#Dollarisation: The removal of a ventilator from an economy in ICU

1/ An ailing, sick or troubled economy needs medication of policy & actions.

Does this include abandoning a domestic currency & then dollarise?

What is #dollarisation?

⏩Price stability leads to the achievement of primary objectives of the fiscal economic policy consisting of:

• investment,

• economic growth, and

• employment.

⏩It is all those who have trusted the stability of the value of a domestic currency!

1. Those who have saved or lent lose out,

2. Economic efficiency impaired,

3. Detrimental to investment, economic growth&employment,

4. Purchasing power of employees eroded,&

5. Difficulty in foreseeing future prices&costs.

⏩To dollarise an economy, means having USD notes are circulating as a domestic currency. Such circulation is what is called M0, i.e. notes and coins in circulation + banks operational balances at the central bank.

⏩When an economy is dollarised, all the measures of money supply: M0, M1, M2, M3 and M4 are pegged in USDs.

i. M0: Reserve Money, i.e. material currency (physical cash of notes and coins itself) in circulation + bearer certificates convertible on demand (Bankers’ deposits + Other deposits with RBZ). This is the monetary base of the economy.

ii. M1: "Cash equivalent" i.e. instantly convertible into cash of equal value. This consists of currency with public (physical currency and coins) + Bank demand deposit accounts + Other deposits with central bank + negotiable order of withdrawal accounts.

⏩Narrow money describes M0 and M1 as coins and notes in circulation & other money equivalents that are easily convertible into cash.

iv. M3 =M2 plus "all other investment instruments like worthy of equities&bonds that can be converted into cash, but may have significant restrictions on a timely conversion &/or a lack of guarantee that the investment's stated worth will be retained in the conversion 2 cash"

v. M4 = M3 plus + “time deposits” and “recurring deposits” through post office savings & building societies.

Broad money is used to describe M2, M3 or M4.

How is the dollarisation of an economy done?

Lets now understand the banking processes when there is dollarisation:

To dollarise, the economy needs M0 money supply, i.e., USD notes and coins to be in circulation.

To have the USD notes and coins, there should have been bought and imported by the local commercial banks or central bank from foreign commercial banks and central banks, respectively.

How can the domestic currency stabilised?

I will repeat the following remarks that I mentioned in my last article and shall continue to do so multiple times.

⏩1. Respect of property rights of exporters by the government as provided for by s69(1)-(3), and s71(2)-(3),

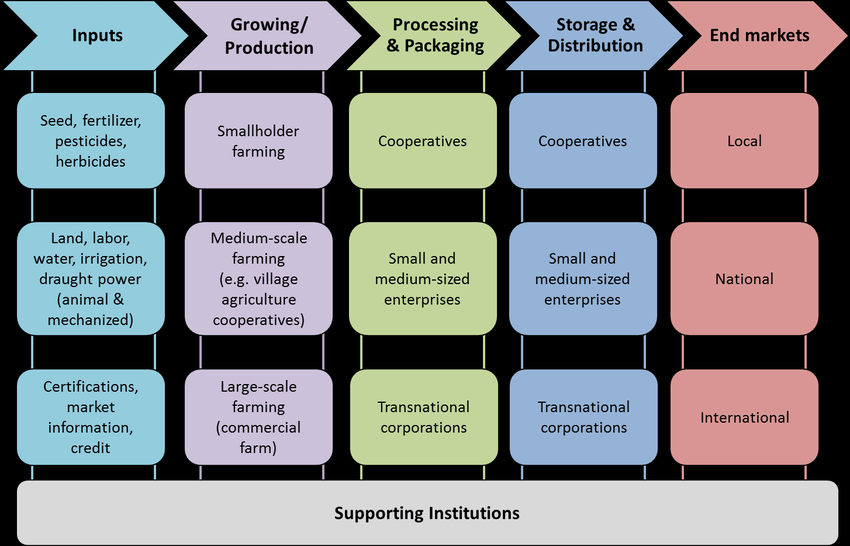

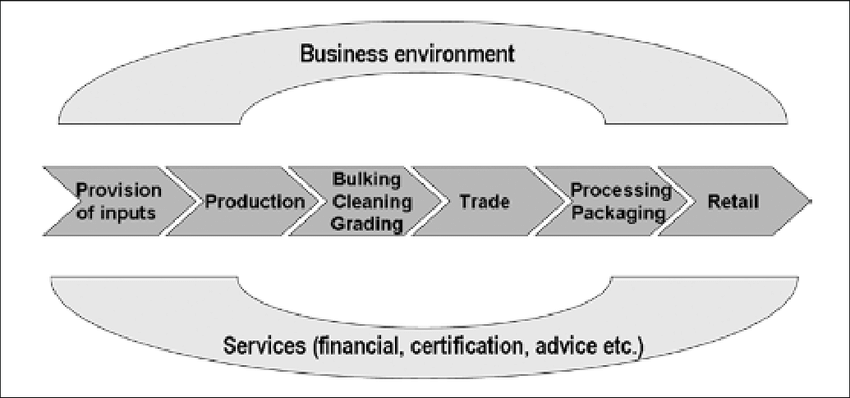

⏩2. Robustly promote and incentivise productivity capacity of manufacturing, mining and agriculture to increase exports and reduce imports by using SMART goals, and

⏩3. Exercise fiscal prudence for robust accountability and public sector efficiency to profligacy, wastefulness, abuse of public office and duplicity.

Immediate actions that have a direct impact on the forex supply side:

⏩1. Remove the RBZ retention and liquidation requirements, and let all export proceeds be acquitted within 90 days,

⏩2. The government to build on forex reserves and the forex it needs for its obligations transparently from the open market of the auction system,

⏩3. Remove arbitrage enhancers like paying or letters of credit for fuel and grain by the RBZ,

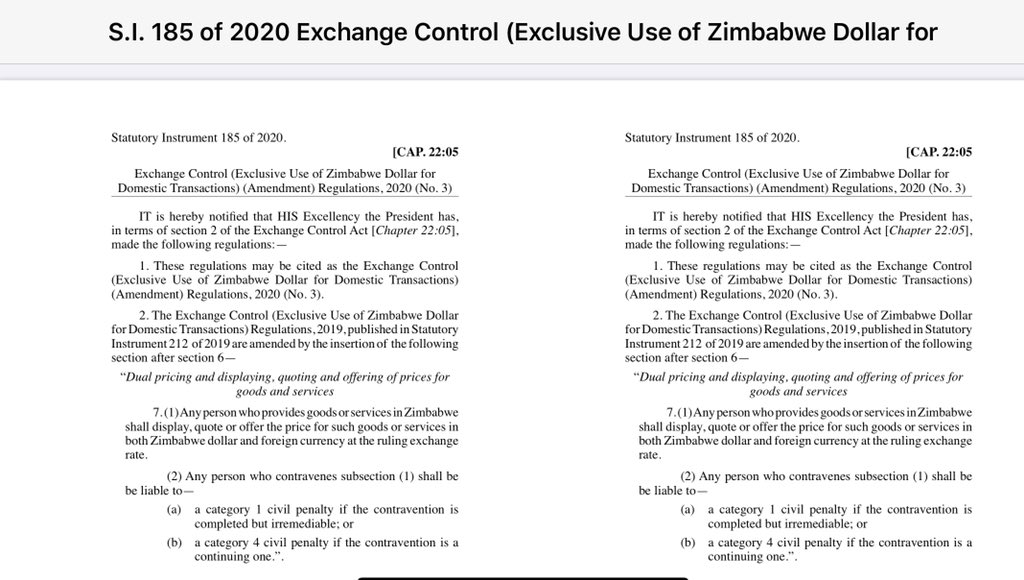

4. On exchange control, the legal position should be, an exporter should:

⏩• Liquidate full or part of the export earnings at an open market price through an authorised dealer; OR

⏩• Retain the full or the remainder of the earnings in a FCA at an authorised dealer.

In general, public policy and regulations should be underpinned by prudential interventions of 3Cs:

⏩• Credibility: sound and consistent polices,

⏩• Confidence: assurance of continuity to stimulate trust and ready willingness to invest in skills and technology, and

⏩• Competitiveness: fiscal incentives to enhance productive capabilities and invest in new capacities in manufacturing, mining and agriculture.

⏩If the exchange rate stabilizes, the domestic currency will automatically stabilise and even government-backed securities and public contracts will become attractive. There will not be need for the domestic market to demand for forex to transact, save and invest.

⏩It’s economically suicidal to dollarise using forex the economy doesn’t have, the forex the economy isn’t producing and the little that is there has been expropriated from exporters!