Thinking of buying a house? When is the right time to pull the trigger? This is for you [Thread]

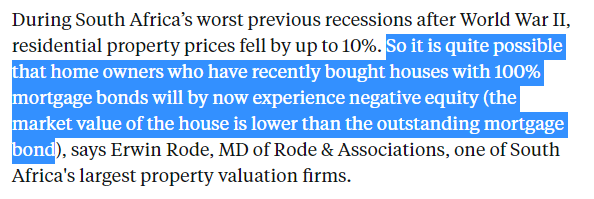

If you take out a 100% bond for a house of R1m, you owe the bank R1m (before interest). If the house loses 5% of value - it's now worth R950k... but you're still paying back R1m.

In short - you can make a loss buying a house. Shout-out EMS Twitter.

Three pro tips on this:

1. You can't usually a fix a rate for more than 5 years

2. The fixed rate will usually be higher than the current rate (banks are smart)

3. You could end up losing out if there's more rates cuts on the way

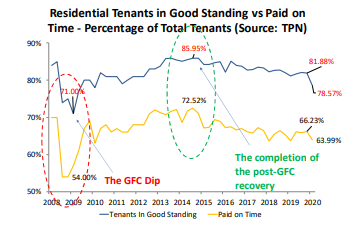

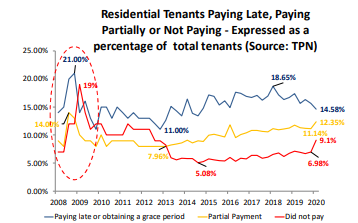

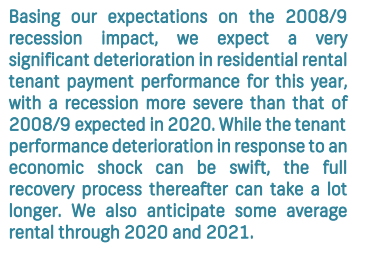

We're also hamstrung by unemployment, thin liquidity, greater defaults (post payment holidays) & allocations toward being overweight cash.

- Banks

- Property development companies

- Home loan companies

- Estate agents

- "Influencers"

Remember, once the sale is done - they don't give a fuck whether your property loses value.

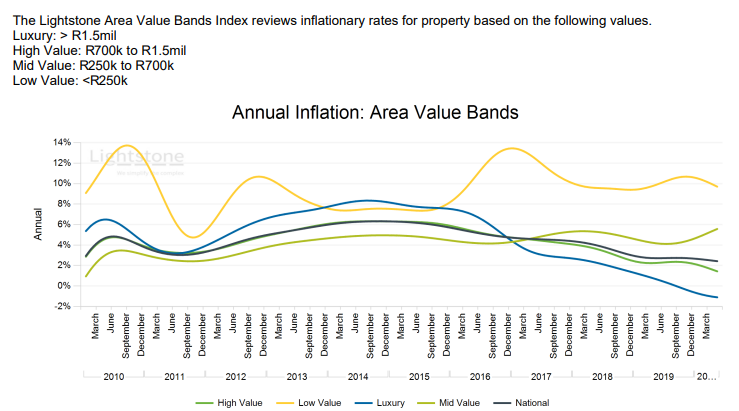

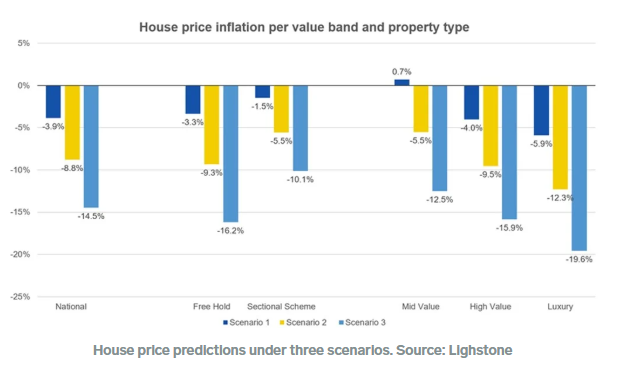

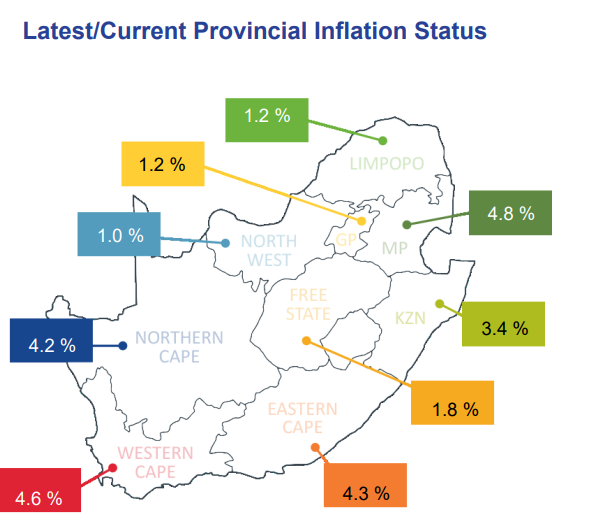

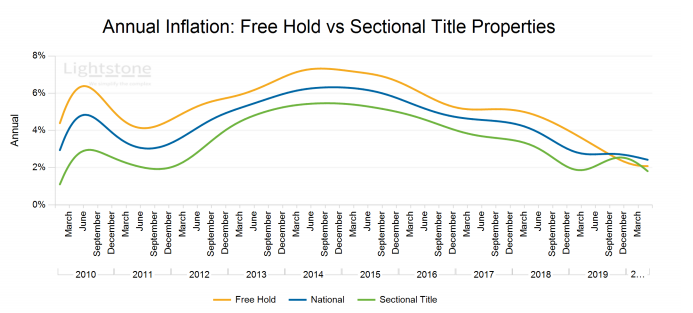

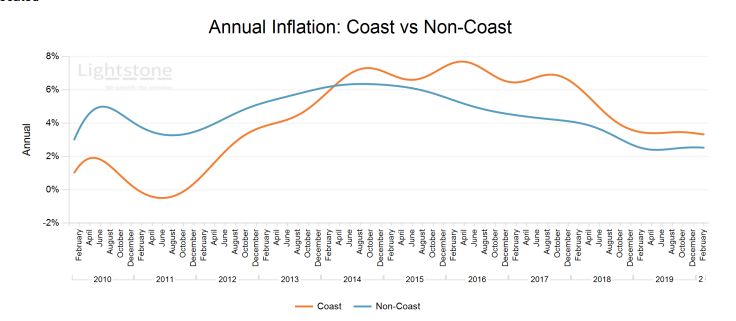

1. Lightstone June report lightstoneproperty.co.za/news/Residenti…

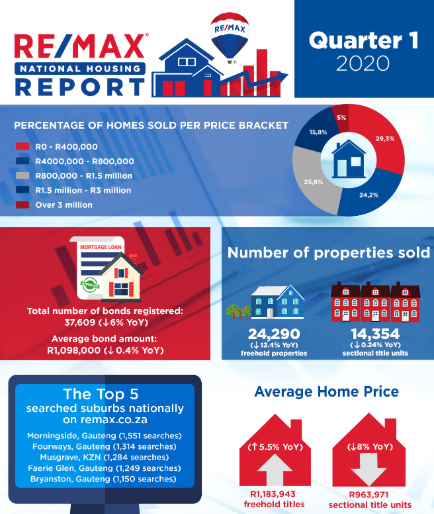

2. FNB/ PayProp & REMAX sector insights library

myproperty.co.za/tools/property…

3. Residential property think pieces

propertywheel.co.za/category/resid…

4. Global comparison

businesstech.co.za/news/property/…

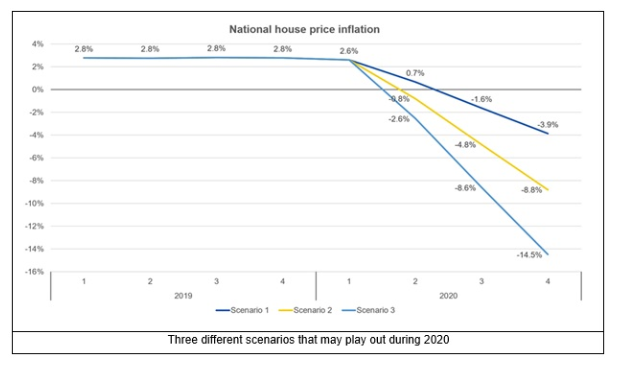

SA property also looks far from bottoming out.

Could be worth holding off on that big ticket purchase - for 2020 at least