Retired entrepreneur, investor, eSports pioneer, ex-President International @C2FO, ex-Atomico, PhD Superconductors Oxford Uni, 90% #Bitcoin maxi, ETH, U3O8, Li

4 subscribers

How to get URL link on X (Twitter) App

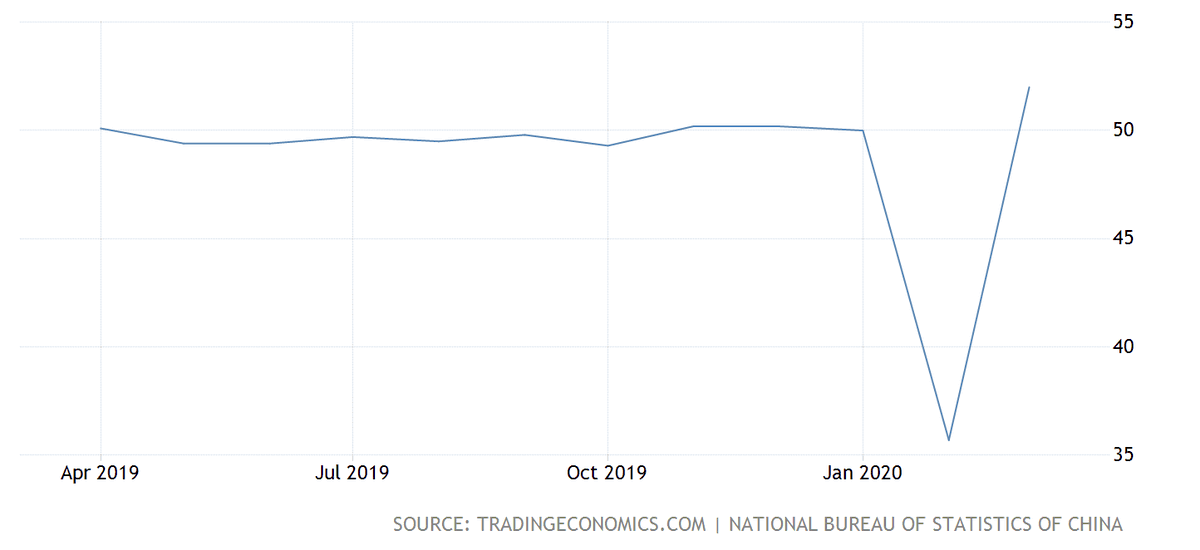

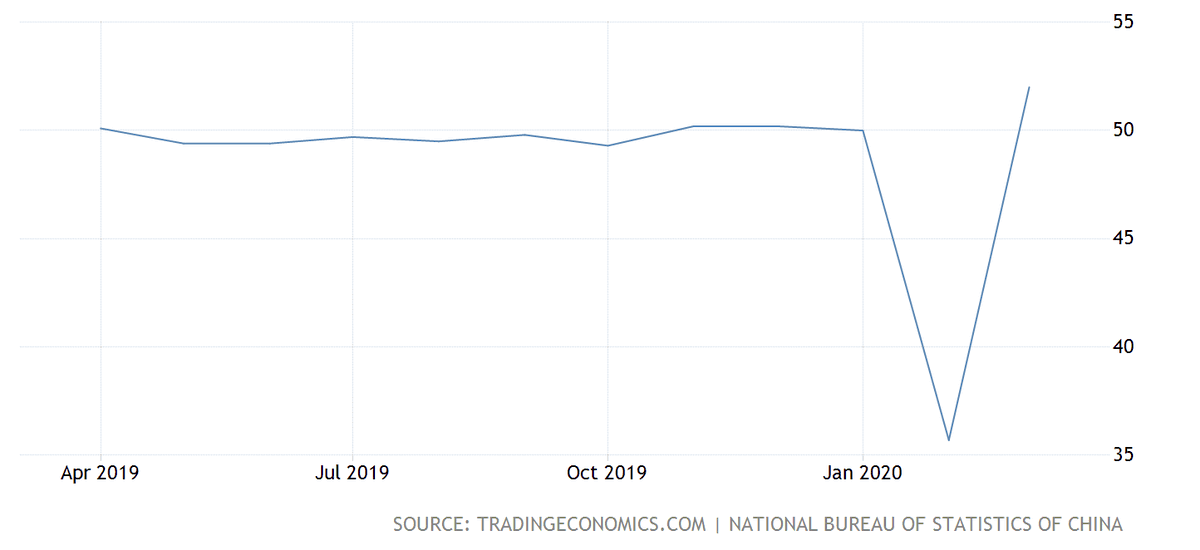

https://twitter.com/PlungingAdvice/status/1306304371144171528But pump didn't work, markets know it's just BS talk...