#PriceAction

Range strategy

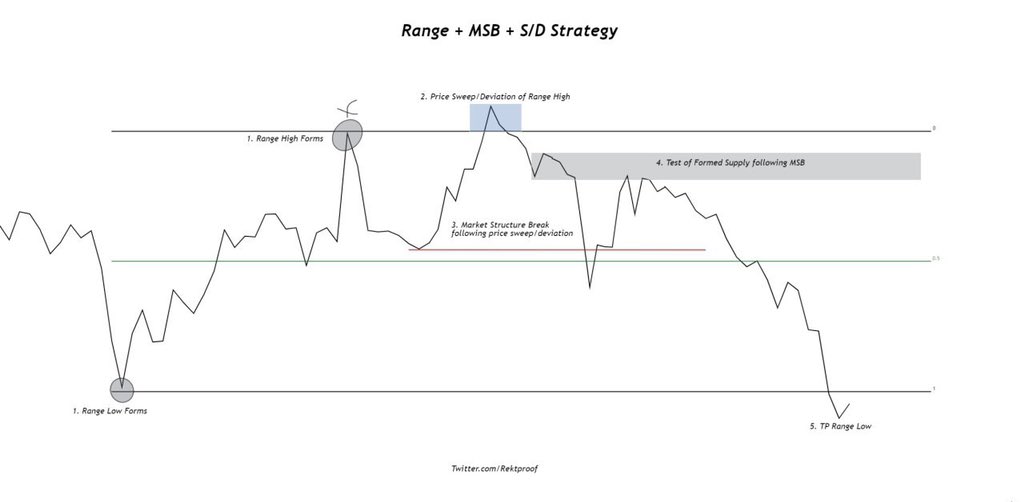

Quick write up on a commonly used setup I tend to look for when price ranges.

Criteria is as such:

- Range Forms

- Price sweep/deviation of range point

- MSB (Market structure break)

- Test of formed SD

- TP

Enjoy!

Range strategy

Quick write up on a commonly used setup I tend to look for when price ranges.

Criteria is as such:

- Range Forms

- Price sweep/deviation of range point

- MSB (Market structure break)

- Test of formed SD

- TP

Enjoy!

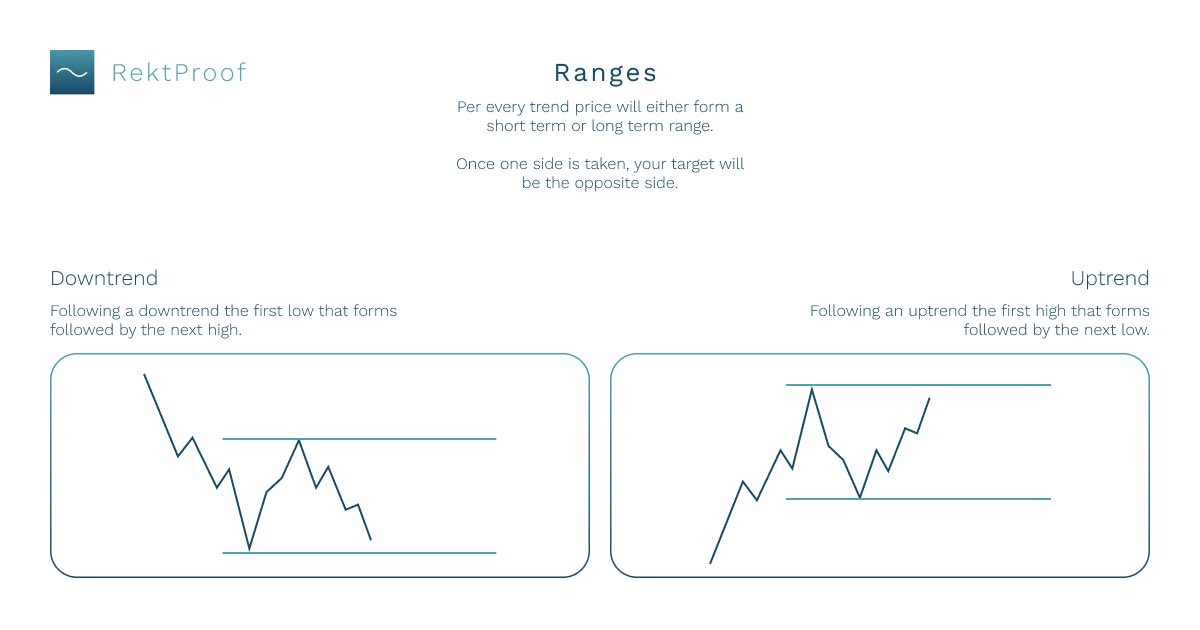

Range forms

Price outlines two swing points in the market.

Price sweep/deviation

Following the identified swing points- price proceeds to sweep/deviate before closing back inside range

Price outlines two swing points in the market.

Price sweep/deviation

Following the identified swing points- price proceeds to sweep/deviate before closing back inside range

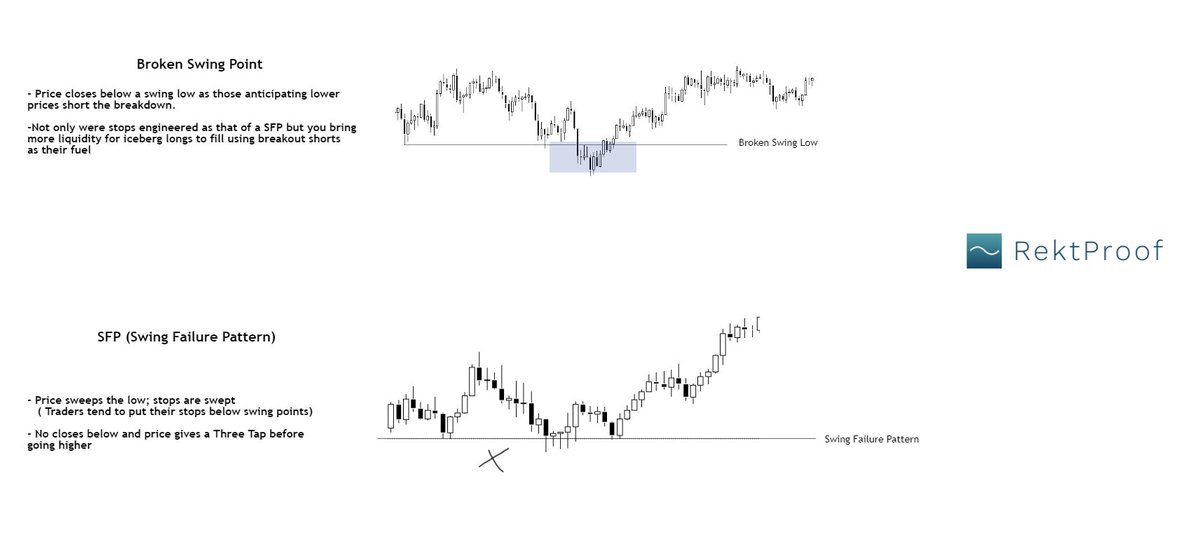

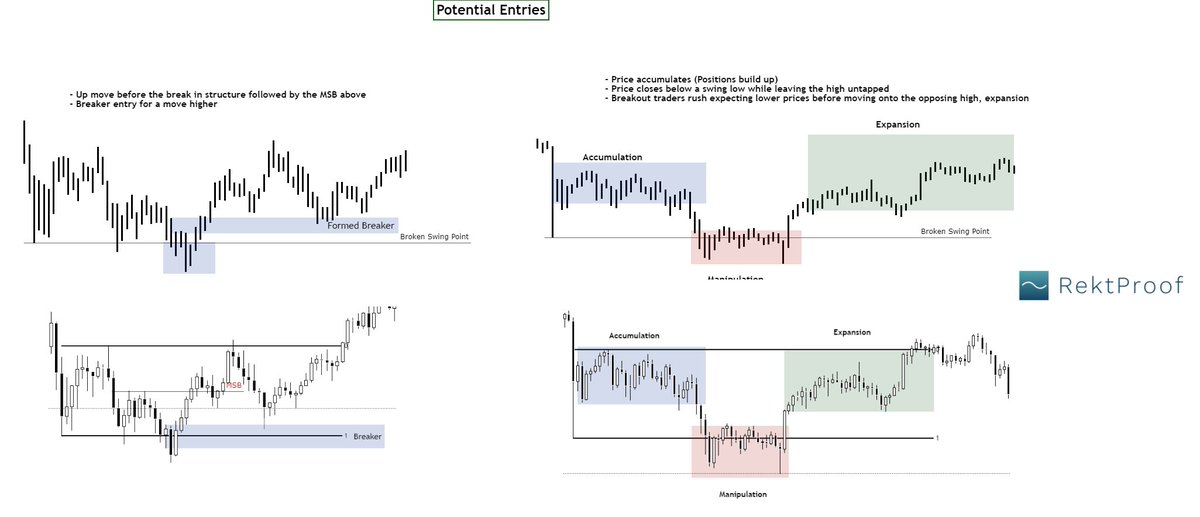

MSB

Following the price sweep/deviation; price breaks structure and shifts a new low.

Test of formed SD

Formed supply following sweep + MSB

Following the price sweep/deviation; price breaks structure and shifts a new low.

Test of formed SD

Formed supply following sweep + MSB

• • •

Missing some Tweet in this thread? You can try to

force a refresh