Safaricom approaches the Central Bank of Kenya

regarding M-Pesa

The Central Bank of Kenya requests further information

from Safaricom regardning Mpesa

Safaricom submits detailed risk mitigation program as per Central Bank request Consult Hyperion conducts detailed assessment of M-pesa systems

Safaricom is issued with a “Letter of No

Objection” by the Central Bank of Kenya for its Mpesa product

Mpesa officially launches

175,000 Mpesa customers, and 577 Mpesa agents;

Safaricom submits first returns to the Central Bank of Kenya

Safaricom allows bulk payments to pay salaries with M-Pesa ‘Organizational’ accounts created so schools can accept fees with M-Pesa

Safaricom reports 2.5 million active M-Pesa customers

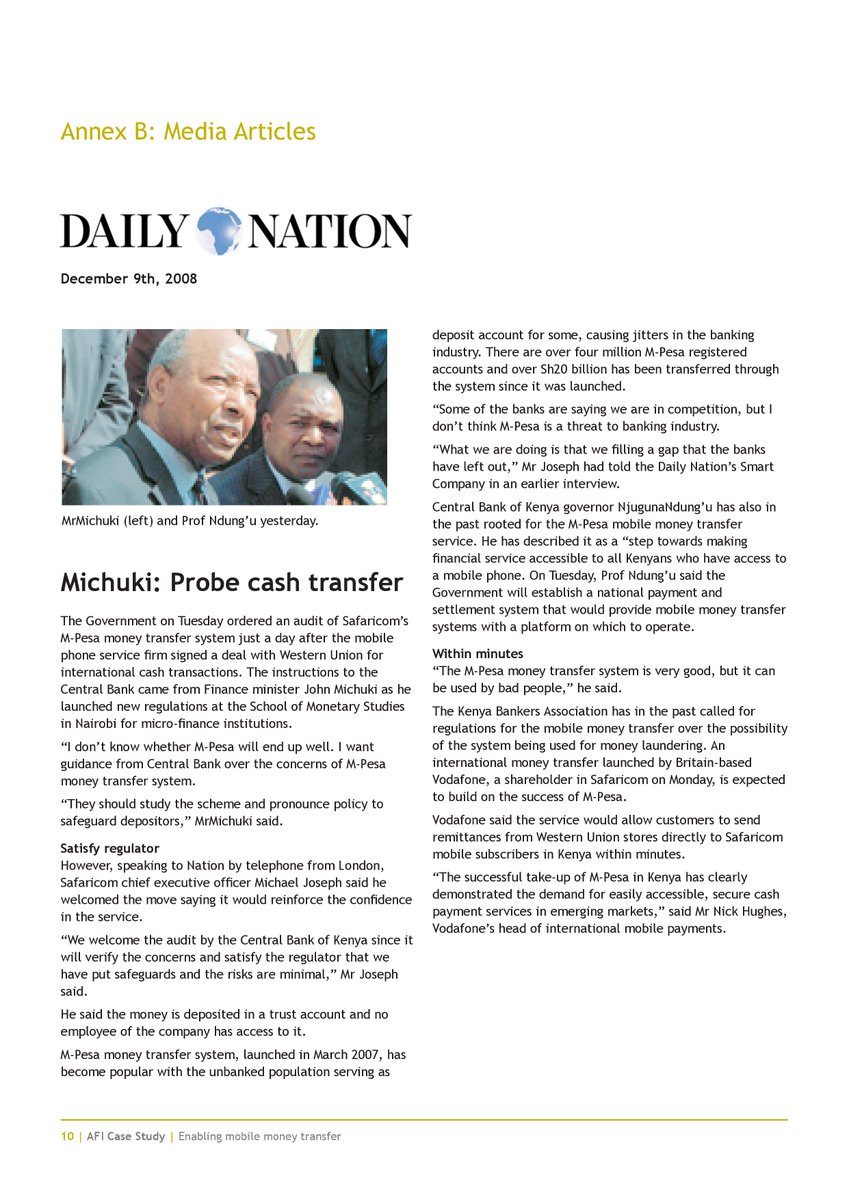

Safaricom reports 4 million Mpesa customers and 4,230 Mpesa agents

Safaricom requests CBK to add a 'buy goods' feature with M-Pesa

Safaricom reports 4.5 million active Mpesa customers, over Sh20 billion transferred through

the system since it was launch.

Gerald Nyaoma, Director of Banking Services at the Central Bank of Kenya, returned to his office to discover a newspaper lying on his desk reporting that the Minister of Finance, John Michuki, had

requested the Central Bank of Kenya (CBK) to audit M-Pesa

Michael Joseph, Safaricom Mpesa CEO

“Some of the banks are saying we are in competition, but I don’t think M-Pesa is a threat to banking industry.

“What we are doing is that we filling a gap that the banks

have left out,”

to respond to the new service

M-Pesa had grown to over 8.5 million customers served by over 12,000 agents throughout Kenya. M-Pesa services have expanded to include bill payments, group salary payments, school fee payments

Mpesa suspends services for Bitpesa without notice claiming Bitpesa failed to obtain authorization for bitcoin transfers from CBK. Bitcoins are not regulated in Kenya, but Safaricom insists that it produces a licence to that effect kenyainsights.com/revealed-how-a…

Central Bank of Kenya (CBK) issues public notice cautioning the public on Virtual Currencies such as Bitcoin

"CBK reiterates that Bitcoin and similar products are not legal tender nor are they regulated in Kenya" centralbank.go.ke/images/docs/me…

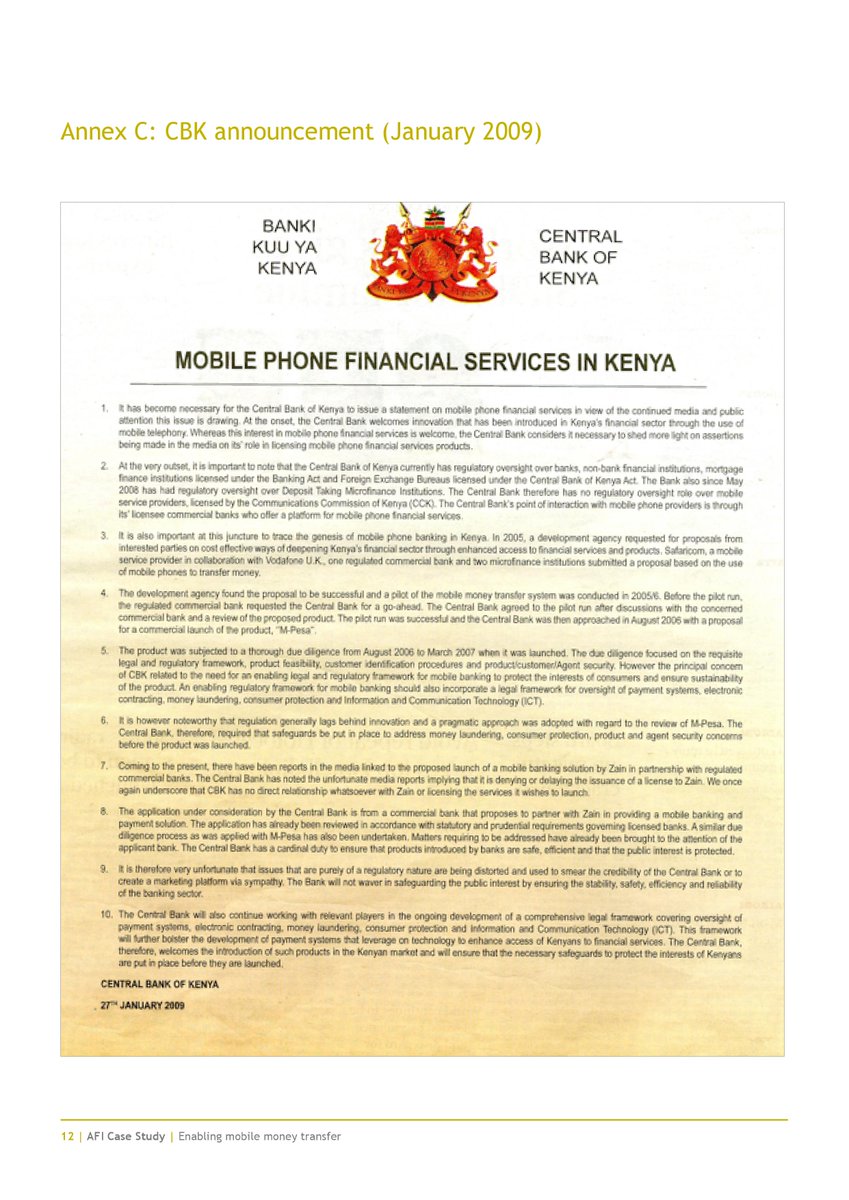

Case study Enabling mobile money transfer The Central Bank of Kenya’s treatment of M-Pesa

gsma.com/mobilefordevel…