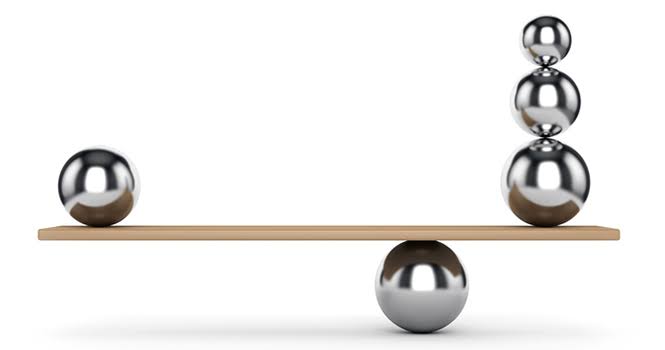

As said in auction theory. Try to understand whenever price too high or low, mostly big players will not going to buy or sell bcoz of big risk. Thats why whenever price too low smart people not going to sell at low lets price come to their price. Same like uptrend.

Read few times

Read few times

Every buyer is a seller and every seller is a buyer. Buyer strong so market moving up and seller strong so mkt moving down is totally different perspective from my side.

After every time u buy, actually u become seller either by target or stop. Strong player accumulate position.

After every time u buy, actually u become seller either by target or stop. Strong player accumulate position.

And seat tight for selling at only higher price. For hitting higher price such order filled by weak or late buyers & profit booking start; become resistance zone bcoz of strong seller sitting there. Same like mkt stop falling when some strong buyers coming and its become support.

There is nothing like aggresive buyer / seller yet. Thats why #AuctionTheory come into picture. Why high price rejected bcoz smart players know why buy costly or high price n supply coming down with price and when price low then strong player come and protect that level.

Now in Market not only one smart player, there r also so many smart player who wait for liquidity and good price and trapping different smart players. Now price at high strong player coming in and its become resistance, but other strong player think enough liquidity at high and

Price should move further up as per them they buy & trapped other smart players. If player strong at high then u will see price never reject quickly and stay there 4 a while and break high again n again and even with more big volume where weak hand keep selling

In thinking of price too high it will come down now & price keep moving until they dont think price enough to liquidate position.

Thats why oversold can be highly oversold.

2cent: If u r trend follower always try to buy high sell higher & intraday player then buy low sell high.

Thats why oversold can be highly oversold.

2cent: If u r trend follower always try to buy high sell higher & intraday player then buy low sell high.

Test of demand or supply trade example when mkt stay in range after that one shakeout which is basically as per diagram test of supply n demand.

https://twitter.com/sanjufunda/status/1304325782836097024?s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh