How to get URL link on X (Twitter) App

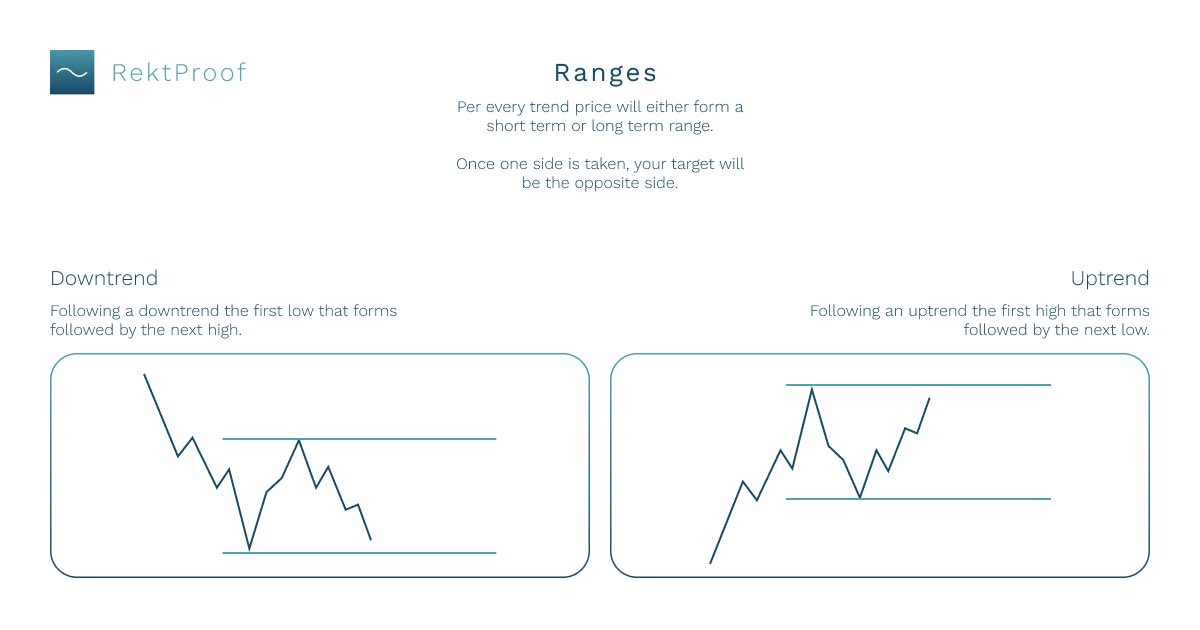

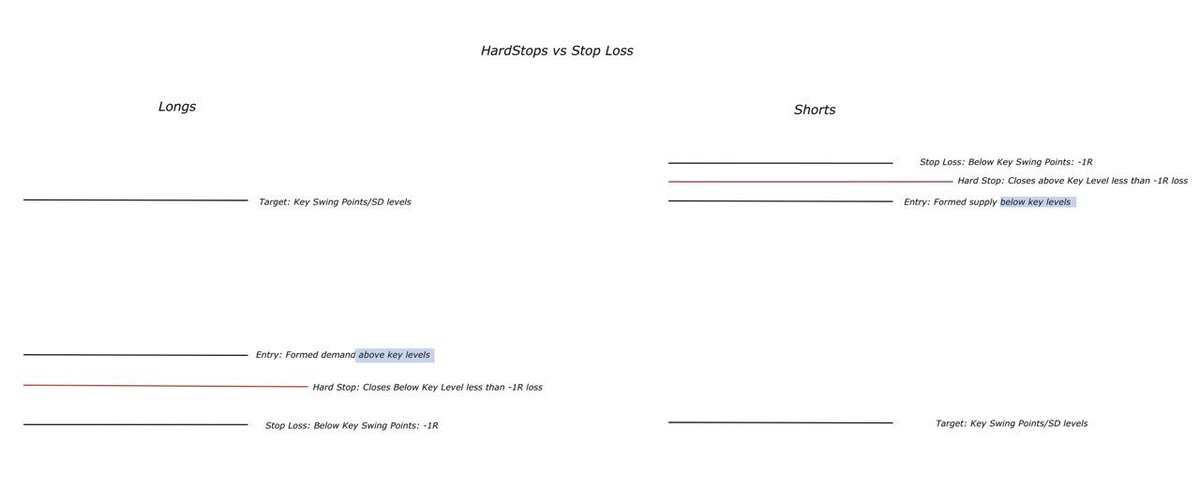

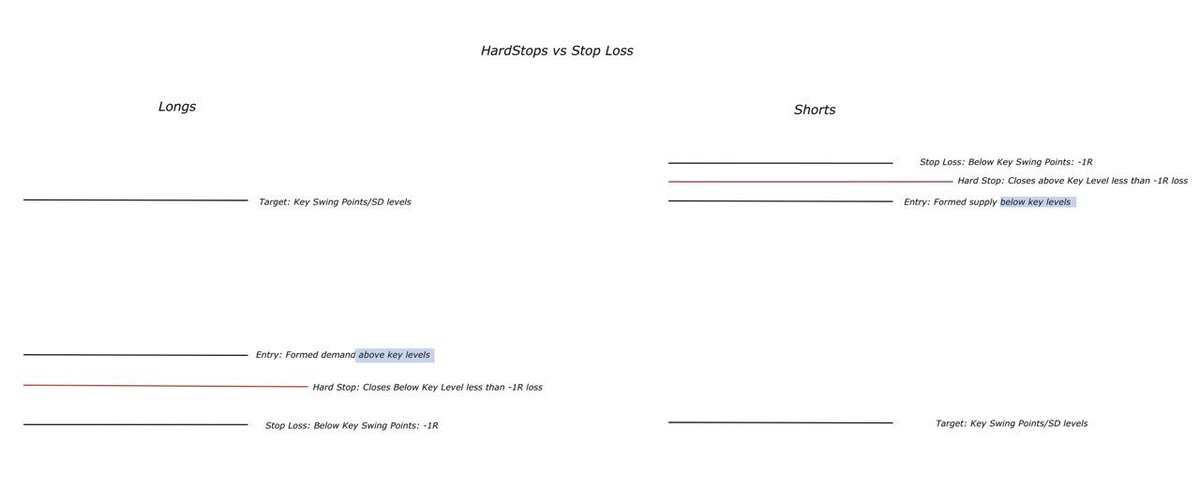

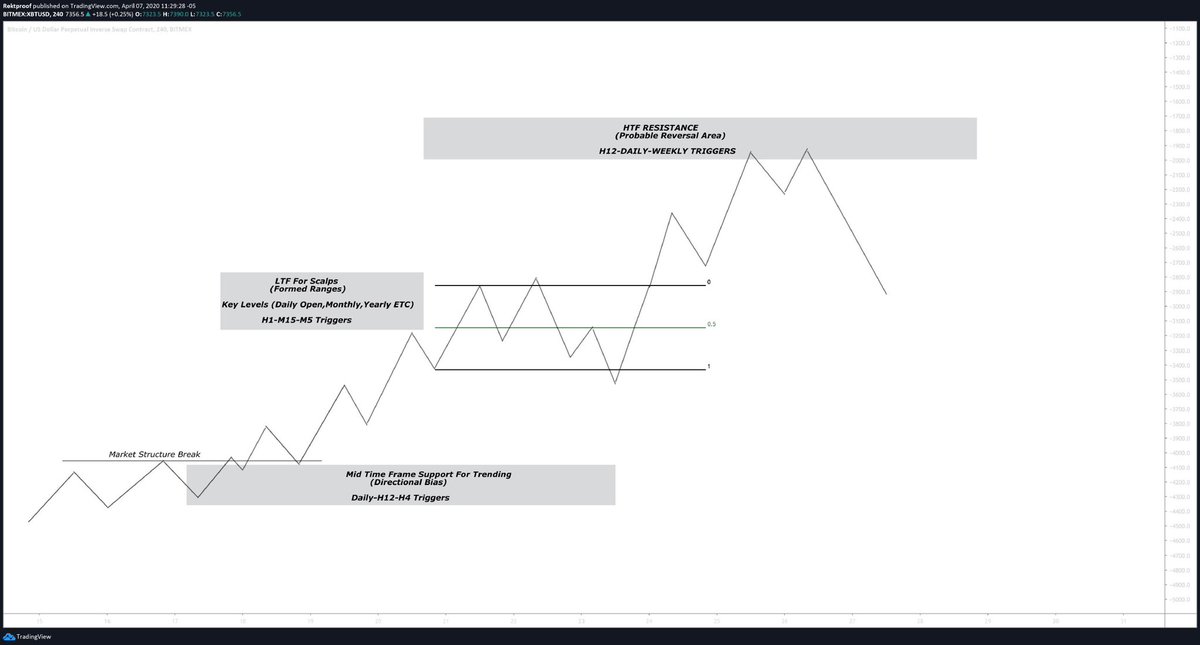

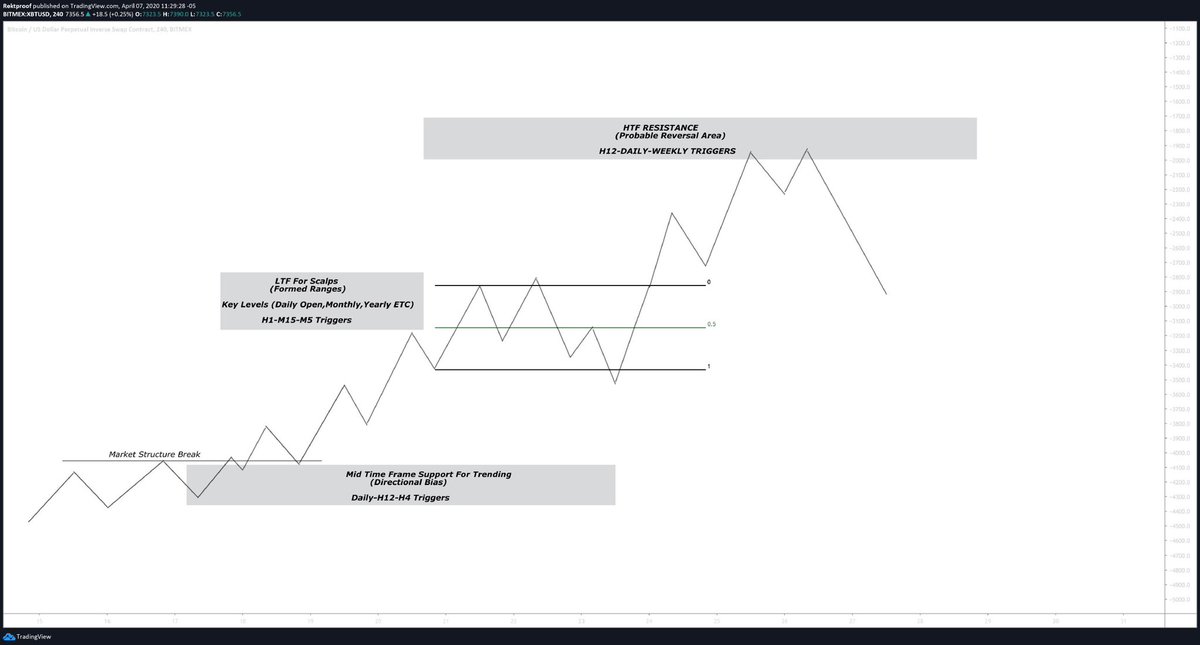

Formatting ranges:

Formatting ranges:

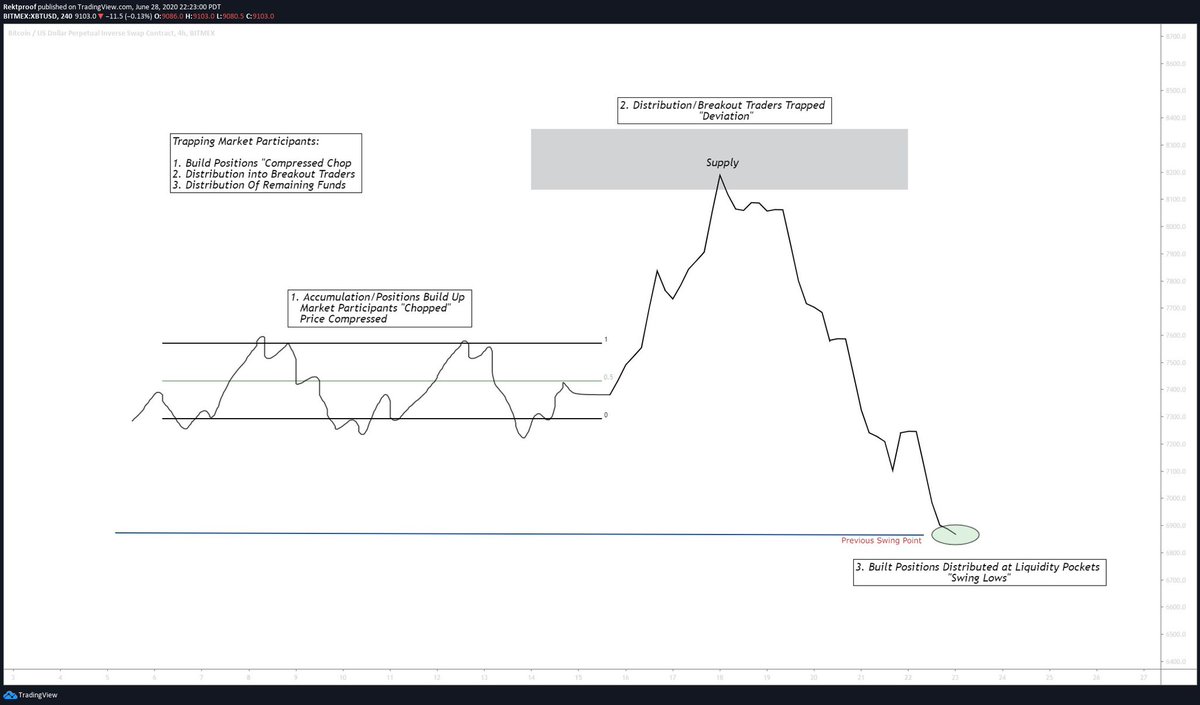

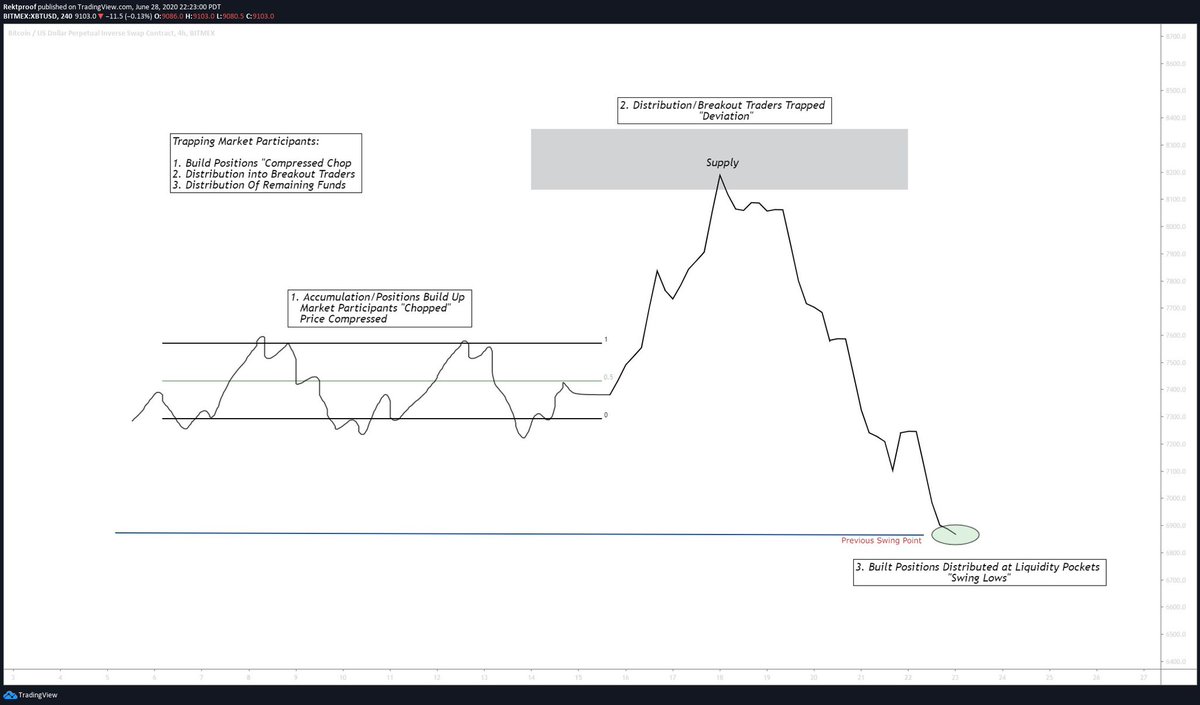

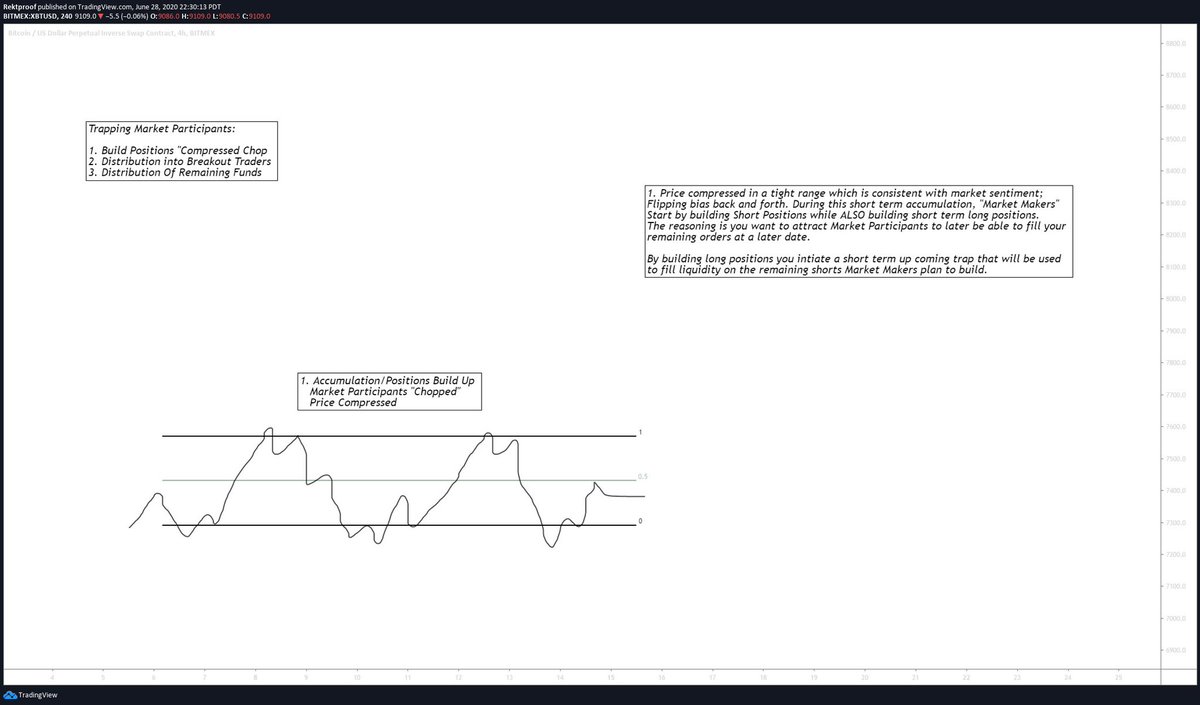

$BTC / $USD

$BTC / $USD

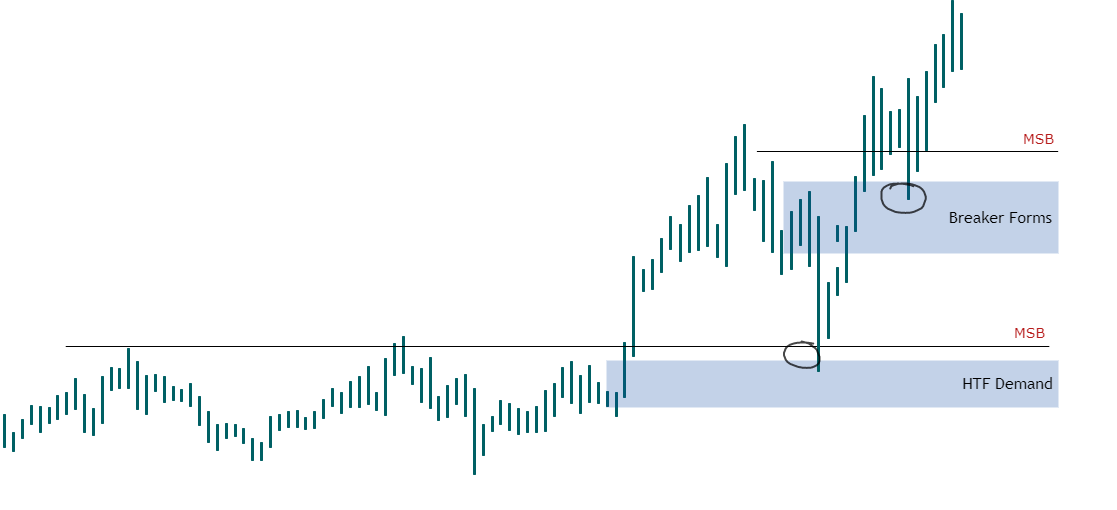

Improper use of SD, to my perspective.

Improper use of SD, to my perspective.

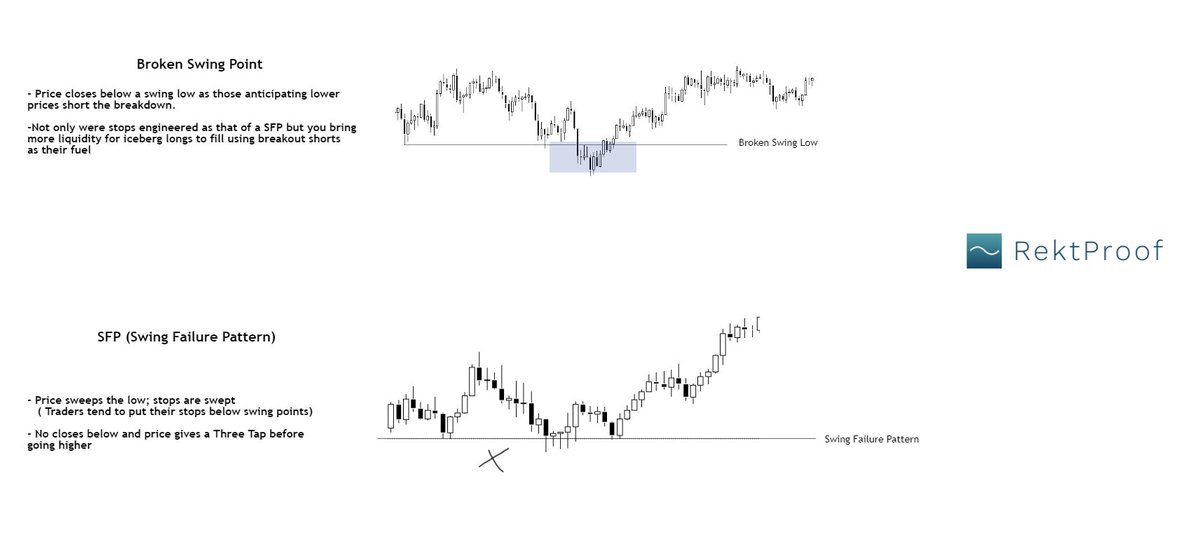

Broken swing points vs SFP's

Broken swing points vs SFP's

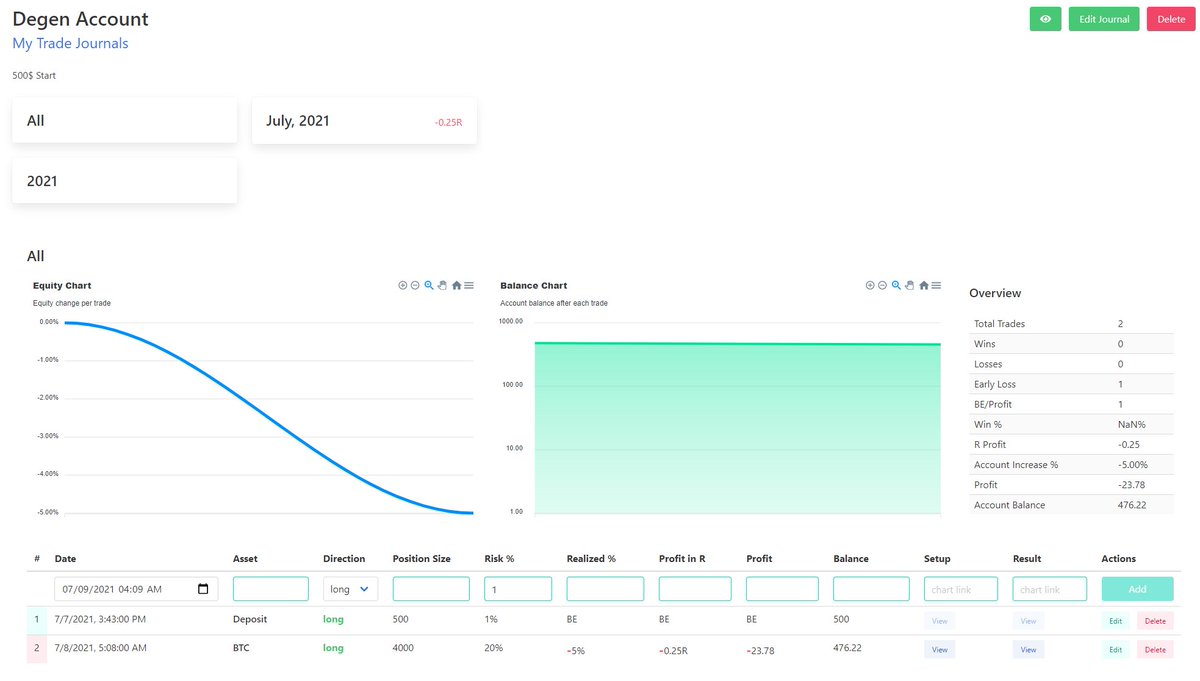

Degen Account Update:

Degen Account Update:

2/4

2/4

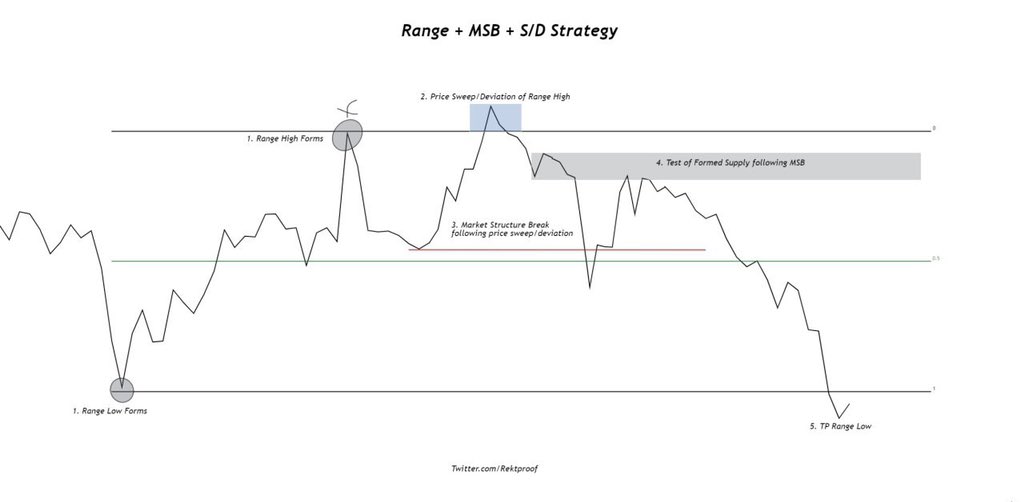

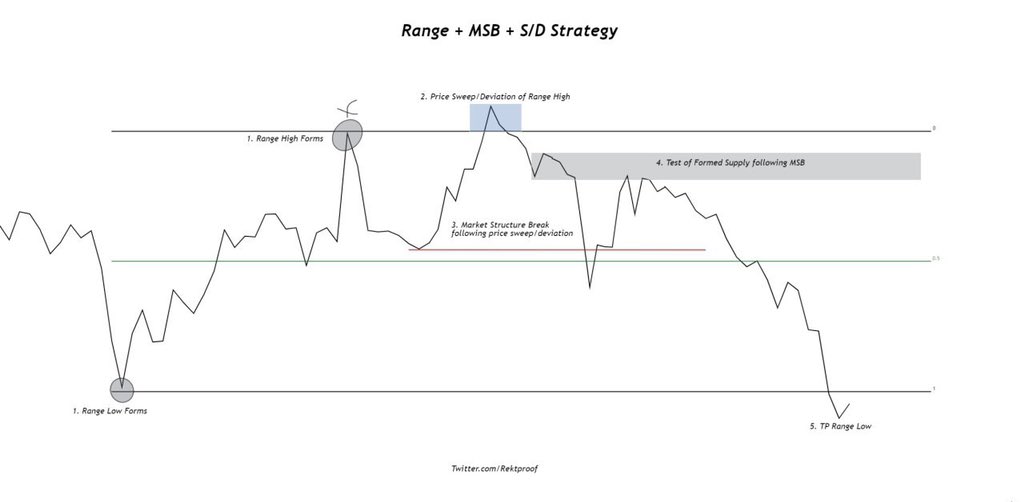

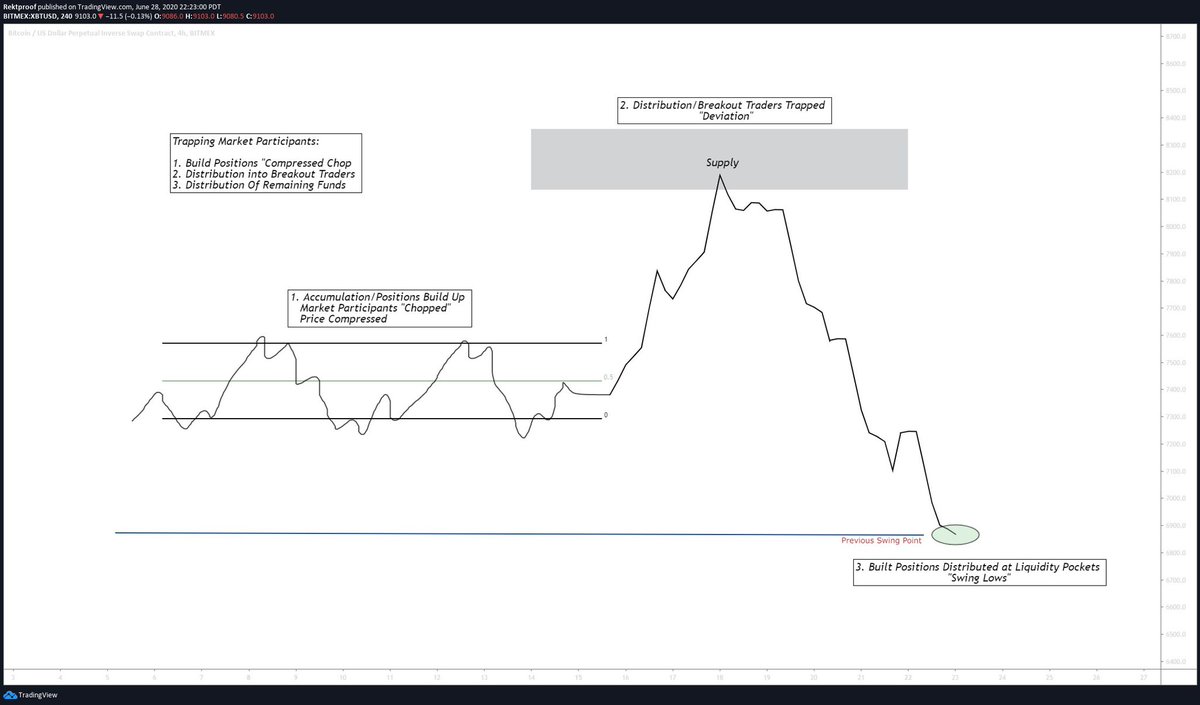

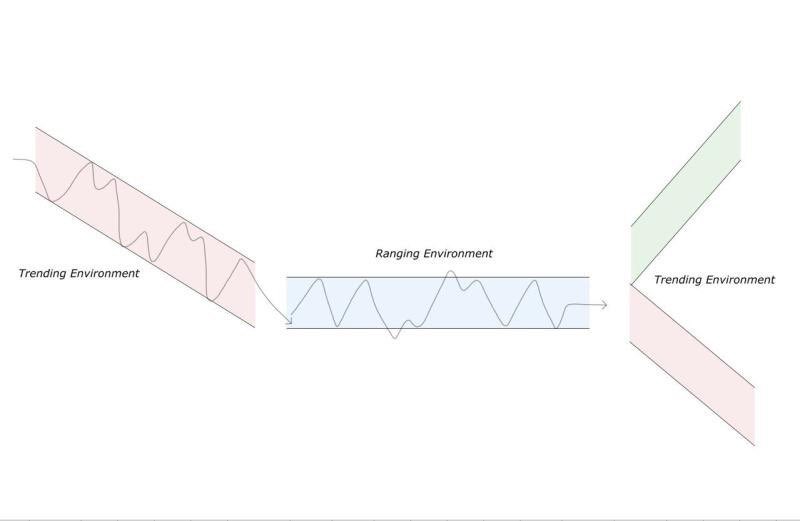

Range forms

Range forms

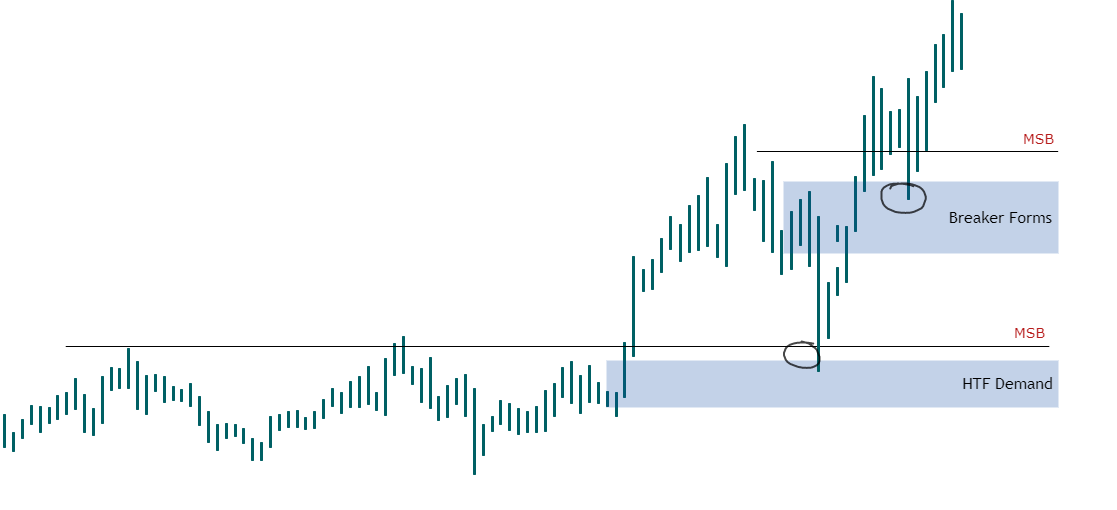

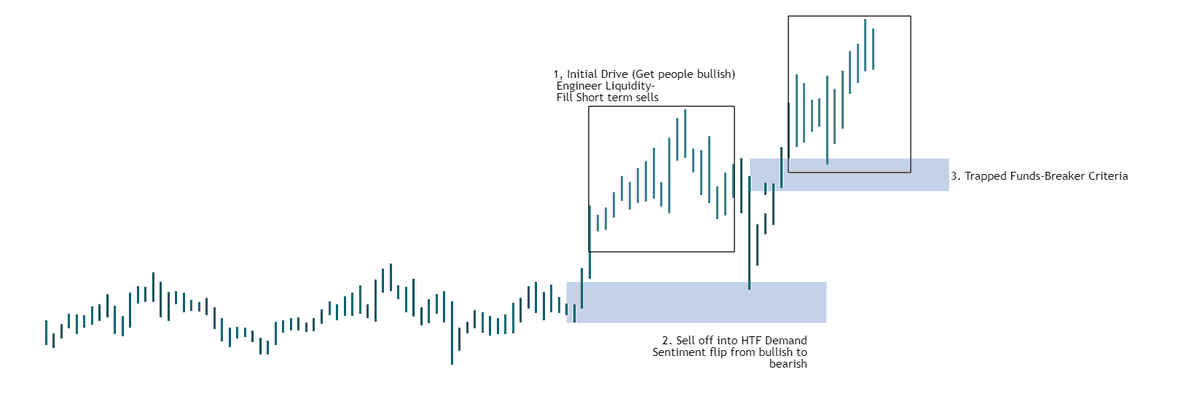

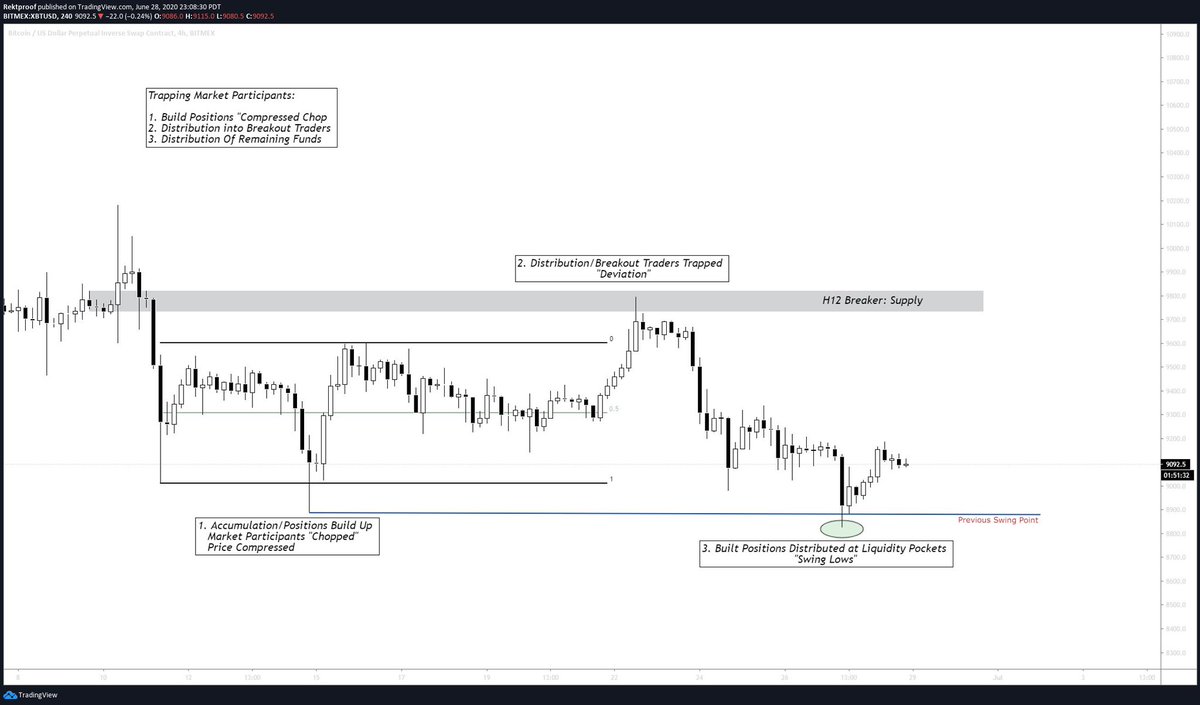

1. Accumulation:Postions Build up

1. Accumulation:Postions Build up

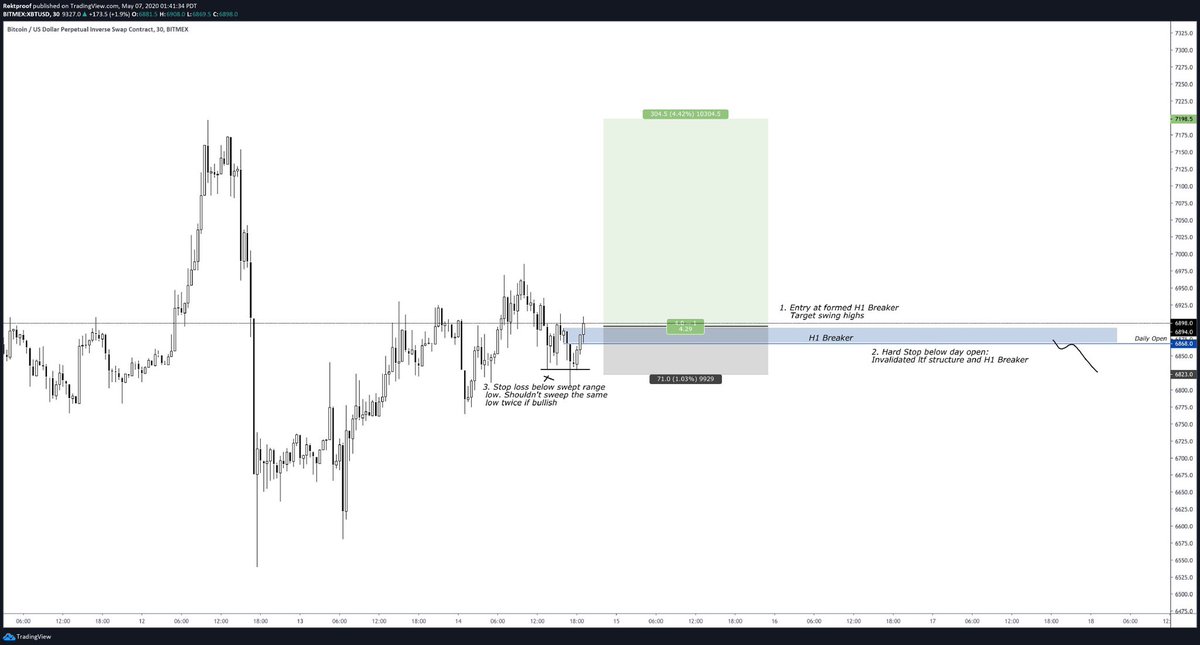

1. Long Example

1. Long Example

/

/

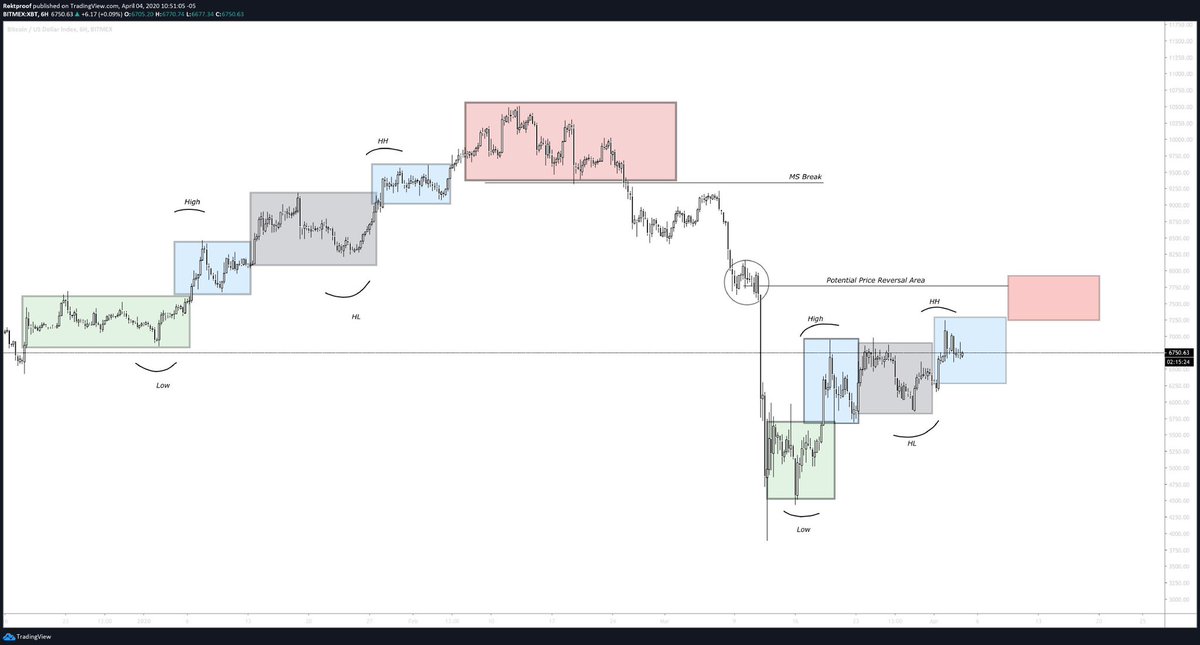

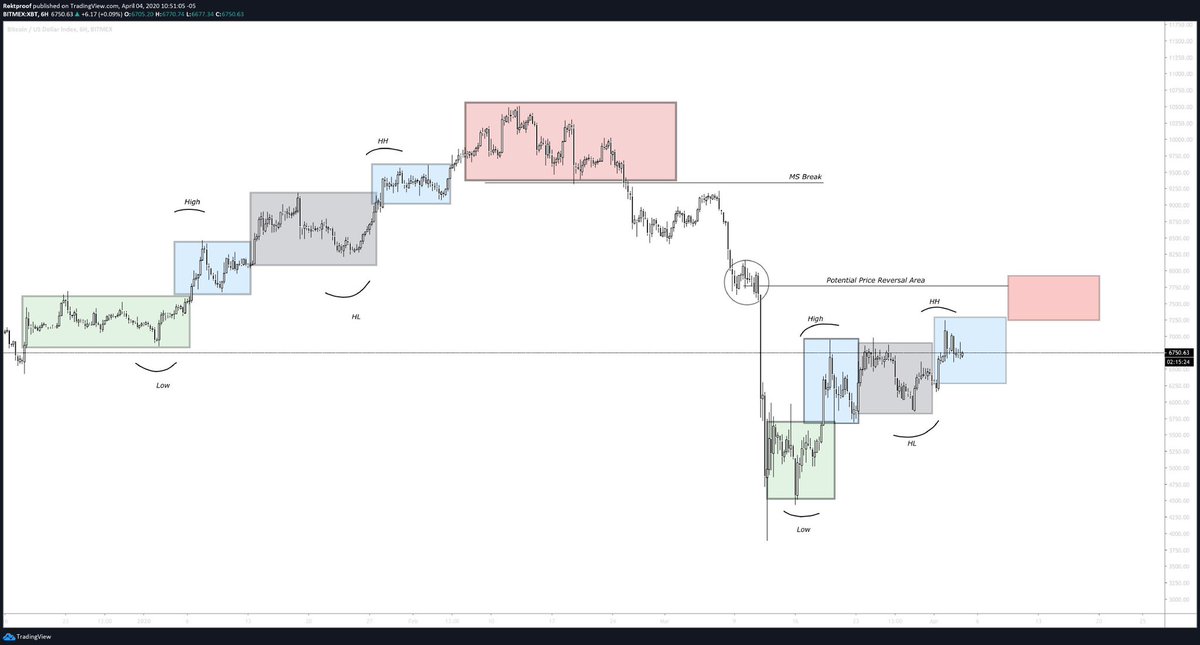

1. Previous Price Action

1. Previous Price Action

/

/

$BTC / $USD

$BTC / $USD

2/4

2/4