A deep thank you to my guests, all who listened, and @MathewPassy for his unbelievable editing.

I thought I'd do a quick thread on something I learned from each episode.

Position size is not a great measure of a manager's conviction; we have to normalize against that manager's behavior incentives.

A small, off-style position put on late in the year could mean a lot.

blog.thinknewfound.com/podcast/s3e1-k…

Look-ahead bias can be an effective means of measuring the upper limits of your portfolio construction process.

blog.thinknewfound.com/podcast/s3e2-m…

Options aren't as simple as "I think it's going up" or "I think it's going down." You can get the direction correct and still lose money on your position (see )

blog.thinknewfound.com/podcast/s3e3-b…

Building candidate portfolios that emphasize certain regimes or attributes can be an effective way of identifying assets with out-sized sensitivities or portfolio impacts.

blog.thinknewfound.com/podcast/s3e4-j…

Intra-day trend following seeks to exploit the hedging / de-risking of institutional players that must happen during market hours.

blog.thinknewfound.com/podcast/s3e5-e…

When building a portfolio of convex positions, a correct directional bet means a position becomes less convex and introduces greater delta risk, requiring a manager to "re-convexify" their portfolio.

blog.thinknewfound.com/podcast/s3e6-j…

CTA portfolio robustness can be tested by removing different futures markets and sectors and re-running backtests.

blog.thinknewfound.com/podcast/s3e7-e…

"How do you calculate the covariance matrix?" may be one of the best questions you can ask a quant firm.

blog.thinknewfound.com/podcast/s3e8-m…

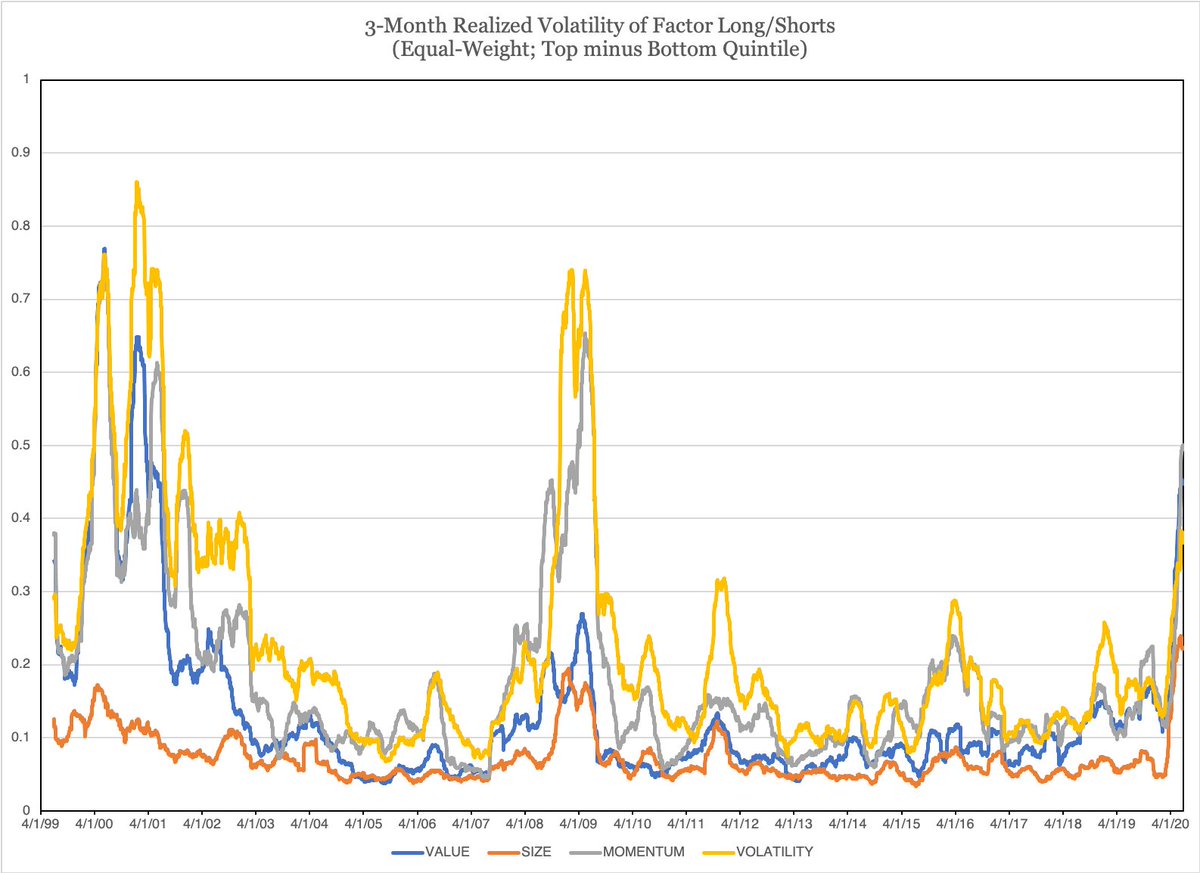

Unintended bets can plague factor construction. When combining multiple factors, you have to think about which parts of the distribution to use to best match turnover speeds.

blog.thinknewfound.com/podcast/s3e9-m…

Explicit risk transfer from banks to institutional investors (e.g. offloading risk at a discount for regulatory reasons) may be a new, interesting frontier of alternative risk premia.

blog.thinknewfound.com/podcast/s3e10-…

Discretionary managers should explicitly focus on trying to harvest idiosyncratic risk and utilize factor models to recognize the latent style risks that may add meaningful unintended bets.

blog.thinknewfound.com/podcast/s3e11-…

Equity factors may represent an interesting source of return for option traders as well.

blog.thinknewfound.com/podcast/s3e12-…

"The more risk you take out, the more leverage you need." e.g. Not taking industry bets may be great, but it might require more leverage to hit the same return as before.

blog.thinknewfound.com/podcast/s3e13-…

If you have the time, we'd sincerely appreciate it if you'd share the podcast with a friend and give us a rating or review on iTunes (podcasts.apple.com/us/podcast/fli…).