A walk through my reasoning:

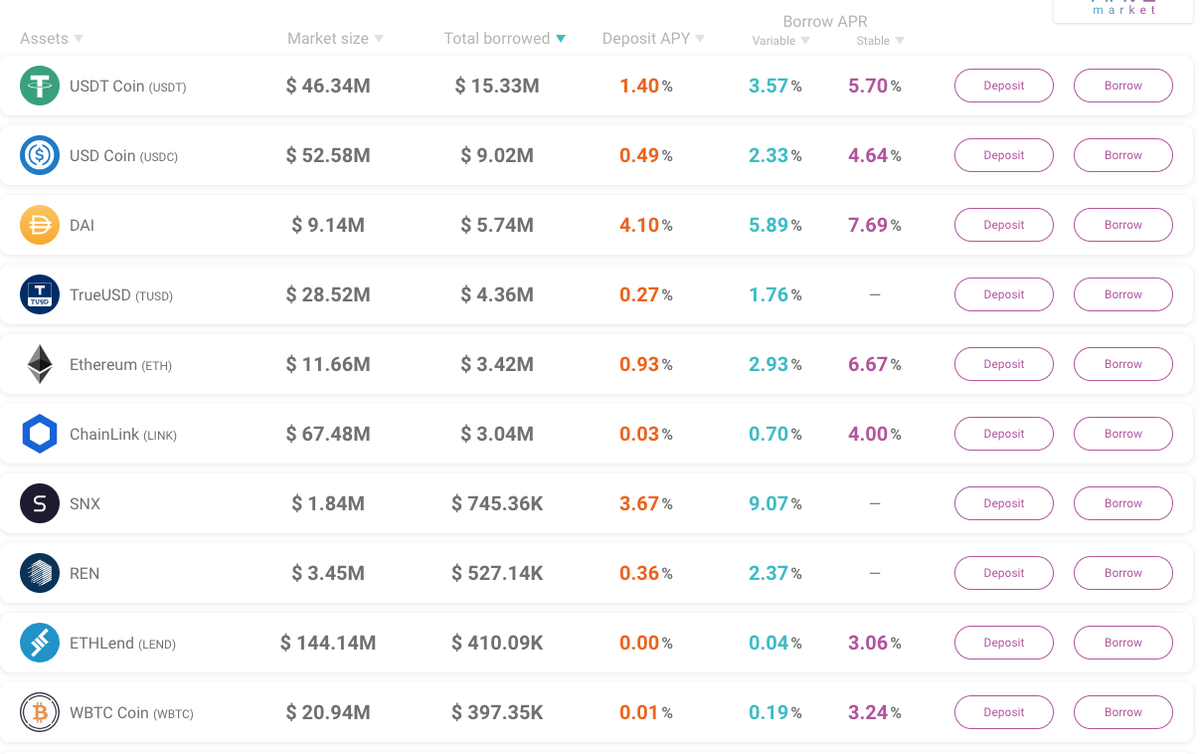

Today, I'd venture to say 90%+ of demand for DeFi borrowing is for leverage, which means stablecoins are naturally the most borrowed assets.

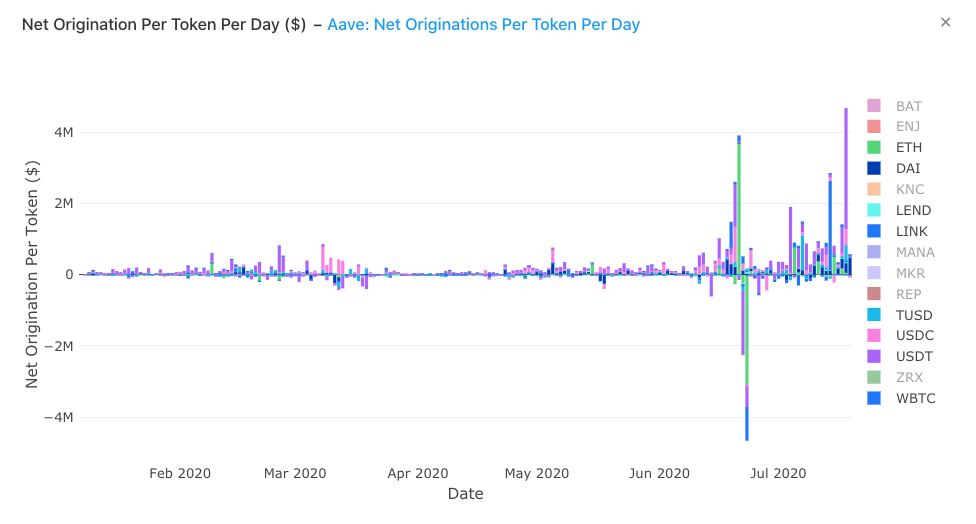

As a venue that provides USDT/C, + other stablecoins, @AaveAave was the natural place to absorb the demand for leverage.

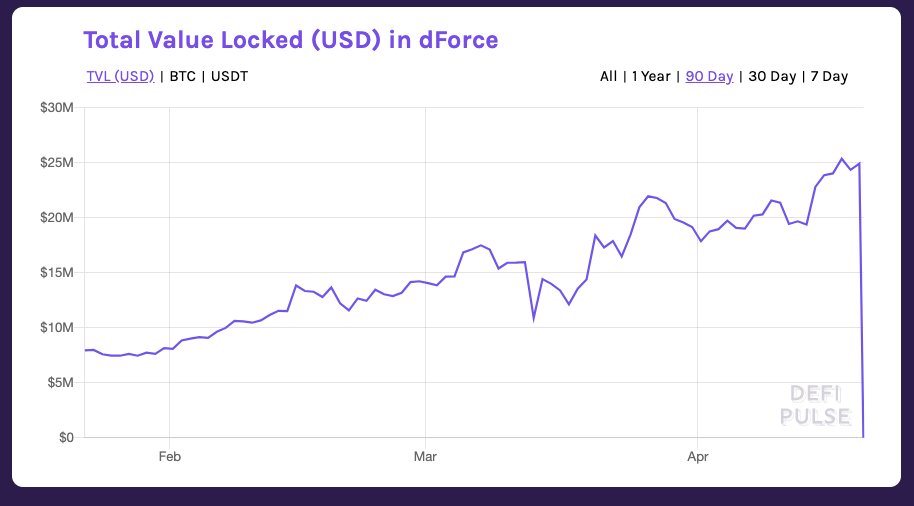

This was the signal to start paying attention.

Maker's native stablecoin also warranted a premium in val.

This changed when launched.

Introduction of liquidity mining clearly reignited risk in DeFi markets, and hints at a token model revamp likely meant better value capture for token as well.

In a bull cycle, using LTM/ NTM fee multiples or DCFs to justify fair valuation means I will miss out on every move.

Relevant...

At $80m, I had my reservations against val as well, before diving more into Aave's plans.

is currently valued at $400M.

Lending Club mcap: 1B, most activity in US

Transferwise last private val: 3B

With more DeFi tokens resembling pseudo equity, I won't be surprised to see a few of the lending protocols valued at $1B+