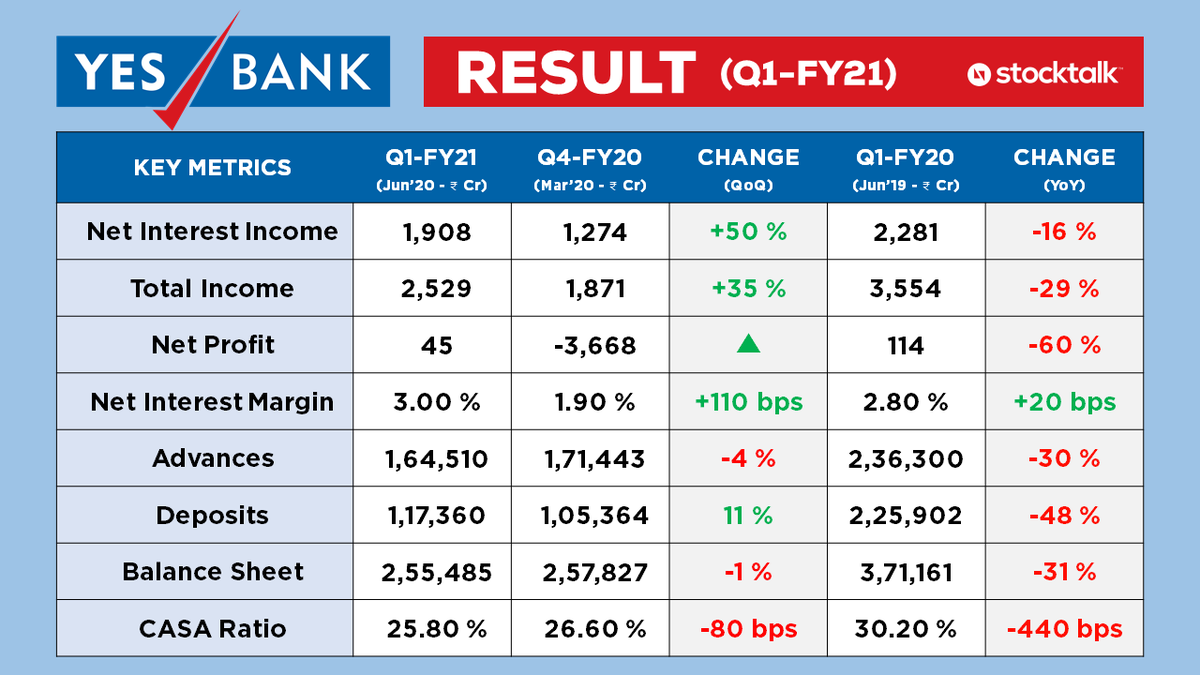

FINANCIAL HIGHLIGHTS (Q1-FY21)

🟢 Interest Income: ₹1908 Cr

🟢 Total Income: ₹2529 Cr

🟢 Net Profit: ₹45 Cr

🟢 Interest Margin: 3%

🔴 Advances: ₹1,64,510 Cr

🟢 Deposits: ₹1,17,360

🔴 Balance Sheet: ₹2,55,485

🔴 CASA: 25.80%

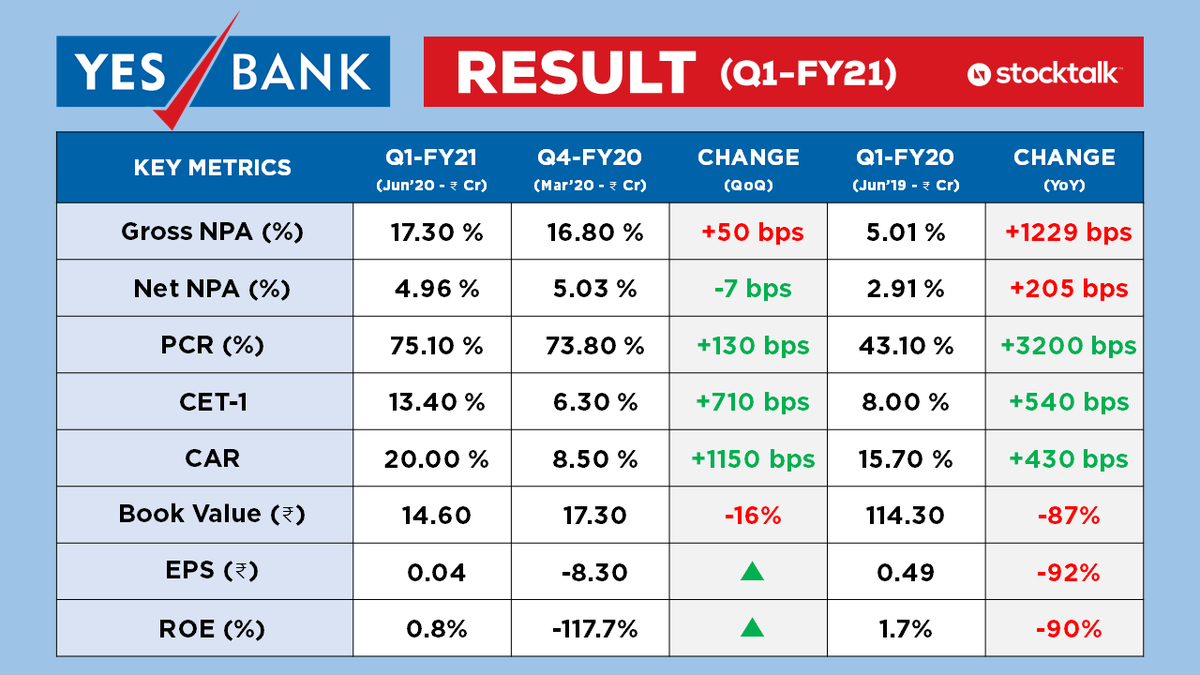

ASSET QUALITY (Q1-FY21)

🔴 Gross NPA (%): 17.30%

🟢 Net NPA (%): 4.96%

🟢 Provisions (%): 75.10%

🟢 CET-1: 13.40%

🟢 CAR: 20%

🔴 Book Value: ₹14.60

🟢 EPS: ₹0.04

🟢 ROE: 0.8%

PRELIMINARY ANALYSIS (Q1-FY21)

🔸 The bank has reported fair result as a starting point post the management reshuffle and moratorium saga of last quarter.

🔸 Biggest issue of capital adequacy is now sorted. The bank is now well capitalized.

PRELIMINARY ANALYSIS (Q1-FY21)

🔸 There has been a massive dilution due to the recent capital raise via FPO route resulting in a drop in book value to ₹14.

🔸 Provision coverage ratio has improved and is now on par with other top banks.

PRELIMINARY ANALYSIS (Q1-FY21)

🔸 Advances have gone down a bit (good for now) while deposits have seen improvement but the overall balance sheet has shrunk in size.

🔸 CASA ratio has taken a hit and gone down which is not a good sign