How fully diluted market cap matters in crypto.

A thread for (retail) investors.

A thread for (retail) investors.

1/ At the negotiation table, investors that tend to be longer term focused often ask about fully diluted valuations (s/o @santiagoroel) vs. investors who are not.

This is because founders can count on them to stick around long enough for inflation to matter.

This is because founders can count on them to stick around long enough for inflation to matter.

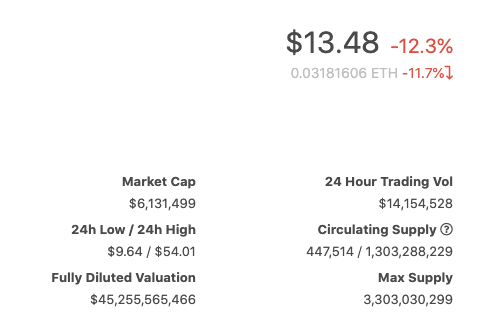

2/ Inflation impacts a project's valuation significantly. As an exaggerated example, look at $CRV 12 hrs ago.

At $2M market cap, you think @CurveFinance is undervalued.

You're right - $2M prices each dollar of value in Curve at a 100x discount to @MakerDAO.

At $2M market cap, you think @CurveFinance is undervalued.

You're right - $2M prices each dollar of value in Curve at a 100x discount to @MakerDAO.

3/ So you've found the next gem! You're a real big boi investor now 🤩

Anons on Twitter are telling you to ignore the weird "fully diluted" number, which claims $CRV is valued at almost half of $BTC.

"That's stupid lmao," you said.

You market buy $CRV

Anons on Twitter are telling you to ignore the weird "fully diluted" number, which claims $CRV is valued at almost half of $BTC.

"That's stupid lmao," you said.

You market buy $CRV

https://twitter.com/mrjasonchoi/status/1294107229944082432?s=20

4/ Congratulations - you were right! 👏

$2M was indeed undervaluing $CRV. 7 hours later, $CRV is now 3x in value at $6M.

Then you check your balance.

You're down almost 50%.

$2M was indeed undervaluing $CRV. 7 hours later, $CRV is now 3x in value at $6M.

Then you check your balance.

You're down almost 50%.

5/ You go on the feed of the anon who shilled this shit to you.

They've already exited their bags hours ago.

And turns out, all of them farmed the coins and acquired $CRV at near 0 principal. You were their exit liquidity.

They've already exited their bags hours ago.

And turns out, all of them farmed the coins and acquired $CRV at near 0 principal. You were their exit liquidity.

6/ This is an exaggerated example since $CRV books are thin inflation is high, full dilution takes 300 years, no real price discovery bla bla bla bla...

But stretch this out on a longer horizon (months, years) - you begin to see how inflation impacts your crypto investments.

But stretch this out on a longer horizon (months, years) - you begin to see how inflation impacts your crypto investments.

7/ There are a few ways people think about the value of a crypto network today. The most relevant ones are:

- Circulating cap = price of token * tokens that have been minted and are not locked up

- Fully diluted cap = price of token * all tokens that will ever be released

- Circulating cap = price of token * tokens that have been minted and are not locked up

- Fully diluted cap = price of token * all tokens that will ever be released

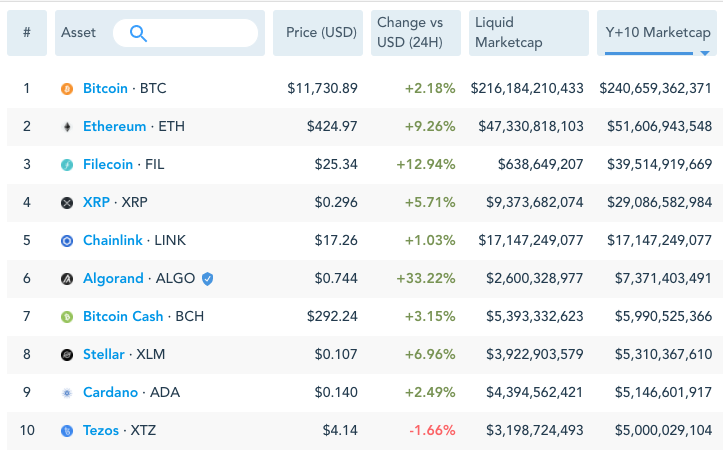

8/ Circulating cap is what most retails follow since it's what's most commonly cited on @CoinMarketCap, and it allows retails to justify higher valuations vs. fully diluted cap in a bull market.

But circ cap is dependent on inflation, vesting etc...which vary across networks.

But circ cap is dependent on inflation, vesting etc...which vary across networks.

9/ So maybe fully diluted cap is a more objective way to *compare* token value.

But what about tokens with perpetual inflation?

Does it mean they're worth infinite!?

Or projects with long inflation schedules?

Why should I care what it's worth in 2300!?

But what about tokens with perpetual inflation?

Does it mean they're worth infinite!?

Or projects with long inflation schedules?

Why should I care what it's worth in 2300!?

10/ This is where "fully diluted" needs some nuance.

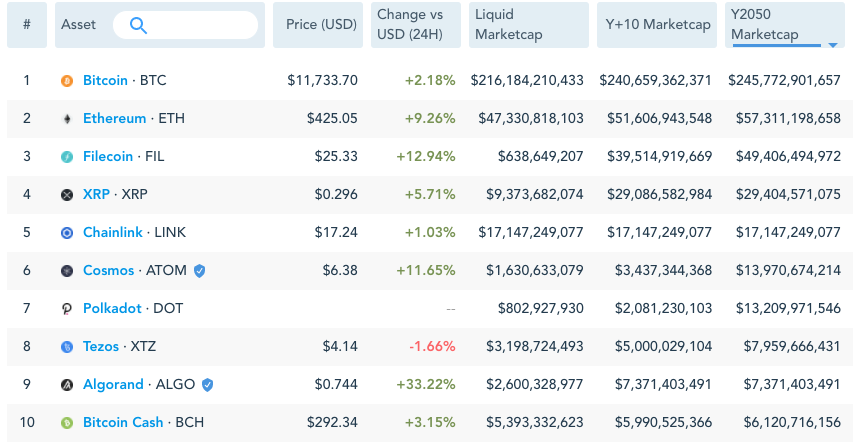

As a solution to allow for investors to compare tokens on a more apples:apples basis, @MessariCrypto has "Y2050 mcap" - which projects supply out 30 years to Y2050 for every token.

This is an ok workaround.

As a solution to allow for investors to compare tokens on a more apples:apples basis, @MessariCrypto has "Y2050 mcap" - which projects supply out 30 years to Y2050 for every token.

This is an ok workaround.

11/ What about staking?

How can the yield be valued?

The staking "yield" you receive on PoS networks is simply to counteract network inflation.

The real yield is [staking rewards] - [inflation tax], which should be >0 assuming <100% of network is staked.

How can the yield be valued?

The staking "yield" you receive on PoS networks is simply to counteract network inflation.

The real yield is [staking rewards] - [inflation tax], which should be >0 assuming <100% of network is staked.

12/ For simplicity sake, let's say staking fully counteracts the effects of network inflation.

That means your % claim to a network will always remain the same.

The only thing you have to think about then is how much the network is worth at the end of your investment horizon.

That means your % claim to a network will always remain the same.

The only thing you have to think about then is how much the network is worth at the end of your investment horizon.

13/ For investors who intend to hold something for 10 years (long term VCs), having a rough idea about where a token should be worth in 10 years is probably most relevant.

In this case, perhaps a 10-year diluted market cap makes the most sense.

In this case, perhaps a 10-year diluted market cap makes the most sense.

14/ On the other end, if you have a shorter term orientation/ want to trade retail mania, circulating market cap may make the most sense.

For something like $CRV, even weeks to months make sense. But dilution should *never* be ignored.

For something like $CRV, even weeks to months make sense. But dilution should *never* be ignored.

15/ tl;dr - investors have different horizons.

a16z may be willing to buy a network at $1B because in 10 years it may be worth $100B.

Short term vol is not a concern to them because they have the clout and track record to attract long term, patient, locked up capital.

a16z may be willing to buy a network at $1B because in 10 years it may be worth $100B.

Short term vol is not a concern to them because they have the clout and track record to attract long term, patient, locked up capital.

16/ A hedge fund with monthly mark favor Y+1, +2, +5... valuations, and hence may prefer a lower price, lower quality project.

Lastly, beware shillers who tell you to ignore inflation/ dilution. You may still make money in a bull market buying their bags - until you don't.

Lastly, beware shillers who tell you to ignore inflation/ dilution. You may still make money in a bull market buying their bags - until you don't.

• • •

Missing some Tweet in this thread? You can try to

force a refresh