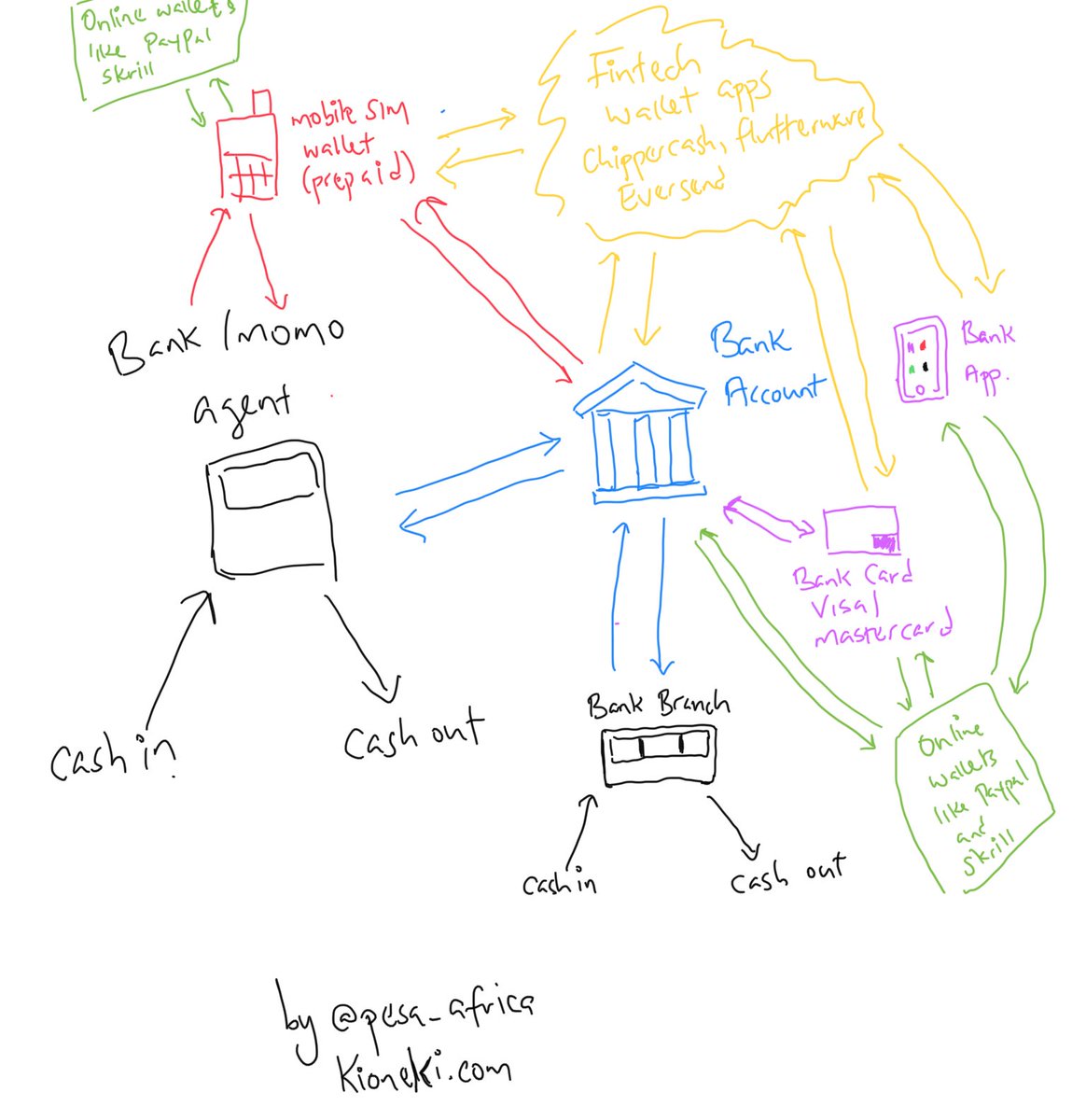

Sometimes agents are also bank agents for cash in to bank money or cashing out bank money via card or app

most popular for underbanked and unbanked. Works on featurephones, and smartphones

Sometimes via smartphone apps on android and IOS

Sometimes via USSD

Sometimes via physical cards issued with Visa and Mastercard

Can be peer to peer transfer

Can be peer to business payment

Can be bank to mobile disbursement

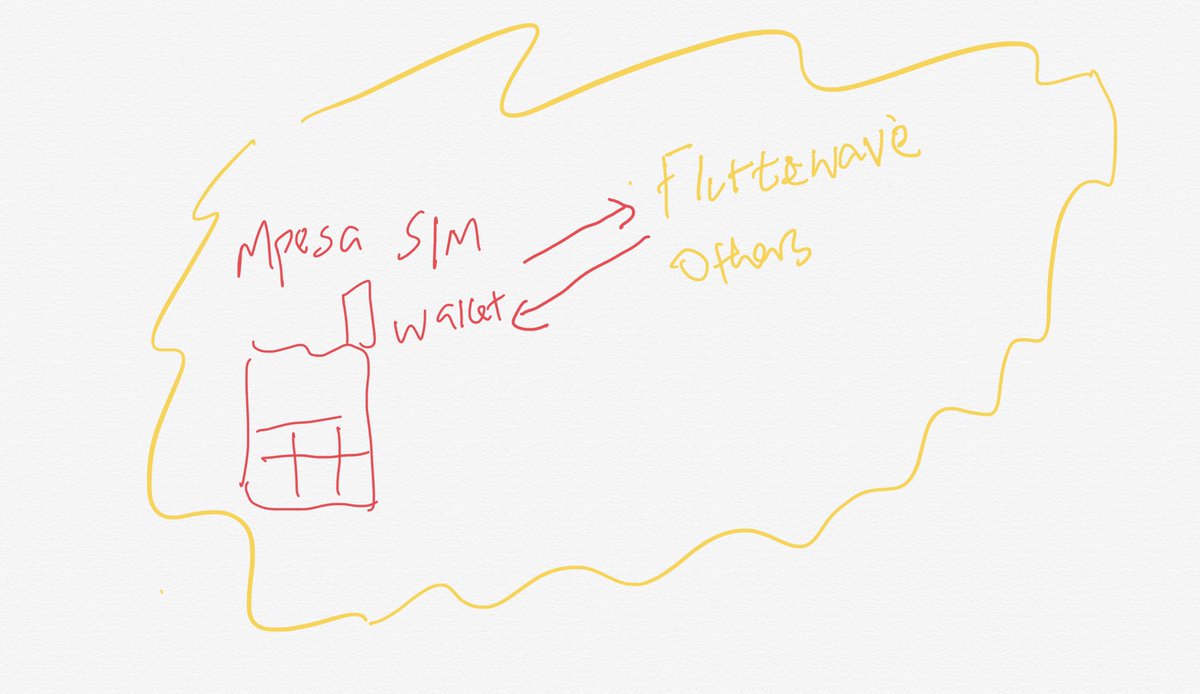

Some Mobile SIM money operators like Mpesa (red) partnered with Paypal (green) to allow their customers to send money from red to green

You can link your card or bank account to a wallet like Paypal

They allow you to connect your mobile SIM money (red) and your bank account (blue) and card and app (purple) and transfer money in ands out of their wallets

Tough business but they trying

Notice how only 2 entities have the power to do cash in and cash out

These guys call the shots b/c they own and control the gateways for cash in and cash out

Black + (red and blue)

Fintech wallets (yellow) cannot do this.

Virtual card

USD balance

Airtime

Bills

Yawn!

So they can offer a lot more services like Insurance, savings, lending, investments etc

Eversend for example, has an Microfinance license in Uganda

Savings (mshwari)

investment (mali)

Loans (mshwari, KCb Mpesa)

Advance (fuliza)

Cross border payments (w/ Western Union)

Online payments (w/paypal)

Etc

Like partnering with Visa

via partnerships mostly

Where blockchain payment rails fit

Where central bank digital currencies fit

Where platform virtual currencies like Libra fit in

Also exciting new products like @Chamapesa

/end