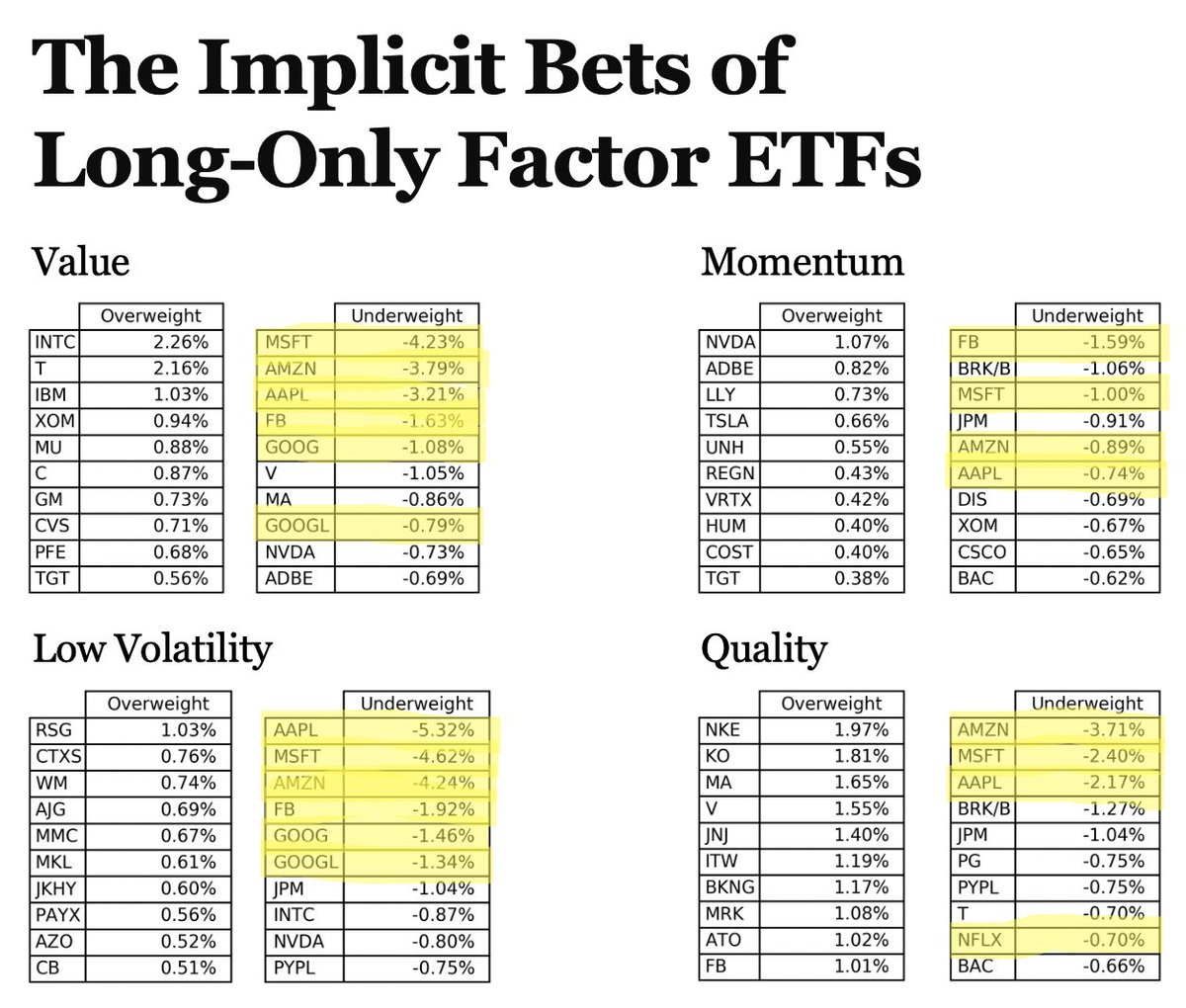

And when we market-cap weight our legs, we end up with significant short exposure to them.

Equal-weight still shorts them, but doesn't do so in an out-sized manner.

Recall that a long-only portfolio can be decomposed into two pieces:

Benchmark + Active Share x Active Bets

where Active Bets is a dollar-neutral long/short portfolio capturing over- and under-weights.

e.g. You can implicitly short a lot more AAPL than UA.

eg If we charge 1% and go from 100% active share to 70% active share, our hurdle rate goes from 1% to 1.42%!

blog.thinknewfound.com/2017/11/longsh…

Not only are FANMAG stocks on the -ve side of many factors, but their sheer size + the portfolio construction of many factor portfolios forces us to implicitly short them!

(See thinknewfound.com/style-dashboar…)

As FANMAG becomes a larger and larger part of the index, our equal-weight portfolio creates a larger and larger implicit short against them.

It's not just that the factors are betting against FANMAG, but also that the construction methodology often creates an (unintended?) implicit tilt against them.

Long-only investors are inherently constrained to active bets that look more like the market-cap weighted long/short than the equal-weight long/short.

In some circles, it's often said that passive is distorting the market.

But here we're seeing that long-only factor investors have been structural sellers of FANMAG.

I'll just lob that one out there to incite debate (riots?).

FIN.