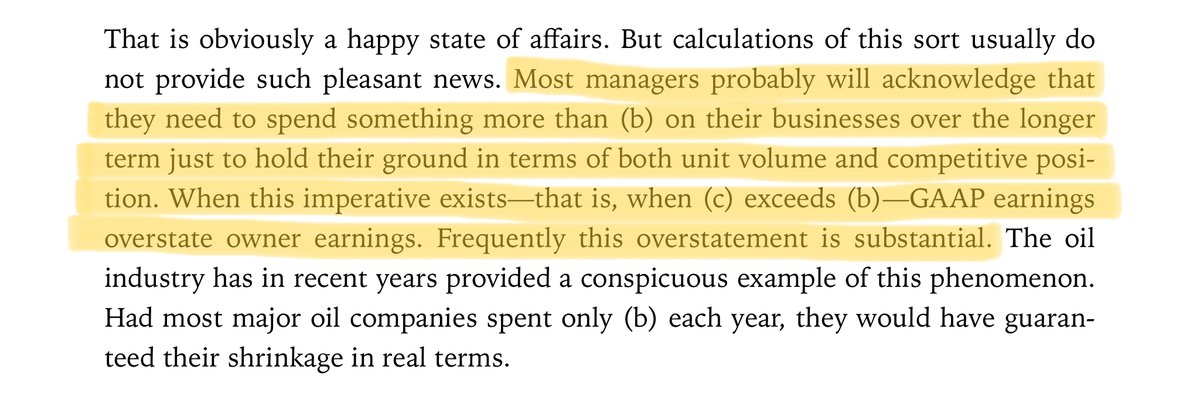

Owner earnings is not net income. It's not operating cash flow. It's not free cash flow.

It's an estimate based on how much cash it takes to maintain a business's earning power.

It's imprecise. But it's a concept that will help you think about businesses the right way.

Owner earnings is not net income. It's not operating cash flow. It's not free cash flow.

It's an estimate based on how much cash it takes to maintain a business's earning power.

It's imprecise. But it's a concept that will help you think about businesses the right way.

23/

I'll leave you with a couple of references to learn more about owner earnings.

Buffett's 1986 letter explains the concept beautifully: berkshirehathaway.com/letters/1986.h…

I'll leave you with a couple of references to learn more about owner earnings.

Buffett's 1986 letter explains the concept beautifully: berkshirehathaway.com/letters/1986.h…

24/

This @FocusedCompound episode on cash flow statements also has many nuggets on owner earnings.

For example, if a growing business ties up a lot of money in working capital, then that money is not really available to be distributed to owners.

This @FocusedCompound episode on cash flow statements also has many nuggets on owner earnings.

For example, if a growing business ties up a lot of money in working capital, then that money is not really available to be distributed to owners.

25/

Thanks for reading! Enjoy your weekend. Stay safe. Think like an owner. 😀

/End

Thanks for reading! Enjoy your weekend. Stay safe. Think like an owner. 😀

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh