That's bad. Really bad. As in the worst decline in quarterly GDP in recorded U.S. history.

What they mean is that it fell at an annualized rate of -32.9% which is the result of a thought experiment asking how much lower would GDP be if the recent rate of decline persisted for a year.

But no-one thinks that'll happen. Ignore it

The short-term virus-related economic suppression is turning into a more enduring recession.

The Fed's target (PCE deflator) declined at an annualized rate of -1.9%.

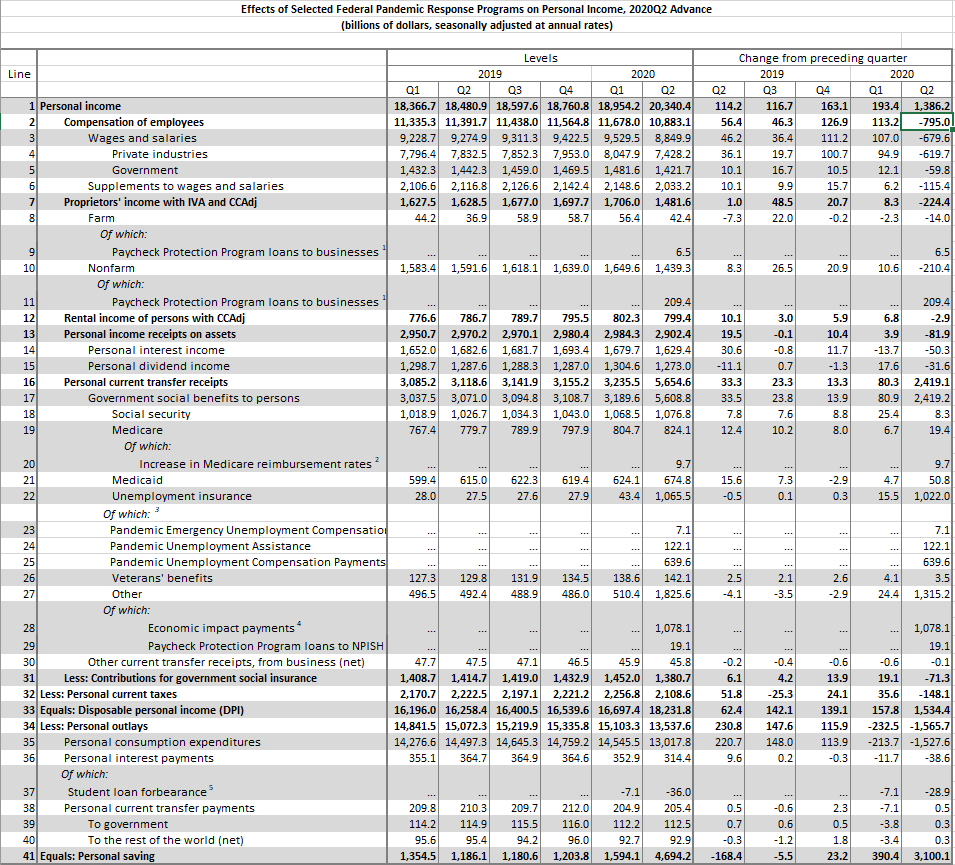

The difference? An extraordinary level of government support through economic impact payments, unemployment assistance, and PPP for businesses.

(Source: bea.gov/system/files/2…)

(More generally, beware of simple stories about what's been happening to a pandemic economy.)

Roughly one third of this latest decline in GDP is due to reduced spending on health care. (Ironic, right?)

Another third is due to reduced spending on recreation, food and accommodation.

The other third is the rest of the economy (mainly investment).

The good news is that they were unusually boring with almost no important changes. The pre-covid economy was largely as we had thought it was.

(okay, that's not really good news.)

If they don't, this will create a recessionary impulse that'll outlast Covid.

GDP fell by 10% last quarter, which means that we still produced 90% as much as we were previously.

When I look at the world around me—which is unrecognizable—it's genuinely staggering that we still produced 90% as much stuff.