Retail Option Trader, Since 2014;

Volatility 🦘, Portfolio 🐮, and

Mechanical Engineer (M. Tech).

18 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/sanjufunda/status/1471493804347719688ORB high/low, DH/DL, WH/WL, MH/ML, PDH/PDL, Inside Swing High/Low, Fractal, BRN, POC/HVN etc.

https://twitter.com/sanjufunda/status/1471493804347719688Normally ended with few players win and few loss. So in other word some kind of consolidation happen initially which anyone can relate big volume at initial candle.

As we know derivative product approx 6x leverage which means for 6L we normally pay 1L for taking it delivery in account. What if we take without leverage, less leverage risk exposure or even 10x leverage. Any system robustness checked by its drawdown properties.

As we know derivative product approx 6x leverage which means for 6L we normally pay 1L for taking it delivery in account. What if we take without leverage, less leverage risk exposure or even 10x leverage. Any system robustness checked by its drawdown properties.

https://twitter.com/_rajade/status/1470329615554007040There is some difference always wat we look in theory and practical. Hope this link will be helpful.

https://twitter.com/sanjufunda/status/1462780309519450113?s=20

https://twitter.com/sanjufunda/status/1307136977129660416

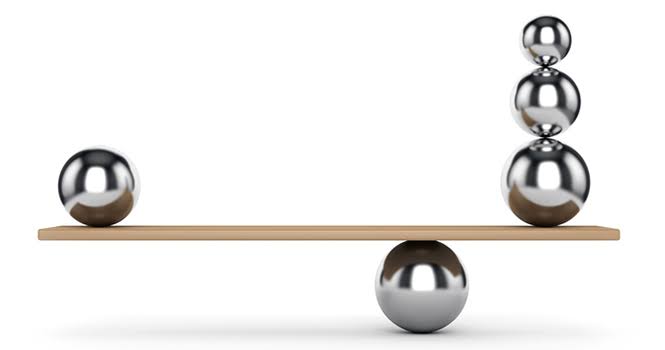

1. Locking Profit

1. Locking Profit

https://twitter.com/sanjufunda/status/1362820860113952768Please check discription of youtube, there is Google drive link i leave excercise file and rtd tweak file there.

https://twitter.com/sanjufunda/status/1354983159520083970?s=1946. Engulfing, Insider/Outsider bar....

https://twitter.com/sanjufunda/status/1363552725925957636?s=19

No effect of vega. Almost fraction.

No effect of vega. Almost fraction.https://twitter.com/AakashN50/status/1329820646344310786?s=19

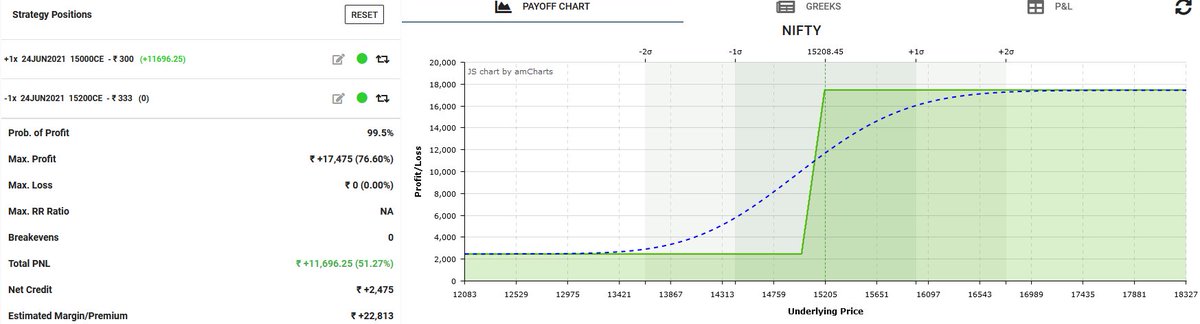

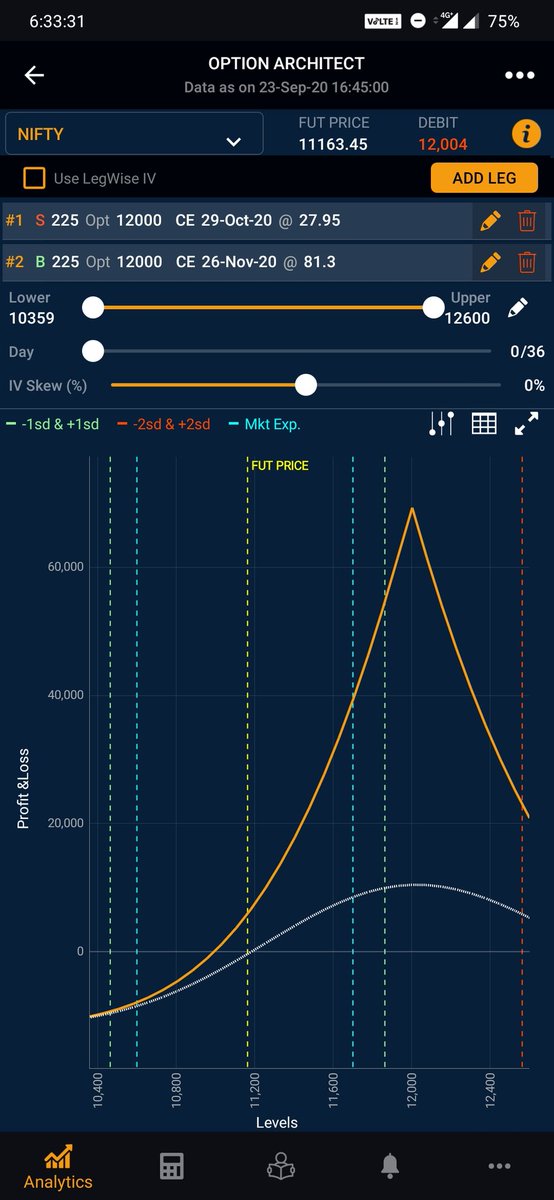

But i prefer put calendar due to its less sensitive to delta and more effective on vega as we know put side more premium mostly available and they decay slow and near to end of day/near to expiry.

But i prefer put calendar due to its less sensitive to delta and more effective on vega as we know put side more premium mostly available and they decay slow and near to end of day/near to expiry.

One diffence i can see fut to fut arbitrage pts difference. Rest everything almost same for me.

One diffence i can see fut to fut arbitrage pts difference. Rest everything almost same for me.

https://twitter.com/sanjufunda/status/1297399119795744769?s=19

https://twitter.com/sanjufunda/status/1307877107347775488