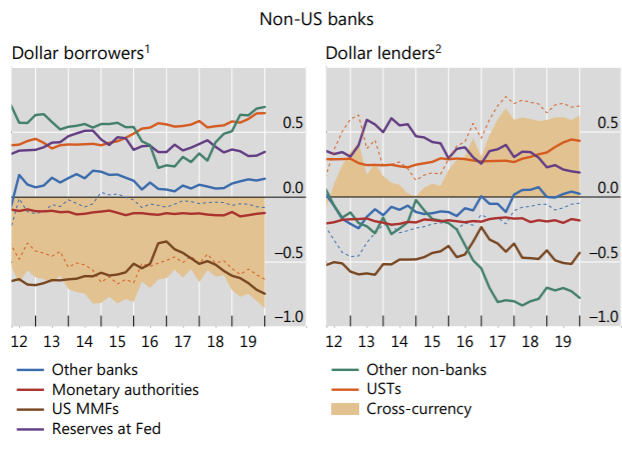

"Dollar borrowers (Graph 3, left-hand panel) obtained between $630 billion and $855 billion via FX

swaps, and channelled these funds into liquid assets and to non-banks."

1/n

"For their part, the dollar lenders supplied between $628 billion and $701 billion. On net, non-US banks as a

whole therefore needed around $227 billion from other sources."

In normal times, banks outside the US could have sold liquid assets (Treasuries) to meet their need too ... but March wasn't normal

3/n

(footnotes are often critical ... thanks to one of the authors of the report for pointing this out to me!)

5/n

6/n

7/n

9/n

The creation of the BIS Bulletin by @HyunSongShin is a crisis era innovation that I hope lives on!

bis.org/publ/bisbull27…