(for US economic recovery)

Quick thread looking at some real time data

Bottom line = no, it's not (sorry, but it's not)

@TetotRemi @RaoulGMI @DiMartinoBooth @chigrl @Barton_options

1/N

Learn more:

businesscycle.com/ecri-reports-i…

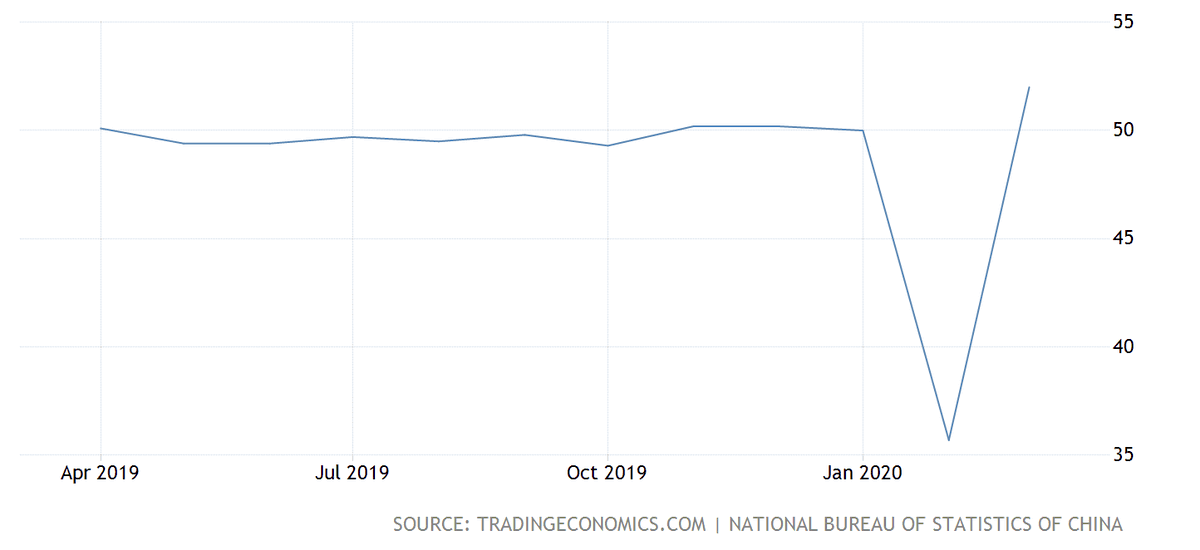

2/N

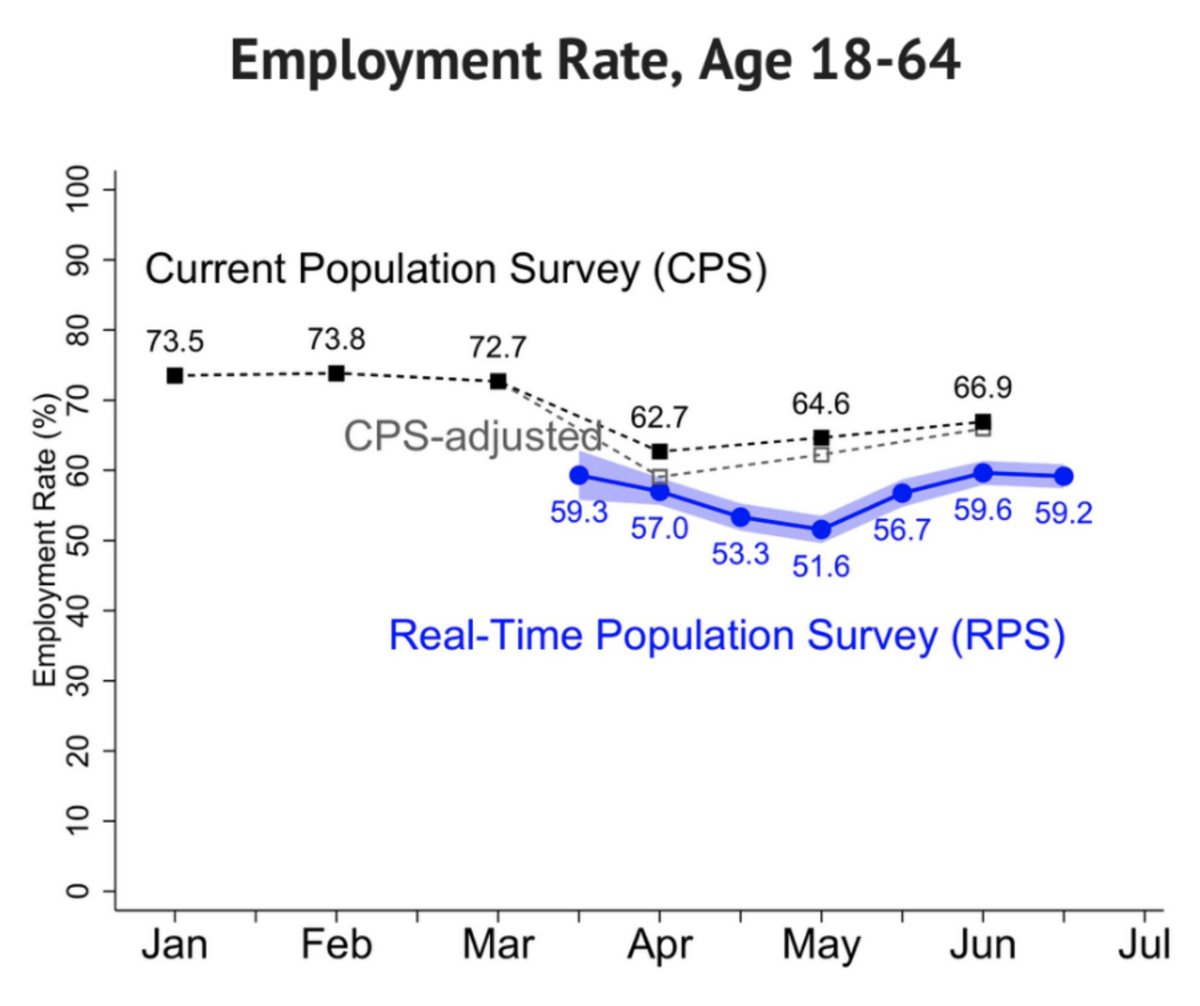

Learn more: sites.google.com/view/covid-rps/

3/N

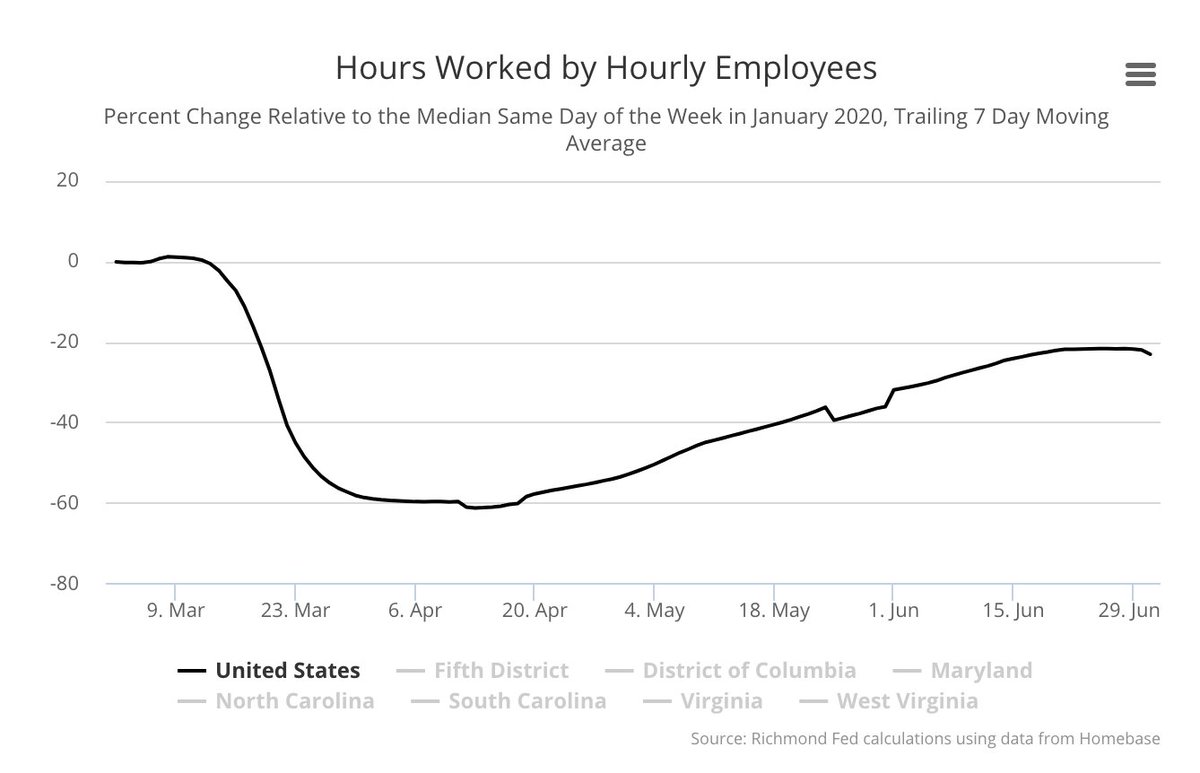

Learn more:

richmondfed.org/publications/r…

6/N

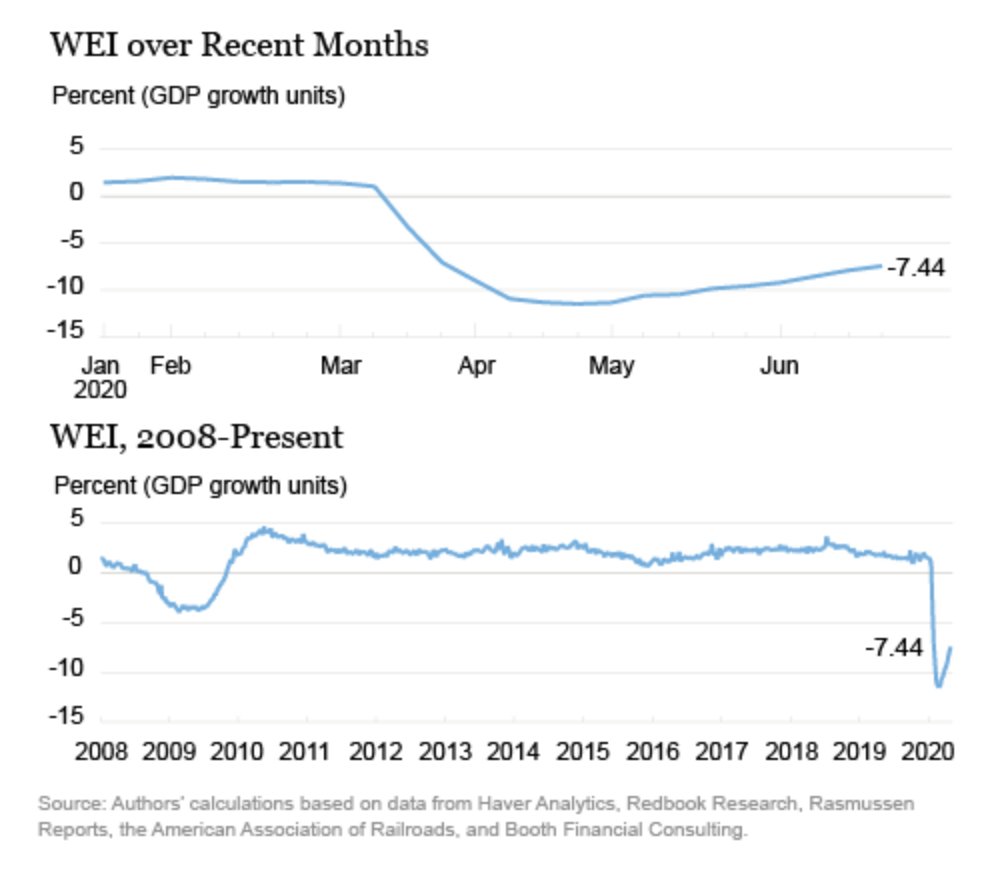

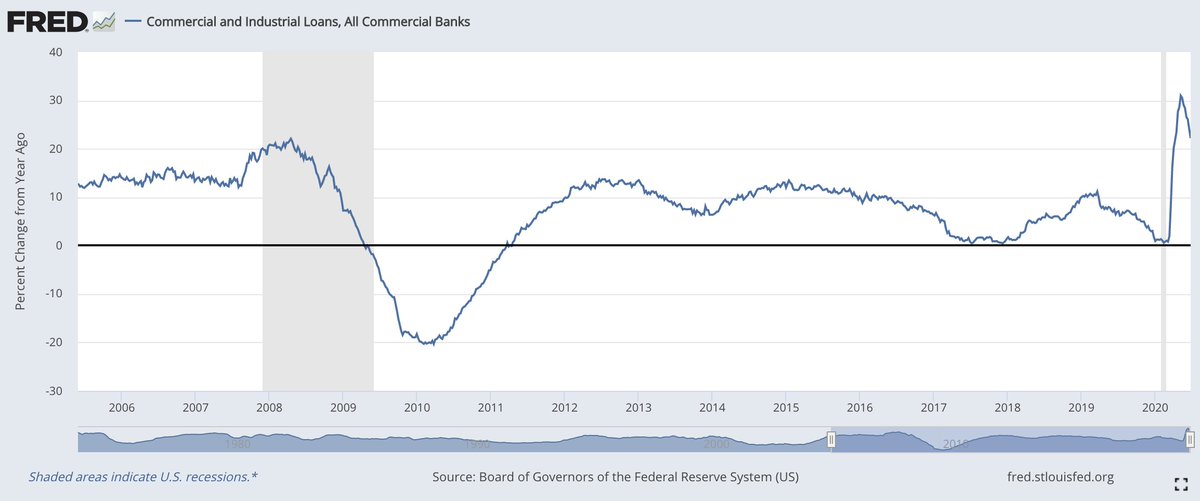

Also, look at longer tern chart (!), we are a long way from a 'V'

Learn more: newyorkfed.org/research/polic…

8/N

Learn more: fred.stlouisfed.org/series/TOTCI#0

9/N

10/N

11/N

12/N

But it's not a V

13/N

Non-V could lead to much more stimulus too

14/N

FIN