It just takes two graphs (see later)

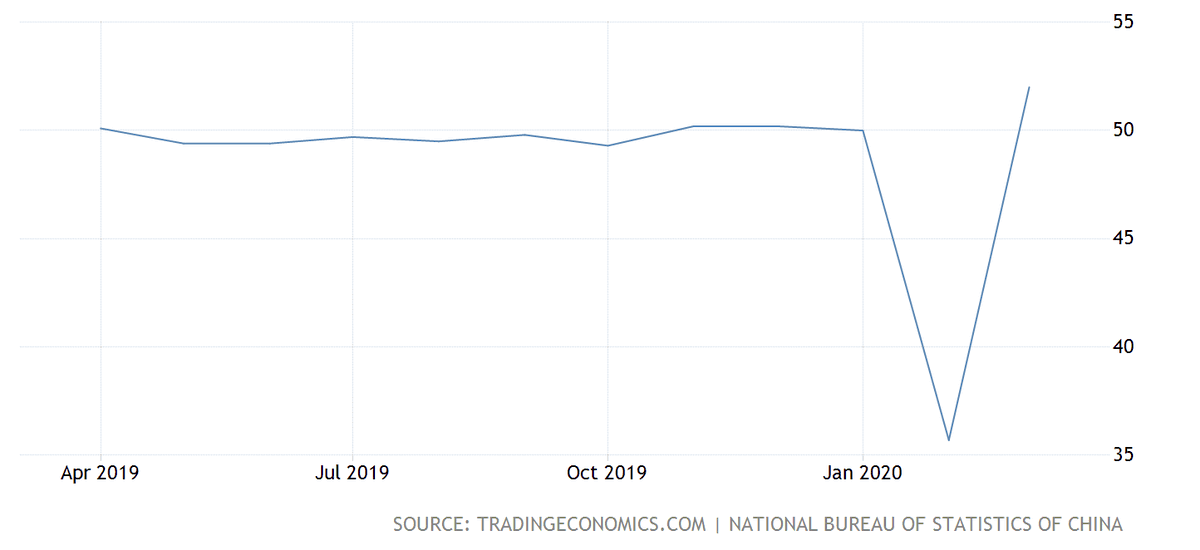

But first, the China Manufacturing Data from Feb/Mar

1/N

PMI is a MoM diffusion index, companies are asked if they had more/less/same biz activity in the month

3/N

'fake data', 'can't trust China' etc

(as we all know there has not been a 'V' recovery there)

4/N

The PMI represents a MoM growth/reduction in biz activity, it's not an absolute measure of biz activity

5/N

6/N

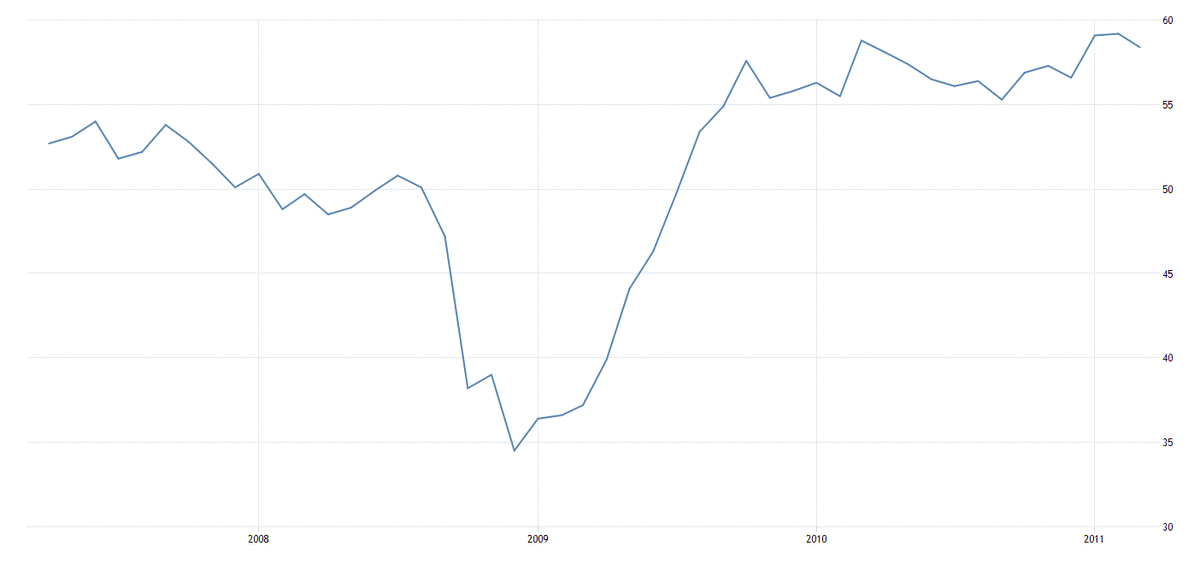

1. US ISM Manufacturing

2. US Industrial Production Index

7/N

8/N

This occurred in Dec 2008 (see graph #2) and exactly matches the PMI data (which is cool, as PMI = soft survey, and IP = hard data)

10/N

And as it should be, Aug 2009 is the first month the PMI was >50, confirming this is when on a MoM basis the biz activity was first improving

11/N

Using US data, we can see the curves show different things, one a RoC (i.e. MoM) and one an absolute measure (i.e. Index)

12/N

If China had posted a 40 PMI after the 35, then it would have shown a further deterioration in biz activity in March as 40 < 50

40 means there is less activity vs previous month

13/N

I don't want to publicly shame people

14/N

I do want to publicly praise her 🙌

15/N

And it will happen with US data very soon...

16/N