If you need to make sense of everything and avoid entanglement, this is for you [Thread]

The concept extends to basically anything. Today you can own a fraction of a Ferrari, rare sneakers, a Rolex & even a Picasso painting.

Think Growthpoint, Redefine, Hyprop, Resilient.

1. Diversification & managing risk

2. Liquidity & realizing value

3. Track record & experience

4. Access to capital, management & scale

5. Outlook on property

If you're buying a fraction of one physical property - your risk is HEAVILY concentrated. You're not just betting on residential property but on this one specific residential property.

Benefit of buying into a REIT is having exposure to a vast portfolio.

With EasyProperties you can only sell the fraction you own once a quarter (when they hold an auction). If you need to realize cash quickly - you're stuck.

With a REIT, you can sell at any time during the trading day. You know EXACTLY what your share is worth daily.

No matter how great the investment thesis sounds, you're always rolling the dice on a newly launched investment product. REITs have been around for a long, long time.

There's upside in waiting it out to see how the first wave of investors perform.

Listed property hinges on optimum leverage, ability to source capital cheaply & manage interest rate exposure.

Having built hedging models for some of these guys, optimum capital structures are a priority. They also borrow very cheaply.

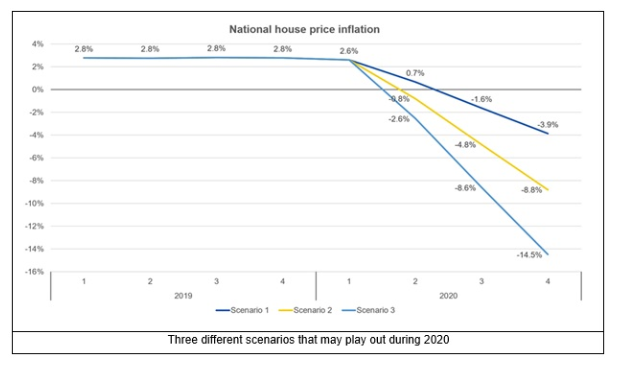

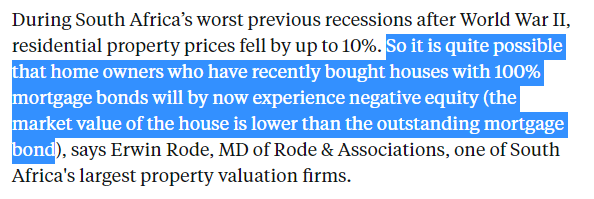

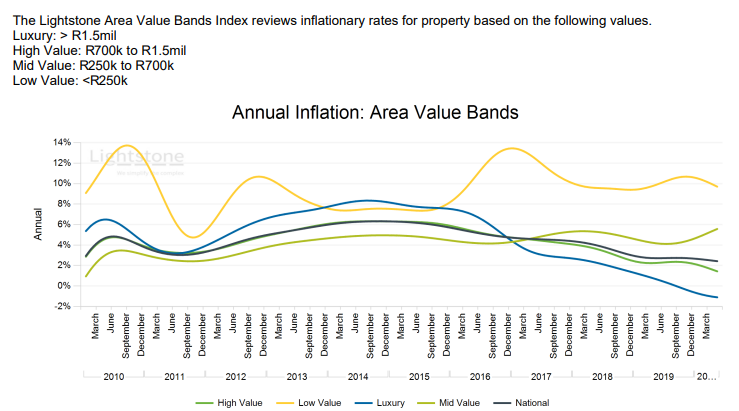

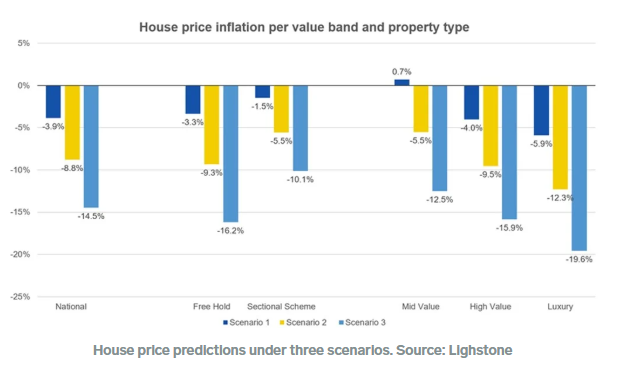

SA property outlook is grim

This will affect both fractional ownership & REITs. Every round of data is progressively worse & it could get much worse before it gets better. Decision to buy really depends on your investment horizon.

REITs are required to pay out at least 75% of earnings but they are also struggling & are pushing back on this. It really reflects the shocking state of the SA economy.

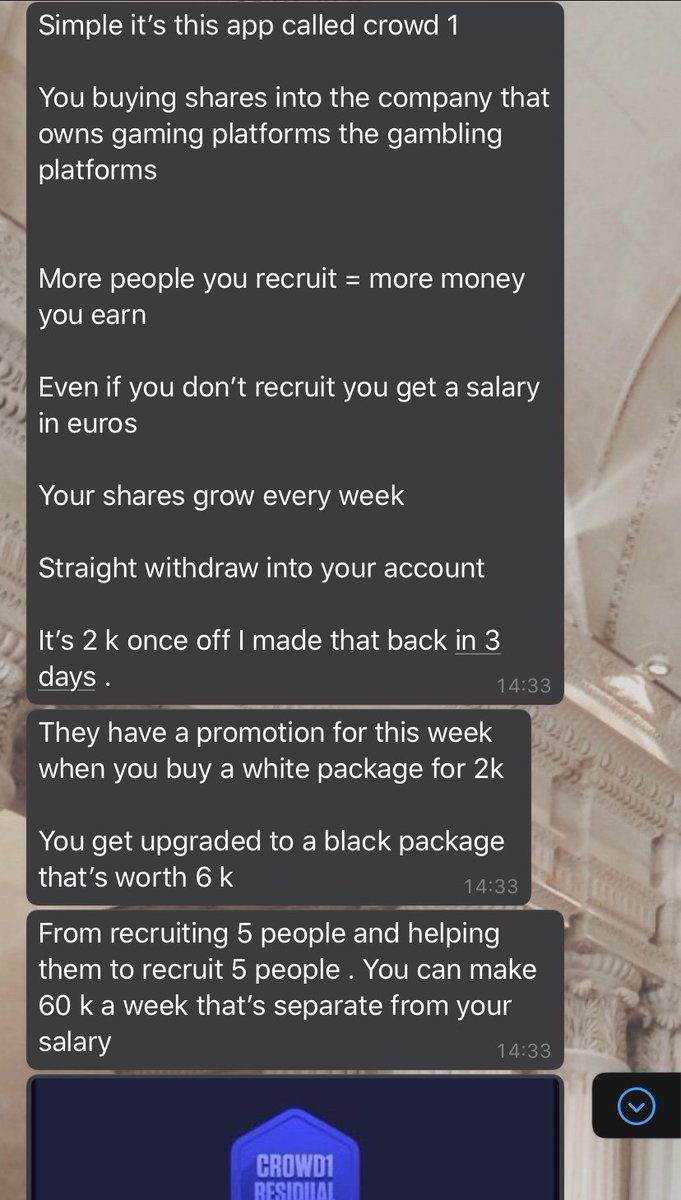

However, it's precisely why a higher degree of due diligence is an imperative - especially in the age of gamification of financial apps.

1. bloomberg.com/news/articles/…

2. support.easyproperties.co.za/support/soluti…

3. r3.com/blog/asset-fra…

4. dailymaverick.co.za/article/2020-0…

5. moneyweb.co.za/news/companies…