Lots of recent developments in this space. Anyone else up for a thread? Then let's read on!

I'm only barred to practice in NY, but as a friend I can tell you try not to violate usury laws.

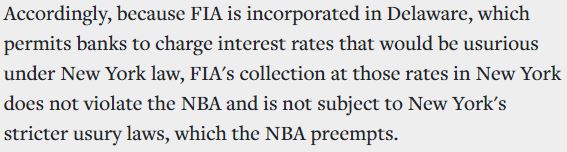

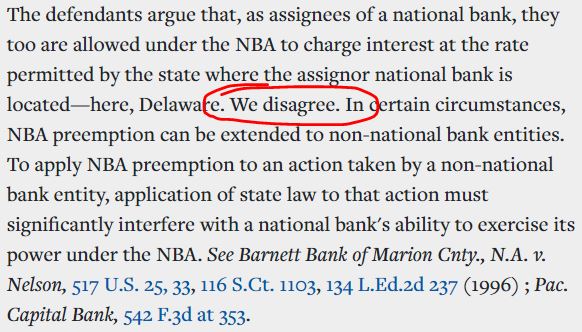

Midland initially gets the case dismissed. They bought the debt from a bank. Bank debt is -- key term coming up -- “Valid when made.”

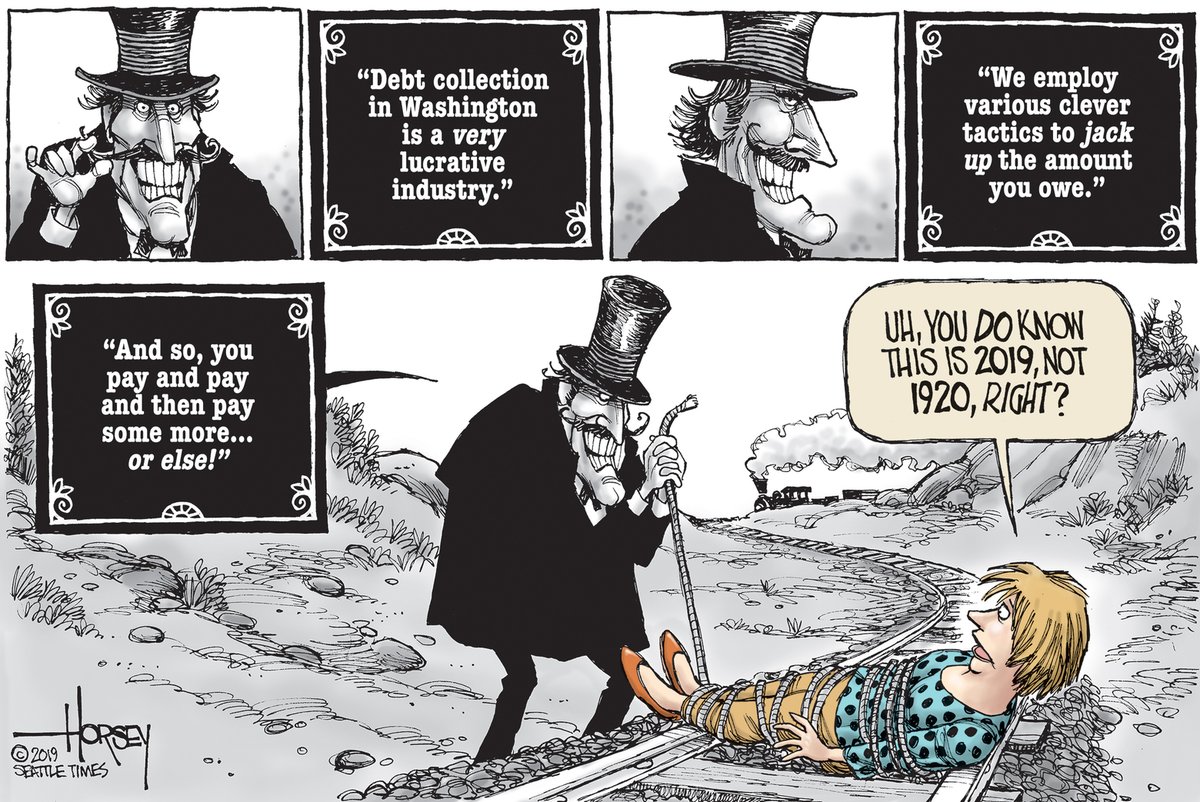

Powers like . . . preempting NY’s interest rate laws with those of Delaware (where BofA and FIA had set up shop).

What’s the deal with true lender? We’ll cover that another day ;)