How to get URL link on X (Twitter) App

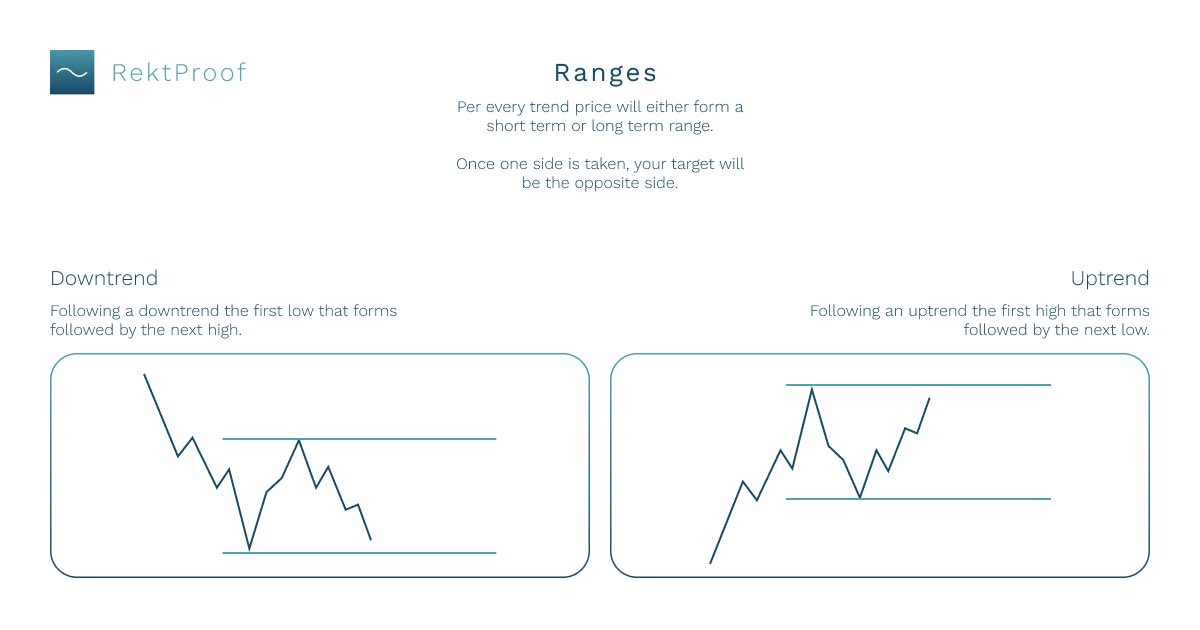

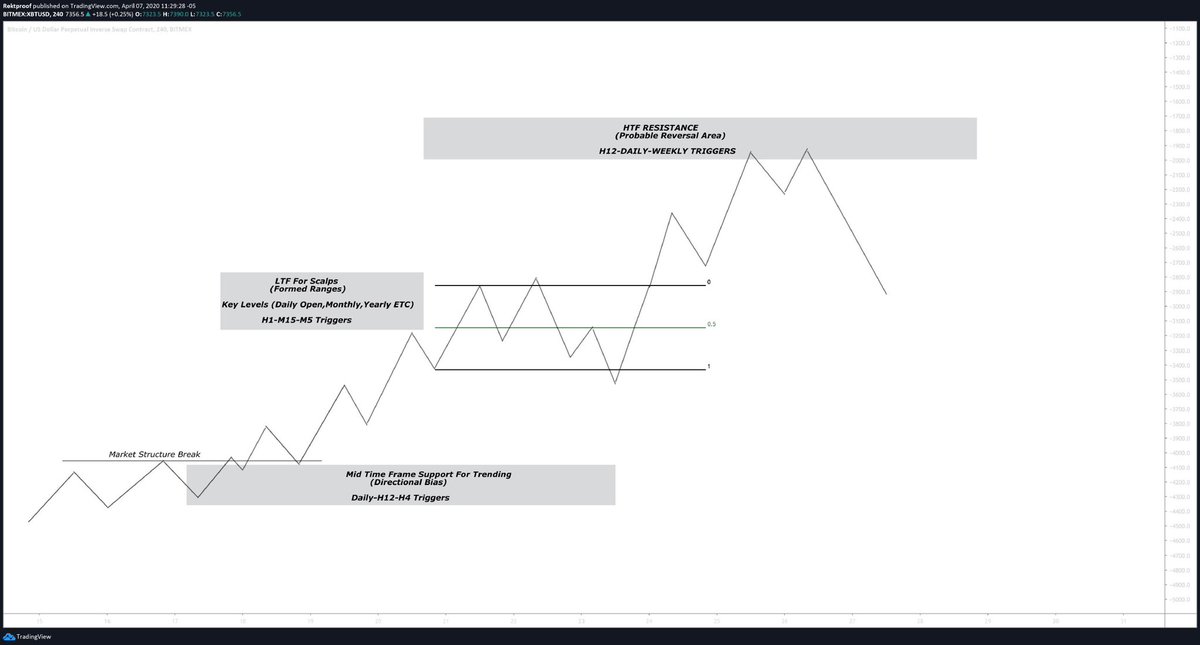

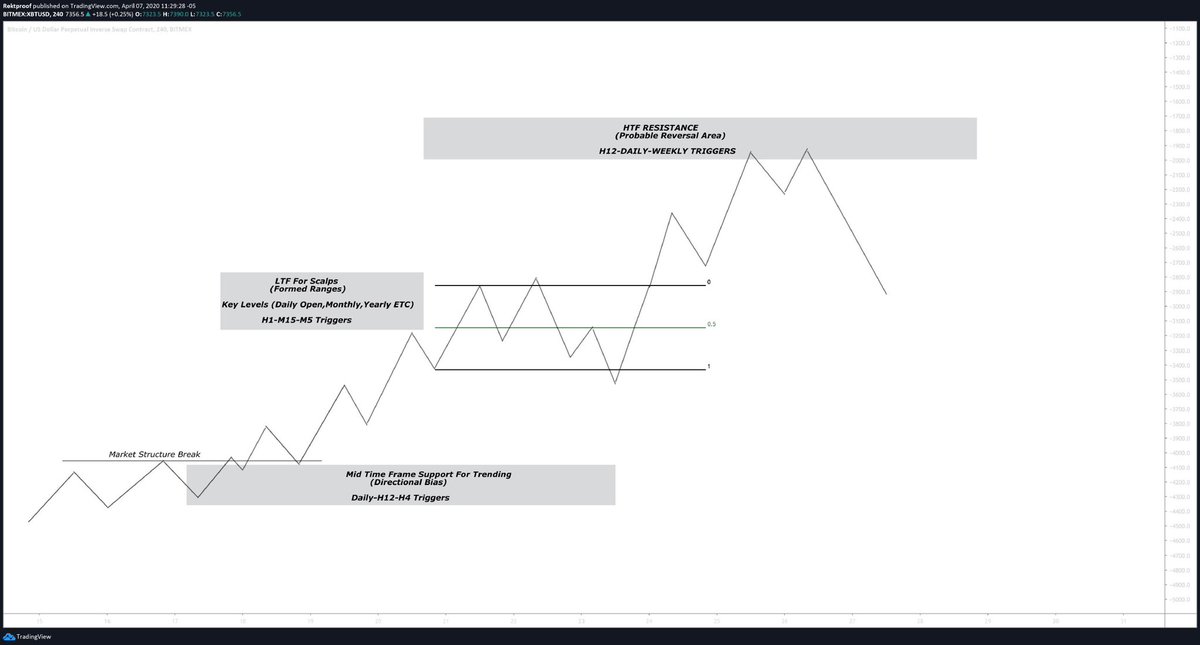

Formatting ranges:

Formatting ranges:

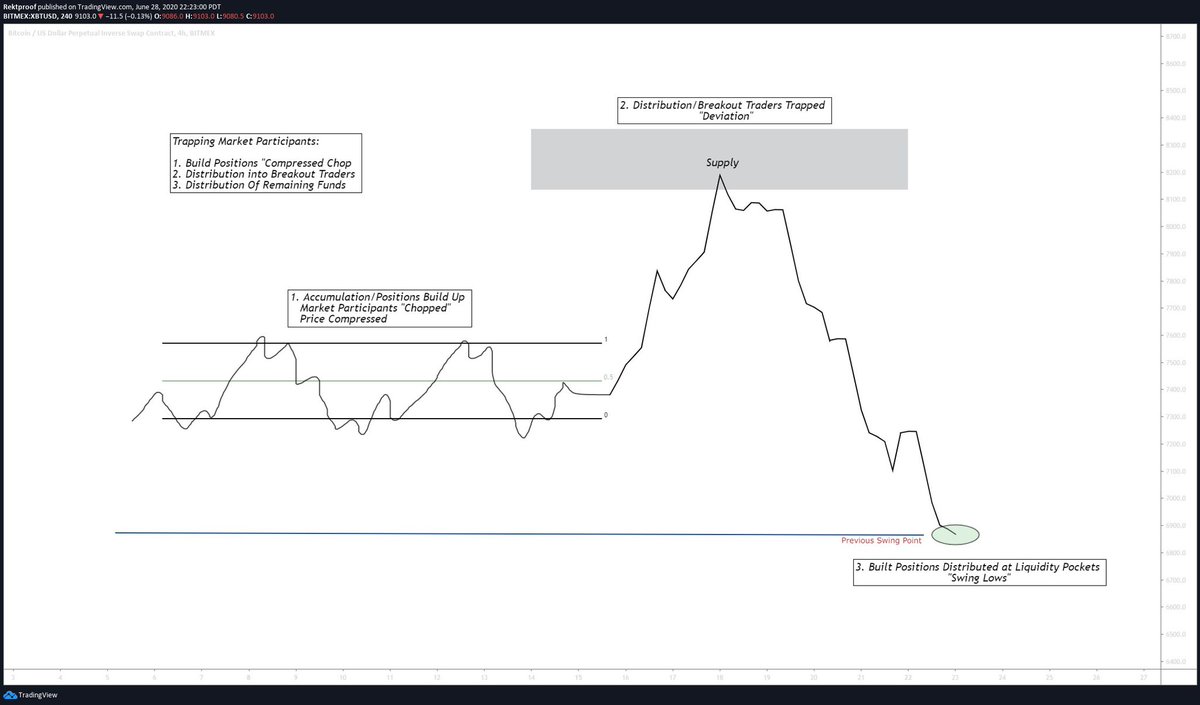

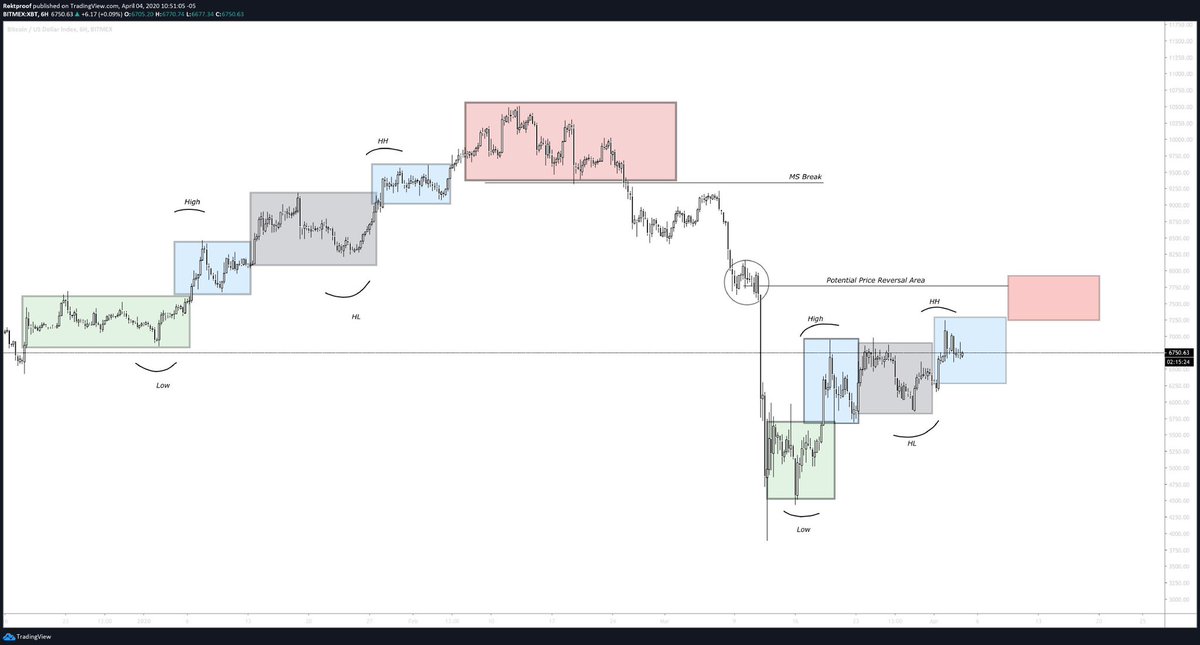

$BTC / $USD

$BTC / $USD

Improper use of SD, to my perspective.

Improper use of SD, to my perspective.

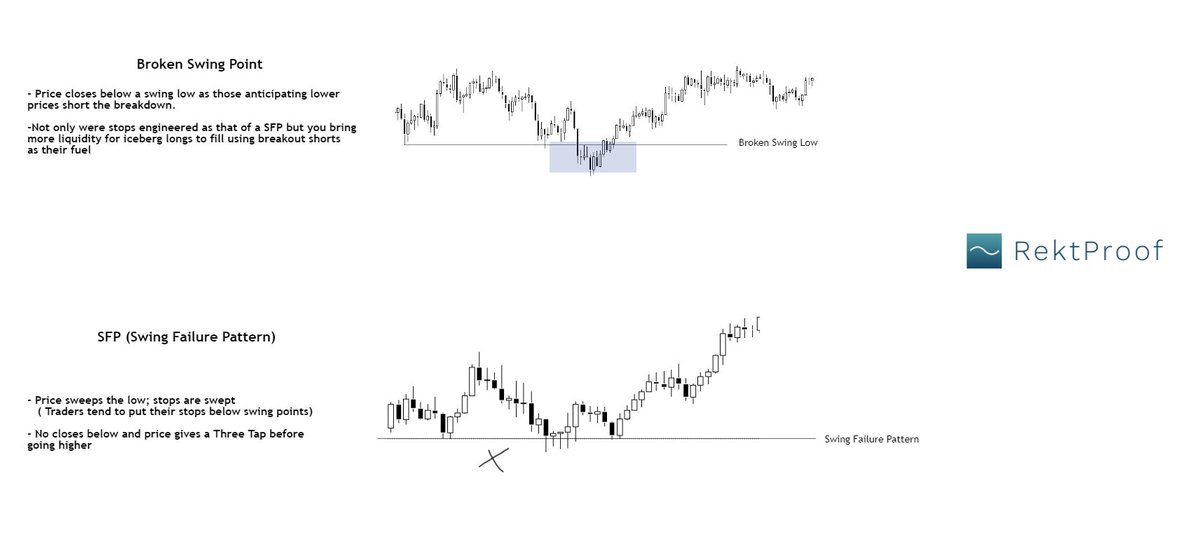

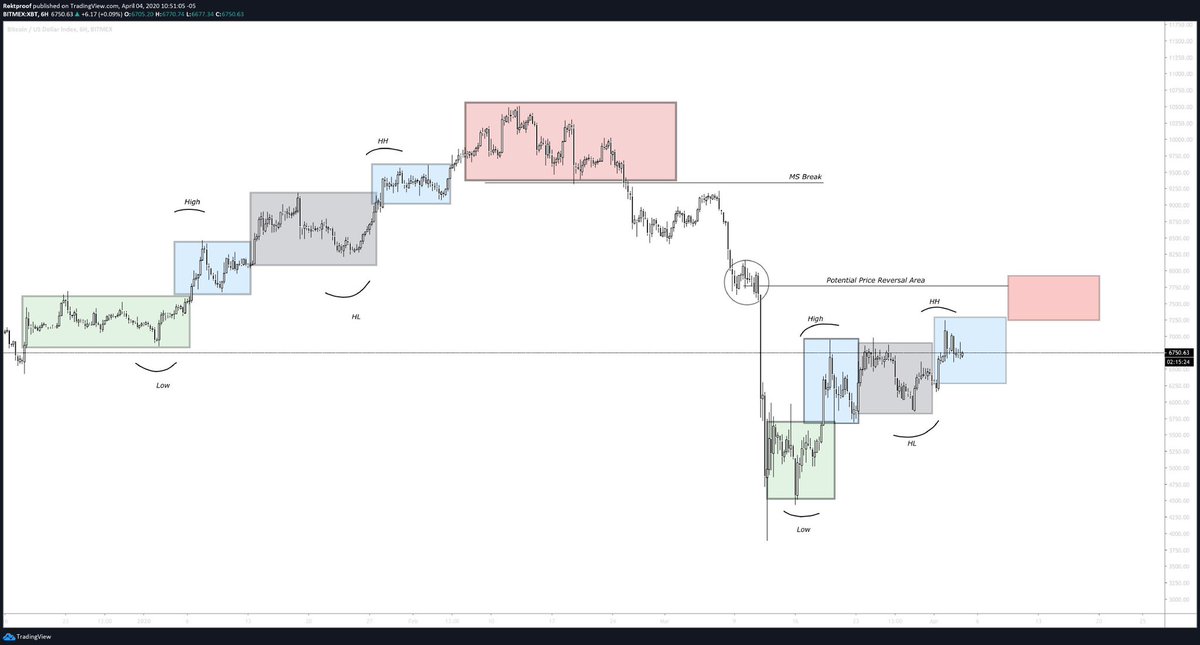

Broken swing points vs SFP's

Broken swing points vs SFP's

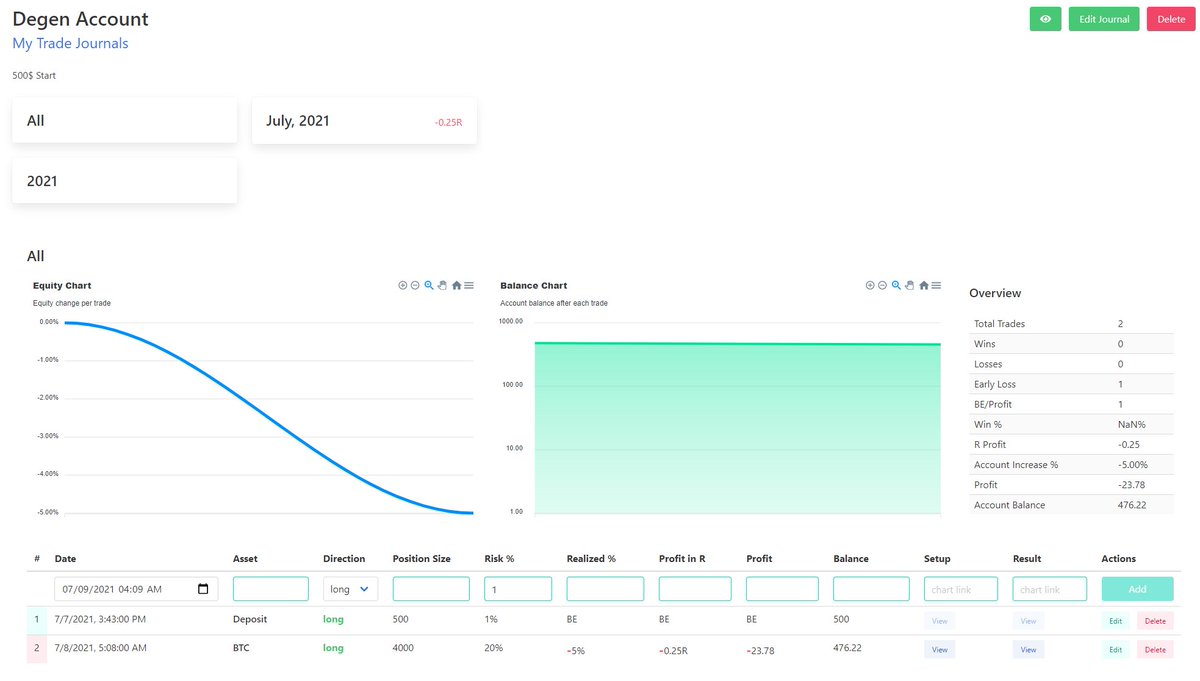

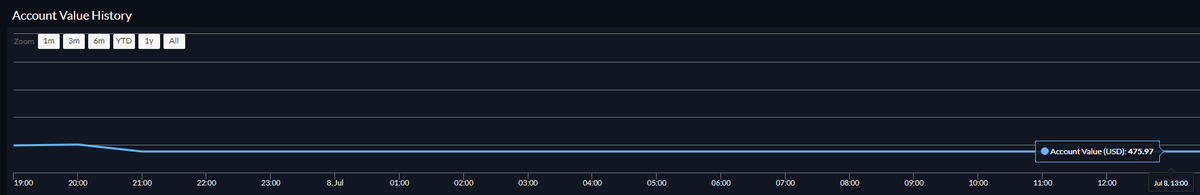

Degen Account Update:

Degen Account Update:

2/4

2/4

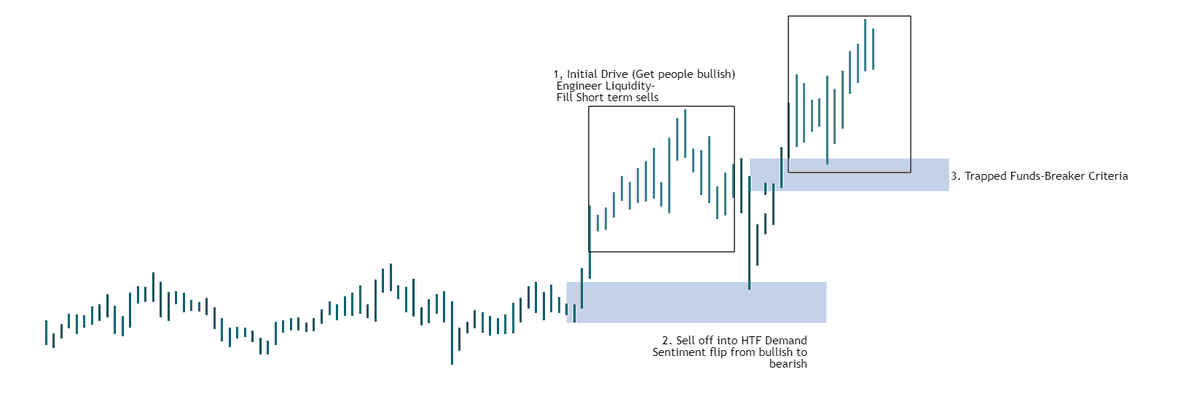

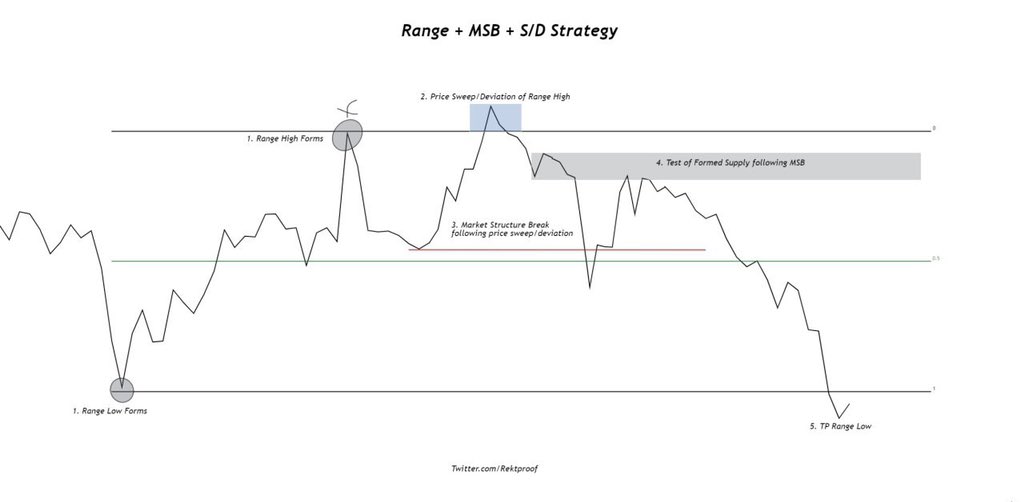

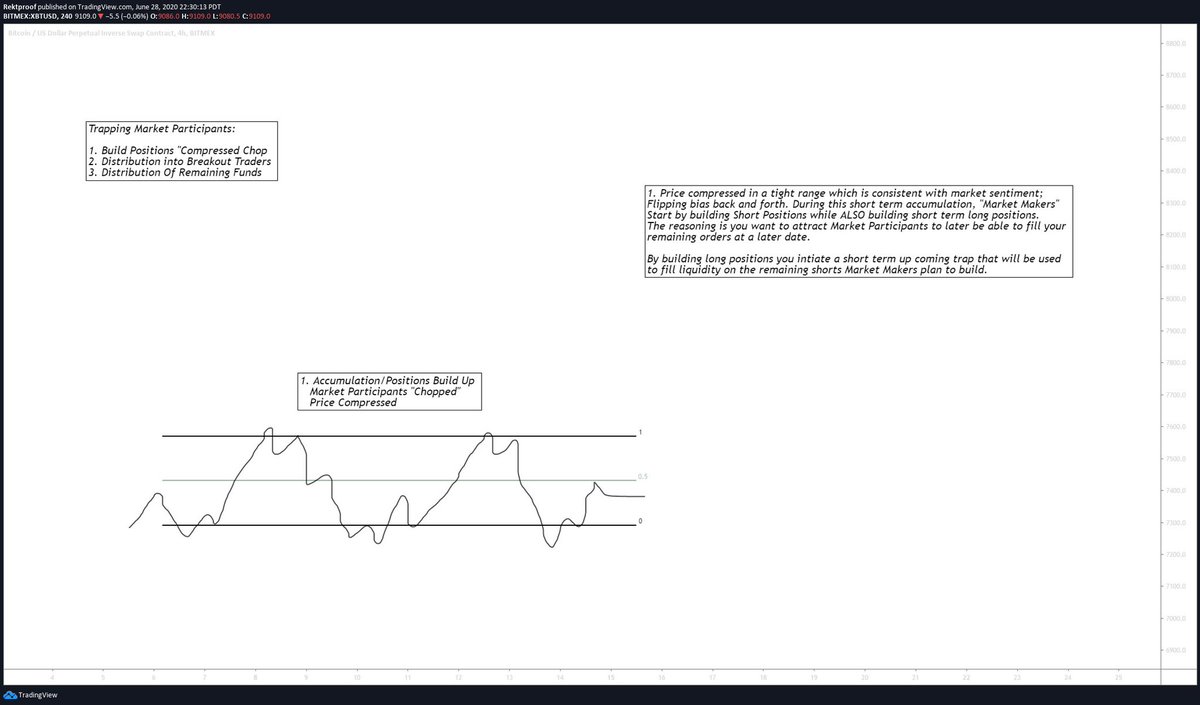

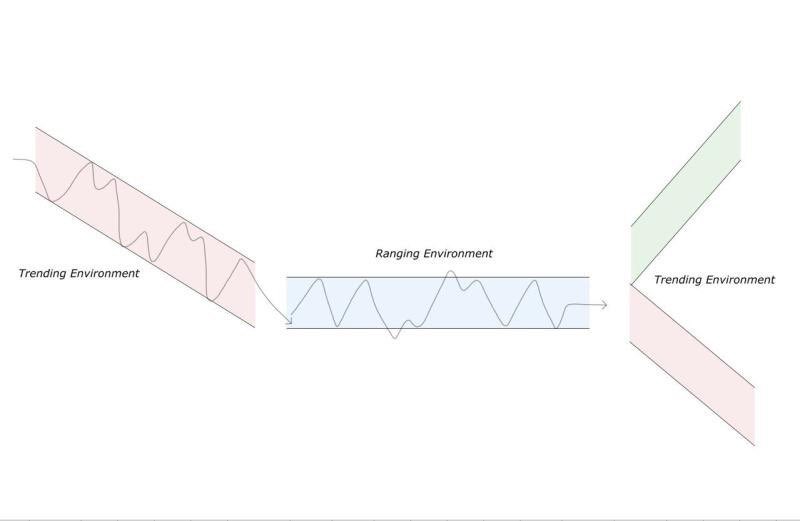

Range forms

Range forms

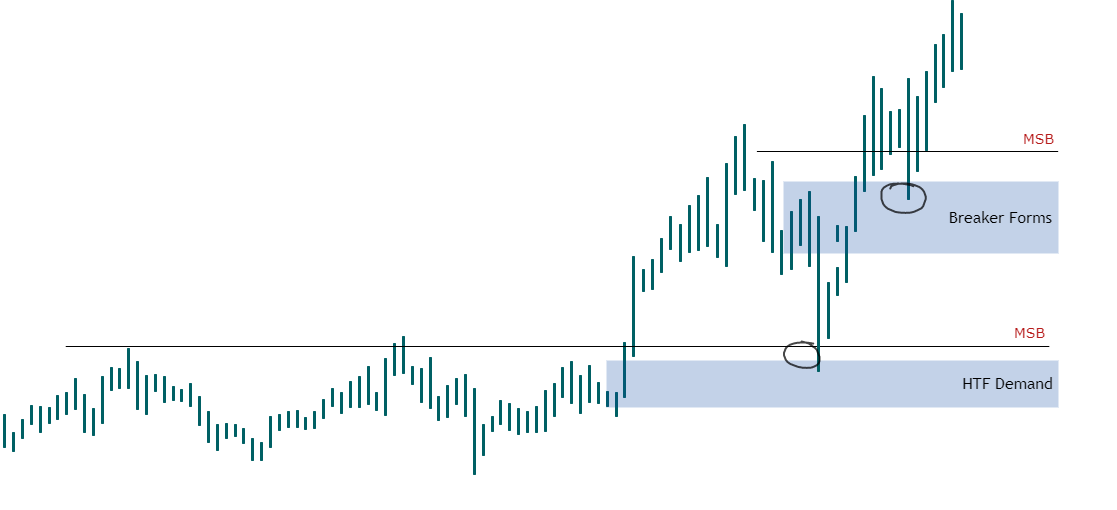

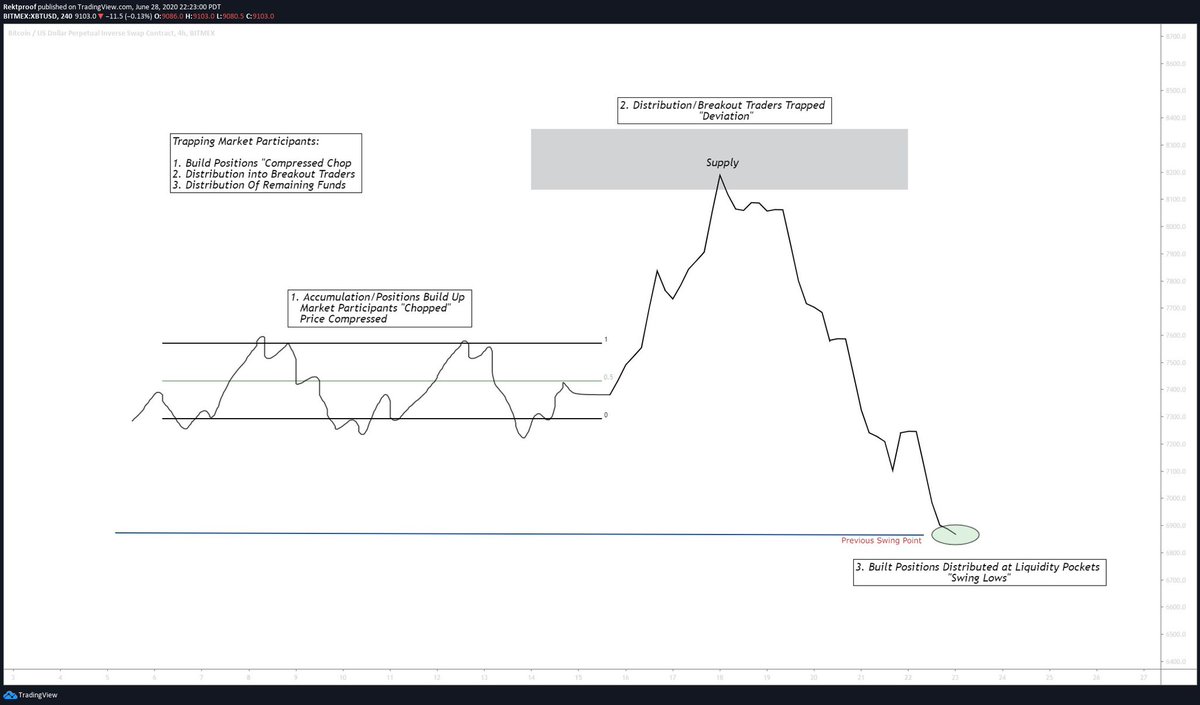

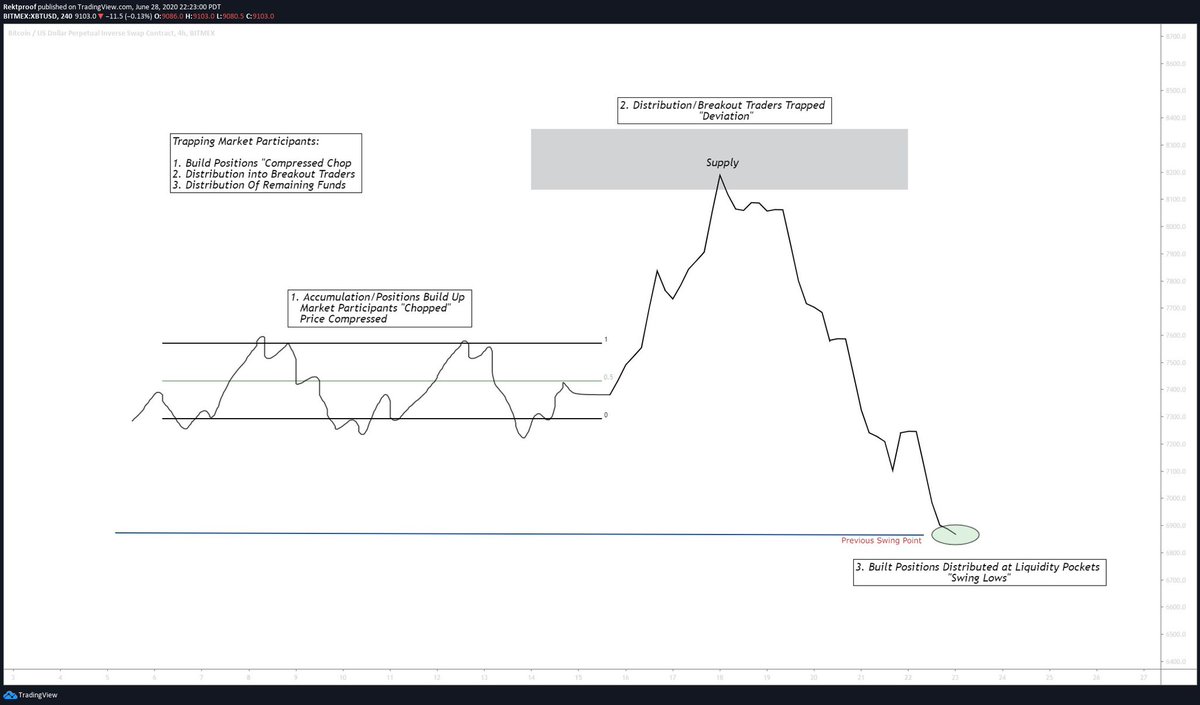

1. Accumulation:Postions Build up

1. Accumulation:Postions Build up

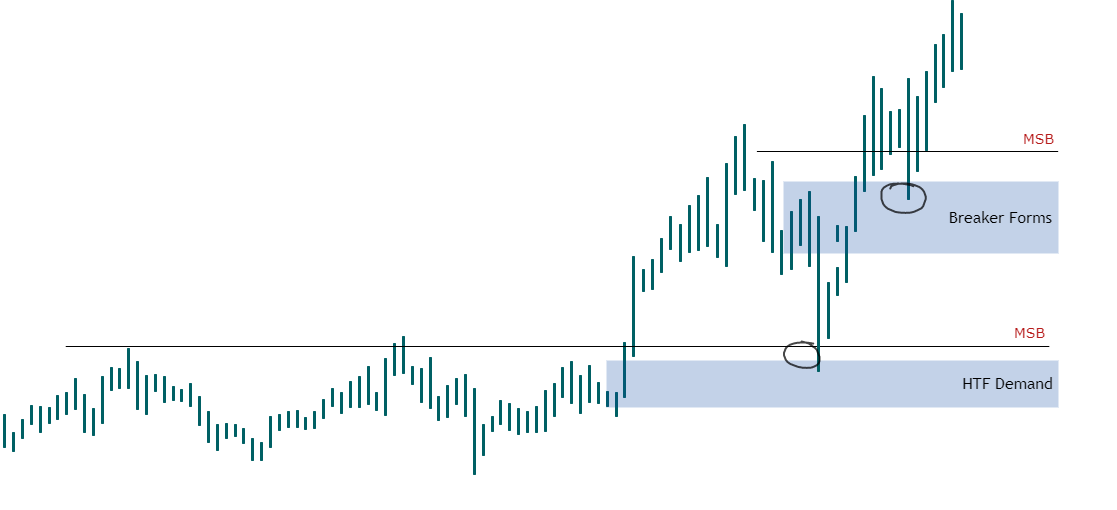

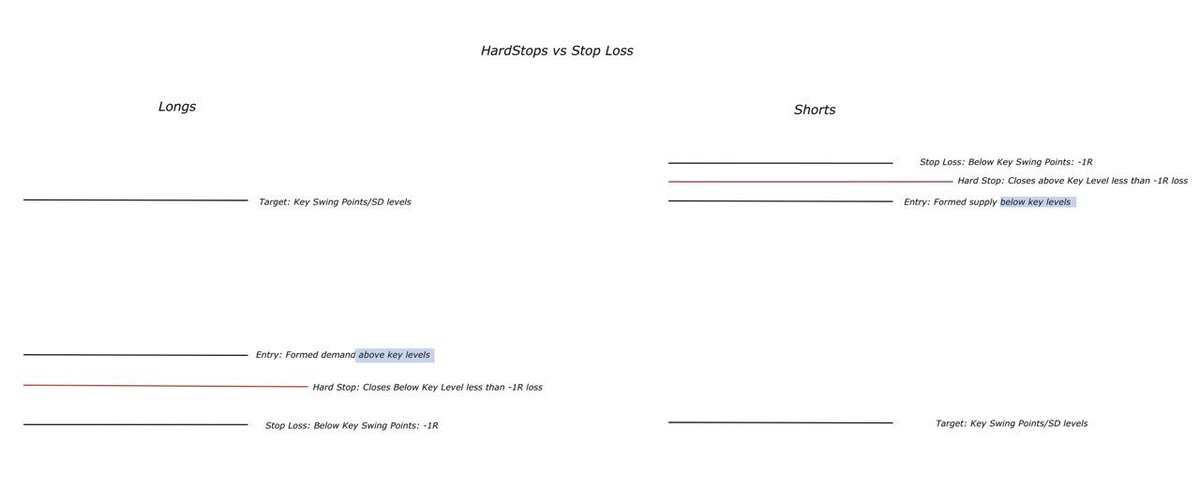

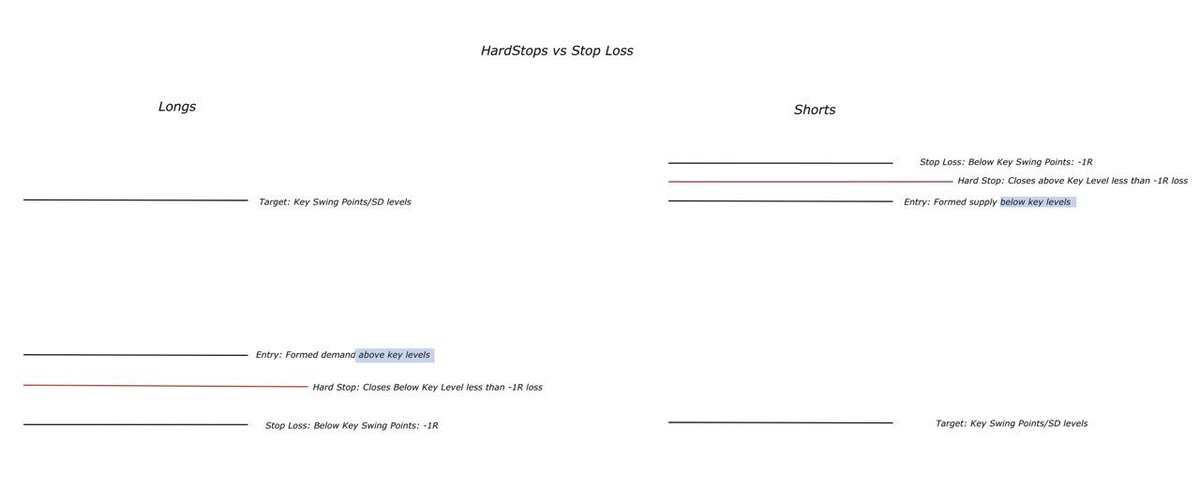

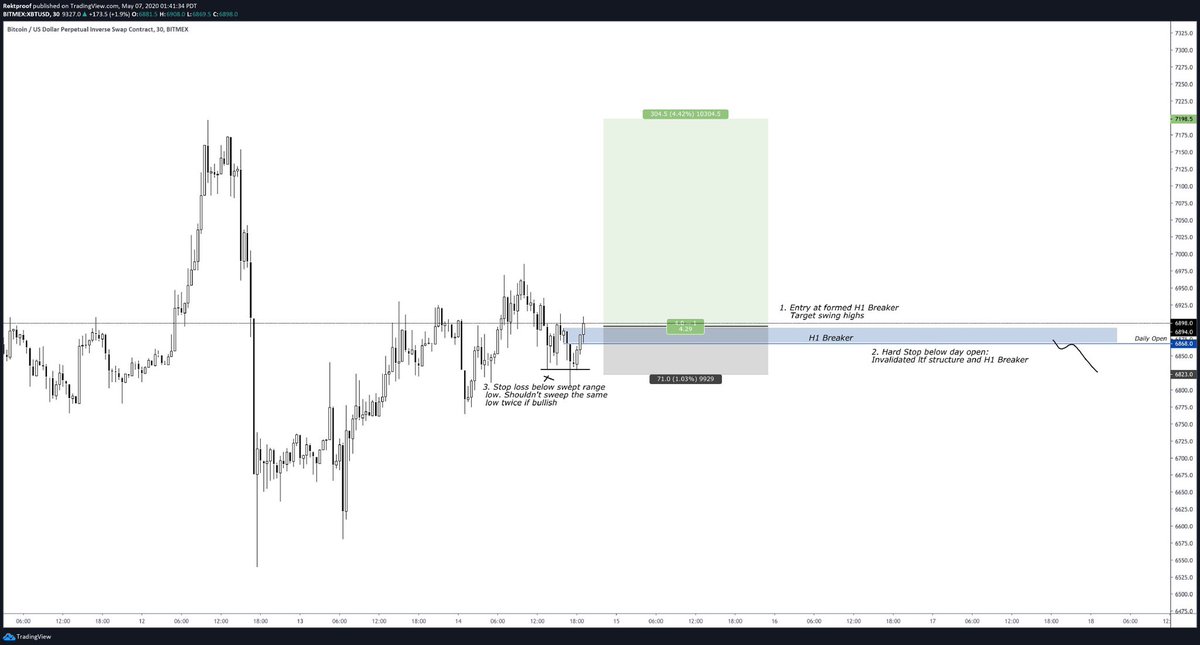

1. Long Example

1. Long Example

/

/

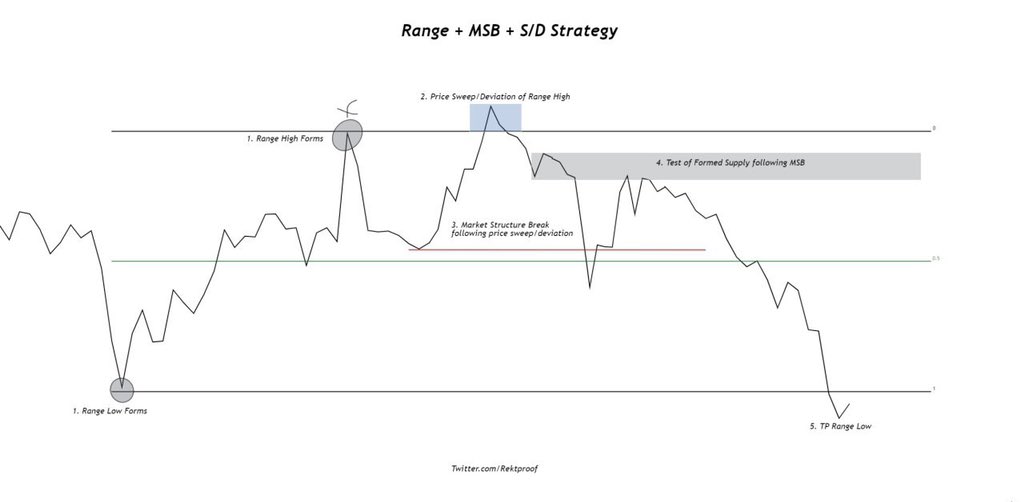

1. Previous Price Action

1. Previous Price Action

/

/

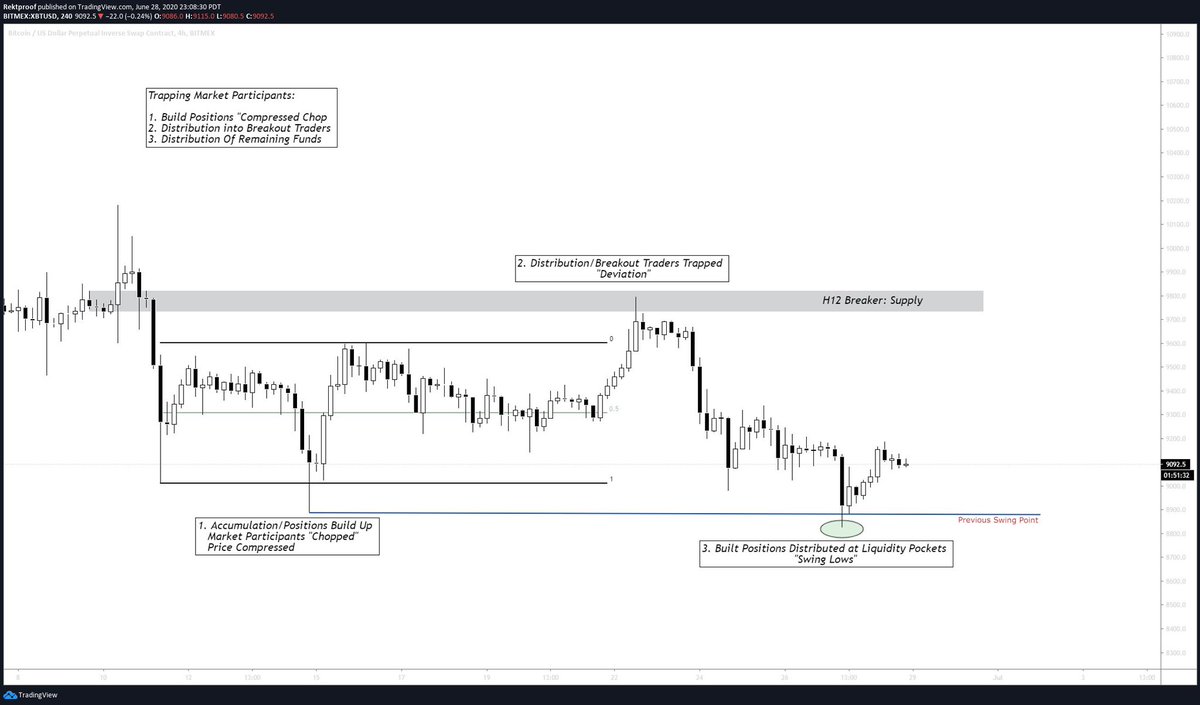

$BTC / $USD

$BTC / $USD

2/4

2/4